Cryptocurrency Spot Multi-Symbol Dual Moving Average Strategy (Pengajaran)

Penulis:Ninabadass, Dicipta: 2022-04-07 16:14:35, Dikemas kini: 2022-04-08 09:13:58Cryptocurrency Spot Multi-Symbol Dual Moving Average Strategy (Pengajaran)

Atas permintaan pengguna kami di Forum bahawa mereka berharap untuk mempunyai strategi purata bergerak berganda berbilang simbol sebagai rujukan reka bentuk, strategi purata bergerak berganda berganda berbilang simbol akan dilaksanakan dalam perkongsian hari ini.

Pemikiran Strategi

Logik strategi purata bergerak berganda adalah sangat mudah, iaitu, dua purata bergerak. purata bergerak dengan tempoh kecil (garis pantas) dan purata bergerak dengan tempoh besar (garis perlahan). Apabila kedua-dua garis mempunyai salib emas (garis pantas melintasi garis perlahan dari bawah), beli panjang, dan apabila kedua-dua garis mempunyai salib mati (garis pantas ke bawah melintasi garis perlahan dari atas), jual pendek. Untuk purata bergerak, Kami menggunakan EMA.

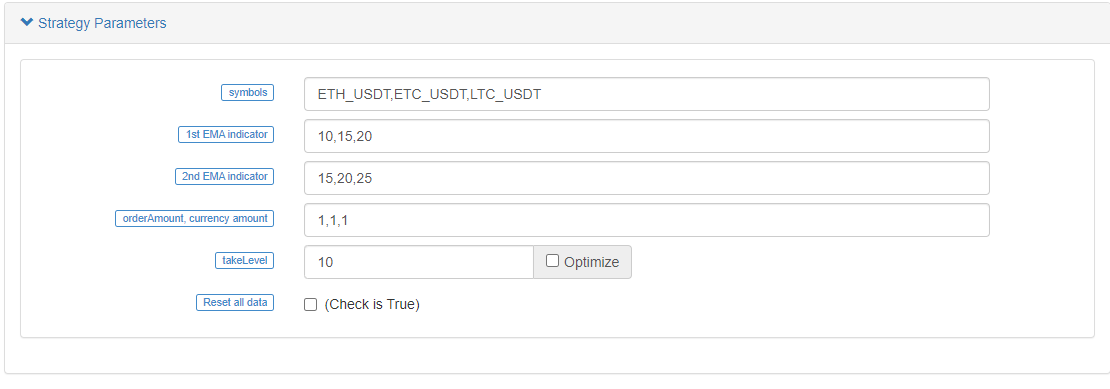

Ia hanya bahawa strategi perlu direka untuk pelbagai simbol, jadi parameter simbol yang berbeza mungkin berbeza (simbol yang berbeza menggunakan parameter purata bergerak yang berbeza), jadi perlu untuk merancang parameter dalam array

Parameter direka dalam bentuk rentetan, dengan setiap parameter dibahagikan dengan koma. rentetan ini dianalisis apabila strategi bermula berjalan, yang akan sepadan dengan logik pelaksanaan untuk setiap simbol (pasangan perdagangan). Undian strategi mengesan sebut harga pasaran, semua simbol, pencetus syarat perdagangan, dan cetakan carta. Selepas semua simbol diundi sekali, data digabungkan dan maklumat jadual dipaparkan pada bar status.

Strategi ini direka dengan sangat mudah dan sangat sesuai untuk pemula; ia hanya mempunyai 200+ baris secara keseluruhan.

Kod Strategi

// function effect: to cancel all pending orders of the current trading pair

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// function effect: to calculate the real-time profit and loss

function getProfit(account, initAccount, lastPrices) {

// account indicates the current account information; initAccount is the initial account information; lastPrices is the the latest prices of all current symbols

var sum = 0

_.each(account, function(val, key) {

// traverse the current total assets, and calculate asset currency (except USDT) difference and amount difference

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// return the asset profit and loss calculated by the current price

return account["USDT"] - initAccount["USDT"] + sum

}

// function effect: to generate chart configuration

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol indicates trading pair; ema1Period indicates the first EMA period; ema2Period indicates the second EMA period

