쿠베란 전략: 시장 지배를 위한 컨플루엔스 접근

저자:차오장, 날짜: 2024-03-22 14:08:11태그:

전략 개요

쿠베란 전략 (Kuberan strategy) 은 카티르가 개발한 강력한 거래 전략이다. 독특한 강력한 거래 접근 방식을 형성하기 위해 여러 분석 기법을 결합합니다. 부의 신인 쿠베란에서 따온 이 전략은 거래자의 포트폴리오를 풍요롭게 하는 목표를 상징합니다.

쿠베란은 단순한 전략 이상의 것이 아니라 포괄적인 거래 시스템입니다. 트렌드 분석, 추진력 지표 및 볼륨 메트릭을 통합하여 높은 확률의 거래 기회를 식별합니다. 이러한 요소의 시너지를 활용하여 쿠베란은 모든 수준의 거래자에게 적합한 명확한 입출시그널을 제공합니다.

전략 원칙

쿠베란 전략의 핵심은 다중 지표의 합동 원칙이다. 소음과 잘못된 신호를 줄이기 위해 조화롭게 작동하는 지표의 독특한 조합을 활용합니다. 구체적으로 전략은 다음과 같은 주요 구성 요소를 사용합니다.

- 트렌드 방향 결정: 현재 가격을 지원 및 저항 수준과 비교하여 지배적인 트렌드 방향을 결정합니다.

- 지원 및 저항 수준: 지그자그 지표와 피브 포인트를 사용하여 주요 지원 및 저항 수준을 식별합니다.

- 디버전스 탐지: 디버전스에 의해 신호되는 잠재적 인 트렌드 반전을 발견하기 위해 추진력 지표와 가격 행동을 비교합니다.

- 변동성 적응: 시장 변동성에 적응하기 위해 ATR 지표에 기반하여 스톱 로스 수준을 동적으로 조정합니다.

- 촛불 패턴 인식: 특정 촛불 조합을 사용하여 트렌드 및 역전 신호를 확인합니다.

이러한 요인을 종합적으로 고려함으로써 쿠베란 전략은 다양한 시장 조건에 적응적으로 적응하고 높은 확률의 거래 기회를 포착 할 수 있습니다.

전략적 장점

- 다중 지표 합동: 쿠베란은 여러 지표의 시너지를 활용하여 신호 신뢰성을 크게 향상시키고 노이즈 간섭을 줄입니다.

- 높은 적응력: 동적 매개 변수 조정을 통해 전략은 시장을 변화시키는 환경에 적응하여 노후화를 피할 수 있습니다.

- 명확한 신호: 쿠베란은 명확한 진입 및 출구 신호를 제공하여 거래 결정 프로세스를 단순화합니다.

- 강력한 역 테스트: 전략은 엄격한 역사적 역 테스트를 거쳐 다양한 시장 시나리오에서 일관된 성과를 보여주었습니다.

- 광범위한 적용 가능성: 쿠베란은 특정 거래 수단에 국한되지 않고 여러 시장과 도구에 적용됩니다.

전략 위험

- 매개 변수 민감성: 쿠베란 전략의 성능은 매개 변수 선택에 민감합니다. 부적절한 매개 변수는 열등한 결과를 초래할 수 있습니다.

- 블랙 스완 이벤트: 전략은 주로 기술적 신호에 의존하며 기본적인 블랙 스완 이벤트를 처리하는 능력이 제한되어 있습니다.

- 과도한 적응 위험: 매개 변수 최적화 과정에서 너무 많은 역사적 데이터가 고려되면 전략은 과거에 과도하게 적응하여 미래의 시장 조건에 적응할 수 있는 능력을 줄일 수 있습니다.

- 레버리지 리스크: 과도한 레버리지 사용은 상당한 마진 도출 시 마진 호출의 위험을 야기합니다.

이러한 위험을 완화하기 위해 주기적인 매개 변수 조정, 합리적인 스톱 로스 설정, 레버리지 완화 및 근본적인 변화 모니터링과 같은 적절한 통제 조치가 시행될 수 있습니다.

최적화 방향

- 기계 학습 최적화: 기계 학습 알고리즘을 도입하여 전략 매개 변수를 동적으로 최적화하고 적응력을 향상시킵니다.

- 기본 요소의 통합: 기술적 신호가 실패하는 상황을 처리하기 위해 기본 분석을 거래 결정에 통합하는 것을 고려하십시오.

- 포트폴리오 관리: 자본 관리 수준에서, 다른 전략과 효과적인 헤딩을 달성하기 위해 다양화된 포트폴리오에 Kuberan 전략을 포함합니다.

- 시장별 최적화: 다른 시장과 도구의 특성에 따라 전략 매개 변수를 조정합니다.

