Estratégia de acompanhamento das tendências quantitativas combinadas

Autora:ChaoZhang, Data: 2024-02-27 15:54:24Tags:

Resumo

A ideia central desta estratégia é combinar a estratégia de reversão 123 e o indicador do oscilador do arco-íris para alcançar o rastreamento de tendências duplas e melhorar a taxa de ganho da estratégia.

Princípios

A estratégia consiste em duas partes:

-

123 Estratégia de reversão: vá longo se o preço de fechamento cair nos dois dias anteriores e subir hoje, e a linha Slow K de 9 dias estiver abaixo de 50; vá curto se o preço de fechamento subir nos dois dias anteriores e cair hoje, e a linha Fast K de 9 dias estiver acima de 50.

-

Indicador do oscilador do arco-íris: Este indicador reflete o grau de desvio dos preços em relação às médias móveis. Quando o indicador é superior a 80, indica que o mercado tende a ser instável. Quando o indicador é inferior a 20, indica que o mercado tende a reverter.

Esta estratégia abre posições quando aparecem sinais longos e curtos, caso contrário, estabiliza as posições.

Análise das vantagens

As vantagens desta estratégia são as seguintes:

- O duplo filtro melhora a qualidade do sinal e reduz o erro de julgamento.

- O ajustamento dinâmico da posição reduz as perdas nos mercados unidirecionais.

- Integra indicadores de curto e médio prazo para melhorar a estabilidade.

Análise de riscos

Os riscos desta estratégia incluem:

- A otimização de parâmetros inadequada pode levar a um sobreajuste.

- A dupla abertura aumenta os custos comerciais.

- O ponto de stop loss é vulnerável quando o preço flutua violentamente.

Esses riscos podem ser mitigados ajustando os parâmetros, otimizando a gestão das posições e definindo o stop loss de forma razoável.

Orientações de otimização

Esta estratégia pode ser otimizada nos seguintes aspectos:

- Otimize os parâmetros para encontrar a melhor combinação de parâmetros.

- Adicionar um módulo de gestão de posições para ajustar as posições de forma dinâmica com base na volatilidade e no drawdown.

- Aumentar o módulo de stop loss e definir um stop loss em movimento razoável.

- Aumentar algoritmos de aprendizagem de máquina para ajudar a julgar pontos de inflexão.

Conclusão

Esta estratégia integra a estratégia de reversão 123 e o indicador do oscilador do arco-íris para alcançar o rastreamento de tendência dupla.

