Teori Perdagangan Dinamis: Eksponensial Moving Average dan Cumulative Volume Periode Crossover Strategy

Penulis:ChaoZhang, Tanggal: 2025-01-06 11:45:38Tag:EMACVPAVWPTOD

Gambaran umum

Strategi ini adalah sistem perdagangan yang menggabungkan Exponential Moving Average (EMA) dan Cumulative Volume Period (CVP). Strategi ini menangkap titik pembalikan tren pasar dengan menganalisis crossover antara harga EMA dan harga tertimbang volume kumulatif. Strategi ini mencakup filter waktu built-in untuk membatasi sesi perdagangan dan mendukung penutupan posisi otomatis pada akhir periode perdagangan.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada perhitungan kunci berikut:

- Hitung Harga Rata-rata (AVWP): Kalikan rata-rata aritmatika harga tinggi, rendah, dan dekat dengan volume.

- Menghitung Nilai Periode Volume Kumulatif: Jumlahkan harga tertimbang volume selama periode yang ditetapkan dan bagi dengan volume kumulatif.

- Menghitung EMA harga penutupan dan EMA CVP secara terpisah.

- Membuat sinyal panjang ketika harga EMA melintasi di atas EMA CVP

; Membuat sinyal pendek ketika harga EMA melintasi di bawah EMA CVP . - Sinyal keluar dapat menjadi sinyal crossover terbalik atau sinyal berdasarkan periode CVP khusus.

Keuntungan Strategi

- Sistem Sinyal yang Kuat: Menggabungkan informasi tren harga dan volume untuk penilaian arah pasar yang lebih akurat.

- Kemampuan beradaptasi yang tinggi: Dapat beradaptasi dengan lingkungan pasar yang berbeda dengan menyesuaikan periode EMA dan CVP.

- Manajemen Risiko Lengkap: Filter waktu internal mencegah perdagangan selama periode yang tidak sesuai.

- Mekanisme Keluar Fleksibel: Menyediakan dua metode keluar yang berbeda untuk dipilih berdasarkan karakteristik pasar.

- Visualisasi yang baik: Strategi memberikan antarmuka grafis yang jelas termasuk penanda sinyal dan pengisian area tren.

Risiko Strategi

- Risiko keterlambatan: EMA memiliki keterlambatan yang melekat, yang dapat menyebabkan sedikit keterlambatan dalam waktu masuk dan keluar.

- Risiko osilasi: Dapat menghasilkan sinyal palsu di pasar sisi.

- Sensitivitas parameter: Kombinasi parameter yang berbeda dapat menyebabkan variasi kinerja yang signifikan.

- Risiko likuiditas: Perhitungan CVP mungkin tidak akurat di pasar dengan likuiditas rendah.

- Kecenderungan Zona Waktu: Strategi menggunakan waktu New York untuk penyaringan waktu, yang membutuhkan perhatian pada jam perdagangan pasar yang berbeda.

Arah Optimasi Strategi

- Memperkenalkan Volatility Filter: Sesuaikan parameter strategi berdasarkan volatilitas pasar untuk meningkatkan kemampuan beradaptasi.

- Mengoptimalkan Filter Waktu: Tambahkan beberapa jendela waktu untuk kontrol sesi perdagangan yang lebih tepat.

- Tambahkan Penilaian Kualitas Volume: Memperkenalkan indikator analisis volume untuk menyaring sinyal volume berkualitas rendah.

- Penyesuaian Parameter Dinamis: Mengembangkan sistem parameter adaptif untuk menyesuaikan periode EMA dan CVP secara otomatis berdasarkan kondisi pasar.

- Tambahkan Indikator Sentimen Pasar: Gabungkan dengan indikator teknis lainnya untuk mengkonfirmasi sinyal perdagangan.

Ringkasan

Ini adalah strategi perdagangan kuantitatif dengan struktur lengkap dan logika yang jelas. Dengan menggabungkan keuntungan dari EMA dan CVP, ini menciptakan sistem perdagangan yang dapat menangkap tren dan fokus pada pengendalian risiko. Strategi ini sangat dapat disesuaikan dan cocok untuk digunakan di lingkungan pasar yang berbeda.