- 높은 주파수 변환: 더 많은 단기 거래 기회를 포착하기 위해 전략을 높은 주파수 거래 버전으로 조정합니다.

결론

쿠베란 (Kuberan) 은 여러 가지 기술 분석 방법을 기발하게 결합한 강력하고 신뢰할 수 있는 거래 전략이다. 지표의 합동 원칙을 통해 트렌드를 파악하고 전환점을 식별하는 데 탁월하다. 어떤 전략도 위험으로부터 자유롭지 않지만, 쿠베란은 백테스팅에서 견고함을 입증했다. 적절한 위험 통제 조치와 최적화 노력으로,이 전략은 거래자가 시장 전투에서 우위를 점하고 장기적이고 안정적인 투자 포트폴리오 성장을 촉진하는 데 도움이 될 수 있다.

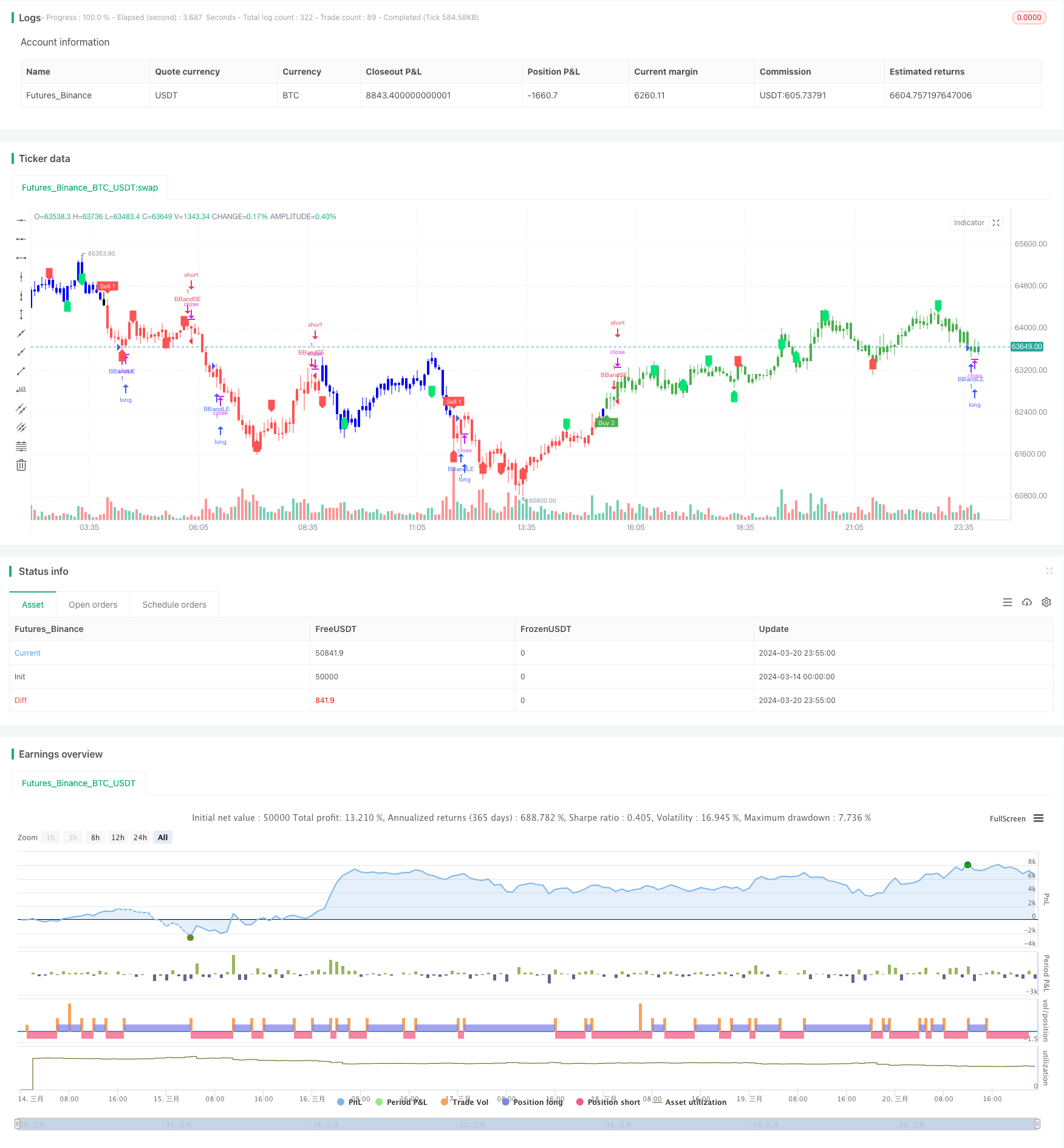

/*backtest

start: 2024-03-14 00:00:00

end: 2024-03-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

//@version=5

strategy('Kuberan*', overlay=true, max_lines_count=500)

lb = input.int(5, title='Left Bars', minval=1)

rb = input.int(5, title='Right Bars', minval=1)

showsupres = input.bool(false, title='Support/Resistance', inline='srcol')

supcol = input.color(color.lime, title='', inline='srcol')

rescol = input.color(color.red, title='', inline='srcol')

