Estratégia de média móvel dupla de símbolos múltiplos de criptomoeda (Teaching)

Autora:Ninabadass, Criado: 2022-04-07 16:14:35, Atualizado: 2022-04-08 09:13:58Estratégia de média móvel dupla de símbolos múltiplos de criptomoeda (Teaching)

A pedido de nossos usuários nos fóruns que esperam ter uma estratégia de média móvel dupla de múltiplos símbolos como referência de design, uma estratégia de média móvel dupla de múltiplos símbolos será implementada no compartilhamento de hoje.

Pensamento estratégico

A lógica da estratégia de média móvel dupla é muito simples, ou seja, duas médias móveis. Uma média móvel com um período pequeno (linha rápida) e uma média móvel com um período grande (linha lenta). Quando as duas linhas têm uma cruz de ouro (a linha rápida cruza a linha lenta de baixo), comprar longo, e quando as duas linhas têm uma cruz morta (a linha rápida para baixo cruza a linha lenta de cima), vender curto. Para a média móvel, usamos a EMA.

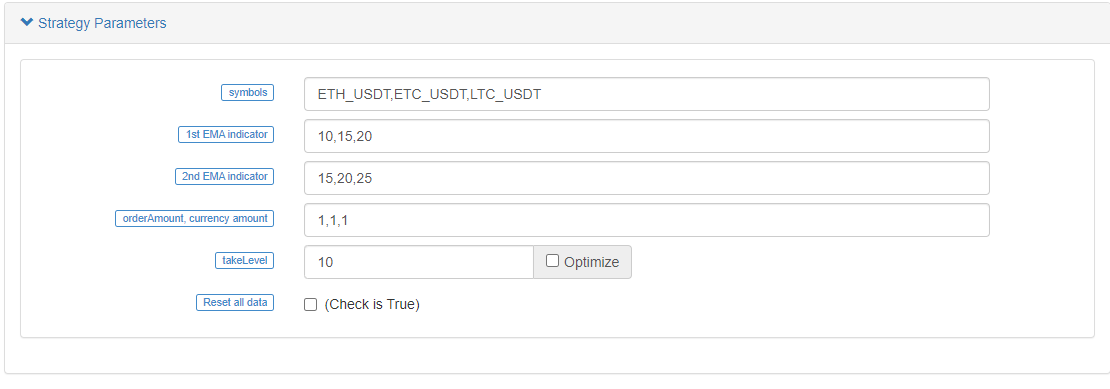

É apenas que a estratégia precisa ser projetada para vários símbolos, de modo que os parâmetros de diferentes símbolos podem ser diferentes (simbolos diferentes usam diferentes parâmetros de média móvel), por isso é necessário projetar parâmetros em uma matriz de parâmetros.

Os parâmetros são projetados em forma de cadeia, com cada parâmetro dividido por vírgula. Essas cadeias são analisadas quando a estratégia começa a ser executada, que será combinada com a lógica de execução para cada símbolo (pares de negociação).

A estratégia é super simples e muito adequada para iniciantes; é de apenas mais de 200 linhas no total.

Código de estratégia

// function effect: to cancel all pending orders of the current trading pair

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// function effect: to calculate the real-time profit and loss

function getProfit(account, initAccount, lastPrices) {

// account indicates the current account information; initAccount is the initial account information; lastPrices is the the latest prices of all current symbols

var sum = 0

_.each(account, function(val, key) {

// traverse the current total assets, and calculate asset currency (except USDT) difference and amount difference

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// return the asset profit and loss calculated by the current price

return account["USDT"] - initAccount["USDT"] + sum

}

// function effect: to generate chart configuration

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol indicates trading pair; ema1Period indicates the first EMA period; ema2Period indicates the second EMA period