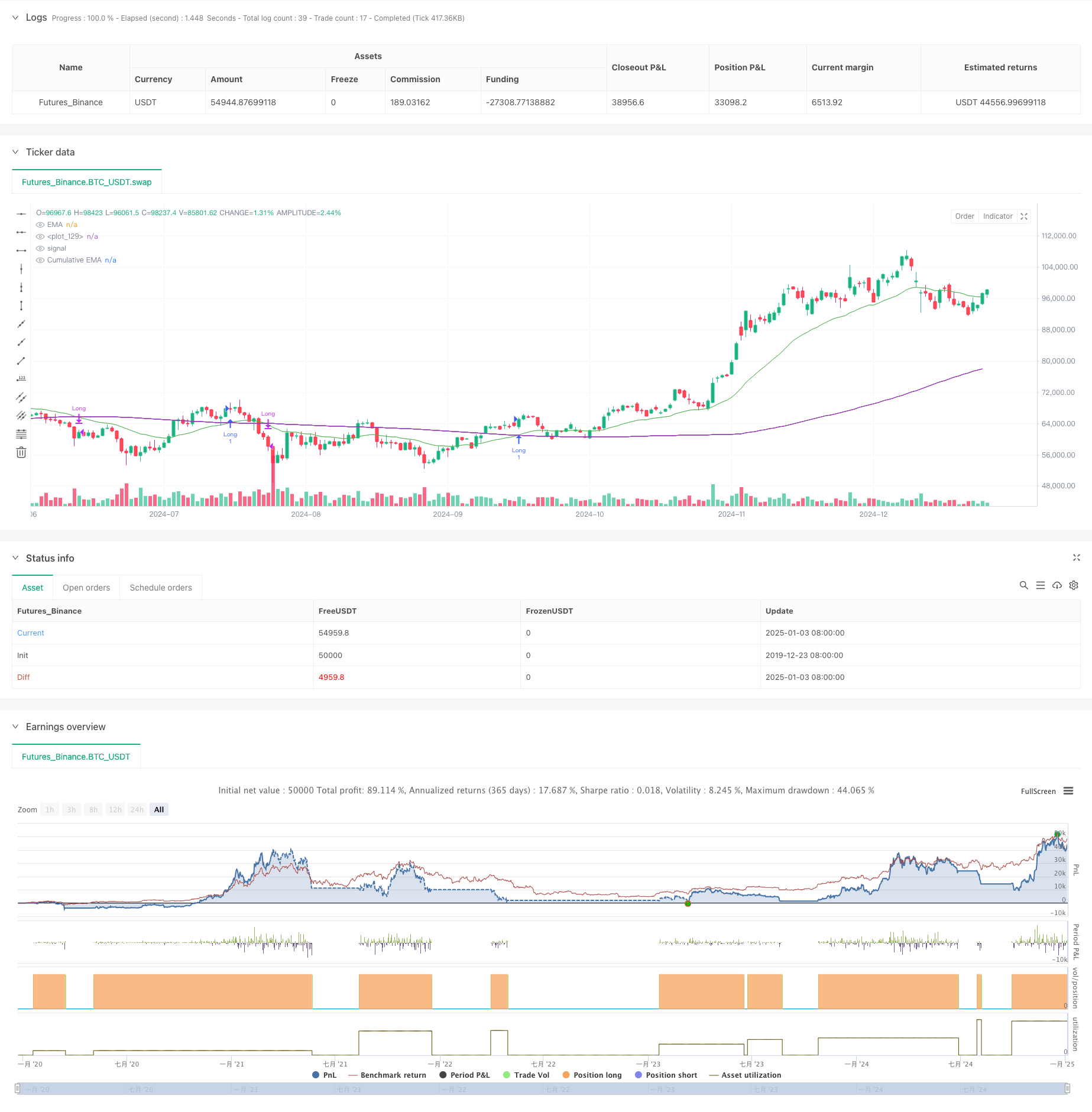

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// © sapphire_edge

// # ========================================================================= #

// #

// # _____ __ _ ______ __

// # / ___/____ _____ ____ / /_ (_)_______ / ____/___/ /___ ____

// # \__ \/ __ `/ __ \/ __ \/ __ \/ / ___/ _ \ / __/ / __ / __ `/ _ \

// # ___/ / /_/ / /_/ / /_/ / / / / / / / __/ / /___/ /_/ / /_/ / __/

// # /____/\__,_/ .___/ .___/_/ /_/_/_/ \___/ /_____/\__,_/\__, /\___/

// # /_/ /_/ /____/

// #

// # ========================================================================= #

strategy(shorttitle="⟡Sapphire⟡ EMA/CVP", title="[Sapphire] EMA/CVP Strategy", initial_capital= 50000, currency= currency.USD,default_qty_value = 1,commission_type= strategy.commission.cash_per_contract,overlay= true )

