Estratégia de negociação da SMA Golden Cross

Autora:ChaoZhang, Data: 2024-01-26 14:29:01Tags:

Resumo

A estratégia de negociação do SMA cruzado em ouro gera sinais de compra e venda com base no cruzamento entre duas médias móveis de diferentes prazos. Especificamente, quando a média móvel mais rápida cruza acima da média móvel mais lenta de baixo, uma cruz de ouro é formada, indicando uma inversão de tendência de alta. Quando a MA mais rápida cruza abaixo da MA mais lenta de cima, uma cruz de morte é formada, indicando uma inversão de tendência de baixa.

Princípios

A estratégia baseia-se em dois princípios:

As médias móveis podem refletir a tendência e o ímpeto do mercado. A MA de curto prazo capta movimentos e reversões recentes de preços. A MA de longo prazo mostra a tendência predominante.

Quando o MA mais rápido forma uma cruz de ouro com o MA mais lento, indica que o ímpeto de curto prazo está ganhando força sobre a tendência de longo prazo, portanto, provavelmente o início de uma tendência de alta.

Especificamente, esta estratégia usa médias móveis simples de 13 e 30 períodos e negocia seus sinais de cruzamento.

A viabilidade do sinal é avaliada exigindo uma tendência de alta persistente durante algum período mínimo para confirmar a tendência de alta.

A cruz de morte entre os MAs gera um sinal curto.

A diferença de inclinação entre os MAs é usada para medir a força dos sinais de cruzamento. Somente quando a diferença excede um limite, o sinal seria considerado forte o suficiente para negociar. Isso ajuda a eliminar sinais falsos.

O stop loss é fixado em 20% e o take profit em 100%.

Vantagens

A estratégia de cruzamento da SMA tem as seguintes vantagens:

A lógica é simples e fácil de entender, adequada para iniciantes.

Utiliza a média de preços para filtrar o ruído e evitar ser enganado por flutuações de curto prazo.

Avalia a persistência da tendência em vez de seguir cegamente os sinais cruzados, garantindo uma maior confirmação com as condições globais do mercado.

Introduz o fator de momento de inclinação nos MAs para tornar os sinais mais confiáveis.

Facil backtesting e otimização com apenas alguns parâmetros-chave como períodos MA e duração da tendência.

Riscos

A estratégia apresenta igualmente os seguintes riscos:

Os sinais de cruzamento são atrasados por natureza e não podem prever perfeitamente reversões. Existe risco de atraso.

Os sistemas mecânicos tendem a desencadear negociações simultâneas, exacerbando o impulso e invalidando o stop loss / take profit.

Não tem um bom desempenho em mercados laterais agitados.

O desempenho depende muito de parâmetros devidamente calibrados, como a duração da tendência.

Orientações de otimização

A estratégia pode ser melhorada através de:

Adicionar uma avaliação da tendência de um prazo mais longo para evitar transações contrárias à tendência.

Requer confirmação de volume de negociação para eliminar sinais falsos.

Otimizar parâmetros de MA para encontrar a melhor combinação de períodos.

Incorporar indicadores populares como MACD, KD para ajudar a confirmação e precisão do sinal.

Adotar stop loss/take profit em fases para melhor controlar o risco.

Conclusão

A estratégia de cruzamento SMA é altamente intuitiva e fácil de interpretar. Combina a propriedade de filtragem de ruído das médias móveis com a capacidade de identificação de tendência simples dos sinais de cruzamento. A confirmação de sinal adicional fornece maior praticidade e estabilidade.