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line date series

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA data series

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA data series

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// reset all data

if (isReset) {

_G(null) // vacuum all persistently recorded data

LogReset(1) // vacuum all logs

LogProfitReset() // vacuum all profit logs

LogVacuum() // release the resource occupied by the bot database

Log("reset all data", "#FF0000") // print information

}

// parse parameters

var arrSymbols = symbols.split(",") // use comma to split the trading symbol strings

var arrEma1Periods = ema1Periods.split(",") // split the string of the first EMA parameter

var arrEma2Periods = ema2Periods.split(",") // split the string of the second EMA parameter

var arrAmounts = orderAmounts.split(",") // split the order amount of each symbol

var account = {} // the variable used to record the current asset information

var initAccount = {} // the variable used to record the initial asset information

var currTradeMsg = {} // the variable used to record whether the current BAR is executed

var lastPrices = {} // the variable used to record the latest price of the monitored symbol

var lastBarTime = {} // the variable used to record the time of the latest BAR, to judge the BAR update during plotting

var arrChartConfig = [] // the variable used to record the chart configuration information, to plot

if (_G("currTradeMsg")) { // for example, when restart, recover currTradeMsg data

currTradeMsg = _G("currTradeMsg")

Log("recover GetRecords", currTradeMsg)

}

// initialize account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// initialize the related data of chart

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("recover initial account information", initAccount)

} else {

// use the current asset information to initialize initAccount (variable)

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // print asset information

// initialize the chart objects

var chart = Chart(arrChartConfig)

// reset chart

chart.reset()

// strategy logic of the main loop

while (true) {

// traverse all symbols, and execute the dual moving average logic one by one

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // switch the trading pair to the trading pair recorded by by symbol string

var arrCurrencyName = symbol.split("_") // split trading pairs by "_"

var baseCurrency = arrCurrencyName[0] // string of base currency

var quoteCurrency = arrCurrencyName[1] // string of quote currency

// according to index, obtain the EMA paramater of the current trading pair

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// obtain the K-line data of the current trading pair

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // when the length of K-line is not long enough, return directly

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // record the current BAR timestamp

lastPrices[symbol] = r[r.length - 1].Close // record the current latest price

var ema1 = TA.EMA(r, ema1Period) // calculate EMA indicator

var ema2 = TA.EMA(r, ema2Period) // calculate EMA indicator

if (ema1.length < 3 || ema2.length < 3) { // when the length of EMA indicator array is too short, return derectly

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // EMA on the second last BAR

var ema1Last3 = ema1[ema1.length - 3] // EMA on the third last BAR

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// write the chart data

var klineIndex = index + 2 * index

// traverse k-line data

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // plot; update the current BAR and its indicator

// update

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // plot; add BAR and its indicator

// add

lastBarTime[symbol] = r[i].Time // update the timestamp

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// golden cross

var depth = exchange.GetDepth() // obtain the depth data of the current order book

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // select the 10th level price; taker

if (depth && price * amount <= account[quoteCurrency]) { // obtain that the depth data is normal, and the assets are enough to place an order

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // maker; buy

cancelAll(exchange) // cancel all pending orders

var acc = _C(exchange.GetAccount) // obtain the account asset information

if (acc.Stocks != account[baseCurrency]) { // detect the account assets changed

account[baseCurrency] = acc.Stocks // update assets

account[quoteCurrency] = acc.Balance // update assets

currTradeMsg[symbol] = currBarTime // record the current BAR has been executed

_G("currTradeMsg", currTradeMsg) // persistently record

var profit = getProfit(account, initAccount, lastPrices) // calculate profit

if (profit) {

LogProfit(profit, account, initAccount) // print profit

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// death cross

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// variables in the table of status bar

var tbl = {

type : "table",

title : "account information",

cols : [],

rows : []

}

// write the data in the table structure of status bar

tbl.cols.push("--")

tbl.rows.push(["initial"])

tbl.rows.push(["current"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // initial

tbl.rows[1].push(val) // current

}

})