// # ========================================================================= #

// # // Settings Menu //

// # ========================================================================= #

// -------------------- Main Settings -------------------- //

groupEMACVP = "EMA / Cumulative Volume Period"

tradeDirection = input.string(title='Trade Direction', defval='LONG', options=['LONG', 'SHORT'], group=groupEMACVP)

emaLength = input.int(25, title='EMA Length', minval=1, maxval=200, group=groupEMACVP)

cumulativePeriod = input.int(100, title='Cumulative Volume Period', minval=1, maxval=200, step=5, group=groupEMACVP)

exitType = input.string(title="Exit Type", defval="Crossover", options=["Crossover", "Custom CVP" ], group=groupEMACVP)

cumulativePeriodForClose = input.int(50, title='Cumulative Period for Close Signal', minval=1, maxval=200, step=5, group=groupEMACVP)

showSignals = input.bool(true, title="Show Signals", group=groupEMACVP)

signalOffset = input.int(5, title="Signal Vertical Offset", group=groupEMACVP)

// -------------------- Time Filter Inputs -------------------- //

groupTimeOfDayFilter = "Time of Day Filter"

useTimeFilter1 = input.bool(false, title="Enable Time Filter 1", group=groupTimeOfDayFilter)

startHour1 = input.int(0, title="Start Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

startMinute1 = input.int(0, title="Start Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

endHour1 = input.int(23, title="End Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

endMinute1 = input.int(45, title="End Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

closeAtEndTimeWindow = input.bool(false, title="Close Trades at End of Time Window", group=groupTimeOfDayFilter)

// -------------------- Trading Window -------------------- //

isWithinTradingWindow(startHour, startMinute, endHour, endMinute) =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

startInMinutes = startHour * 60 + startMinute

endInMinutes = endHour * 60 + endMinute

timeInMinutes >= startInMinutes and timeInMinutes <= endInMinutes

timeCondition = (useTimeFilter1 ? isWithinTradingWindow(startHour1, startMinute1, endHour1, endMinute1) : true)

// Check if the current bar is the last one within the specified time window

isEndOfTimeWindow() =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

endInMinutes = endHour1 * 60 + endMinute1

timeInMinutes == endInMinutes

// Logic to close trades if the time window ends

if timeCondition and closeAtEndTimeWindow and isEndOfTimeWindow()

strategy.close_all(comment="Closing trades at end of time window")

// # ========================================================================= #

// # // Calculations //

// # ========================================================================= #

avgPrice = (high + low + close) / 3

avgPriceVolume = avgPrice * volume

cumulPriceVolume = math.sum(avgPriceVolume, cumulativePeriod)

cumulVolume = math.sum(volume, cumulativePeriod)

cumValue = cumulPriceVolume / cumulVolume

cumulPriceVolumeClose = math.sum(avgPriceVolume, cumulativePeriodForClose)

cumulVolumeClose = math.sum(volume, cumulativePeriodForClose)

cumValueClose = cumulPriceVolumeClose / cumulVolumeClose

emaVal = ta.ema(close, emaLength)

emaCumValue = ta.ema(cumValue, emaLength)

// # ========================================================================= #

// # // Signal Logic //

// # ========================================================================= #

// Strategy Entry Conditions

longEntryCondition = ta.crossover(emaVal, emaCumValue) and tradeDirection == 'LONG'

shortEntryCondition = ta.crossunder(emaVal, emaCumValue) and tradeDirection == 'SHORT'

