Camarilla Pivot Points 戦略 ボリンジャー帯に基づく

作者: リン・ハーンチャオチャン開催日:2024-02-05 14:23:59タグ:

概要

この戦略は,先日の取引日の最高価格,最低価格,閉場価格に基づいて,まずカマリラピホットポイントを計算します.その後,価格がピホットポイントを突破したときの取引信号を生成するために,ボリンジャーバンド指標で価格をフィルターします.

戦略の論理

- 前回の取引日の最高価格,最低価格,閉店価格を計算する

- 公式に従って,上列 H4,H3,H2,H1と下列 L1,L2,L3,L4を含むカマリラピホット線を計算する

- 20日ボリンジャー帯の上帯と下帯を計算する

- 価格が下帯を超えるとロング,上帯を超えるとショート

- Bollinger Bands の上または下帯に近いストップ損失を設定する

利点分析

- Camarillaのピボットラインは,取引信号の信頼性を高めるために複数の主要なサポートとレジスタンスレベルを含みます.

- ボリンジャー・バンドと組み合わせると,誤ったブレイクが効果的にフィルターされます.

- 複数のパラメータの組み合わせにより取引が柔軟になります

リスク分析

- 不適切なボリンジャー・バンドパラメータ設定は,間違った取引信号を引き起こす可能性があります.

- Camarillaのピボットポイントは,前の取引日の価格に依存し,オバーナイトギャップの影響を受ける可能性があります.

- 長期・短期ポジションの両方には損失リスクがあります

オプティマイゼーションの方向性

- 最適な組み合わせを見つけるためにボリンガー帯のパラメータを最適化

- 誤ったブレイクシグナルをフィルターするために他の指標を追加します.

- 単一の損失を減らすためにストップ損失戦略を増やす

概要

この戦略は,Camarillaピボットラインとボリンジャーバンドを組み合わせ,価格が主要なサポートとレジスタンスレベルを突破したときの取引信号を生成する. 戦略の収益性と安定性はパラメータ最適化と信号フィルタリングを通じて改善することができる. 全体的に,この戦略は明確な取引論理と高い操作性があり,ライブ取引の検証に値する.

