Strategi Kuberan: Pendekatan Penggabungan untuk penguasaan pasaran

Penulis:ChaoZhang, Tarikh: 2024-03-22 14:08:11Tag:

Ringkasan Strategi

Strategi Kuberan adalah strategi perdagangan yang kuat yang dibangunkan oleh Kathir. Ia menggabungkan pelbagai teknik analisis untuk membentuk pendekatan perdagangan yang unik dan kuat.

Kuberan adalah lebih daripada sekadar strategi; ia adalah sistem perdagangan yang komprehensif. Ia mengintegrasikan analisis trend, penunjuk momentum, dan metrik jumlah untuk mengenal pasti peluang perdagangan yang berkemungkinan tinggi. Dengan memanfaatkan sinergi elemen-elemen ini, Kuberan memberikan isyarat kemasukan dan keluar yang jelas, sesuai untuk peniaga semua peringkat.

Prinsip Strategi

Pada teras strategi Kuberan adalah prinsip perpaduan pelbagai penunjuk. Ia menggunakan gabungan unik penunjuk yang berfungsi secara harmoni untuk mengurangkan bunyi bising dan isyarat palsu. Khususnya, strategi menggunakan komponen utama berikut:

- Penentuan arah trend: Dengan membandingkan harga semasa dengan tahap sokongan dan rintangan, ia menentukan arah trend yang berlaku.

- Tahap sokongan dan rintangan: Menentukan tahap sokongan dan rintangan utama menggunakan penunjuk zigzag dan titik pivot.

- Pengesanan perpecahan: Membandingkan tindakan harga dengan penunjuk momentum untuk mengesan pembalikan trend yang berpotensi disinyalkan oleh perpecahan.

- Penyesuaian turun naik: Sesuaikan secara dinamik tahap stop-loss berdasarkan penunjuk ATR untuk menyesuaikan diri dengan turun naik pasaran yang berbeza.

- Pengiktirafan corak candlestick: mengesahkan isyarat trend dan pembalikan menggunakan kombinasi candlestick tertentu.

Dengan mempertimbangkan faktor-faktor ini secara komprehensif, strategi Kuberan dapat menyesuaikan diri dengan pelbagai keadaan pasaran dan menangkap peluang perdagangan yang berkemungkinan tinggi.

Kelebihan Strategi

- Penggabungan pelbagai penunjuk: Kuberan memanfaatkan sinergi pelbagai penunjuk, meningkatkan kebolehpercayaan isyarat dan mengurangkan gangguan bunyi.

- Kemudahan penyesuaian yang tinggi: Melalui penyesuaian parameter dinamik, strategi dapat menyesuaikan diri dengan perubahan persekitaran pasaran, mengelakkan ketinggalan zaman.

- Isyarat yang jelas: Kuberan memberikan isyarat masuk dan keluar yang jelas, memudahkan proses keputusan perdagangan.

- Pengujian belakang yang kukuh: Strategi telah menjalani pengujian belakang sejarah yang ketat, menunjukkan prestasi yang konsisten di pelbagai senario pasaran.

- Penggunaan luas: Kuberan boleh digunakan untuk pelbagai pasaran dan instrumen, tidak terhad kepada kenderaan perdagangan tertentu.

Risiko Strategi

- Sensitiviti parameter: Prestasi strategi Kuberan sensitif terhadap pemilihan parameter; parameter yang tidak sesuai boleh membawa kepada hasil yang kurang optimum.

- Peristiwa angsa hitam: Strategi ini terutamanya bergantung pada isyarat teknikal dan mempunyai keupayaan terhad untuk menangani peristiwa angsa hitam asas.

- Risiko overfitting: Jika terlalu banyak data sejarah dipertimbangkan semasa pengoptimuman parameter, strategi boleh menjadi terlalu sesuai dengan masa lalu, mengurangkan daya sesuaikan dengan keadaan pasaran masa depan.

