波動傾向とVWMAベースの傾向

作者: リン・ハーンチャオチャン開催日:2024年1月26日 17:35:29タグ:

概要

この戦略は,波動トレンドオシレーターとVWMA指標を組み合わせて,量子取引戦略に従ってトレンドを実装する.それは市場のトレンドを特定し,波動トレンドオシレーターからの信号に基づいて購入または販売決定を下すことができる.一方,取引サイズはVWMA指標からの信号によって決定される.

戦略の論理

この戦略は主に以下の2つの指標に基づいています

-

波動トレンドオシレーター:これは,価格変動における

波を識別し,買/売シグナルを生成するLazyBearによってTradingViewに移植されたオシレーターである.具体的な計算は,まず平均価格apを計算し,その後apのEMA (esaと呼ばれる),その後apとesaの絶対値のEMAを計算し,最終的に一貫性インデックスci=(ap-esa) /(0.015*dを計算し,ciのEMAは波動トレンド (wt1), wt1の4期SMAは wt2である. wt1が wt2を超えると購入信号であり, wt1が wt2を下回ると販売信号である. -

VWMA インディケーター:これはボリューム重度の移動平均線です.価格はVWMA バンド (VWMA の上下帯) の内側か外側にあるかによって, +1 (上昇),0 (中立) または -1 (下落) の信号を生成します.

波動トレンド信号は,いつ買い,いつ売るべきかを決定する.一方,VWMA指標からの上昇/下落信号は,各取引の特定の取引サイズを決定する.

利点

- 2つの指標からの信号を組み合わせて意思決定の正確さを向上させる

- VWMAは市場強さを判断するために,流量流量を考慮する

- ニュースからの変動を避けるために,カスタマイズ可能な取引セッション

- リスク削減のため,VWMA信号に基づいて調整された取引規模

リスク

- 波動トレンドからの潜在的な誤った信号

- 誤った量データにより VWMA が影響を受ける可能性があります

- 指標の計算には長い歴史データが必要です

- ストップ損失がない

最適化

- 最適値を見つけるために異なるパラメータの組み合わせをテスト

- ストップ損失戦略を追加

- シグナルフィルタリングのための他の指標と組み合わせることを検討する

- 取引セッションの異なる設定をテストする

- 取引サイズ計算を動的に調整する

結論

この戦略は,先進的なトレンドフォローアプローチのために,トレンド判断とボリューム能力を統合している.いくつかの利点はありますが,注意すべきリスクもあります.パラメータと規則のさらなる改善は,安定性と収益性を向上させることができます.

