변화율 양적 전략

저자:차오장, 날짜: 2023-12-12 15:56:56태그:

전반적인 설명

이 전략은 시장 방향을 결정하고 거래 신호를 생성하기 위해 변화율 (ROC) 지표를 사용합니다. 전략의 핵심 아이디어는 장기 트렌드를 따라 더 큰 위험을 감수함으로써 시장을 능가하는 것입니다.

전략 논리

입국 규칙

- ROC>0이면 장거리, ROC<0이면 단거리. ROC의 긍정적/부적자를 사용하여 시장 방향을 판단하십시오.

- 변동성을 필터링하기 위해, ROC가 2일 연속 같은 쪽에 있는 경우에만 거래 신호를 발행합니다.

손실 중지

6%의 스톱 러스가 설정되어 있습니다. 스톱 러스가 트리거될 때, 역전 위치입니다. 이것은 우리가 시장의 잘못된 편에 있을 수 있음을 나타냅니다. 그래서 우리는 즉시 빠져 나갑니다.

방광 방지 메커니즘

ROC가 200을 넘으면 시장이 거품으로 간주됩니다. ROC가 거품 영역 아래로 떨어지면 짧은 신호가 발생합니다. 거품이 적어도 1 주 동안 지속되어야합니다.

돈 관리

고정 포지션 사이징 + 인크리멘탈 방법을 사용하십시오. $ 400 이득 / 손실에 대해 $ 200씩 증가 / 감소 포지션. 이것은 우리가 피라미드 수익을 얻을 수 있지만 또한 인드다운을 증가시킵니다.

이점 분석

이 전략의 장점:

- 장기적으로 긍정적인 수익을 낼 가능성이 높은 철학을 따르는 트렌드를 따르고 있습니다.

- 스톱 로스를 사용하여 위험을 통제하고 단기 변동성을 줄이세요.

- 방울 방지 메커니즘은 꼭대기를 쫓는 것을 피합니다.

- 고정된 위치 + 증수적인 방법은 상승 추세에서 기하급수적인 성장을 만듭니다.

위험 분석

또한 다음과 같은 위험 요소가 있습니다.

- ROC 지표는 잘못된 신호를 생성하는 윙사 (wipssaws) 에 유연합니다. 필터링을 위해 다른 지표와 결합하는 것을 고려하십시오.

- 실제 수익을 낮추는 거래 비용이 고려되지 않습니다.

- 안티 버블 매개 변수 조정이 안되면 트렌드가 놓치게 됩니다.

- 부수적인 크기는 손실이 발생했을 때 인수율을 증가시킵니다.

최적화 방향

전략을 최적화하는 몇 가지 방법:

- 마, 변동성 등과 같은 다른 지표를 필터 신호에 추가합니다.

- 더 나은 거품 탐지를 위해 반 거품 파라미터 최적화.

- 고정 포지션과 증가 비율을 조정하여 더 나은 위험/이익 균형을 유지합니다.

- 큰 손실이 발생하면 자동 스톱 손실을 추가합니다.

- 거래 비용을 고려하고 그에 따른 입시 규칙을 설정합니다.

결론

요약하자면, 이것은 ROC 지표를 중심으로 한 전략을 따르는 장기적인 추세이다. 그것은 더 높은 위험을 감수함으로써 알파를 생성하는 것을 목표로합니다. 추가 최적화는 생존성을 향상시킬 수 있습니다. 열쇠는 적절한 위험 관용을 찾는 것입니다.