// display the status bar table

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

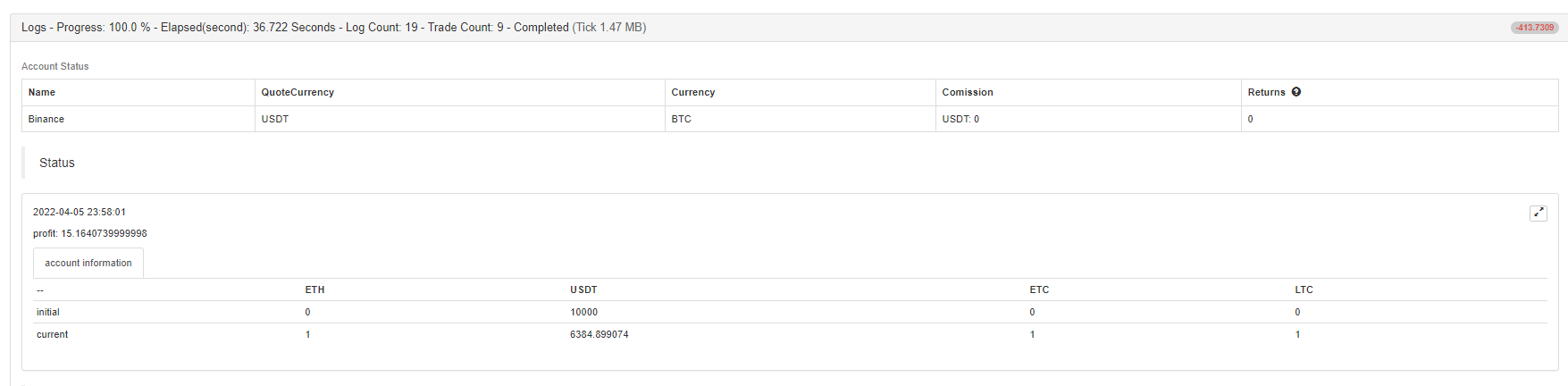

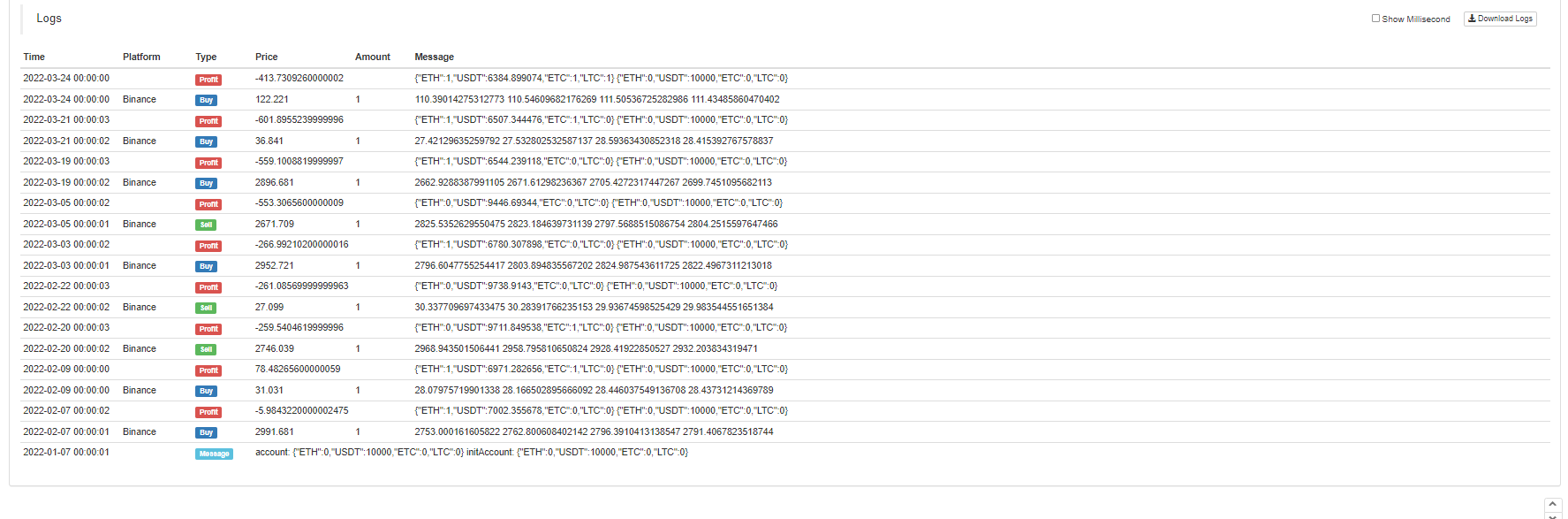

Estratégia Backtest

Você pode ver ETH, LTC e ETC todos tinham negociações de acordo com os gatilhos da cruz de ouro e cruz de morte das médias móveis.