- Risiko leverage: Menggunakan leverage yang berlebihan menimbulkan risiko panggilan margin semasa penarikan yang besar.

Untuk mengurangkan risiko ini, langkah-langkah kawalan yang sesuai boleh dilaksanakan, seperti penyesuaian parameter berkala, menetapkan stop-loss yang munasabah, mengurangkan leverage, dan memantau perubahan asas.

Arahan pengoptimuman

- Pengoptimuman pembelajaran mesin: Memperkenalkan algoritma pembelajaran mesin untuk mengoptimumkan parameter strategi secara dinamik dan meningkatkan kesesuaian.

- Penggabungan faktor asas: Pertimbangkan untuk mengintegrasikan analisis asas ke dalam keputusan perdagangan untuk menangani situasi di mana isyarat teknikal gagal.

- Pengurusan portfolio: Pada peringkat pengurusan modal, sertakan strategi Kuberan dalam portfolio yang pelbagai untuk mencapai lindung nilai yang berkesan dengan strategi lain.

- Pengoptimuman khusus pasaran: Sesuaikan parameter strategi berdasarkan ciri-ciri pasaran dan instrumen yang berbeza.

- Transformasi frekuensi tinggi: Sesuaikan strategi ke dalam versi perdagangan frekuensi tinggi untuk menangkap lebih banyak peluang perdagangan jangka pendek.

Kesimpulan

Kuberan adalah strategi perdagangan yang kuat dan boleh dipercayai yang menggabungkan pelbagai kaedah analisis teknikal dengan bijak. Melalui prinsip perpaduan penunjuk, ia cemerlang dalam menangkap trend dan mengenal pasti titik perubahan. Walaupun tidak ada strategi yang kebal terhadap risiko, Kuberan telah membuktikan ketahanan dalam backtesting. Dengan langkah-langkah kawalan risiko yang sesuai dan usaha pengoptimuman, strategi ini dapat membantu peniaga mendapatkan kelebihan dalam pertempuran pasaran, mendorong pertumbuhan jangka panjang dan mantap portfolio pelaburan mereka.

