ダイナミック・トレード理論:指数的な移動平均値と累積的なボリューム期間クロスオーバー戦略

作者: リン・ハーンチャオチャン, 日付: 2025-01-06 11:45:38タグ:エイマCVPAVWP死亡時間

概要

この戦略は,指数関数移動平均値 (EMA) と累積量期間 (CVP) を組み合わせた取引システムである.価格EMAと累積量重量価格のクロスオーバーを分析することによって市場トレンド逆転点を捕捉する.この戦略には,取引セッションを制限するための内蔵時間フィルターが含まれ,取引期間終了時に自動ポジション閉鎖をサポートする.逆クロスオーバー出口とカスタムCVP出口という2つの異なる出口方法を提供し,強い柔軟性と適応性を提供する.

戦略原則

戦略の基本論理は次の主要な計算に基づいています

- 平均価格 (AVWP) を計算する: 高値,低値,閉値の算術平均をボリュームで掛けます.

- 累積量 期間値を計算する: 設定された期間中の量重量化された価格を合計し,累積量で割る.

- 閉じる価格の EMA と CVP の EMA を別々に計算する.

- 価格EMAがCVPのEMAを超えると長信号を生成し,価格EMAがCVPのEMAを下回ると短信号を生成する.

- 出口シグナルは逆クロスオーバーシグナルか,カスタムCVP期間に基づくシグナルである.

戦略 の 利点

- 強力なシグナルシステム: 価格傾向とボリューム情報を組み合わせて,より正確な市場方向判断を行う.

- 高い適応性: EMA と CVP 期間を調整することで異なる市場環境に適応できます.

- 完全なリスク管理: タイムフィルタを組み込み,不適切な期間中に取引を防ぐ.

- 柔軟な退出メカニズム: 市場特性を考慮して選択できる2つの異なる退出方法を提供します.

- 良い視覚化:戦略は,シグナルマーカーとトレンドエリアの埋め込みを含む明確なグラフィックインターフェースを提供します.

戦略リスク

- 遅延リスク: EMA には固有の遅延があり,入入と出出のタイミングにわずかな遅延を引き起こす可能性があります.

- 振動リスク:横向市場では誤った信号を生む可能性があります.

- パラメータの感度:異なるパラメータの組み合わせにより,性能が大きく変化する可能性があります.

- 流動性リスク:低流動性市場では,CVP計算が不正確である可能性があります.

- タイムゾーン依存性: 戦略は,時間フィルタリングのためにニューヨーク時間を使用し,異なる市場取引時間に注意を払う必要があります.

戦略の最適化方向

- 波動性フィルターを導入する: 適応性を向上させるために市場波動性に基づいて戦略パラメータを調整する.

- タイムフィルターを最適化: 取引セッションの制御をより正確にするために複数のタイムウィンドウを追加します.

- 音量品質評価を追加:低品質の音量信号をフィルターするために音量分析指標を導入します.

- ダイナミックパラメータ調整:市場状況に基づいて EMA と CVP 期間を自動的に調整するための適応パラメータシステムを開発する.

- 市場情勢指標を追加:他の技術指標と組み合わせて取引信号を確認します.

概要

EMAとCVPの利点を組み合わせることで,トレンドを把握し,リスク管理に焦点を当てることができるトレードシステムを作成する.この戦略は高度にカスタマイズ可能で,さまざまな市場環境で使用するのに適しています.最適化提案の実施を通じて,さらなるパフォーマンス改善の余地があります.