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line date series

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA data series

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA data series

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// reset all data

if (isReset) {

_G(null) // vacuum all persistently recorded data

LogReset(1) // vacuum all logs

LogProfitReset() // vacuum all profit logs

LogVacuum() // release the resource occupied by the bot database

Log("reset all data", "#FF0000") // print information

}

// parse parameters

var arrSymbols = symbols.split(",") // use comma to split the trading symbol strings

var arrEma1Periods = ema1Periods.split(",") // split the string of the first EMA parameter

var arrEma2Periods = ema2Periods.split(",") // split the string of the second EMA parameter

var arrAmounts = orderAmounts.split(",") // split the order amount of each symbol

var account = {} // the variable used to record the current asset information

var initAccount = {} // the variable used to record the initial asset information

var currTradeMsg = {} // the variable used to record whether the current BAR is executed

var lastPrices = {} // the variable used to record the latest price of the monitored symbol

var lastBarTime = {} // the variable used to record the time of the latest BAR, to judge the BAR update during plotting

var arrChartConfig = [] // the variable used to record the chart configuration information, to plot

if (_G("currTradeMsg")) { // for example, when restart, recover currTradeMsg data

currTradeMsg = _G("currTradeMsg")

Log("recover GetRecords", currTradeMsg)

}

// initialize account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// initialize the related data of chart

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("recover initial account information", initAccount)

} else {

// use the current asset information to initialize initAccount (variable)

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // print asset information

// initialize the chart objects

var chart = Chart(arrChartConfig)

// reset chart

chart.reset()

// strategy logic of the main loop

while (true) {

// traverse all symbols, and execute the dual moving average logic one by one

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // switch the trading pair to the trading pair recorded by by symbol string

var arrCurrencyName = symbol.split("_") // split trading pairs by "_"

var baseCurrency = arrCurrencyName[0] // string of base currency

var quoteCurrency = arrCurrencyName[1] // string of quote currency

// according to index, obtain the EMA paramater of the current trading pair

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// obtain the K-line data of the current trading pair

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // when the length of K-line is not long enough, return directly

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // record the current BAR timestamp

lastPrices[symbol] = r[r.length - 1].Close // record the current latest price

var ema1 = TA.EMA(r, ema1Period) // calculate EMA indicator

var ema2 = TA.EMA(r, ema2Period) // calculate EMA indicator

if (ema1.length < 3 || ema2.length < 3) { // when the length of EMA indicator array is too short, return derectly

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // EMA on the second last BAR

var ema1Last3 = ema1[ema1.length - 3] // EMA on the third last BAR

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// write the chart data

var klineIndex = index + 2 * index

// traverse k-line data

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // plot; update the current BAR and its indicator

// update

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // plot; add BAR and its indicator

// add

lastBarTime[symbol] = r[i].Time // update the timestamp

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// golden cross

var depth = exchange.GetDepth() // obtain the depth data of the current order book

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // select the 10th level price; taker

if (depth && price * amount <= account[quoteCurrency]) { // obtain that the depth data is normal, and the assets are enough to place an order

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // maker; buy

cancelAll(exchange) // cancel all pending orders

var acc = _C(exchange.GetAccount) // obtain the account asset information

if (acc.Stocks != account[baseCurrency]) { // detect the account assets changed

account[baseCurrency] = acc.Stocks // update assets

account[quoteCurrency] = acc.Balance // update assets

currTradeMsg[symbol] = currBarTime // record the current BAR has been executed

_G("currTradeMsg", currTradeMsg) // persistently record

var profit = getProfit(account, initAccount, lastPrices) // calculate profit

if (profit) {

LogProfit(profit, account, initAccount) // print profit

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// death cross

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// variables in the table of status bar

var tbl = {

type : "table",

title : "account information",

cols : [],

rows : []

}

// write the data in the table structure of status bar

tbl.cols.push("--")

tbl.rows.push(["initial"])

tbl.rows.push(["current"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // initial

tbl.rows[1].push(val) // current

}

})

