スイング・ハイス/ローズ&キャンドル・パターン

作者: リン・ハーンチャオチャン, 日時: 2022-05-07 21:12:40タグ:上昇傾向低迷している

このスクリプトは,スイング・ハイスとスイング・ローズと,その特定の時点で発生したキャンドルのパターンを表示します.スクリプトは,次の6つのキャンドルのパターンを検出できます.ハンマー,逆ハンマー,上昇傾向,ハンガリングマン,シューティングスター,下落傾向.

HH,HL,LH,LLの記号は 標識に表示されています

HH: 高い高い HL: 高い低 LH: 低い高 LL: 低い低い

設定

長さ:低値と高値の検出の敏感度,より低い値で,短期間の価格変動の最大値と最小値が返されます.

使用と詳細

特定のキャンドルパターンと関連しているかどうかを見るのは興味深いかもしれません.これは,逆転を示すためのそのようなパターンの可能性を研究することを可能にします. 特定のパターンを持つラベルをハワードで移動して,それについての詳細を見ることができます.

標識がオフセットで,リアルタイムで表示されるので,この指標は,リアルタイムで上位/下位を検出することを意図していません.

長さの値が高くなる場合,エラーが返されます.

バックテスト

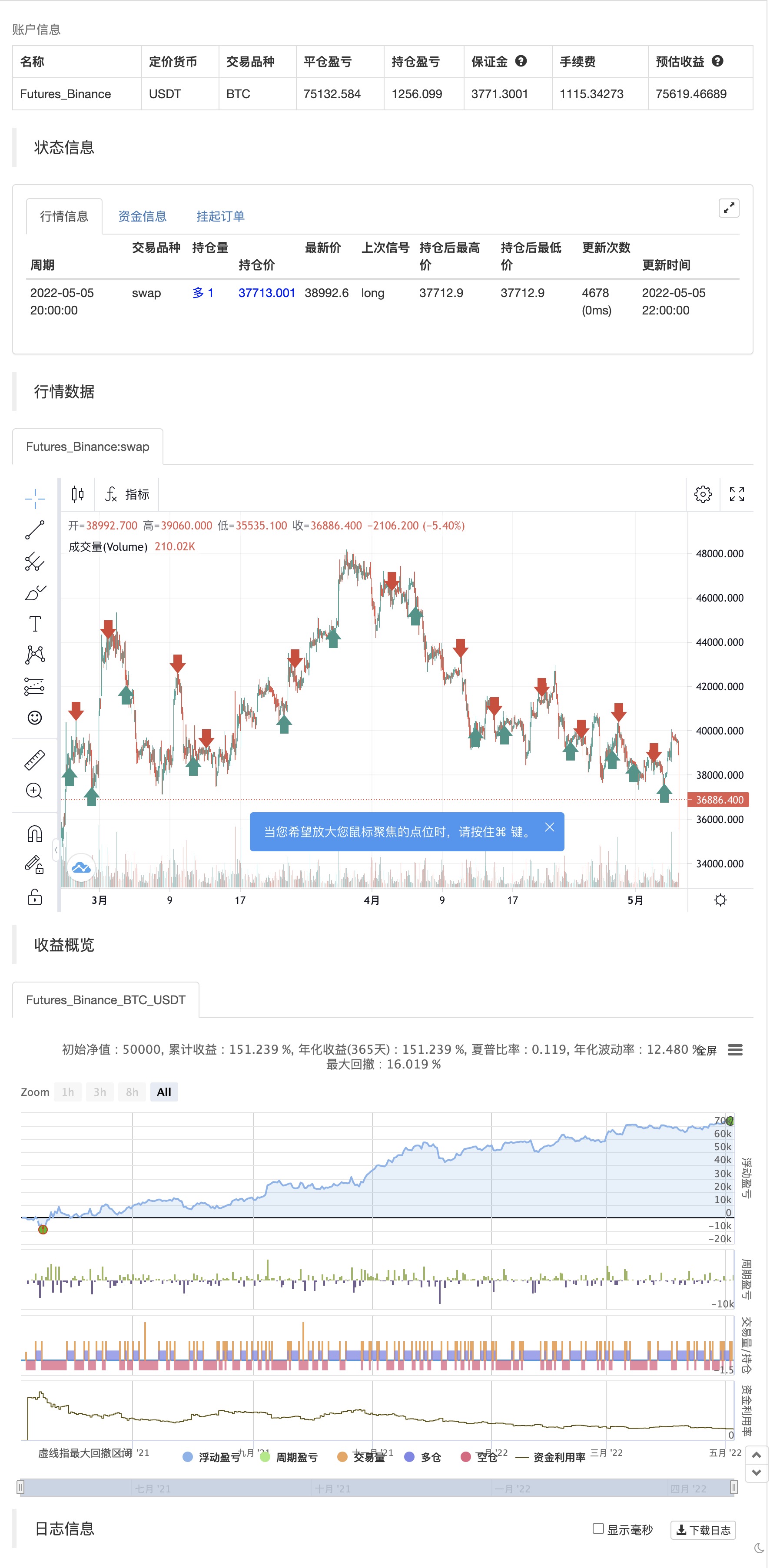

/*backtest

start: 2021-05-06 00:00:00

end: 2022-05-05 23:59:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=4

study("Swing Highs/Lows & Candle Patterns",overlay=true)

length = input(21)

//------------------------------------------------------------------------------

o = open[length],h = high[length]

l = low[length],c = close[length]

//------------------------------------------------------------------------------

ph = pivothigh(close,length,length)

pl = pivotlow(open,length,length)

valH = valuewhen(ph,c,0)

valL = valuewhen(pl,c,0)

valpH = valuewhen(ph,c,1)

valpL = valuewhen(pl,c,1)

//------------------------------------------------------------------------------

d = abs(c - o)

hammer = pl and min(o,c) - l > d and h - max(c,o) < d

ihammer = pl and h - max(c,o) > d and min(c,o) - l < d

bulleng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

hanging = ph and min(c,o) - l > d and h - max(o,c) < d

shooting = ph and h - max(o,c) > d and min(c,o) - l < d

beareng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

//------------------------------------------------------------------------------

//Descriptions

//------------------------------------------------------------------------------

hammer_ = "The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend."

+ "\n" + "\n A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up."

ihammer_ = "The inverted hammer is a similar pattern than the hammer pattern. The only difference being that the upper wick is long, while the lower wick is short."

+ "\n" + "\n It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The inverse hammer suggests that buyers will soon have control of the market."