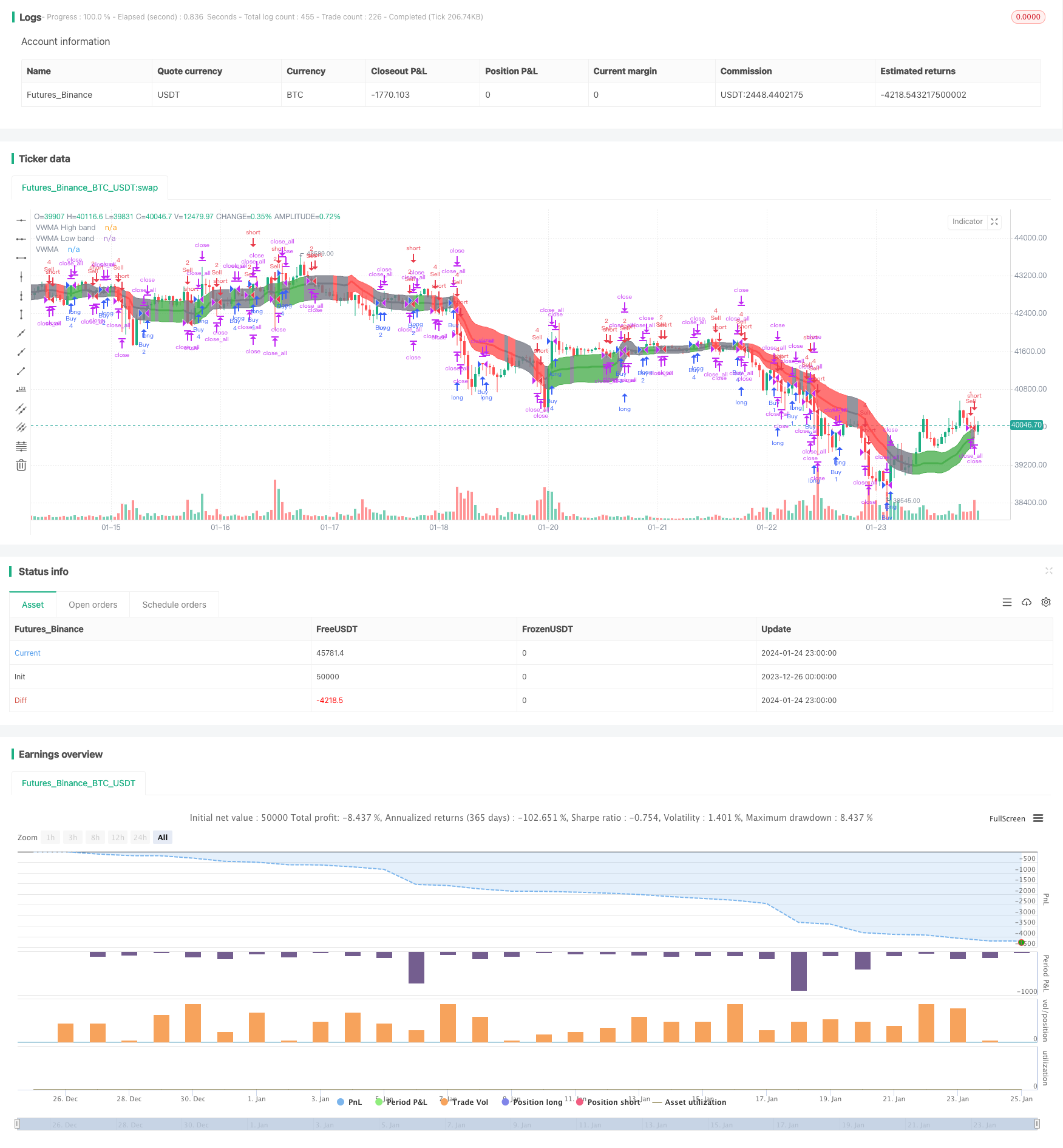

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at

// https://mozilla.org/MPL/2.0/

//

// Created by jadamcraig

//

// This strategy benefits from extracts taken from the following

// studies/authors. Thank you for developing and sharing your ideas in an open

// way!

// * Wave Trend Strategy by thomas.gigure

// * cRSI + Waves Strategy with VWMA overlay by Dr_Roboto

//

//@version=4

//==============================================================================

//==============================================================================

overlay = true // plots VWMA (need to close and re-add)

//overlay = false // plots Wave Trend (need to close and re-add)

strategy("Wave Trend w/ VWMA overlay", overlay=overlay)

baseQty = input(defval=1, title="Base Quantity", type=input.float, minval=1)

useSessions = input(defval=true, title="Limit Signals to Trading Sessions?")

sess1_startHour = input(defval=8, title="Session 1: Start Hour",

type=input.integer, minval=0, maxval=23)

sess1_startMinute = input(defval=25, title="Session 1: Start Minute",

type=input.integer, minval=0, maxval=59)

sess1_stopHour = input(defval=10, title="Session 1: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess1_stopMinute = input(defval=25, title="Session 1: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess2_startHour = input(defval=12, title="Session 2: Start Hour",

type=input.integer, minval=0, maxval=23)

sess2_startMinute = input(defval=55, title="Session 2: Start Minute",

type=input.integer, minval=0, maxval=59)

sess2_stopHour = input(defval=14, title="Session 2: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess2_stopMinute = input(defval=55, title="Session 2: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess1_closeAll = input(defval=false, title="Close All at End of Session 1")

sess2_closeAll = input(defval=true, title="Close All at End of Session 2")

//==============================================================================

//==============================================================================

// Volume Weighted Moving Average (VWMA)

//==============================================================================

//==============================================================================

plotVWMA = overlay

// check if volume is available for this equity

useVolume = input(

title="VWMA: Use Volume (uncheck if equity does not have volume)",

defval=true)

vwmaLen = input(defval=21, title="VWMA: Length", type=input.integer, minval=1,

maxval=200)

vwma = vwma(close, vwmaLen)

vwma_high = vwma(high, vwmaLen)

vwma_low = vwma(low, vwmaLen)

if not(useVolume)

vwma := wma(close, vwmaLen)

vwma_high := wma(high, vwmaLen)

vwma_low := wma(low, vwmaLen)

// +1 when above, -1 when below, 0 when inside

vwmaSignal(priceOpen, priceClose, vwmaHigh, vwmaLow) =>

sig = 0

color = color.gray

if priceClose > vwmaHigh

sig := 1

color := color.green

else if priceClose < vwmaLow

sig := -1

color := color.red

else

sig := 0

color := color.gray

[sig,color]

[vwma_sig, vwma_color] = vwmaSignal(open, close, vwma_high, vwma_low)

priceAboveVWMA = vwma_sig == 1 ? true : false

priceBelowVWMA = vwma_sig == -1 ? true : false

// plot(priceAboveVWMA?2.0:0,color=color.blue)

// plot(priceBelowVWMA?2.0:0,color=color.maroon)

//bandTrans = input(defval=70, title="VWMA Band Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