// srlinestyle = input(line.style_dotted, title='Line Style/Width', inline='style')

srlinewidth = input.int(3, title='', minval=1, maxval=5, inline='style')

changebarcol = input.bool(true, title='Change Bar Color', inline='bcol')

bcolup = input.color(color.blue, title='', inline='bcol')

bcoldn = input.color(color.black, title='', inline='bcol')

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multTLiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

ehl = hl == 1 ? -1 : 1

loc1 = 0.0

loc2 = 0.0

loc3 = 0.0

loc4 = 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

float a = na

float b = na

float c = na

float d = na

float e = na

if not na(hl)

[loc1, loc2, loc3, loc4] = findprevious()

a := zz

b := loc1

c := loc2

d := loc3

e := loc4

e

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(_hl, title='Higher Low', style=shape.labelup, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(_hh, title='Higher High', style=shape.labeldown, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(_ll, title='Lower Low', style=shape.labelup, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(_lh, title='Lower High', style=shape.labeldown, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol ? iff_4 : na)

// Inputs

A1 = input(5, title='Key Value. \'This changes the sensitivity\' for sell1')

C1 = input(400, title='ATR Period for sell1')

A2 = input(6, title='Key Value. \'This changes the sensitivity\' for buy2')

C2 = input(1, title='ATR Period for buy2')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR1 = ta.atr(C1)

xATR2 = ta.atr(C2)

nLoss1 = A1 * xATR1

nLoss2 = A2 * xATR2

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop1 = 0.0

iff_5 = src > nz(xATRTrailingStop1[1], 0) ? src - nLoss1 : src + nLoss1

iff_6 = src < nz(xATRTrailingStop1[1], 0) and src[1] < nz(xATRTrailingStop1[1], 0) ? math.min(nz(xATRTrailingStop1[1]), src + nLoss1) : iff_5

xATRTrailingStop1 := src > nz(xATRTrailingStop1[1], 0) and src[1] > nz(xATRTrailingStop1[1], 0) ? math.max(nz(xATRTrailingStop1[1]), src - nLoss1) : iff_6

xATRTrailingStop2 = 0.0

iff_7 = src > nz(xATRTrailingStop2[1], 0) ? src - nLoss2 : src + nLoss2

iff_8 = src < nz(xATRTrailingStop2[1], 0) and src[1] < nz(xATRTrailingStop2[1], 0) ? math.min(nz(xATRTrailingStop2[1]), src + nLoss2) : iff_7

xATRTrailingStop2 := src > nz(xATRTrailingStop2[1], 0) and src[1] > nz(xATRTrailingStop2[1], 0) ? math.max(nz(xATRTrailingStop2[1]), src - nLoss2) : iff_8

pos1 = 0

iff_9 = src[1] > nz(xATRTrailingStop1[1], 0) and src < nz(xATRTrailingStop1[1], 0) ? -1 : nz(pos1[1], 0)

pos1 := src[1] < nz(xATRTrailingStop1[1], 0) and src > nz(xATRTrailingStop1[1], 0) ? 1 : iff_9

pos2 = 0

iff_10 = src[1] > nz(xATRTrailingStop2[1], 0) and src < nz(xATRTrailingStop2[1], 0) ? -1 : nz(pos2[1], 0)

pos2 := src[1] < nz(xATRTrailingStop2[1], 0) and src > nz(xATRTrailingStop2[1], 0) ? 1 : iff_10

xcolor1 = pos1 == -1 ? color.red : pos1 == 1 ? color.green : color.blue

xcolor2 = pos2 == -1 ? color.red : pos2 == 1 ? color.green : color.blue

ema1 = ta.ema(src, 1)

ema2 = ta.ema(src, 1)

above1 = ta.crossover(ema1, xATRTrailingStop1)

below1 = ta.crossover(xATRTrailingStop1, ema1)

above2 = ta.crossover(ema2, xATRTrailingStop2)

below2 = ta.crossover(xATRTrailingStop2, ema2)

buy1 = src > xATRTrailingStop1 and above1

sell1 = src < xATRTrailingStop1 and below1

buy2 = src > xATRTrailingStop2 and above2

sell2 = src < xATRTrailingStop2 and below2

barbuy1 = src > xATRTrailingStop1

barsell1 = src < xATRTrailingStop1

barbuy2 = src > xATRTrailingStop2

barsell2 = src < xATRTrailingStop2

// plotshape(buy1, title="Buy 1", text='Buy 1', style=shape.labelup, location=location.belowbar, color=color.green, textcolor=color.white, transp=0, size=size.tiny)

plotshape(sell1, title='Sell 1', text='Sell 1', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(buy2, title='Buy 2', text='Buy 2', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// plotshape(sell2, title="Sell 2", text='Sell 2', style=shape.labeldown, location=location.abovebar, color=color.red, textcolor=color.white, transp=0, size=size.tiny)