bulleng_ = "The bullish engulfing pattern is formed of two candlesticks. The first candle is a short red body that is completely engulfed by a larger green candle"

+ "\n" + "\n Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers"

hanging_ = "The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend."

+ "\n" + "It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. The large sell-off is often seen as an indication that the bulls are losing control of the market."

shotting_ = "The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick."

+ "\n" + "Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground."

beareng_ = "A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle."

+ "\n" + "It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The lower the second candle goes, the more significant the trend is likely to be."

//------------------------------------------------------------------------------

n = bar_index

label lbl = na

H = valH > valpH ? "HH" : valH < valpH ? "LH" : na

L = valL < valpL ? "LL" : valL > valpL ? "HL" : na

txt = hammer ? "Hammer" : ihammer ? "Inverse Hammer" :

bulleng ? "Bullish Engulfing" : hanging ? "Hanging Man" :

shooting ? "Shooting Star" : beareng ? "Bearish Engulfing" : "None"

des = hammer ? hammer_ : ihammer ? ihammer_ :

bulleng ? bulleng_ : hanging ? hanging_ :

shooting ? shotting_ : beareng ? beareng_ : ""

//------------------------------------------------------------------------------

if ph

strategy.entry("Enter Long", strategy.long)

else if pl

strategy.entry("Enter Short", strategy.short)

関連コンテンツ

- ジグザグPA戦略 V4.1

- デマルク設定指標

- 壊れたフラクタル: 誰かの壊れた夢はあなたの利益です!

- 飲み込める ろうそく

- マルコフ連鎖確率変換状態量化取引戦略

- サポート・レジスタンスのブレイク

- 双タイムフレームトレンド逆転K線形量化取引戦略

- EMAの均線交差と短期信号戦略

- RSI動的区間反転量化戦略と波動率最適化モデル

- 線形回帰斜率に基づく動的市場状態の識別戦略

もっと見る

- マジックMACD

- 信号によるZスコア

神 易波動率戦略 パイン語版 - 3EMA + ボーリンガー + PIVOT

- 多粒のバゲット

- ミルマシーン

- Kの逆転指標 I

- 飲み込める ろうそく

- MA 皇帝 インシリコノット

- デマルクの逆転点

- TMA オーバーレイ

- MACD + SMA 200 戦略

- CM スリングショットシステム

- ボリンガー+RSI,ダブル戦略 v1.1

- ボリンジャー・バンド戦略

- オプティマイズされたトレンドトラッカー

- パインスクリプト戦略における月間リターン

- v4 の ADX と DI

- MacD カスタム インディケーター - 多重タイムフレーム+すべてのオプション!

- インディケーター: WaveTrend オシレーター