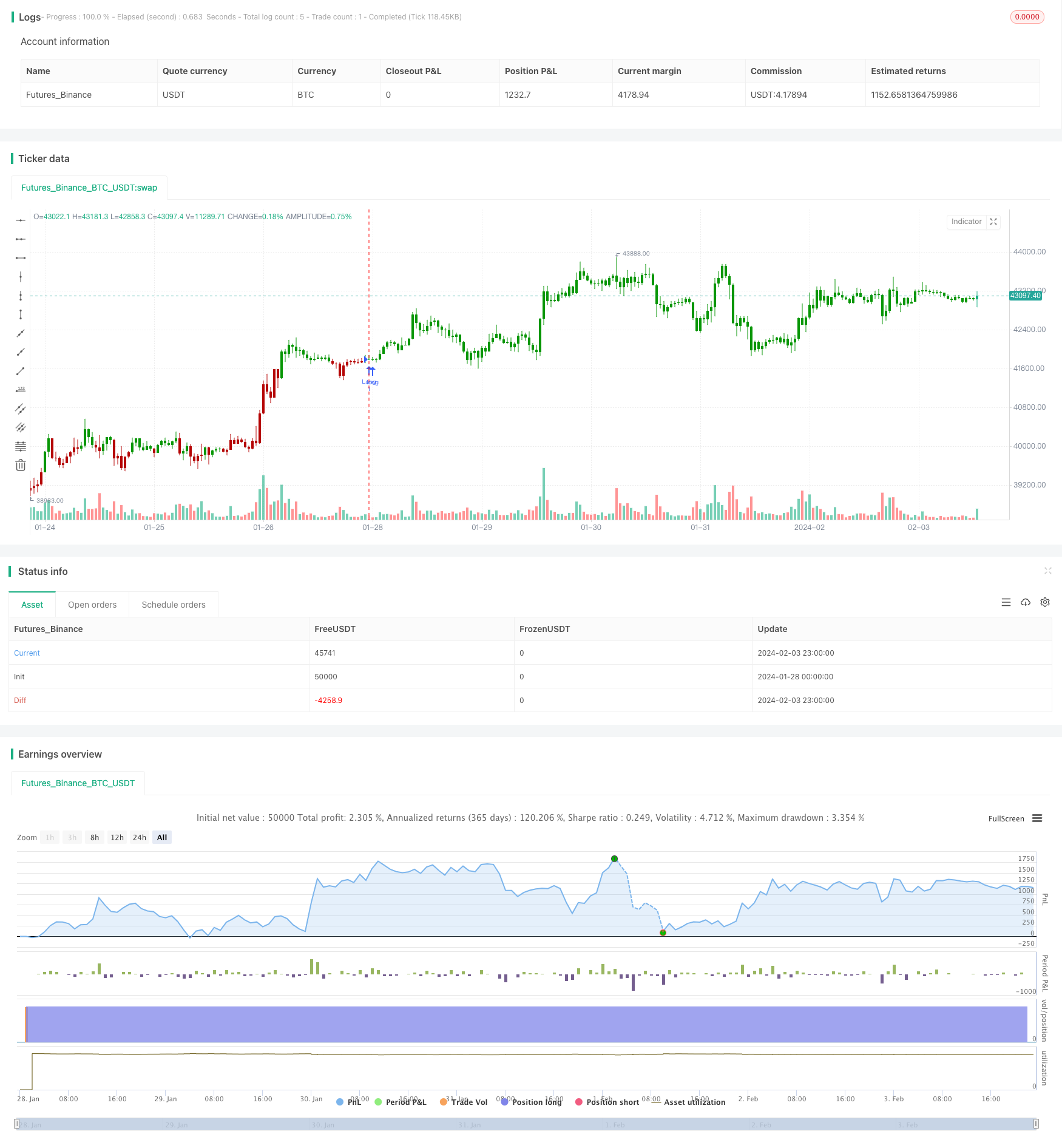

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/05/2020

// Camarilla pivot point formula is the refined form of existing classic pivot point formula.

// The Camarilla method was developed by Nick Stott who was a very successful bond trader.

// What makes it better is the use of Fibonacci numbers in calculation of levels.

//

// Camarilla equations are used to calculate intraday support and resistance levels using

// the previous days volatility spread. Camarilla equations take previous day’s high, low and

// close as input and generates 8 levels of intraday support and resistance based on pivot points.

// There are 4 levels above pivot point and 4 levels below pivot points. The most important levels

// are L3 L4 and H3 H4. H3 and L3 are the levels to go against the trend with stop loss around H4 or L4 .

// While L4 and H4 are considered as breakout levels when these levels are breached its time to

// trade with the trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points V2 Backtest", shorttitle="CPP V2", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

width = input(1, minval=1)

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

H4 = (0.55*(xHigh-xLow)) + xClose

H3 = (0.275*(xHigh-xLow)) + xClose

H2 = (0.183*(xHigh-xLow)) + xClose

H1 = (0.0916*(xHigh-xLow)) + xClose

L1 = xClose - (0.0916*(xHigh-xLow))

L2 = xClose - (0.183*(xHigh-xLow))

L3 = xClose - (0.275*(xHigh-xLow))

L4 = xClose - (0.55*(xHigh-xLow))

pos = 0

S = iff(BuyFrom == "S1", H1,

iff(BuyFrom == "S2", H2,

iff(BuyFrom == "S3", H3,

iff(BuyFrom == "S4", H4,0))))

B = iff(SellFrom == "R1", L1,

iff(SellFrom == "R2", L2,

iff(SellFrom == "R3", L3,

iff(SellFrom == "R4", L4,0))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

もっと

- 双重逆転モメントムインデックス取引戦略

- ボトムハンター戦略

- 日時範囲選択のボリンジャーバンド戦略

- トレンド・アラート・インディケーターに基づくストップ・ロスの戦略をフォローする傾向

- ストーカスティック・ブレスレット・ストラテジー

- 定量的な戦略に従うストキャスティックと移動平均のクロスオーバー傾向

- 5日間の移動平均チャネルブレークアウト戦略とマイレージコンセプトを組み合わせた

- ストップ・ロスのブレークアウト逆転戦略

- 勢い 突破 EMA 戦略

- LazyBear インディケーターに基づく Squeeze モメンタム トレーディング戦略

- EMA ラインに基づく戦略をフォローする傾向

- 動的封筒移動平均戦略

- 戦略に従って移動平均クロスオーバー傾向

- ステップバイピラミッド 移動平均のブレイク戦略

- ボリンジャー・バンドズ 双方向突破戦略

- 境界線の将来のライン バックテスト戦略

- スーパートレンドチャンネルに基づく量子取引戦略

- 利子率理論 変動指数の定量化戦略

- 相対力指数 長期的量子戦略

- 双動平均追跡ストップ損失戦略