//fillTrans = input(defval=70, title="VWMA Fill Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

bandTrans = 60

fillTrans = 60

// ***** Plot VWMA *****

highband = plot(plotVWMA?fixnan(vwma_high):na, title='VWMA High band',

color = vwma_color, linewidth=1, transp=bandTrans)

lowband = plot(plotVWMA?fixnan(vwma_low):na, title='VWMA Low band',

color = vwma_color, linewidth=1, transp=bandTrans)

fill(lowband, highband, title='VWMA Band fill', color=vwma_color,

transp=fillTrans)

plot(plotVWMA?vwma:na, title='VWMA', color = vwma_color, linewidth=3,

transp=bandTrans)

//==============================================================================

//==============================================================================

// Wave Trend

//==============================================================================

//==============================================================================

plotWaveTrend = not(overlay)

n1 = input(10, "Wave Trend: Channel Length")

n2 = input(21, "Wave Trend: Average Length")

obLevel1 = input(60, "Wave Trend: Over Bought Level 1")

obLevel2 = input(53, "Wave Trend: Over Bought Level 2")

osLevel1 = input(-60, "Wave Trend: Over Sold Level 1")

osLevel2 = input(-53, "Wave Trend: Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(plotWaveTrend?0:na, color=color.gray)

plot(plotWaveTrend?obLevel1:na, color=color.red)

plot(plotWaveTrend?osLevel1:na, color=color.green)

plot(plotWaveTrend?obLevel2:na, color=color.red, style=3)

plot(plotWaveTrend?osLevel2:na, color=color.green, style=3)

plot(plotWaveTrend?wt1:na, color=color.green)

plot(plotWaveTrend?wt2:na, color=color.red, style=3)

plot(plotWaveTrend?wt1-wt2:na, color=color.blue, transp=80)

//==============================================================================

//==============================================================================

// Order Management

//==============================================================================

//==============================================================================

// Define Long and Short Conditions

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

// Define Quantities

orderQty = baseQty * 2

if (longCondition)

if (vwma_sig == 1)

if ( strategy.position_size >= (baseQty * 4 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 4 + abs(strategy.position_size)

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size >= (baseQty * 2 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 2 + abs(strategy.position_size)

else

orderQty := baseQty * 2

else if (vwma_sig == -1)

if ( strategy.position_size >= (baseQty * 1 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 1 + abs(strategy.position_size)

else

orderQty := baseQty * 1

else if (shortCondition)

if (vwma_sig == -1)

if ( strategy.position_size <= (baseQty * 4) and

strategy.position_size > 0 )

orderQty := baseQty * 4 + strategy.position_size

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size <= (baseQty * 2) and

strategy.position_size > 2 )

orderQty := baseQty * 2 + strategy.position_size

else

orderQty := baseQty * 2

else if (vwma_sig == 1)

if ( strategy.position_size <= (baseQty * 1) and

strategy.position_size > 0 )

orderQty := baseQty * 1 + strategy.position_size

else

orderQty := baseQty * 1

// Determine if new trades are permitted

newTrades = false

if (useSessions)

if ( hour == sess1_startHour and minute >= sess1_startMinute )

newTrades := true

else if ( hour > sess1_startHour and hour < sess1_stopHour )

newTrades := true

else if ( hour == sess1_stopHour and minute < sess1_stopMinute )

newTrades := true

else if ( hour == sess2_startHour and minute >= sess2_startMinute )

newTrades := true

else if ( hour > sess2_startHour and hour < sess2_stopHour )

newTrades := true

else if ( hour == sess2_stopHour and minute < sess2_stopMinute )

newTrades := true

else

newTrades := false

else

newTrades := true

// Long Signals

if ( longCondition )

strategy.order("Buy", strategy.long, orderQty)

// Short Signals

if ( shortCondition )

strategy.order("Sell", strategy.short, orderQty)

// Close open position at end of Session 1, if enabled

if (sess1_closeAll )

strategy.close_all()

// Close open position at end of Session 2, if enabled

if (sess2_closeAll )

strategy.close_all()

もっと

- RSIに基づくストップ・ロスト・アンド・テイク・プロフィート戦略

- 移動平均チャネルブレイク戦略

- 固定時間分断テスト戦略

- 時間と空間を最適化したマルチタイムフレームMACD戦略

- ストックRSIとMFIをベースにした量的な取引戦略

- 多指標複合取引戦略

- クロスオーバー EMA 短期取引戦略

- 動的ストップロスの戦略をフォローする傾向

- ブールマーケットのブレイク ダルバス・ボックス・バイ・戦略

- 相対的な動力戦略

- アダプティブ・トリプル・スーパートレンド戦略

- 移動平均のクロスオーバー戦略

- 重要な逆転バックテスト戦略

- 3つのEMAストカスティックRSIクロスオーバーゴールデンクロス戦略

- 逆転キャンドルスタイクバックテスト戦略

- エーラースムーズストカスティックRSI戦略