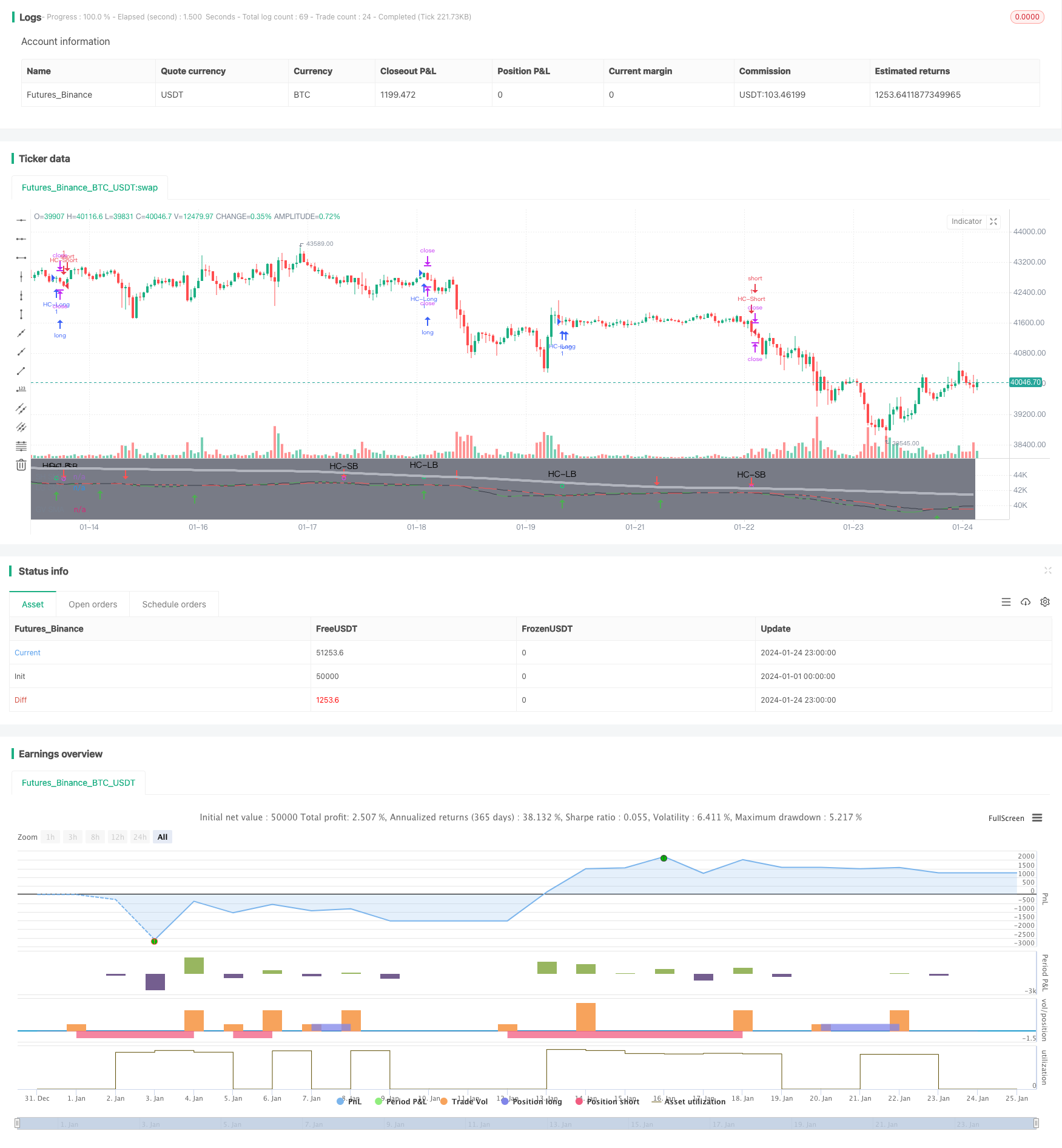

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MakeMoneyCoESTB2020

//*********************Notes for continued work***************

//************************************************************

//Hello my fellow investors

//I am creating a simple non-cluttered strategy that uses 3(+1) simple means to determine: viability, entry, and exit

//1) Has a consistent trend been maintained for several days/weeks

//2) SH SMA crossover LG SMA = Bullish entry/LG SMA crossover SH SMA = Bearish entry

//3) Use the Slope factor & Weeks in Trend (WiT) to dertermine how strong of an entry signal you are comfortable with

//4) Exit position based on next SMA cross and trend reversal or stop loss%

//3+1) For added confidence in trend detection: Apply MACD check - buy--> MACD line above signal line and corssover below histogram \\ sell --> MACD line below signal line and crossover above histogram.

//*)This code also allows you to determine your desired backtesting date compliments of alanaster

//This code is the product of many hours of hard work on the part of the greater tradingview community. The credit goes to everyone in the community who has put code out there for the greater good.

//Happy Hunting!

// 1. Define strategy settings*************************************************************************************************************************************************************************

//Title

strategy("KISS Strategy: SMA + EMA", shorttitle="KISS Strat")

//define calculations price source

price = input(title="Price Source", defval=close)

// 2. Calculate strategy values*************************************************************************************************************************************************************************

//Calculate 13/30/200SMA

SH_SMA_length= input(title="SH SMA Length", defval=13) //short SMA length

LG_SMA_length= input(title="LG SMA Length", defval=30) //long SMA length

GV_SMA_length= input(title="SH SMA Length", defval=200) //Gravitational SMA length

SH_SMA=sma(price, SH_SMA_length) //short SMA

LG_SMA=sma(price, LG_SMA_length) //long SMA

GV_SMA=sma(price, GV_SMA_length) //gravitational SMA

//calculate MACD

//define variables for speed

fast = 12, slow = 26

//define parameters to calculate MACD

fastMA = ema(price, fast)

slowMA = ema(price, slow)

//define MACD line

macd = fastMA - slowMA

//define SIGNAL line

signal = sma(macd, 9)