// display the status bar table

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

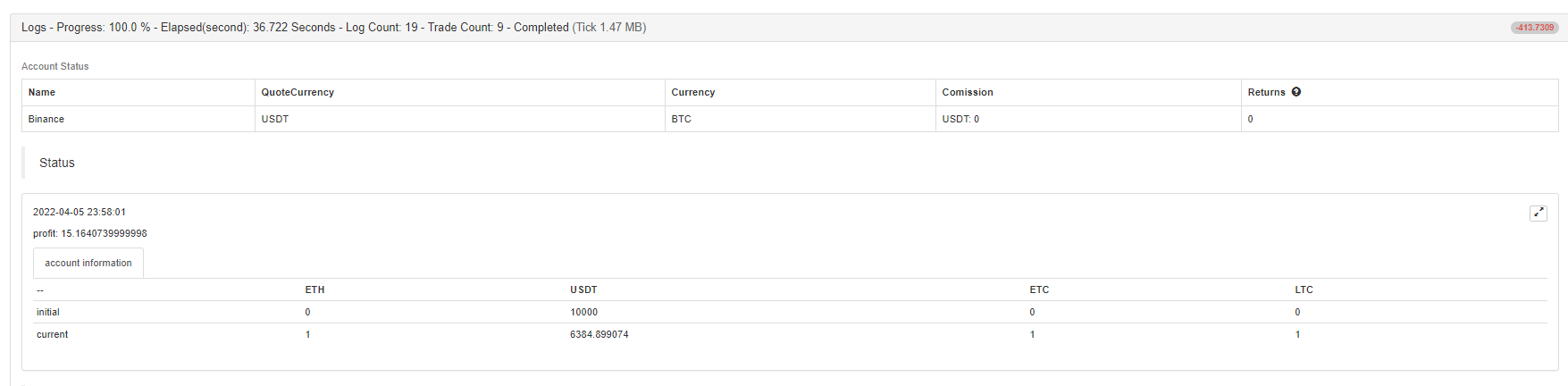

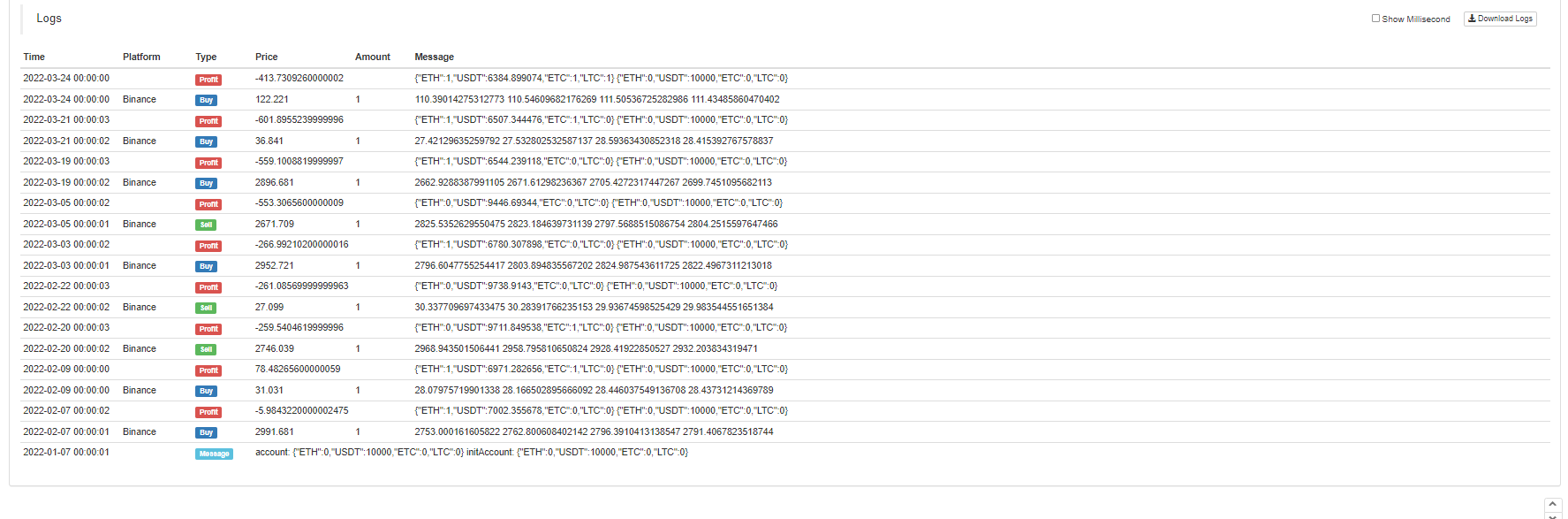

Ujian Kembali Strategi

Anda boleh melihat ETH, LTC dan ETC semua mempunyai perdagangan mengikut pencetus salib emas dan salib kematian purata bergerak.

