다중 이동 평균 교차 거래 전략

저자:차오장날짜: 2023-12-20 14:12:20태그:

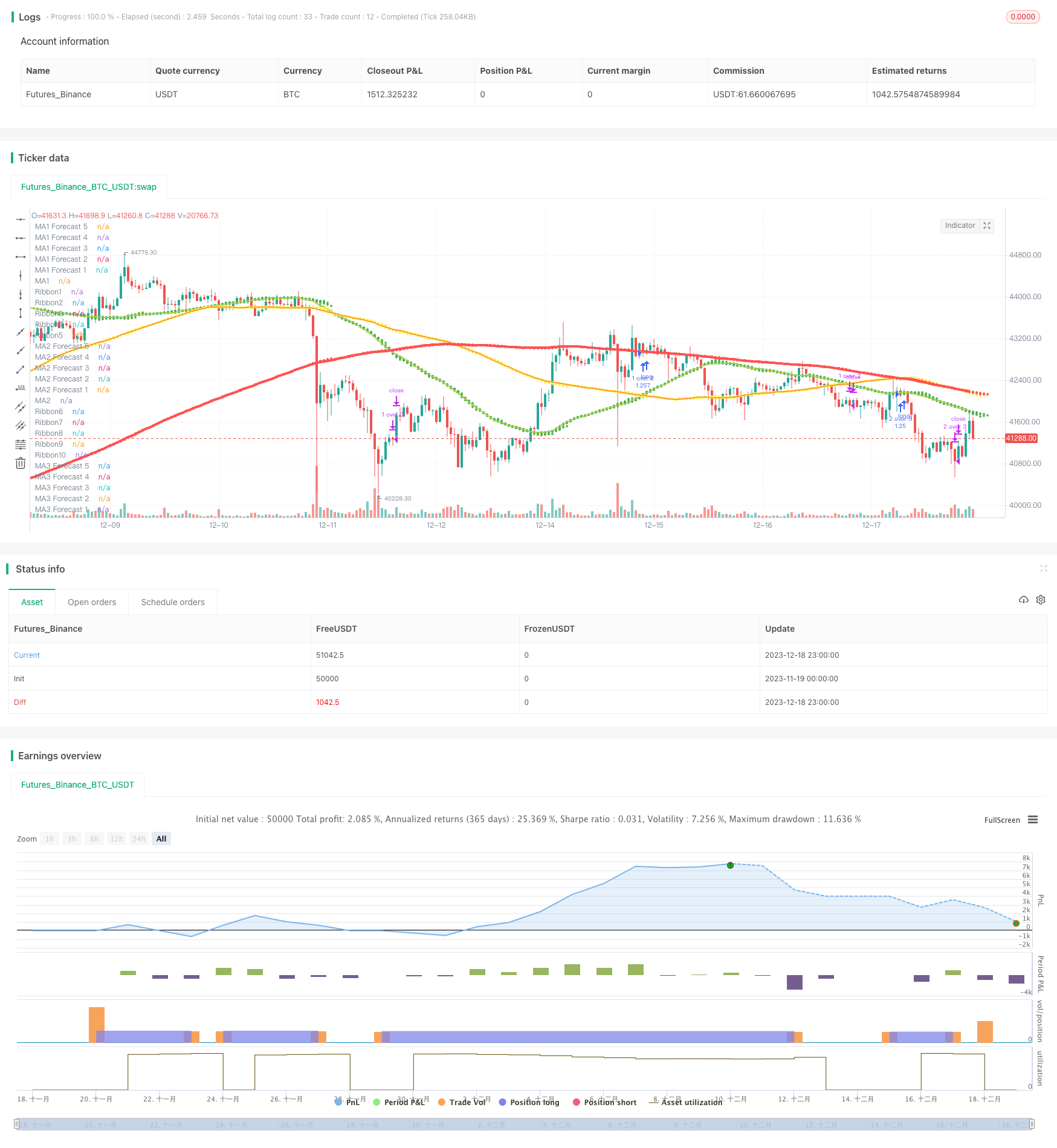

전반적인 설명 이 전략은 세 개의 이동 평균 라인 (MA1, MA2, MA3) 의 교차에 기반합니다. 세 가지 MAs의 유형, 기간, 가격 데이터 소스, 해상도를 설정하고 또한 교차 상에서 거래를 가능하게 함으로써 유연한 거래 전략 조합을 얻을 수 있습니다.

원칙 이 전략은 주로 3개의 이동 평균선 사이의 크로스오버 및 언더크로스 신호를 거래 신호로 사용합니다. 짧은 기간 MA가 더 긴 기간 MA를 밑에서 위로 넘으면 긴 입구 신호를 생성합니다. 짧은 기간 MA가 더 긴 기간 MA를 위에서 아래로 넘으면 출구 신호를 생성합니다.

