暗号通貨先物 (Teaching) の二重移動平均ブレイクポイント戦略

作者: リン・ハーンニナバダス, 作成日:2022-04-08 11:46:22, 更新日:2022-04-08 11:58:28暗号通貨先物 (Teaching) の二重移動平均ブレイクポイント戦略

この記事では,簡単なトレンド戦略の設計を戦略設計レベルからのみ説明し,初心者が簡単な戦略の設計方法と戦略プログラムの実行プロセスを理解することを学ぶのを助ける. 戦略のパフォーマンスの質については,戦略パラメータと大きく関係しています (これはほとんどすべてのトレンド戦略の場合です).

戦略設計

EMAの2つの指標を使用すると,両方の移動平均値がブレイクポイントを有し,ブレイクポイントは,長期および短期ポジションを開く (または逆転) 信号として使用され,固定目標利益分散を設計する.コメントは,読みやすくするために戦略コードに直接書かれています.全体的な戦略コードは非常に短く,初心者にとって適しています.

戦略コード

/*backtest

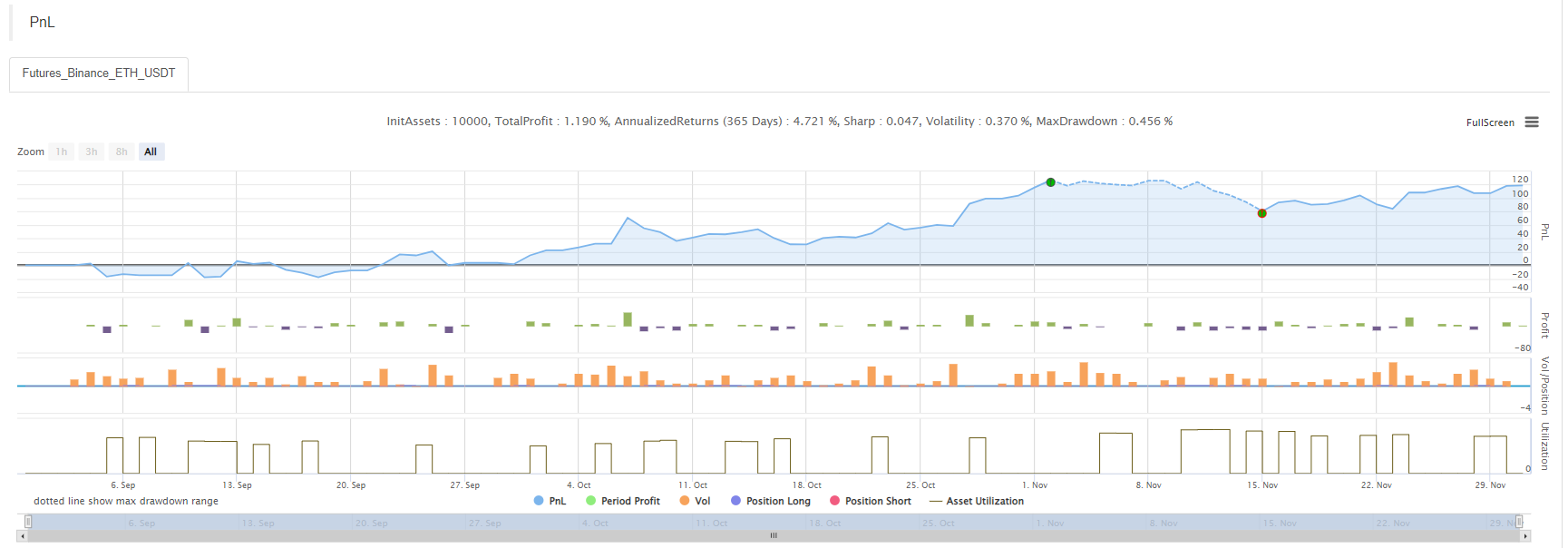

start: 2021-09-01 00:00:00

end: 2021-12-02 00:00:00

period: 1h

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// above /**/ inside these are the default backtest settings; the backtest page can be reset by the related controls on the backtest page

var LONG = 1 // mark of holding long positions; enum constant

var SHORT = -1 // mark of holding short positions; enum constant

var IDLE = 0 // mark of not holding no position; enum constant

// obtain the positions with a specified direction; positions indicates position data; direction indicates the direction of the positions to be obtained

function getPosition(positions, direction) {

var ret = {Price : 0, Amount : 0, Type : ""} // define a structure when holding no position

// traverse positions, among which find the positions conforming to the direction

if (pos.Type == direction) {

ret = pos

}

})

// return the positions found

return ret

}

// cancel all pending orders of the current trading pair and contract

function cancellAll() {

// infinite loop, detect without stop, until break is triggered

while (true) {

// obtain the pending orders data of the current trading pair and contract, namely orders

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

// when orders is a null array, namely orders.length == 0, execute "break" statement to break the while loop

break

} else {

// traverse all the current pending orders, and cancel them one by one

for (var i = 0 ; i < orders.length ; i++) {

// the function to cancel a specified order, canceling the order with an ID of:orders[i].Id

exchange.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// function of closing position, which executes close position, according to the passed tradeFunc and direction

function cover(tradeFunc, direction) {

var mapDirection = {"closebuy": PD_LONG, "closesell": PD_SHORT}

var positions = _C(exchange.GetPosition) // obtain the position data of the current trading pair and contract

var pos = getPosition(positions, mapDirection[direction]) // find the position information of the specified close position direction