/*backtest

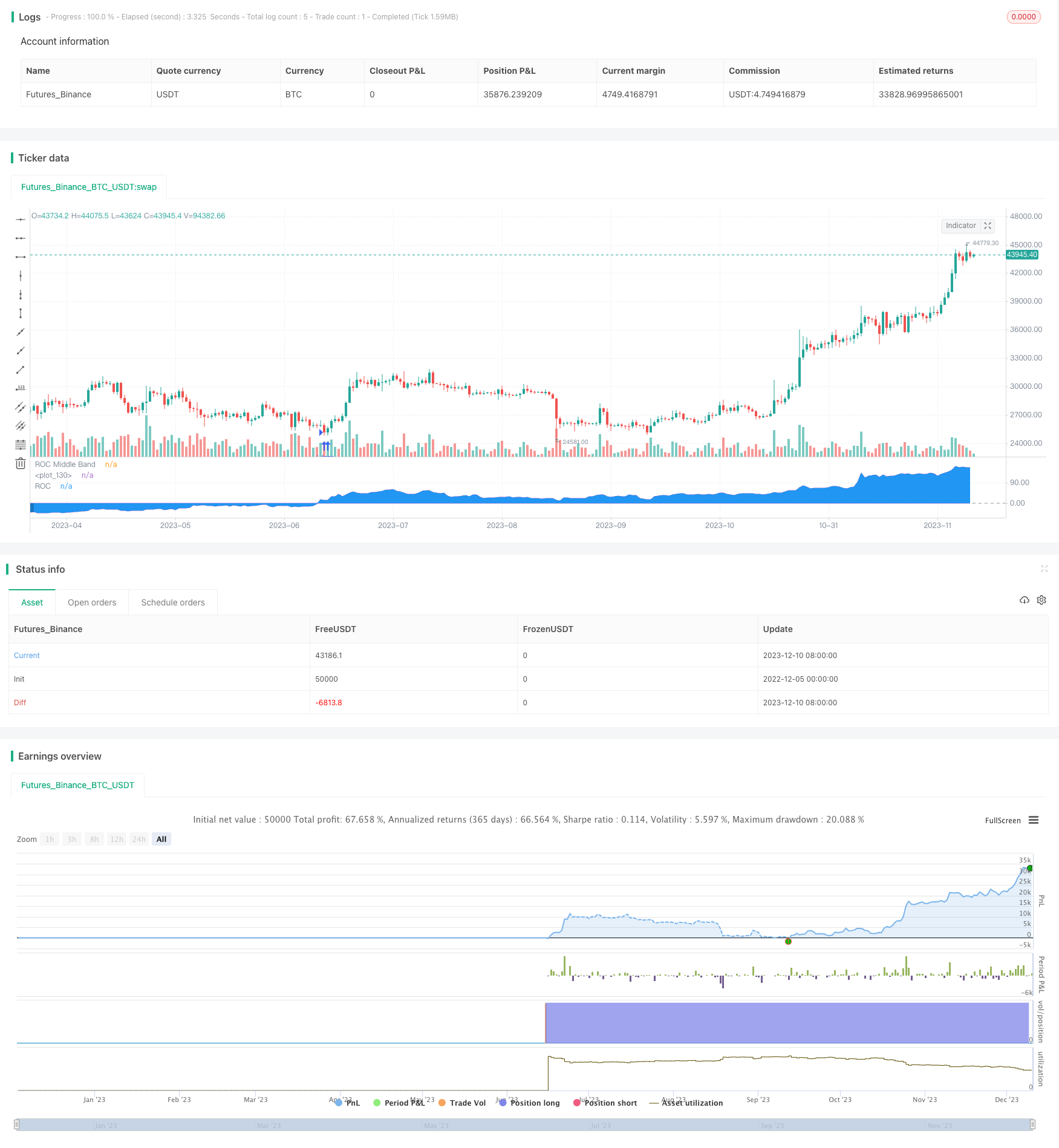

start: 2022-12-05 00:00:00

end: 2023-12-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gsanson66

//This strategy use the Rate of Change (ROC) of the closing price to send enter signal.

//@version=5

strategy("RATE OF CHANGE BACKTESTING", shorttitle="ROC BACKTESTING", overlay=false, precision=3, initial_capital=1000, default_qty_type=strategy.cash, default_qty_value=950, commission_type=strategy.commission.percent, commission_value=0.18)

//--------------------------------FUNCTIONS-----------------------------------//

//@function Displays text passed to `txt` when called.

debugLabel(txt, color, loc) =>

label.new(bar_index, loc, text = txt, color=color, style = label.style_label_lower_right, textcolor = color.black, size = size.small)

//@function which looks if the close date of the current bar falls inside the date range

inBacktestPeriod(start, end) => (time >= start) and (time <= end)

//----------------------------------USER INPUTS----------------------------------//

//Technical parameters

rocLength = input.int(defval=365, minval=0, title='ROC Length', group="Technical parameters")

bubbleValue = input.int(defval=200, minval=0, title="ROC Bubble signal", group="Technical parameters")

//Risk management

stopLossInput = input.float(defval=10, minval=0, title="Stop Loss (in %)", group="Risk Management")

//Money management

fixedRatio = input.int(defval=400, minval=1, title="Fixed Ratio Value ($)", group="Money Management")

increasingOrderAmount = input.int(defval=200, minval=1, title="Increasing Order Amount ($)", group="Money Management")

//Backtesting period

startDate = input(title="Start Date", defval=timestamp("1 Jan 2017 00:00:00"), group="Backtesting Period")

endDate = input(title="End Date", defval=timestamp("1 July 2024 00:00:00"), group="Backtesting Period")

//-------------------------------------VARIABLES INITIALISATION-----------------------------//

roc = (close/close[rocLength] - 1)*100

midlineConst = 0

var bool inBubble = na

bool shortBubbleCondition = na

equity = strategy.equity - strategy.openprofit

strategy.initial_capital = 50000

var float capital_ref = strategy.initial_capital

var float cashOrder = strategy.initial_capital * 0.95

bool inRange = na

//------------------------------CHECKING SOME CONDITIONS ON EACH SCRIPT EXECUTION-------------------------------//

//Checking if the date belong to the range

inRange := true

//Checking if we are in a bubble

if roc > bubbleValue and not inBubble

inBubble := true

//Checking if the bubble is over

if roc < 0 and inBubble

inBubble := false

//Checking the condition to short the bubble : The ROC must be above the bubblevalue for at least 1 week

if roc[1]>bubbleValue and roc[2]>bubbleValue and roc[3]>bubbleValue and roc[4]>bubbleValue and roc[5]>bubbleValue and roc[6]>bubbleValue and roc[7]>bubbleValue