// barcolor(barbuy1 ? color.green : na)

barcolor(barsell1 ? color.red : na)

barcolor(barbuy2 ? color.green : na)

// barcolor(barsell2 ? color.red : na)

// alertcondition(buy1, "UT Long 1", "UT Long 1")

alertcondition(sell1, 'UT Short 1', 'UT Short 1')

alertcondition(buy2, 'UT Long 2', 'UT Long 2')

// strategy.entry('long', strategy.long, when=buy2)

source = close

length = input.int(20, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

buyEntry = ta.crossover(source, lower)

sellEntry = ta.crossunder(source, upper)

if (ta.crossover(source, lower) )

strategy.entry("BBandLE", strategy.long, stop=lower, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (ta.crossunder(source, upper))

strategy.entry("BBandSE", strategy.short, stop=upper, oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

lengthTL = input.int(14, 'Swing Detection Lookback')

multTL = input.float(1., 'Slope', minval = 0, step = .1)

calcMethod = input.string('Atr', 'Slope Calculation Method', options = ['Atr','Stdev','Linreg'])

backpaint = input(true, tooltip = 'Backpainting offset displayed elements in the past. Disable backpainting to see real time information returned by the indicator.')

//Style

upCss = input.color(color.teal, 'Up Trendline Color', group = 'Style')

dnCss = input.color(color.red, 'Down Trendline Color', group = 'Style')

showExt = input(true, 'Show Extended Lines')

//-----------------------------------------------------------------------------}

//Calculations

//-----------------------------------------------------------------------------{

var upperTL = 0.

var lowerTL = 0.

var slope_phTL = 0.

var slope_plTL = 0.

var offset = backpaint ? lengthTL : 0

n = bar_index

srcTL = close

phTL = ta.pivothigh(lengthTL, lengthTL)

plTL = ta.pivotlow(lengthTL, lengthTL)

//Slope Calculation Method

slope = switch calcMethod

'Atr' => ta.atr(lengthTL) / lengthTL * multTL

'Stdev' => ta.stdev(srcTL,lengthTL) / lengthTL * multTL

'Linreg' => math.abs(ta.sma(srcTL * n, lengthTL) - ta.sma(srcTL, lengthTL) * ta.sma(n, lengthTL)) / ta.variance(n, lengthTL) / 2 * multTL

//Get slopes and calculate trendlines

slope_phTL := phTL ? slope : slope_phTL

slope_plTL := plTL ? slope : slope_plTL

upperTL := phTL ? phTL : upperTL - slope_phTL

lowerTL := pl ? pl : lowerTL + slope_plTL

var upos = 0

var dnos = 0

upos := phTL ? 0 : close > upperTL - slope_phTL * lengthTL ? 1 : upos

dnos := pl ? 0 : close < lowerTL + slope_plTL * lengthTL ? 1 : dnos

- 이중 기하급수적 이동 평균 클라우드 크로스오버 자동 거래 전략

- 이중 시간 프레임 EMA 크로스오버 장기 단기 전략

- 선체 이동 평균 크로스오버 전략

- 최적화된 스톱 로스 전략과 함께 이중 이동 평균 크로스오버

- ATR 트렌드 브레이크 전략

- 여러 이동 평균 및 RSI 크로스 오버 거래 전략

- Swing Trading 전략에 따른 MA 및 RSI 기반 트렌드

- 볼링거 밴드 + EMA 트렌드 다음 전략

- 두 개의 이동 평균 크로스오버와 다중 시간 프레임 DMI 지표에 기초한 트렌드 다음 전략

- 지원/저항-심리학-촛불 피드백-돈 관리 전략

- 촛불 패턴 트렌드 필터 전략

- 이중 이동 평균 트렌드 전략

- 이중 ATR 트레일링 스톱에 기반한 동적 스톱 손실 및 영업 전략

- MACD + EMA 다중 시간 프레임 브레이크 전략

- 결함없는 승리의 DCA 동력 및 변동성 전략

- MACD, ADX 및 EMA200에 기초한 다시간 프레임 트렌드 거래 전략

- 초기 스톱 로스로 이중 방향 거래 전략

- 자동 예측 장기/단기 목표 중단 손실 전략 9:15 높은/하위

- MACD와 EMA를 결합한 SMC 전략

- 동적 멀티SMA 및 MACD 기반 XAUUSD 거래 전략