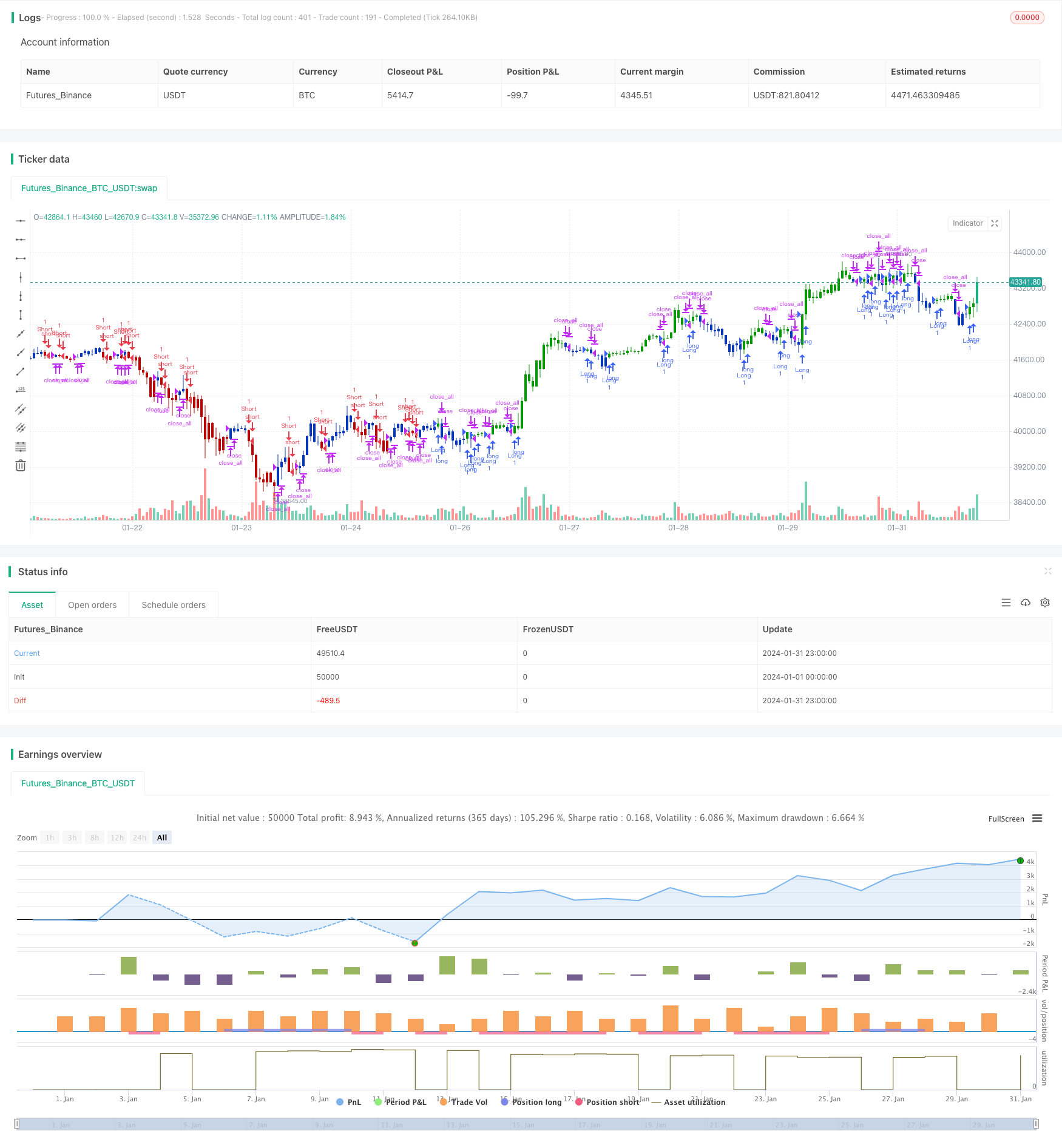

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 25/05/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Ever since the people concluded that stock market price movements are not

// random or chaotic, but follow specific trends that can be forecasted, they

// tried to develop different tools or procedures that could help them identify

// those trends. And one of those financial indicators is the Rainbow Oscillator

// Indicator. The Rainbow Oscillator Indicator is relatively new, originally

// introduced in 1997, and it is used to forecast the changes of trend direction.

// As market prices go up and down, the oscillator appears as a direction of the

// trend, but also as the safety of the market and the depth of that trend. As

// the rainbow grows in width, the current trend gives signs of continuity, and

// if the value of the oscillator goes beyond 80, the market becomes more and more

// unstable, being prone to a sudden reversal. When prices move towards the rainbow

// and the oscillator becomes more and more flat, the market tends to remain more

// stable and the bandwidth decreases. Still, if the oscillator value goes below 20,

// the market is again, prone to sudden reversals. The safest bandwidth value where

// the market is stable is between 20 and 80, in the Rainbow Oscillator indicator value.

// The depth a certain price has on a chart and into the rainbow can be used to judge

// the strength of the move.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RO(Length, LengthHHLL) =>

pos = 0.0

xMA1 = sma(close, Length)

xMA2 = sma(xMA1, Length)

xMA3 = sma(xMA2, Length)

xMA4 = sma(xMA3, Length)

xMA5 = sma(xMA4, Length)

xMA6 = sma(xMA5, Length)

xMA7 = sma(xMA6, Length)

xMA8 = sma(xMA7, Length)

xMA9 = sma(xMA8, Length)

xMA10 = sma(xMA9, Length)

xHH = highest(close, LengthHHLL)

xLL = lowest(close, LengthHHLL)

xHHMAs = max(xMA1,max(xMA2,max(xMA3,max(xMA4,max(xMA5,max(xMA6,max(xMA7,max(xMA8,max(xMA9,xMA10)))))))))

xLLMAs = min(xMA1,min(xMA2,min(xMA3,min(xMA4,min(xMA5,min(xMA6,min(xMA7,min(xMA8,min(xMA9,xMA10)))))))))

xRBO = 100 * ((close - ((xMA1+xMA2+xMA3+xMA4+xMA5+xMA6+xMA7+xMA8+xMA9+xMA10) / 10)) / (xHH - xLL))

xRB = 100 * ((xHHMAs - xLLMAs) / (xHH - xLL))

pos:= iff(xRBO > 0, 1,

iff(xRBO < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Rainbow Oscillator", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Rainbow Oscillator ----")

LengthRO = input(2, minval=1)

LengthHHLL = input(10, minval=2, title="HHV/LLV Lookback")

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRO = RO(LengthRO, LengthHHLL)

pos = iff(posReversal123 == 1 and posRO == 1 , 1,

iff(posReversal123 == -1 and posRO == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Estratégia de combinação de indicadores de oscilação quantitativa

- Tendência de Nuvem Ichimoku Seguindo Estratégia

- Estratégia de negociação de média móvel dupla intradiária

- Guia de caça ao tesouro maia

- Estratégia de acompanhamento da tendência baseada na média móvel

- EMA Cross Trend Seguindo a Estratégia

- Estratégia de cruzamento de média móvel dupla

- Estratégia de acompanhamento das bandas de Bollinger

- Estratégia de cruzamento das médias móveis rápidas e lentas

- Uma estratégia avançada de rastreamento de tendências de duplo período de tempo para um estoque quente

- Excelente Oscilador Estratégia de Negociação de Divergência Filtrada Estocástica Dupla

- Estratégia quantitativa baseada em canais de Keltner e indicador CCI

- Estratégia de avanço dinâmico do canal

- Estratégia de acompanhamento das tendências de suporte e resistência

- Estratégia de cruzamento do MACD com confirmação do RSI

- Estratégia dinâmica de paragem

- Estratégia de negociação baseada no canal Donchain

- Momentum Rectangle Channel Dual Moving Average Estratégia de negociação

- Média móvel dupla seguindo estratégia

- Estratégia de otimização de filtragem de tendências duplas