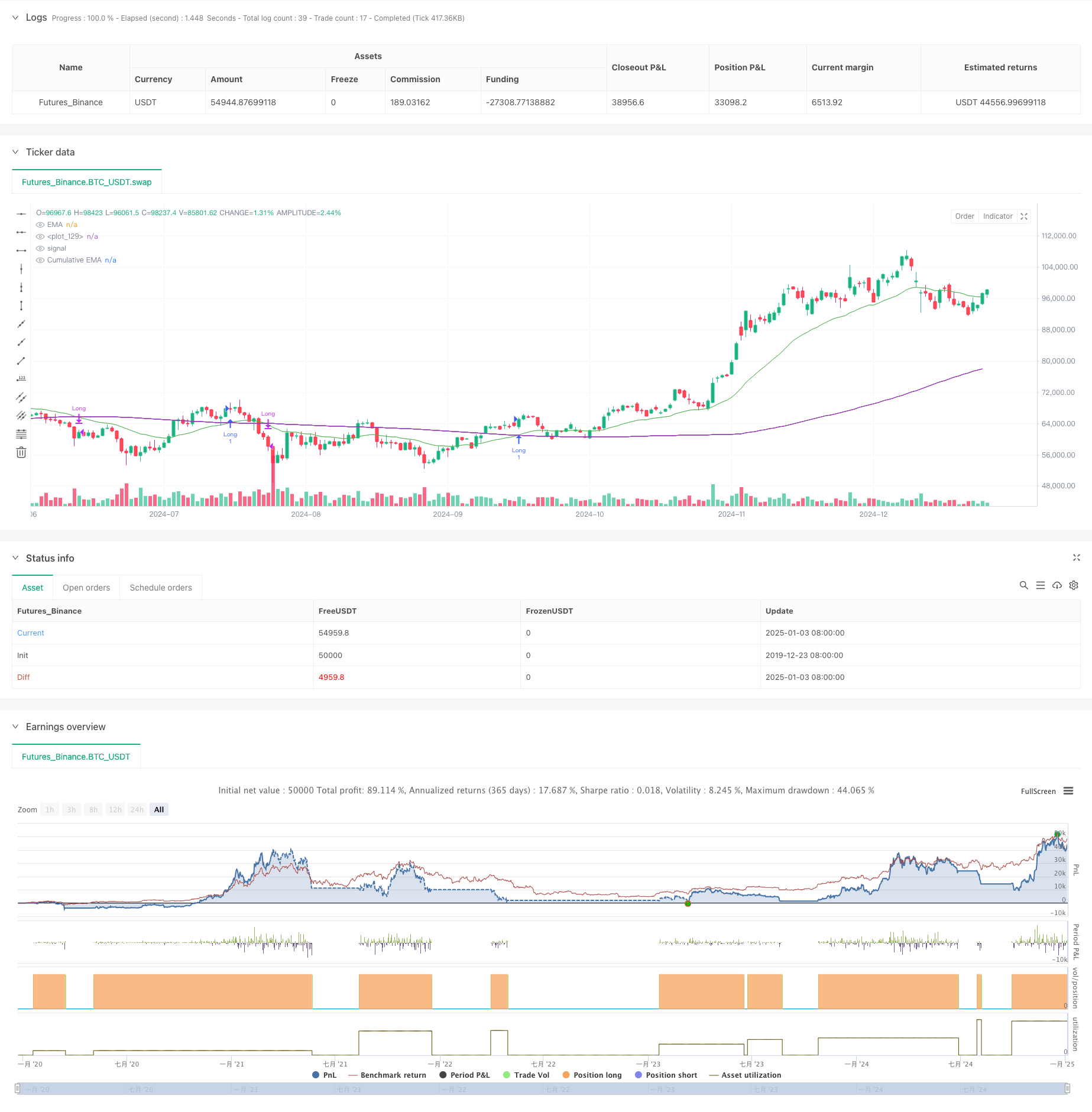

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// © sapphire_edge

// # ========================================================================= #

// #

// # _____ __ _ ______ __

// # / ___/____ _____ ____ / /_ (_)_______ / ____/___/ /___ ____

// # \__ \/ __ `/ __ \/ __ \/ __ \/ / ___/ _ \ / __/ / __ / __ `/ _ \

// # ___/ / /_/ / /_/ / /_/ / / / / / / / __/ / /___/ /_/ / /_/ / __/

// # /____/\__,_/ .___/ .___/_/ /_/_/_/ \___/ /_____/\__,_/\__, /\___/

// # /_/ /_/ /____/

// #

// # ========================================================================= #

strategy(shorttitle="⟡Sapphire⟡ EMA/CVP", title="[Sapphire] EMA/CVP Strategy", initial_capital= 50000, currency= currency.USD,default_qty_value = 1,commission_type= strategy.commission.cash_per_contract,overlay= true )

