Estratégias de quantificação baseadas no eixo de Kamachira e na faixa de Brin

Autora:ChaoZhang, Data: 2024-02-05 14:23:59Tags:

Resumo

A estratégia calcula primeiro os eixos de Kamachi com base nos preços mais altos, mais baixos e mais baixos do dia anterior; e, em combinação com os indicadores da faixa de Bryn, filtra os preços para gerar sinais de negociação quando o preço quebra o eixo central.

Princípios estratégicos

- Calcula o preço máximo, o preço mínimo e o preço de fechamento do dia anterior

- Calculada com base na fórmula do eixo cardinal de Kamachi, contendo o trajeto superior H4, H3, H2, H1 e o trajeto inferior L1, L2, L3, L4

- Calculação de 20 dias de embarque e desembarque da faixa de Brin

- Quando o preço está em baixo, faça mais, quando está em baixo, faça menos.

- Ponto de interrupção localizado na faixa de brin ou perto da pista

Análise de vantagens

- O eixo cardinal de Camachila contém vários pontos de resistência de suporte críticos, aumentando a confiabilidade do sinal de negociação

- Combinado com o indicador de faixa de brinquedos, pode filtrar efetivamente o falso avanço

- Combinação de múltiplos parâmetros, negociação flexível

Análise de riscos

- A configuração incorreta dos parâmetros do indicador de faixa de brinquedo pode causar erros no sinal de negociação.

- O cálculo dos bits-chave do eixo do cardão de Kamachi depende do preço do dia anterior, podendo ser afetado por saltos noturnos.

- A operação multi-cabeça também é um risco de prejuízo.

Optimização

- Otimizar os parâmetros da faixa de brinquedos para encontrar a melhor combinação de parâmetros

- Em combinação com outros indicadores, filtrar sinais de ruptura falsa

- Aumentar a estratégia de stop-loss para reduzir os prejuízos

Resumo

A estratégia usa a combinação de um eixo cardinal de Kamachi e um indicador de faixa de brinquedos para gerar sinais de negociação quando o preço atravessa o nível de resistência de suporte crítico. A estratégia pode melhorar a rentabilidade e a estabilidade da estratégia através da otimização de parâmetros e filtragem de sinais.

