Strategi Perpindahan Momentum dengan Stop Loss Trailing Dinamik

Penulis:ChaoZhang, Tarikh: 2024-02-29 13:55:16Tag:

Ringkasan

Strategi ini menggabungkan penunjuk purata bergerak dan penunjuk indeks pergerakan arah (DMI) untuk menjana isyarat beli dan jual berdasarkan silang dua penunjuk.

Logika Strategi

- Membina penunjuk purata bergerak menggunakan EMA 9 hari pendek dan EMA 21 hari panjang. Isyarat beli dihasilkan apabila EMA pendek melintasi EMA panjang. Isyarat jual dihasilkan apabila EMA pendek melintasi EMA panjang.

- Membina penunjuk DMI menggunakan ADX, +DI dan -DI. Isyarat beli diaktifkan apabila +DI melintasi di atas -DI. Isyarat jual diaktifkan apabila -DI melintasi di atas +DI.

- Menggabungkan isyarat EMA dan DMI, yang memerlukan kedua-dua penunjuk untuk memenuhi syarat sebelum mengeluarkan isyarat beli atau jual sebenar.

- Menggunakan stop loss yang dinamik untuk mengesan harga tertinggi/harga terendah untuk stop loss.

Analisis Kelebihan

- Kombo penunjuk ganda menapis isyarat palsu dan meningkatkan ketepatan isyarat.

- Penunjuk momentum boleh menangkap perubahan trend awal dengan beberapa ciri utama.

- Stop loss yang dinamik mengunci keuntungan sebanyak mungkin sambil mengawal risiko.

Analisis Risiko

- Dengan kombinasi dua penunjuk, frekuensi isyarat dikurangkan, mungkin kehilangan beberapa peluang.

- Penyesuaian parameter indikator yang tidak baik boleh membawa kepada perdagangan berlebihan atau isyarat berkualiti rendah.

- Set stop loss terlalu luas meningkatkan risiko kerugian manakala set terlalu ketat meningkatkan risiko pemutusan trend.

Arahan pengoptimuman

- Uji gabungan EMA dengan panjang jangka pendek dan jangka panjang yang berbeza untuk mencari yang optimum.

- Mengoptimumkan parameter ADX untuk meningkatkan kualiti isyarat DMI.

- Sesuaikan parameter stop loss untuk mengunci keuntungan sambil menguruskan risiko.

- Pertimbangkan untuk menambah lebih banyak penapis untuk meningkatkan kualiti isyarat.

Kesimpulan

Strategi ini menggabungkan kekuatan purata bergerak dan penunjuk momentum untuk pengesahan isyarat berganda, saling melengkapi untuk meningkatkan keuntungan. Sementara itu, penghentian kerugian yang dinamis secara berkesan mengawal risiko. Pengoptimuman parameter dan penyempurnaan strategi yang lebih lanjut dapat meningkatkan keuntungan dan kestabilan.