// # ========================================================================= #

// # // Settings Menu //

// # ========================================================================= #

// -------------------- Main Settings -------------------- //

groupEMACVP = "EMA / Cumulative Volume Period"

tradeDirection = input.string(title='Trade Direction', defval='LONG', options=['LONG', 'SHORT'], group=groupEMACVP)

emaLength = input.int(25, title='EMA Length', minval=1, maxval=200, group=groupEMACVP)

cumulativePeriod = input.int(100, title='Cumulative Volume Period', minval=1, maxval=200, step=5, group=groupEMACVP)

exitType = input.string(title="Exit Type", defval="Crossover", options=["Crossover", "Custom CVP" ], group=groupEMACVP)

cumulativePeriodForClose = input.int(50, title='Cumulative Period for Close Signal', minval=1, maxval=200, step=5, group=groupEMACVP)

showSignals = input.bool(true, title="Show Signals", group=groupEMACVP)

signalOffset = input.int(5, title="Signal Vertical Offset", group=groupEMACVP)

// -------------------- Time Filter Inputs -------------------- //

groupTimeOfDayFilter = "Time of Day Filter"

useTimeFilter1 = input.bool(false, title="Enable Time Filter 1", group=groupTimeOfDayFilter)

startHour1 = input.int(0, title="Start Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

startMinute1 = input.int(0, title="Start Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

endHour1 = input.int(23, title="End Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

endMinute1 = input.int(45, title="End Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

closeAtEndTimeWindow = input.bool(false, title="Close Trades at End of Time Window", group=groupTimeOfDayFilter)

// -------------------- Trading Window -------------------- //

isWithinTradingWindow(startHour, startMinute, endHour, endMinute) =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

startInMinutes = startHour * 60 + startMinute

endInMinutes = endHour * 60 + endMinute

timeInMinutes >= startInMinutes and timeInMinutes <= endInMinutes

timeCondition = (useTimeFilter1 ? isWithinTradingWindow(startHour1, startMinute1, endHour1, endMinute1) : true)

// Check if the current bar is the last one within the specified time window

isEndOfTimeWindow() =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

endInMinutes = endHour1 * 60 + endMinute1

timeInMinutes == endInMinutes

// Logic to close trades if the time window ends

if timeCondition and closeAtEndTimeWindow and isEndOfTimeWindow()

strategy.close_all(comment="Closing trades at end of time window")

// # ========================================================================= #

// # // Calculations //

// # ========================================================================= #

avgPrice = (high + low + close) / 3

avgPriceVolume = avgPrice * volume

cumulPriceVolume = math.sum(avgPriceVolume, cumulativePeriod)

cumulVolume = math.sum(volume, cumulativePeriod)

cumValue = cumulPriceVolume / cumulVolume

cumulPriceVolumeClose = math.sum(avgPriceVolume, cumulativePeriodForClose)

cumulVolumeClose = math.sum(volume, cumulativePeriodForClose)

cumValueClose = cumulPriceVolumeClose / cumulVolumeClose

emaVal = ta.ema(close, emaLength)

emaCumValue = ta.ema(cumValue, emaLength)

// # ========================================================================= #

// # // Signal Logic //

// # ========================================================================= #

// Strategy Entry Conditions

longEntryCondition = ta.crossover(emaVal, emaCumValue) and tradeDirection == 'LONG'

shortEntryCondition = ta.crossunder(emaVal, emaCumValue) and tradeDirection == 'SHORT'