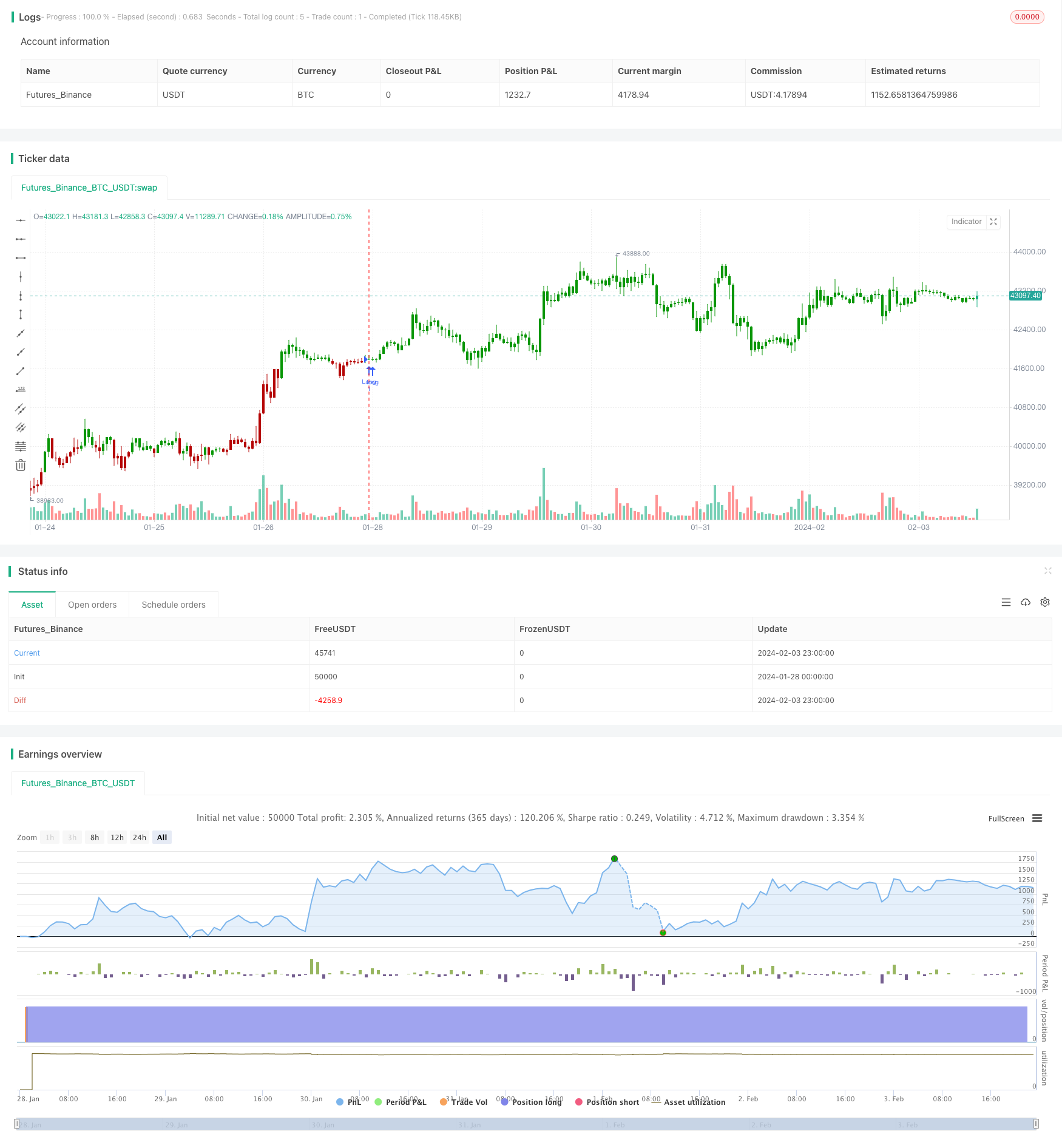

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/05/2020

// Camarilla pivot point formula is the refined form of existing classic pivot point formula.

// The Camarilla method was developed by Nick Stott who was a very successful bond trader.

// What makes it better is the use of Fibonacci numbers in calculation of levels.

//

// Camarilla equations are used to calculate intraday support and resistance levels using

// the previous days volatility spread. Camarilla equations take previous day’s high, low and

// close as input and generates 8 levels of intraday support and resistance based on pivot points.

// There are 4 levels above pivot point and 4 levels below pivot points. The most important levels

// are L3 L4 and H3 H4. H3 and L3 are the levels to go against the trend with stop loss around H4 or L4 .

// While L4 and H4 are considered as breakout levels when these levels are breached its time to

// trade with the trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points V2 Backtest", shorttitle="CPP V2", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

width = input(1, minval=1)

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

H4 = (0.55*(xHigh-xLow)) + xClose

H3 = (0.275*(xHigh-xLow)) + xClose

H2 = (0.183*(xHigh-xLow)) + xClose

H1 = (0.0916*(xHigh-xLow)) + xClose

L1 = xClose - (0.0916*(xHigh-xLow))

L2 = xClose - (0.183*(xHigh-xLow))

L3 = xClose - (0.275*(xHigh-xLow))

L4 = xClose - (0.55*(xHigh-xLow))

pos = 0

S = iff(BuyFrom == "S1", H1,

iff(BuyFrom == "S2", H2,

iff(BuyFrom == "S3", H3,

iff(BuyFrom == "S4", H4,0))))

B = iff(SellFrom == "R1", L1,

iff(SellFrom == "R2", L2,

iff(SellFrom == "R3", L3,

iff(SellFrom == "R4", L4,0))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Mais informações

- Estratégia de índice de rotação duplo

- A estratégia do caçador de fundo

- Dinâmica de seleção de estratégias de faixa de tempo

- Estratégias de rastreamento de tendências

- Estratégia de Bresser para o índice aleatório de duplo deslizamento

- Estratégias de quantificação de rastreamento de tendências baseadas nos indicadores Stoch e EMA

- A estratégia de ruptura do canal de cinco dias

- Baseado em estratégias de reversão de prejuízos

- Estratégia de quebra da EMA baseada em potência

- Estratégias de negociação quantitativas baseadas no indicador de compressão de movimento do LazyBear

- Estratégias de rastreamento de tendências baseadas na EMA

- Estratégias de rede dinâmica

- Estratégias de rastreamento de tendências de cruzamento da linha média móvel

- A estratégia de quebra da linha de equilíbrio

- A estratégia de negociação de ruptura de duas órbitas baseada no cinturão de brinquedos

- Estratégias de retrospecção do futuro da linha de preço

- Estratégias de negociação quantitativas baseadas em canais de supertrend

- Estratégias de quantificação de indicadores de fluctuação da teoria dos rendimentos

- Estratégias de quantificação de longo prazo baseadas no RSI

- Estratégias de detecção de prejuízos de dupla movimentação