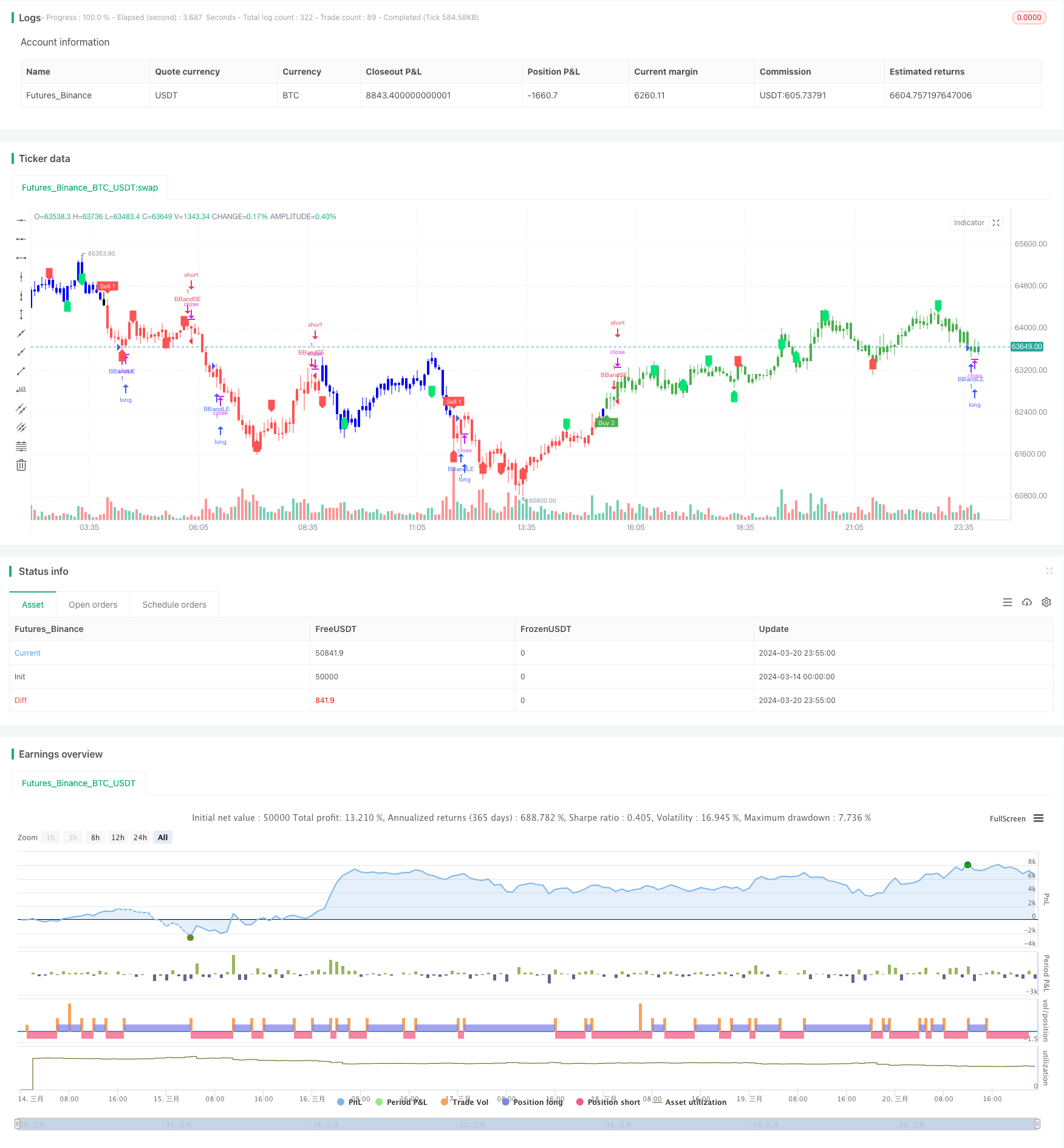

/*backtest

start: 2024-03-14 00:00:00

end: 2024-03-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

//@version=5

strategy('Kuberan*', overlay=true, max_lines_count=500)

lb = input.int(5, title='Left Bars', minval=1)

rb = input.int(5, title='Right Bars', minval=1)

showsupres = input.bool(false, title='Support/Resistance', inline='srcol')

supcol = input.color(color.lime, title='', inline='srcol')

rescol = input.color(color.red, title='', inline='srcol')

// srlinestyle = input(line.style_dotted, title='Line Style/Width', inline='style')

srlinewidth = input.int(3, title='', minval=1, maxval=5, inline='style')

changebarcol = input.bool(true, title='Change Bar Color', inline='bcol')

bcolup = input.color(color.blue, title='', inline='bcol')

bcoldn = input.color(color.black, title='', inline='bcol')

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multTLiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

ehl = hl == 1 ? -1 : 1

loc1 = 0.0

loc2 = 0.0

loc3 = 0.0

loc4 = 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

float a = na

float b = na

float c = na

float d = na

float e = na

if not na(hl)

[loc1, loc2, loc3, loc4] = findprevious()

a := zz

b := loc1

c := loc2

d := loc3

e := loc4

e

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(_hl, title='Higher Low', style=shape.labelup, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(_hh, title='Higher High', style=shape.labeldown, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(_ll, title='Lower Low', style=shape.labelup, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(_lh, title='Lower High', style=shape.labeldown, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol ? iff_4 : na)

// Inputs

A1 = input(5, title='Key Value. \'This changes the sensitivity\' for sell1')

C1 = input(400, title='ATR Period for sell1')

A2 = input(6, title='Key Value. \'This changes the sensitivity\' for buy2')