//Determine what type of trend we are in

dcp = security(syminfo.tickerid, 'D', close) //daily close price

wcp = security(syminfo.tickerid, 'W', close) //weekly close price

WiT = input(title="Weeks In Trend", defval=1, maxval=5, minval=1) //User input for how many weeks of price action to evaluate (Weeks in Trend = WiT)

BearTrend = false //initialize trend variables as false

BullTrend = false //initialize trend variables as false

// BullTrend := (wcp > SH_SMA) and (SH_SMA > LG_SMA) //true if price is trending up based on weekly price close

// BearTrend := (wcp < SH_SMA) and (SH_SMA < LG_SMA) //true if price is trending down based on weekly price close

// BullTrend := (price > SH_SMA) and (SH_SMA > LG_SMA) //true if price is trending up

// BearTrend := (price < SH_SMA) and (SH_SMA < LG_SMA) //true if price is trending down

//Determine if the market has been in a trend for 'n' weeks

n=WiT //create loop internal counting variable

for i=1 to WiT //create loop to determine if BearTrend=true to set number of weeks

if (wcp[n] < price) //evaluate if BearTrend=false comparing the current price to a paticular week close

BearTrend := false //set value to false if older price value is less than newer: trending up

break //break out of for loop when trend first falters

if (wcp[n] > price) //evaluate if BearTrend=true comparing the current price to a paticular week close

BearTrend := true //set value to true if older price value is greater than newer: trending down

n:=n-1 //set internal counter one day closer to present

m=WiT //create loop internal counting variable

for j=1 to WiT //create loop to determine if BearTrend=true to set number of weeks

if (wcp[m] > price) //evaluate if BullTrend=false comparing the current price to a paticular week close

BullTrend := false //set value to false if older price value is greater than newer: trending down

break //break out of for loop when trend first falters

if (wcp[m] < price) //evaluate if BullTrend=true comparing the current price to a paticular week close

BullTrend := true //set value to true if older price value is less than newer: trending up

m:=m-1 //set internal counter one day closer to present

//Determine if crossings occur

SH_LGcrossover = crossover(SH_SMA, LG_SMA) //returns true if short crosses over long

SH_LGcrossunder = crossunder(SH_SMA, LG_SMA) //returns true if short crosses under long

//Determine the slope of the SMAs when a cross over occurs

SlopeFactor= input(title="Slope Factor", defval=.01, minval=0, step = 0.001) //user input variable for what slope to evaluate against

XSlopeSH = abs(SH_SMA-SH_SMA[2]) //slope of short moving average (time cancels out)

XSlopeLG = abs(LG_SMA-LG_SMA[2]) //slope of long moving average (time cancels out)

StrongSlope = iff (abs(XSlopeSH-XSlopeLG)>SlopeFactor, true, false) //create a boolean variable to determine is slope intensity requirement is met

// ************************************ INPUT BACKTEST RANGE ******************************************=== coutesy of alanaster

fromMonth = input(defval = 4, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

bgcolor(color = showDate and window() ? color.gray : na, transp = 90)

// === EXECUTION ===

//strategy.entry("L", strategy.long, when = window() and crossOv) // enter long when "within window of time" AND crossover

//strategy.close("L", when = window() and crossUn) // exit long when "within window of time" AND crossunder

// 3. Output strategy data*************************************************************************************************************************************************************************

//Embolden line if a trend exists

trendcolorLG = BearTrend?color.red:color.black //highlights beartrend condition met graphically

trendcolorSH = BullTrend?color.green:color.black //highlights beartrend condition met graphically

//plot SMAs

plot(SH_SMA, title = "SH SMA", color = trendcolorSH)

plot(LG_SMA, title = "LG SMA", color = trendcolorLG)

plot(GV_SMA, title = "GV SMA", color = color.silver, linewidth = 4, transp = 70)

//Highlight crossovers

plotshape(series=SH_LGcrossover, style=shape.arrowup, location=location.belowbar,size=size.normal, color=color.green)

plotshape(series=SH_LGcrossunder, style=shape.arrowdown, location=location.abovebar,size=size.normal, color=color.red)

// 4. Determine Long & Short Entry Calculations*************************************************************************************************************************************************************************

//Define countback variable

countback=input(minval=0, maxval=5, title="Price CountBack", defval=0)

//User input for what evaluations to run: SMA or SMA + EMA

SMA_Y_N=input(defval = "Y", title="Run SMA", type=input.string, options=["Y", "N"])

MACD_Y_N=input(defval = "N", title="Run MACD", type=input.string, options=["Y", "N"])

//Calculate SMA Cross entry conditions

SMAbuy=false

SMAsell=false

SMAbuy := SH_LGcrossover and StrongSlope and BearTrend[WiT*7] //enter long if short SMA crosses over long SMA & security has been in a BearTrend for 'n' days back