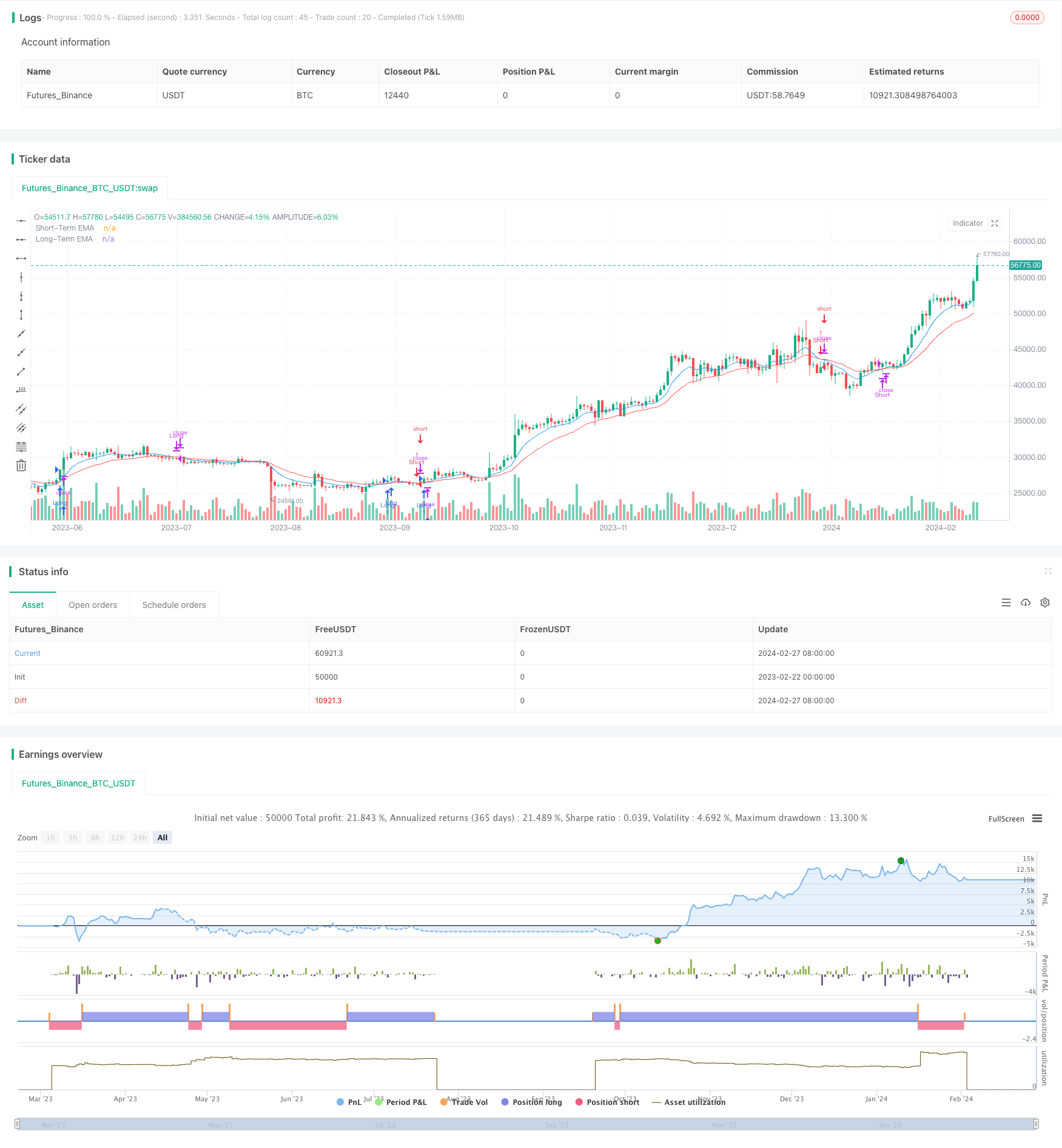

/*backtest

start: 2023-02-22 00:00:00

end: 2024-02-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined EMA and DMI Strategy with Enhanced Table", overlay=true)

// Input parameters for EMA

shortTermEMA = input.int(9, title="Short-Term EMA Period")

longTermEMA = input.int(21, title="Long-Term EMA Period")

riskPercentageEMA = input.float(1, title="Risk Percentage EMA", minval=0.1, maxval=5, step=0.1)

// Calculate EMAs

emaShort = ta.ema(close, shortTermEMA)

emaLong = ta.ema(close, longTermEMA)

// EMA Crossover Strategy

longConditionEMA = emaShort > emaLong and emaShort[1] <= emaLong[1]

shortConditionEMA = emaShort < emaLong and emaShort[1] >= emaLong[1]

// Input parameters for DMI

adxlen = input(17, title="ADX Smoothing")

dilen = input(17, title="DI Length")

// DMI Logic

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

truerange = ta.tr

plus = fixnan(100 * ta.rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * ta.rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adxValue = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

[adxValue, plus, minus]

[adxValue, up, down] = adx(dilen, adxlen)

// DMI Conditions

buyConditionDMI = up > down or (up and adxValue > down)

sellConditionDMI = down > up or (down and adxValue > up)

// Combined Conditions for Entry

longEntryCondition = longConditionEMA and buyConditionDMI

shortEntryCondition = shortConditionEMA and sellConditionDMI

// Combined Conditions for Exit

longExitCondition = shortConditionEMA

shortExitCondition = longConditionEMA

// Enter long trade based on combined conditions

if (longEntryCondition)

strategy.entry("Long", strategy.long)

// Enter short trade based on combined conditions

if (shortEntryCondition)

strategy.entry("Short", strategy.short)

// Exit trades

if (longExitCondition)

strategy.close("Long")

if (shortExitCondition)

strategy.close("Short")

// Plot EMAs

plot(emaShort, color=color.blue, title="Short-Term EMA")

plot(emaLong, color=color.red, title="Long-Term EMA")

// Create and fill the enhanced table

var tbl = table.new(position.top_right, 4, 1)

if (barstate.islast)

table.cell(tbl, 0, 0, "ADX: " + str.tostring(adxValue), bgcolor=color.new(color.red, 90), width=15, height=4)

table.cell(tbl, 1, 0, "+DI: " + str.tostring(up), bgcolor=color.new(color.blue, 90), width=15, height=4)

table.cell(tbl, 2, 0, "-DI: " + str.tostring(down), bgcolor=color.new(color.orange, 90), width=15, height=4)

Lebih lanjut

- Adaptive Channel Breakout Strategi

- Satu EMA Trend Advanced Following Strategy dengan RSI Relaxed dan ATR Filters

- Strategi Pengesanan Trend Bertiga

- Strategi Dagangan Purata Bergerak Berganda

- Sistem Keputusan Perdagangan Penyu

- Gelombang Beli dan Jual Pembalikan 5 minit Strategi Jangka Masa

- Strategi Perdagangan Auto berasaskan RSI

- Strategi Pembebasan Kompaun

- Strategi Pembebasan Momentum

- Trend Mengikut Strategi Purata Bergerak

- EMA dan RSI Strategi Perdagangan Kuantitatif

- Strategi Trend Momentum Berdasarkan MACD dan Bollinger Bands

- Strategi Stochastic Berbilang Jangka Masa

- Strategi Crossover purata bergerak dengan corak candlestick intraday

- Strategi Scalping Bitcoin Berdasarkan Moving Average Crossover dan corak candlestick

- Strategi panjang gabungan momentum dan purata bergerak

- Momentum Purata Indeks Pergerakan Arah Pergerakan Purata Pergerakan Strategi Crossover

- Strategi Pengesanan Trend Crossover EMA Berganda

- Strategi Dagangan Gabungan Purata Bergerak Berganda dan MACD

- Strategi Trend Mengambil Dinamis