사용자는 세 개의 MAs의 유형 (SMA, EMA, 등), 기간, 가격 데이터 소스 (폐기 가격, 최고 가격, 등) 및 해상도 (분간 바, 일간 바, 등) 를 자유롭게 선택할 수 있습니다. 또한 각 MA 사이의 교차에서 거래는 특정 교차에서 거래 조치를 취할지 여부를 결정하기 위해 활성화 또는 비활성화 할 수 있습니다.

현재 전략은 단지 시장 주문으로 입점 및 출점 포지션으로 장기간 진행됩니다. 기본적으로 각 거래는 전체 계정 자본의 100%를 사용합니다.

장점

- 유연한 최적화 및 조합, MA의 매개 변수를 자유롭게 선택하여 곡선 적응 위험을 낮추는

- 여러 MA 교차는 더 많은 거래 기회를 창출하고 거래 빈도를 증가시킵니다.

- 추세와 역전 사이의 장기, 중장기 및 단기 MA 균형 사용

- 다른 해상도의 지원은 여러 시간 프레임 분석을 허용합니다.

- 내장 예측 기능은 매개 변수 적합 효과 테스트를 가능하게 합니다.

위험성

- 많은 수의 매개 변수 조합은 과도한 부착으로 이어질 수 있습니다.

- 높은 거래 빈도는 거래 수수료 및 미끄러진 비용의 비용을 증가시킬 수 있습니다

- 입시 가격을 제한할 수 없는 시장 주문

- 여러 MA에서 충돌 신호가 나타날 수 있습니다.

- 백테스트와 라이브 거래의 성능 차이가 있을 수 있습니다.

최적화 제안

- 걸음 앞으로 분석을 통해 유효한 매개 변수 범위를 얻으십시오

- 백테스트에서 거래 수수료와 미끄러짐 비용을 추가

- 시장 주문 대신 제한 주문을 시도

- 충돌 신호를 피하기 위해 필터를 추가합니다

- 시뮬레이션 현실적인 환경에서 전략 안정성을 검증

요약 이 전략은 MAs의 매끄러운 특성과 크로스오버 신호의 패턴 인식 능력을 포괄적으로 활용합니다. 사용자는 트렌드 다음과 역전 식별 사이의 균형을 맞추기 위해 매개 변수를 유연하게 선택할 수 있습니다. 또한 백테스트에서 시뮬레이션 된 복잡한 시장 조건 하에서 전략 견고성을 검증함으로써 과잉 적합성의 위험을 제어해야합니다. 결론적으로이 전략은 거래에 여러 MAs를 활용하는 효과적인 예를 제공합니다.

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// Pine Script v4

// @author BigBitsIO

// Script Library: https://www.tradingview.com/u/BigBitsIO/#published-scripts

//

// study(title, shorttitle, overlay, format, precision)

// https://www.tradingview.com/pine-script-reference/#fun_strategy

strategy(shorttitle = "TManyMA Strategy - ST9 - Long Market Only", title="Triple Many Moving Averages", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// MA#Period is a variable used to store the indicator lookback period. In this case, from the input.

// input - https://www.tradingview.com/pine-script-docs/en/v4/annotations/Script_inputs.html

MA1Period = input(50, title="MA1 Period", minval=1, step=1)

MA1Type = input(title="MA1 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA1Source = input(title="MA1 Source", type=input.source, defval=close)

MA1Resolution = input(title="MA1 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA1Visible = input(title="MA1 Visible", type=input.bool, defval=true) // Will automatically hide crossBovers containing this MA

MA2Period = input(100, title="MA2 Period", minval=1, step=1)

MA2Type = input(title="MA2 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA2Source = input(title="MA2 Source", type=input.source, defval=close)

MA2Resolution = input(title="MA2 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA2Visible = input(title="MA2 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

MA3Period = input(200, title="MA3 Period", minval=1, step=1)

MA3Type = input(title="MA3 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA3Source = input(title="MA3 Source", type=input.source, defval=close)

MA3Resolution = input(title="MA3 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA3Visible = input(title="MA3 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

ShowCrosses = input(title="Show Crosses", type=input.bool, defval=false)

ForecastBias = input(title="Forecast Bias", defval="Neutral", options=["Neutral", "Bullish", "Bearish"])

ForecastBiasPeriod = input(14, title="Forecast Bias Period")

ForecastBiasMagnitude = input(1, title="Forecast Bias Magnitude", minval=0.25, maxval=20, step=0.25)

ShowForecasts = input(title="Show Forecasts", type=input.bool, defval=true)

ShowRibbons = input(title="Show Ribbons", type=input.bool, defval=true)

TradeMA12Crosses = input(title="Trade MA 1-2 Crosses", type=input.bool, defval=true)

TradeMA13Crosses = input(title="Trade MA 1-3 Crosses", type=input.bool, defval=true)

TradeMA23Crosses = input(title="Trade MA 2-3 Crosses", type=input.bool, defval=true)

// MA# is a variable used to store the actual moving average value.