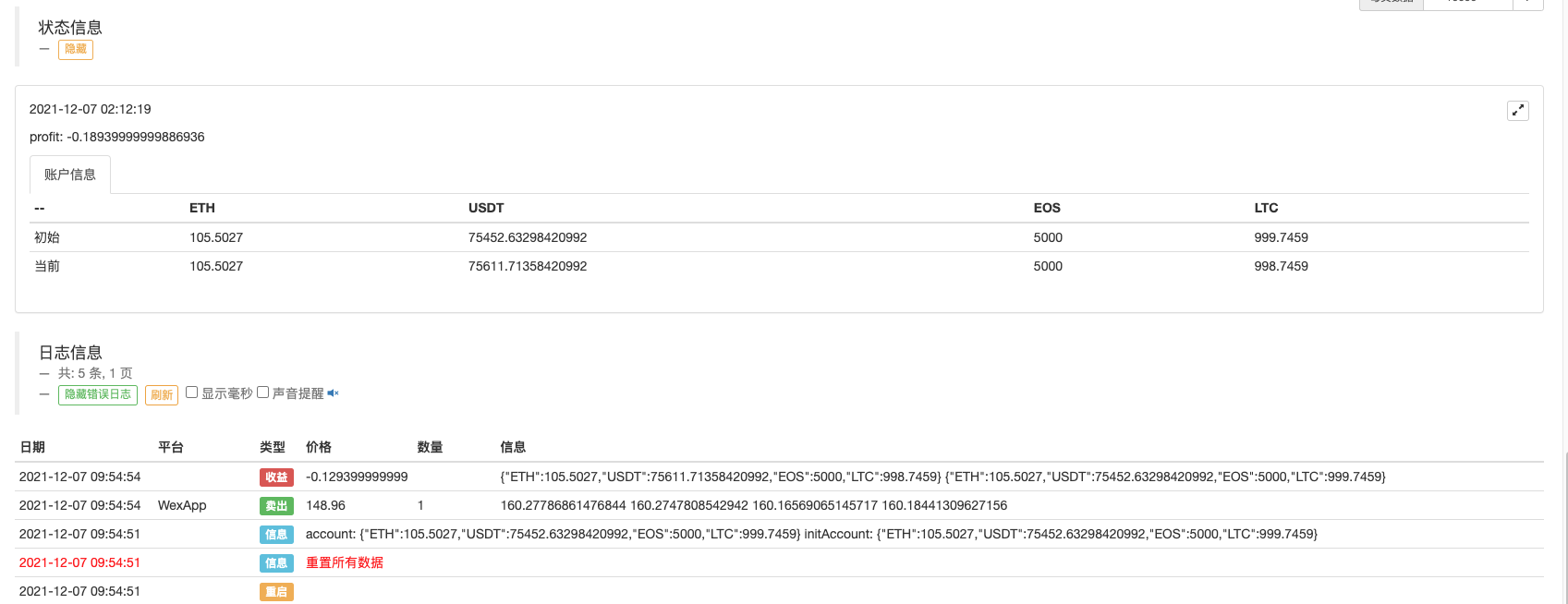

Anda juga boleh menunggu pada simulasi bot untuk menguji.

Kod sumber strategi:https://www.fmz.com/strategy/333783

Strategi ini hanya digunakan untuk backtest dan pembelajaran reka bentuk strategi, jadi menggunakannya dalam bot dengan berhati-hati.

- Platform pembayaran berdasarkan FMZ

- Kontrak Cryptocurrency Bot Pengawasan Perintah Sederhana

- Apabila menggunakan getdepth untuk mendapatkan timestamp yang sesuai

- Mengingkari, diselesaikan

- Masalah nilai muka

- Contoh Reka Bentuk Strategi dYdX

- Penjelajahan Awal Menggunakan Python Crawler di FMZ

Penjelajahan Kandungan Pengumuman Binance - Penyelidikan Reka Bentuk Strategi Hedge & Contoh Perintah Tunggu Spot dan Masa Depan

- Keadaan terkini dan operasi disyorkan strategi kadar pembiayaan

- Strategi titik pemutusan purata bergerak berganda niaga hadapan cryptocurrency (Pengajaran)

- Mencapai Fisher Indicator dalam JavaScript & Plotting pada FMZ

- Pengurus

- 2021 Ulasan TAQ Cryptocurrency & Strategi Termudah yang Terlewatkan Peningkatan 10 Kali

- Cryptocurrency Futures Multi-Symbol ART Strategy (Pengajaran)

- Peningkatan! Cryptocurrency Futures Strategi Martingale

- Fungsi Getrecords tidak dapat mendapatkan grafik K dalam unit saat

- Reka bentuk Sistem Pengurusan Sinkron Berasaskan Perintah FMZ (2)

- Data Volume yang dikembalikan oleh Getticker adalah salah.

- Reka bentuk Sistem Pengurusan Sinkron berdasarkan Perintah FMZ (1)

- Merancang Perpustakaan Plot Berbilang Carta