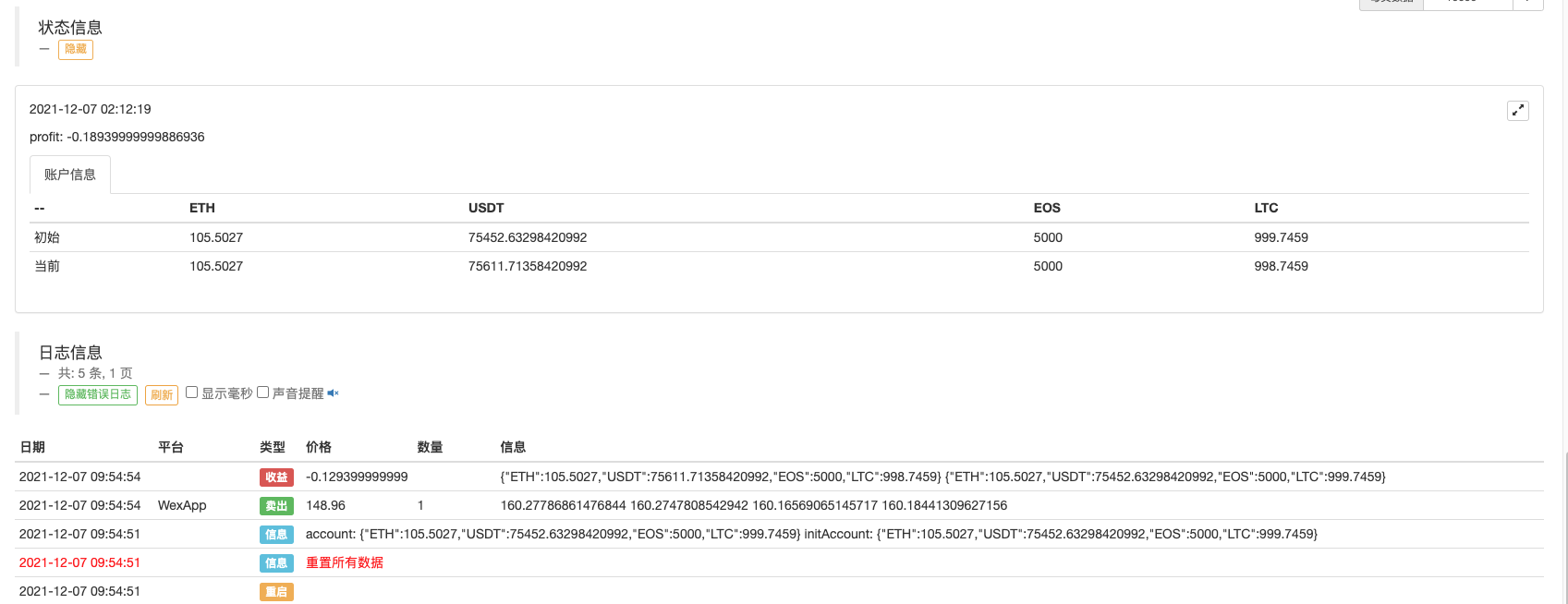

Também pode esperar por um robô simulado para testar.

Código fonte da estratégia:https://www.fmz.com/strategy/333783

A estratégia é usada apenas para backtest e aprendizado de design de estratégia, então use-a em um bot com cautela.

- Baseado no FMZ como plataforma de pagamento

- Contrato de criptomoeda Bot de supervisão de ordens simples

- Quando você quer obter o cronograma correspondente usando o getdepth

- Ignorado, resolvido

- A questão do valor facial

- DYdX Exemplo de Design de Estratégia

- Exploração inicial da aplicação do Python Crawler no FMZ

Crawling Binance Anúncio de conteúdo - Pesquisa de conceção de estratégias de cobertura e exemplo de ordens pendentes de spot e futuros

- Situação recente e funcionamento recomendado da estratégia de taxa de financiamento

- Estratégia de ponto de ruptura de média móvel dupla de futuros de criptomoedas (Teaching)

- Realização de Fisher Indicator em JavaScript & Plotting em FMZ

- Custódia

- 2021 Revisão do TAQ da criptomoeda e estratégia simples perdida de aumento de 10 vezes

- Estratégia ART multi-símbolo de futuros de criptomoedas (Instrução)

- Atualização!

- A função Getrecords não consegue obter K-string em segundos

- Projeto de sistema de gestão síncrona baseado em ordens FMZ (2)

- Os dados de volume que o Getticker devolveu não estão corretos.

- Projeto do sistema de gestão síncrona baseado em ordens FMZ (1)

- Projetar uma biblioteca de gráficos múltiplos