SMAsell := SH_LGcrossunder and StrongSlope and BullTrend[WiT*7] //enter short if short SMA crosses under long SMA & security has been in a BullTrend for 'n' days back

//Calculate MACD Cross entry conditions

MACDbuy = iff(MACD_Y_N=="Y", crossunder(signal[countback], macd[countback]), true) and iff(MACD_Y_N=="Y", macd[countback]<0, true) and StrongSlope and BearTrend //enter long if fast MACD crosses over slow MACD & there is a strong slope & security has been in a BearTrend for 'n' days back

MACDsell = iff(MACD_Y_N=="Y", crossunder(macd[countback], signal[countback]), true) and iff(MACD_Y_N=="Y", signal[countback]>0, true) and StrongSlope and BullTrend //enter short if fast MACD crosses under slow MACD & there is a strong slope & security has been in a BullTrend for 'n' days back

//long entry condition

dataHCLB=(iff(SMA_Y_N=="Y", SMAbuy, true) and iff(MACD_Y_N=="Y", MACDbuy, true))

plotshape(dataHCLB, title= "HC-LB", color=color.lime, style=shape.circle, text="HC-LB")

strategy.entry("HC-Long", strategy.long, comment="HC-Long", when = dataHCLB and window())

//short entry condition

dataHCSB=(iff(SMA_Y_N=="Y", SMAsell, true) and iff(MACD_Y_N=="Y", MACDsell, true))

plotshape(dataHCSB, title= "HC-SB", color=color.fuchsia, style=shape.circle, text="HC-SB")

strategy.entry("HC-Short", strategy.short, comment="HC-Short", when=dataHCSB and window())

// 5. Submit Profit and Loss Exit Calculations Orders*************************************************************************************************************************************************************************

// User Options to Change Inputs (%)

stopPer = input(12, title='Stop Loss %', type=input.float) / 100

takePer = input(25, title='Take Profit %', type=input.float) / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

//exit position conditions and orders

if strategy.position_size > 0//or crossunder(price[countback], upperBB)

strategy.exit(id="Close Long", when = window(), stop=longStop, limit=longTake)

if strategy.position_size < 0 //or crossover(price[countback], lowerBB)

strategy.exit(id="Close Short", when = window(), stop=shortStop, limit=shortTake)

//Evaluate/debug equation***************************************************************************************************************************************************************************

// plotshape((n==5? true : na), title='n=5', style=shape.labeldown, location=location.abovebar, text='5', color=color.white, textcolor=color.black, transp=0) //print n value if 5

// plotshape((n==4? true : na), title='n=4', style=shape.labeldown, location=location.abovebar, text='4', color=color.white, textcolor=color.black, transp=0) //print n value if 4

// plotshape((n==3? true : na), title='n=3', style=shape.labeldown, location=location.abovebar, text='3', color=color.white, textcolor=color.black, transp=0) //print n value if 3

// plotshape((n==2? true : na), title='n=2', style=shape.labeldown, location=location.abovebar, text='2', color=color.white, textcolor=color.black, transp=0) //print n value if 2

// plotshape((n==1? true : na), title='n=1', style=shape.labeldown, location=location.abovebar, text='1', color=color.white, textcolor=color.black, transp=0) //print n value if 1

// lineValue = 11 //set random visible line value to check when equation is true

// colorP = (BearTrend==true) ? color.green : color.red

// plot (lineValue, title = "BearTrend", color = colorP) //Plot when condition true=green, false=red

// plot (XSlopeLG+15, color=color.white) //used for code debugging

// plot (XSlopeSH+15, color=color.blue) //used for code debugging

// plot (abs(XSlopeSH-XSlopeLG)+20, color=color.fuchsia) //used for code debugging

- Estratégia de ruptura de dupla EMA Golden Cross

- Estratégia de tendência gradual do BB KC

- Estratégia de rastreamento automático de SMA tripla

- Estratégia de negociação de posições de futuros de Bitcoin

- EMA de preços com otimização estocástica baseada em aprendizagem de máquina

- Estratégia dinâmica de ruptura de Bollinger

- Estratégia de média móvel de retracement de dois anos

- Estratégia de negociação de média móvel dupla

- Sistema de rastreamento de tendências de reequilíbrio de posição dinâmico

- Estratégia de inversão aberta diária

- Estratégia de média móvel Golden Cross

- Estratégia de negociação de criptomoedas do MACD

- Estratégia de curto prazo de regressão linear e média móvel dupla

- Estratégia de Impulso Estocástico Tripla Superposição

- Estratégia de tendência de impulso

- Estratégia de quantidade de cruzamento da média móvel de impulso

- Estratégia de combinação de reversão de média móvel dupla e ATR trailing stop

- Estratégia de negociação de futuros de martingale alavancada

- Estratégia de recuperação de impulso

- Dual Candlestick Predicção Estratégia de fechamento