C2 = input(1, title='ATR Period for buy2')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR1 = ta.atr(C1)

xATR2 = ta.atr(C2)

nLoss1 = A1 * xATR1

nLoss2 = A2 * xATR2

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop1 = 0.0

iff_5 = src > nz(xATRTrailingStop1[1], 0) ? src - nLoss1 : src + nLoss1

iff_6 = src < nz(xATRTrailingStop1[1], 0) and src[1] < nz(xATRTrailingStop1[1], 0) ? math.min(nz(xATRTrailingStop1[1]), src + nLoss1) : iff_5

xATRTrailingStop1 := src > nz(xATRTrailingStop1[1], 0) and src[1] > nz(xATRTrailingStop1[1], 0) ? math.max(nz(xATRTrailingStop1[1]), src - nLoss1) : iff_6

xATRTrailingStop2 = 0.0

iff_7 = src > nz(xATRTrailingStop2[1], 0) ? src - nLoss2 : src + nLoss2

iff_8 = src < nz(xATRTrailingStop2[1], 0) and src[1] < nz(xATRTrailingStop2[1], 0) ? math.min(nz(xATRTrailingStop2[1]), src + nLoss2) : iff_7

xATRTrailingStop2 := src > nz(xATRTrailingStop2[1], 0) and src[1] > nz(xATRTrailingStop2[1], 0) ? math.max(nz(xATRTrailingStop2[1]), src - nLoss2) : iff_8

pos1 = 0

iff_9 = src[1] > nz(xATRTrailingStop1[1], 0) and src < nz(xATRTrailingStop1[1], 0) ? -1 : nz(pos1[1], 0)

pos1 := src[1] < nz(xATRTrailingStop1[1], 0) and src > nz(xATRTrailingStop1[1], 0) ? 1 : iff_9

pos2 = 0

iff_10 = src[1] > nz(xATRTrailingStop2[1], 0) and src < nz(xATRTrailingStop2[1], 0) ? -1 : nz(pos2[1], 0)

pos2 := src[1] < nz(xATRTrailingStop2[1], 0) and src > nz(xATRTrailingStop2[1], 0) ? 1 : iff_10

xcolor1 = pos1 == -1 ? color.red : pos1 == 1 ? color.green : color.blue

xcolor2 = pos2 == -1 ? color.red : pos2 == 1 ? color.green : color.blue

ema1 = ta.ema(src, 1)

ema2 = ta.ema(src, 1)

above1 = ta.crossover(ema1, xATRTrailingStop1)

below1 = ta.crossover(xATRTrailingStop1, ema1)

above2 = ta.crossover(ema2, xATRTrailingStop2)

below2 = ta.crossover(xATRTrailingStop2, ema2)

buy1 = src > xATRTrailingStop1 and above1

sell1 = src < xATRTrailingStop1 and below1

buy2 = src > xATRTrailingStop2 and above2

sell2 = src < xATRTrailingStop2 and below2

barbuy1 = src > xATRTrailingStop1

barsell1 = src < xATRTrailingStop1

barbuy2 = src > xATRTrailingStop2

barsell2 = src < xATRTrailingStop2

// plotshape(buy1, title="Buy 1", text='Buy 1', style=shape.labelup, location=location.belowbar, color=color.green, textcolor=color.white, transp=0, size=size.tiny)

plotshape(sell1, title='Sell 1', text='Sell 1', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(buy2, title='Buy 2', text='Buy 2', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// plotshape(sell2, title="Sell 2", text='Sell 2', style=shape.labeldown, location=location.abovebar, color=color.red, textcolor=color.white, transp=0, size=size.tiny)

// barcolor(barbuy1 ? color.green : na)

barcolor(barsell1 ? color.red : na)

barcolor(barbuy2 ? color.green : na)

// barcolor(barsell2 ? color.red : na)

// alertcondition(buy1, "UT Long 1", "UT Long 1")

alertcondition(sell1, 'UT Short 1', 'UT Short 1')

alertcondition(buy2, 'UT Long 2', 'UT Long 2')