// if statements - https://www.tradingview.com/pine-script-reference/#op_if

// MA functions - https://www.tradingview.com/pine-script-reference/ (must search for appropriate MA)

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

ma(MAType, MASource, MAPeriod) =>

if MAType == "SMA"

ta.sma(MASource, MAPeriod)

else

if MAType == "EMA"

ta.ema(MASource, MAPeriod)

else

if MAType == "WMA"

ta.wma(MASource, MAPeriod)

else

if MAType == "RMA"

ta.rma(MASource, MAPeriod)

else

if MAType == "HMA"

ta.wma(2*wma(MASource, MAPeriod/2)-ta.wma(MASource, MAPeriod), round(sqrt(MAPeriod)))

else

if MAType == "DEMA"

e = ta.ema(MASource, MAPeriod)

2 * e - ta.ema(e, MAPeriod)

else

if MAType == "TEMA"

e = ta.ema(MASource, MAPeriod)

3 * (e - ta.ema(e, MAPeriod)) + ta.ema(ema(e, MAPeriod), MAPeriod)

else

if MAType == "VWMA"

ta.vwma(MASource, MAPeriod)

res(MAResolution) =>

if MAResolution == "00 Current"

timeframe.period

else

if MAResolution == "01 1m"

"1"

else

if MAResolution == "02 3m"

"3"

else

if MAResolution == "03 5m"

"5"

else

if MAResolution == "04 15m"

"15"

else

if MAResolution == "05 30m"

"30"

else

if MAResolution == "06 45m"

"45"

else

if MAResolution == "07 1h"

"60"

else

if MAResolution == "08 2h"

"120"

else

if MAResolution == "09 3h"

"180"

else

if MAResolution == "10 4h"

"240"

else

if MAResolution == "11 1D"

"1D"

else

if MAResolution == "12 1W"

"1W"

else

if MAResolution == "13 1M"

"1M"

// https://www.tradingview.com/pine-script-reference/#fun_request.security

MA1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period))

MA2 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period))

MA3 = request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period))

// Plotting crossover/unders for all combinations of crosses

// Crossovers no longer detected in label code, they need to be re-used for strategy - crosses and visibility must be set

MA12Crossover = MA1Visible and MA2Visible and ta.crossover(MA1, MA2)

MA12Crossunder = MA1Visible and MA2Visible and ta.crossunder(MA1, MA2)

MA13Crossover = MA1Visible and MA3Visible and ta.crossover(MA1, MA3)

MA13Crossunder = MA1Visible and MA3Visible and ta.crossunder(MA1, MA3)

MA23Crossover = MA2Visible and MA3Visible and ta.crossover(MA2, MA3)

MA23Crossunder = MA2Visible and MA3Visible and ta.crossunder(MA2, MA3)

// https://www.tradingview.com/pine-script-reference/v4/#fun_label%7Bdot%7Dnew

if ShowCrosses and MA12Crossunder

lun1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA2Period)+' '+MA2Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun1, MA1)

if ShowCrosses and MA12Crossover

lup1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA2Period)+' '+MA2Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup1, MA1)

if ShowCrosses and MA13Crossunder

lun2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun2, MA1)

if ShowCrosses and MA13Crossover

lup2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup2, MA1)

if ShowCrosses and MA23Crossunder

lun3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun3, MA2)

if ShowCrosses and MA23Crossover

lup3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup3, MA2)

// plot - This will draw the information on the chart

// plot - https://www.tradingview.com/pine-script-docs/en/v4/annotations/plot_annotation.html

plot(MA1Visible ? MA1 : na, color=color.green, linewidth=2, title="MA1")

plot(MA2Visible ? MA2 : na, color=color.yellow, linewidth=3, title="MA2")

plot(MA3Visible ? MA3 : na, color=color.red, linewidth=4, title="MA3")

// Forecasting - forcasted prices are calculated using our MAType and MASource for the MAPeriod - the last X candles.