// when position volume is over 0 (only when there is a position, you can operate close position)

if (pos.Amount > 0) {

// cancel all possibly existing pending orders

cancellAll()

// set trading direction

exchange.SetDirection(direction)

// execute close position tradefunc

if (tradeFunc(-1, pos.Amount)) {

// if ordering successfully, return true

return true

} else {

// if the ordering fails, return false

return false

}

}

// no position returns true

return true

}

// strategy main function

function main() {

// used to switch to OKEX V5 simulated bot

if (okexSimulate) {

exchange.IO("simulate", true) // switch to OKEX V5 simulated bot to test

Log("switch to OKEX V5 simulated bot")

}

// set contract code; set ct to swap, namely set the current operated contract to a perpetual contract

exchange.SetContractType(ct)

// the initial status is no position

var state = IDLE

// the initial position price is 0

var holdPrice = 0

// innitialize the timestamp for comparison, to compare whether the current K-line BAR changes

var preTime = 0

// strategy main loop

while (true) {

// obtain the K-line data of the current trading pair and contract

var r = _C(exchange.GetRecords)

// obtain the K-line length, namely 1

var l = r.length

// judge the K-line length of 1, which has to be longer than the indicator period (if the length is less than the indicator period, the indicator function cannot calculate the effective indicatorr data); if not, the loop will be restarted

if (l < Math.max(ema1Period, ema2Period)) {

// wait 1000 miliseconds, namely 1 second, to avoid rotating too fast

Sleep(1000)

// ignore the code after "if" at the moment, and restart the while loop

continue

}

// calculate EMA indicator data

var ema1 = TA.EMA(r, ema1Period)

var ema2 = TA.EMA(r, ema2Period)

// plot

$.PlotRecords(r, 'K-line') // draw K-line chart

// when the timestamp of the last BAR changes, namely when the new K-line BAR is generated

if(preTime !== r[l - 1].Time){

// before the new K-line BAR is generated, it is the last update of the last BAR

$.PlotLine('ema1', ema1[l - 2], r[l - 2].Time)

$.PlotLine('ema2', ema2[l - 2], r[l - 2].Time)

// draw the EMA lines of the new BAR, namely the EMA indicator data on the current last BAR

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

// update the timestamp for comparison

preTime = r[l - 1].Time

} else {

// at the moment when there is no new BAR generated, just update the EMA indicator data of the last BAR in the chart

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

}

// condition of open long position, breakpoint

var up = (ema1[l - 2] > ema1[l - 3] && ema1[l - 4] > ema1[l - 3]) && (ema2[l - 2] > ema2[l - 3] && ema2[l - 4] > ema2[l - 3])

// condition of open short position, breakpoint

var down = (ema1[l - 2] < ema1[l - 3] && ema1[l - 4] < ema1[l - 3]) && (ema2[l - 2] < ema2[l - 3] && ema2[l - 4] < ema2[l - 3])

// when the condition of open long position is triggered and currently short positions are held, or when the condition of open long position is triggered but there is no position

if (up && (state == SHORT || state == IDLE)) {

// if holding short, close first

if (state == SHORT && cover(exchange.Buy, "closesell")) {

// after close positions, mark the status of no position

state = IDLE

// reset the position price to 0

holdPrice = 0

// mark on the chart

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// after close positions, reverse to open long

exchange.SetDirection("buy")

if (exchange.Buy(-1, amount)) {

// mark the current status

state = LONG

// record the current price

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openLong', 'L')

}

} else if (down && (state == LONG || state == IDLE)) {

// similar to the judge of up condition

if (state == LONG && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

}

exchange.SetDirection("sell")

if (exchange.Sell(-1, amount)) {

state = SHORT

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openShort', 'S')

}

}

// stop profit

if (state == LONG && r[l - 1].Close - holdPrice > profitTarget && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

} else if (state == SHORT && holdPrice - r[l - 1].Close > profitTarget && cover(exchange.Buy, "closesell")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// display the time on the status bar

LogStatus(_D())

Sleep(500)

}

}

戦略のソースコード:https://www.fmz.com/strategy/333269

この戦略は プログラムデザインの教えに過ぎません だからボットでは 使わないでください

もっと

- 暗号通貨スポットのシンプルなオーダー監督ボットを実現する

- FMZをベースにした決済プラットフォーム

- 暗号通貨契約 単純なオーダー監督ボット

- getdepth で対応する時間軸を取得します.

- 無視して解決した

- 面値の問題

- dYdX 戦略設計例

- FMZの Python クローラーアプリケーションの初期調査

クローリングバイナンス 発表内容 - ヘッジ 戦略 設計 研究 & 待機中のスポットと先物注文の例

- 最近の状況と資金調達の利子戦略の推奨運用

- 仮想通貨スポット・マルチ・シンボル・ダブル・ムービング・平均戦略 (教学)

- JavaScript でフィッシャー インディケーターの実現と FMZ でのプロティング

- 管理者

- 2021年暗号通貨のTAQレビュー&10倍増の最もシンプルな見逃した戦略

- 仮想通貨先物 多シンボル ART 戦略 (教学)

- アップグレード! 仮想通貨先物 マーティンゲール戦略

- Getrecords は秒単位で K 線図を取得できません

- FMZベースのオーダー同期管理システム設計 (2)

- Getticker が返した Volume データは間違っています

- FMZベースのオーダー同期管理システム設計 (1)