// strategy.entry('long', strategy.long, when=buy2)

source = close

length = input.int(20, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

buyEntry = ta.crossover(source, lower)

sellEntry = ta.crossunder(source, upper)

if (ta.crossover(source, lower) )

strategy.entry("BBandLE", strategy.long, stop=lower, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (ta.crossunder(source, upper))

strategy.entry("BBandSE", strategy.short, stop=upper, oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

lengthTL = input.int(14, 'Swing Detection Lookback')

multTL = input.float(1., 'Slope', minval = 0, step = .1)

calcMethod = input.string('Atr', 'Slope Calculation Method', options = ['Atr','Stdev','Linreg'])

backpaint = input(true, tooltip = 'Backpainting offset displayed elements in the past. Disable backpainting to see real time information returned by the indicator.')

//Style

upCss = input.color(color.teal, 'Up Trendline Color', group = 'Style')

dnCss = input.color(color.red, 'Down Trendline Color', group = 'Style')

showExt = input(true, 'Show Extended Lines')

//-----------------------------------------------------------------------------}

//Calculations

//-----------------------------------------------------------------------------{

var upperTL = 0.

var lowerTL = 0.

var slope_phTL = 0.

var slope_plTL = 0.

var offset = backpaint ? lengthTL : 0

n = bar_index

srcTL = close

phTL = ta.pivothigh(lengthTL, lengthTL)

plTL = ta.pivotlow(lengthTL, lengthTL)

//Slope Calculation Method

slope = switch calcMethod

'Atr' => ta.atr(lengthTL) / lengthTL * multTL

'Stdev' => ta.stdev(srcTL,lengthTL) / lengthTL * multTL

'Linreg' => math.abs(ta.sma(srcTL * n, lengthTL) - ta.sma(srcTL, lengthTL) * ta.sma(n, lengthTL)) / ta.variance(n, lengthTL) / 2 * multTL

//Get slopes and calculate trendlines

slope_phTL := phTL ? slope : slope_phTL

slope_plTL := plTL ? slope : slope_plTL

upperTL := phTL ? phTL : upperTL - slope_phTL

lowerTL := pl ? pl : lowerTL + slope_plTL

var upos = 0

var dnos = 0

upos := phTL ? 0 : close > upperTL - slope_phTL * lengthTL ? 1 : upos

dnos := pl ? 0 : close < lowerTL + slope_plTL * lengthTL ? 1 : dnos

- Strategi Dagangan Automatik Crossover Awan Pergerakan Purata Eksponensial Berganda

- Strategi Pendek dan Panjang Rentas EMA Dua Jangka Masa

- Hull Moving Average Crossover Strategi

- Pertukaran purata bergerak berganda dengan strategi stop loss yang dioptimumkan

- ATR Trend Breakout Strategi

- Strategi Perdagangan Crossover RSI dan Purata Bergerak Berbilang

- Trend berasaskan MA dan RSI Berikutan Strategi Dagangan Swing

- Bollinger Bands + EMA Trend Mengikut Strategi

- Trend Mengikut Strategi Berdasarkan Rata-Rata Bergerak Berganda Crossover dan Indikator DMI Multi-Timeframe

- Strategi Sokongan/Kekangan-Psikologi-Sumbangan Candlestick-Pengurusan Wang

- Strategi Penapis Trend Corak Lilin

- Trend purata bergerak berganda mengikut strategi

- Strategi Stop Loss dan Take Profit Dinamik Berdasarkan Stop Trailing ATR Berganda

- MACD+EMA Multi-Timeframe Breakout Strategi

- Perkembangan dan Strategi Volatiliti DCA

- Strategi Dagangan Trend Berbilang Jangka Masa Berdasarkan MACD, ADX, dan EMA200

- RSI Strategi Dagangan Dua Arah dengan Stop Loss Awal

- Ramalan automatik Strategi Stop Loss Sasaran Panjang/Pendek Berdasarkan 9:15 Tinggi/Rendah

- Strategi SMC Menggabungkan MACD dan EMA

- Strategi Dagangan XAUUSD Berkualiti Multi-SMA dan MACD