shortBubbleCondition := true

//Checking performances of the strategy

if equity > capital_ref + fixedRatio

spread = (equity - capital_ref)/fixedRatio

nb_level = int(spread)

increasingOrder = nb_level * increasingOrderAmount

cashOrder := cashOrder + increasingOrder

capital_ref := capital_ref + nb_level*fixedRatio

if equity < capital_ref - fixedRatio

spread = (capital_ref - equity)/fixedRatio

nb_level = int(spread)

decreasingOrder = nb_level * increasingOrderAmount

cashOrder := cashOrder - decreasingOrder

capital_ref := capital_ref - nb_level*fixedRatio

//Checking if we close all trades in case where we exit the backtesting period

if strategy.position_size!=0 and not inRange

debugLabel("END OF BACKTESTING PERIOD : we close the trade", color=color.rgb(116, 116, 116), loc=roc)

strategy.close_all()

//-------------------------------LONG/SHORT CONDITION-------------------------------//

//Long condition

//We reduce noise by taking signal only if the last roc value is in the same side as the current one

if (strategy.position_size<=0 and ta.crossover(roc, midlineConst)[1] and roc>0 and inRange)

//If we were in a short position, we pass to a long position

qty = cashOrder/close

strategy.entry("Long", strategy.long, qty)

stopLoss = close * (1-stopLossInput/100)

strategy.exit("Long Risk Managment", "Long", stop=stopLoss)

//Short condition

//We take a short position if we are in a bubble and roc is decreasing

if (strategy.position_size>=0 and ta.crossunder(roc, midlineConst)[1] and roc<0 and inRange) or

(strategy.position_size>=0 and inBubble and ta.crossunder(roc, bubbleValue) and shortBubbleCondition and inRange)

//If we were in a long position, we pass to a short position

qty = cashOrder/close

strategy.entry("Short", strategy.short, qty)

stopLoss = close * (1+stopLossInput/100)

strategy.exit("Short Risk Managment", "Short", stop=stopLoss)

//--------------------------------RISK MANAGEMENT--------------------------------------//

//We manage our risk and change the sense of position after SL is hitten

if strategy.position_size == 0 and inRange

//We find the direction of the last trade

id = strategy.closedtrades.entry_id(strategy.closedtrades-1)

if id == "Short"

qty = cashOrder/close

strategy.entry("Long", strategy.long, qty)

stopLoss = close * (1-stopLossInput/100)

strategy.exit("Long Risk Managment", "Long", stop=stopLoss)

else if id =="Long"

qty = cashOrder/close

strategy.entry("Short", strategy.short, qty)

stopLoss = close * (1+stopLossInput/100)

strategy.exit("Short Risk Managment", "Short", stop=stopLoss)

//---------------------------------PLOTTING ELEMENTS---------------------------------------//

//Plotting of ROC

rocPlot = plot(roc, "ROC", color=#7E57C2)

midline = hline(0, "ROC Middle Band", color=color.new(#787B86, 25))

midLinePlot = plot(0, color = na, editable = false, display = display.none)

fill(rocPlot, midLinePlot, 40, 0, top_color = strategy.position_size>0 ? color.new(color.green, 0) : strategy.position_size<0 ? color.new(color.red, 0) : na, bottom_color = strategy.position_size>0 ? color.new(color.green, 100) : strategy.position_size<0 ? color.new(color.red, 100) : na, title = "Positive area")

fill(rocPlot, midLinePlot, 0, -40, top_color = strategy.position_size<0 ? color.new(color.red, 100) : strategy.position_size>0 ? color.new(color.green, 100) : na, bottom_color = strategy.position_size<0 ? color.new(color.red, 0) : strategy.position_size>0 ? color.new(color.green, 0) : na, title = "Negative area")

더 많은

- EMA의 크로스오버 거래 전략

- 전략에 따른 격차 매트릭스 트렌드

- 중력 중심 역 테스트 거래 전략

- 피보트 포인트 브레이크업 전략

- 모멘텀 풀백 전략

- 암호화 전략에 따른 RSI 트렌드

- 트렌드 트래킹 전략 (True Strength Index) 과 결합된 듀얼 버텍스 지표 (Dual Vortex Indicator) 를 기반으로

- 이치모쿠 초기 구름 트렌드 전략

- 다중 시간 프레임 이동 평균 시스템 거래 전략

- EVWMA 추세 전략

- EMA 트렌드를 추적하고 오스칠레이션 전략을 억제합니다

- Scalping 전략은 RSI 지표에 기반하여 Trailing Stop Loss

- 부피와 가격 복수 취득을 위한 고급 전략

- 단순 회전 전략 장기 트렌드를 추적

- RSI 지표와 200일 SMA 필터에 기초한 간접 강도 지표 전략

- 스토카스틱 모멘텀 인덱스 및 RSI 기반 양상 거래 전략

- 거래 전략에 따른 동력 지표가 주도하는 경향

- 가격 극단에 기반한 트렌드 거래 전략

- MACD 전략 - 쌍방향 출구 거래

- 모멘텀 필터링 이동 평균 전략