// User-Defined Exit Conditions

longExitCondition = false

shortExitCondition = false

if exitType == "Crossover"

longExitCondition := ta.crossunder(emaVal, emaCumValue)

shortExitCondition := ta.crossover(emaVal, emaCumValue)

if exitType == "Custom CVP"

emaCumValueClose = ta.ema(cumValueClose, emaLength)

longExitCondition := ta.crossunder(emaVal, emaCumValueClose)

shortExitCondition := ta.crossover(emaVal, emaCumValueClose)

// # ========================================================================= #

// # // Strategy Management //

// # ========================================================================= #

// Strategy Execution

if longEntryCondition and timeCondition

strategy.entry('Long', strategy.long)

label.new(bar_index, high - signalOffset, "◭", style=label.style_label_up, color = color.rgb(119, 0, 255, 20), textcolor=color.white)

if shortEntryCondition and timeCondition

strategy.entry('Short', strategy.short)

label.new(bar_index, low + signalOffset, "⧩", style=label.style_label_down, color = color.rgb(255, 85, 0, 20), textcolor=color.white)

if strategy.position_size > 0 and longExitCondition

strategy.close('Long')

if strategy.position_size < 0 and shortExitCondition

strategy.close('Short')

// # ========================================================================= #

// # // Plots and Charts //

// # ========================================================================= #

plot(emaVal, title='EMA', color=color.new(color.green, 25))

plot(emaCumValue, title='Cumulative EMA', color=color.new(color.purple, 35))

fill(plot(emaVal), plot(emaCumValue), color=emaVal > emaCumValue ? #008ee6 : #d436a285, title='EMA and Cumulative Area', transp=70)

- perdagangan jangka waktu yang berbeda

- Strategi Stop Crossover Multi-EMA

- Trend Rata-rata Bergerak Ganda Mengikuti Strategi dengan Manajemen Risiko

- Tren Multi-Timeframe Mengikuti Strategi dengan 200 EMA Filter - Hanya Panjang

- Elliott Wave Stochastic EMA Strategi

- Tren Multi-EMA Mengikuti Strategi Perdagangan

- Strategi Perdagangan Kuantitatif EMA Crossover Dinamis Take-Profit Stop-Loss

- EMA100 dan NUPL Relative Unrealized Profit Quantitative Trading Strategy

- Moving Average Colored EMA/SMA

- EMA Dinamis Trend Crossover Entry Strategi Kuantitatif

- Multi-Moving Average Supertrend dengan Bollinger Breakout Trading Strategy

- Strategi Kuantitatif Crossover Rata-rata Bergerak Dinamis Multi-Indikator

- Rata-rata Bergerak Dua Periode dengan Momentum RSI dan Tren Volume Mengikuti Strategi

- RSI Trend Breakthrough dan Momentum Enhancement Strategi Perdagangan

- Tren Dinamis Dual EMA Crossover Mengikuti Strategi Perdagangan Kuantitatif

- Adaptive Trend Flow Multiple Filter Strategi Perdagangan

- Indikator Teknis Dual Dinamis Strategi Perdagangan Konfirmasi Terlalu Terjual-Terlalu Dibeli

- Strategi perdagangan stop trailing multi-indikator dinamis

- Sistem osilator stokastik EMA ganda: Model perdagangan kuantitatif yang menggabungkan trend berikut dan momentum

- Strategi Perdagangan Volatilitas Dinamis Multi-Indikator

- Strategi Crossover EMA Dinamis dengan Sistem Penyaringan Kekuatan Tren ADX

- Strategi Perdagangan Kuantitatif

- Adaptive Channel Breakout Strategy dengan Dynamic Support and Resistance Trading System

- Filter Dinamis EMA Cross Strategy untuk Analisis Tren Harian

- Multi-EMA Crossover dengan Camarilla Support/Resistance Trend Trading System

- Strategi Perdagangan Dinamis Trend Multi-Signal yang Ditingkatkan

- Adaptive Momentum Martingale Trading System (Sistem Perdagangan Momentum Martingale yang Adaptif)

- Tren Mengikuti RSI dan Moving Average Combined Quantitative Trading Strategy

- Advanced Quantitative Trend Following and Cloud Reversal Composite Trading Strategy (Strategi Perdagangan Komposit Mengikuti Tren Kuantitatif Lanjutan dan Pembalikan Awan)

- Trend Berbasis EMA 5 Hari Mengikuti Model Optimasi Strategi