// User-Defined Exit Conditions

longExitCondition = false

shortExitCondition = false

if exitType == "Crossover"

longExitCondition := ta.crossunder(emaVal, emaCumValue)

shortExitCondition := ta.crossover(emaVal, emaCumValue)

if exitType == "Custom CVP"

emaCumValueClose = ta.ema(cumValueClose, emaLength)

longExitCondition := ta.crossunder(emaVal, emaCumValueClose)

shortExitCondition := ta.crossover(emaVal, emaCumValueClose)

// # ========================================================================= #

// # // Strategy Management //

// # ========================================================================= #

// Strategy Execution

if longEntryCondition and timeCondition

strategy.entry('Long', strategy.long)

label.new(bar_index, high - signalOffset, "◭", style=label.style_label_up, color = color.rgb(119, 0, 255, 20), textcolor=color.white)

if shortEntryCondition and timeCondition

strategy.entry('Short', strategy.short)

label.new(bar_index, low + signalOffset, "⧩", style=label.style_label_down, color = color.rgb(255, 85, 0, 20), textcolor=color.white)

if strategy.position_size > 0 and longExitCondition

strategy.close('Long')

if strategy.position_size < 0 and shortExitCondition

strategy.close('Short')

// # ========================================================================= #

// # // Plots and Charts //

// # ========================================================================= #

plot(emaVal, title='EMA', color=color.new(color.green, 25))

plot(emaCumValue, title='Cumulative EMA', color=color.new(color.purple, 35))

fill(plot(emaVal), plot(emaCumValue), color=emaVal > emaCumValue ? #008ee6 : #d436a285, title='EMA and Cumulative Area', transp=70)

関連性

- 複数のタイムフレーム取引

- マルチEMAクロスオーバー停止戦略

- リスクマネジメントを含む戦略に従った二重移動平均傾向

- マルチタイムフレームトレンド 200 EMA フィルター付きの戦略をフォローする - 長期のみ

- エリオット・ウェーブストカスティックEMA戦略

- 取引戦略をフォローするマルチEMA傾向

- ダイナミック・テイク・プロフィット・ストップ・ロスト EMAクロスオーバー量的な取引戦略

- EMA100とNUPL 相対的未実現利益量的な取引戦略

- 移動平均色 EMA/SMA

- ダイナミック・EMAトレンド・クロスオーバー・エントリー 定量戦略

もっと

- 多動平均スーパートレンドとボリンジャーブレイクトレード戦略

- 多指標動的移動平均のクロスオーバー量的な戦略

- 戦略をフォローするRSIモメントとボリュームトレンドを持つ二期移動平均

- RSI トレンドブレークスルーとモメンタム強化取引戦略

- 定量的な取引戦略をフォローする二重EMAクロスオーバー動的傾向

- アダプティブ・トレンド・フロー・マルチフィルター・トレーディング・戦略

- ダイナミック・ダブル・テクニカル・インディケーター 過剰販売・過剰購入の確認取引戦略

- 多指標動的トレーリングストップ取引戦略

- 双 EMA ストカスティック オシレーター システム: トレンドフォローとモメンタムを組み合わせた定量的な取引モデル

- 多指標動的波動性取引戦略

- ADX トレンド強度フィルタリングシステムによるダイナミック・EMA・クロスオーバー戦略

- 多期トレンド線形吸収パターン 定量的な取引戦略

- ダイナミックなサポートとレジスタンスの取引システムを持つ適応チャネルブレークアウト戦略

- ダイナミックフィルタリング 日々のトレンド分析のためのEMAクロス戦略

- マルチEMAクロスオーバーとカマリラ・サポート/レジスタンスのトレンド・トレーディング・システム

- 強化されたトレンド・マルチ・シグナル・ダイナミック・トレーディング・戦略

- アダプティブ・モメンテム・マルティンゲール・トレーディング・システム

- RSIと移動平均の組み合わせた定量取引戦略の傾向

- 先進的な定量的なトレンドフォローとクラウド逆転複合取引戦略

- 戦略最適化モデルをフォローする5日間のEMAベースのトレンド