// it essentially replaces the oldest X candles, with the selected source * X candles

// Bias - We'll add an "adjustment" for each additional candle being forecasted based on ATR of the previous X candles

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

bias(Bias, BiasPeriod) =>

if Bias == "Neutral"

0

else

if Bias == "Bullish"

(atr(BiasPeriod) * ForecastBiasMagnitude)

else

if Bias == "Bearish"

((atr(BiasPeriod) * ForecastBiasMagnitude) * -1) // multiplying by -1 to make it a negative, bearish bias

// Note - Can not show forecasts on different resolutions at the moment, x-axis is an issue

Bias = bias(ForecastBias, ForecastBiasPeriod) // 14 is default atr period

MA1Forecast1 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 1)) * (MA1Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA1Period

MA1Forecast2 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 2)) * (MA1Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA1Period

MA1Forecast3 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 3)) * (MA1Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA1Period

MA1Forecast4 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 4)) * (MA1Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA1Period

MA1Forecast5 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 5)) * (MA1Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA1Period

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast1 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 1", offset=1, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast2 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 2", offset=2, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast3 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 3", offset=3, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast4 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 4", offset=4, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast5 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 5", offset=5, show_last=1)

MA2Forecast1 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 1)) * (MA2Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA2Period

MA2Forecast2 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 2)) * (MA2Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA2Period

MA2Forecast3 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 3)) * (MA2Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA2Period

MA2Forecast4 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 4)) * (MA2Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA2Period

MA2Forecast5 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 5)) * (MA2Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA2Period

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast1 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 1", offset=1, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast2 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 2", offset=2, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast3 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 3", offset=3, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast4 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 4", offset=4, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast5 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 5", offset=5, show_last=1)

MA3Forecast1 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 1)) * (MA3Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA3Period

MA3Forecast2 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 2)) * (MA3Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA3Period

MA3Forecast3 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 3)) * (MA3Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA3Period

MA3Forecast4 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 4)) * (MA3Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA3Period

MA3Forecast5 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 5)) * (MA3Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA3Period

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast1 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 1", offset=1, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast2 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 2", offset=2, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast3 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 3", offset=3, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast4 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 4", offset=4, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast5 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 5", offset=5, show_last=1)

// Ribbon related code

// For Ribbons to work - they must use the same MAType, MAResolution and MASource. This is to ensure the ribbons are fair between one to the other.

// Ribbons also will usually look better if MA1Period < MA2Period and MA2Period < MA3Period

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

// This function is used to calculate the period to be used on a ribbon based on existing MAs

rperiod(P1, P2, Step, Ribbons) =>

((array.abs(P1 - P2)) / (Ribbons + 1) * Step) + math.min(P1, P2)

// divide by +1 so that 5 lines can show. Divide by 5 and one line shows up on another MA

// MA1-MA2

Ribbon1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 1, 5)))

Ribbon2 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 2, 5)))

Ribbon3 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 3, 5)))

Ribbon4 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 4, 5)))

Ribbon5 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 5, 5)))

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon1 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon1", transp=90)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon2 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon2", transp=85)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon3 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon3", transp=80)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon4 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon4", transp=75)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon5 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon5", transp=70)

// MA2-MA3

Ribbon6 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 1, 5)))

Ribbon7 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 2, 5)))

Ribbon8 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 3, 5)))

Ribbon9 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 4, 5)))

Ribbon10 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 5, 5)))

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon6 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon6", transp=70)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon7 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon7", transp=75)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon8 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon8", transp=80)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon9 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon9", transp=85)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon10 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon10", transp=90)

// Strategy Specific

if MA12Crossover and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 2", strategy.long, comment="1 over 2")

if MA12Crossunder and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 2")

if MA13Crossover and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 3", strategy.long, comment="1 over 3")

if MA13Crossunder and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 3")

if MA23Crossover and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("2 over 3", strategy.long, comment="2 over 3")

if MA23Crossunder and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("2 over 3")

- 스탠 더 맨 - 이중 이동 평균과 변동성에 기초한 고급 주식 거래 전략

- 역대 평균 돌파구 전략

- 이중 이동 평균 역전 전략

- 로가리듬 가격 예측 전략

- 간단한 이동평균 크로스오버 전략

- 볼링거 밴드 및 RSI 트렌드 다음 전략

- 꼼꼼한 EMA 크로스오버 전략

- 이동평균에 기초한 전략을 따르는 경향

- RSI 거래 전략

- 토르트 트렌드 거래 시스템

- 유연한 MA/VWAP 크로스오버 전략 (Stop Loss/Take Profit)

- 볼링거 밴드 기반의 가격 행동 전략

- 이중 이동 평균 범주 파업 전략

- 이동평균선을 가진 격자 전략

- 이중 이동 평균 지능 추적 전략

- RSI-EMA 트렌드 브레이크 전략

- 피브 포인트 예측 오시레이터 백테스팅 전략

- 이동평균 전략에 기초한 통합 이치모쿠 켈트너 거래 시스템

- 이중 추적 거북이 거래 전략

- 이치모쿠 킨코 히오 기반 BTC 거래 전략