Свинговые максимумы / минимумы и шаблоны свечей

Автор:Чао Чжан, Дата: 2022-05-07 21:12:40Тэги:повышенныймедвежий

Этот сценарий обозначает высокие и низкие показатели, а также модель свечей, которая произошла в тот момент. Скрипт может обнаружить следующие 6 моделей свечей: молоток, обратный молоток, бычий поглощение, висячий человек, падающая звезда и медвежий поглощение.

Обозначения HH, HL, LH и LL, которые вы можете увидеть на этикетках, определены следующим образом:

Выше высоко HL: Высокий низкий ЛХ: Нижнее высокое LL: Ниже ниже

Настройка

Длина: чувствительность обнаружения высокого/низкого колебания, причем более низкие значения возвращают максимальный/минимальный показатель краткосрочных колебаний цен.

Использование и подробности

Это может быть интересно, чтобы увидеть, если верхний или нижний ассоциируется с определенным шаблоном свечи, это позволяет нам изучать потенциал такого шаблона, чтобы указать на обратный ход.

Следует отметить, что этикетки смещены и будут отображаться позже в режиме реального времени, поэтому этот индикатор не предназначен для обнаружения вершин / дна в режиме реального времени.

Более высокие значения длины могут возвращать ошибки.

обратная проверка

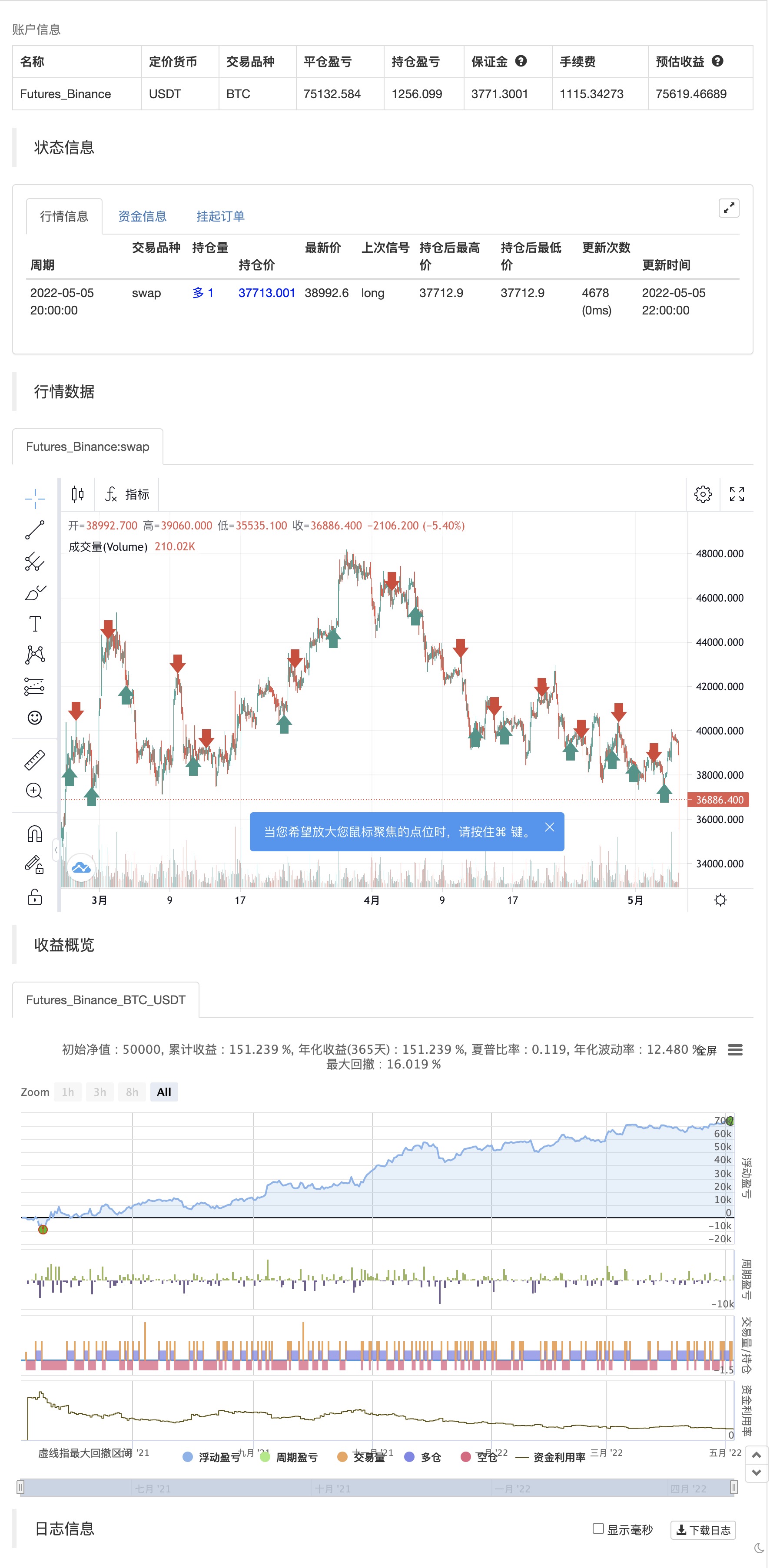

/*backtest

start: 2021-05-06 00:00:00

end: 2022-05-05 23:59:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=4

study("Swing Highs/Lows & Candle Patterns",overlay=true)

length = input(21)

//------------------------------------------------------------------------------

o = open[length],h = high[length]

l = low[length],c = close[length]

//------------------------------------------------------------------------------

ph = pivothigh(close,length,length)

pl = pivotlow(open,length,length)

valH = valuewhen(ph,c,0)

valL = valuewhen(pl,c,0)

valpH = valuewhen(ph,c,1)

valpL = valuewhen(pl,c,1)

//------------------------------------------------------------------------------

d = abs(c - o)

hammer = pl and min(o,c) - l > d and h - max(c,o) < d

ihammer = pl and h - max(c,o) > d and min(c,o) - l < d

bulleng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

hanging = ph and min(c,o) - l > d and h - max(o,c) < d

shooting = ph and h - max(o,c) > d and min(c,o) - l < d

beareng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

//------------------------------------------------------------------------------

//Descriptions

//------------------------------------------------------------------------------

hammer_ = "The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend."

+ "\n" + "\n A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up."

ihammer_ = "The inverted hammer is a similar pattern than the hammer pattern. The only difference being that the upper wick is long, while the lower wick is short."

+ "\n" + "\n It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The inverse hammer suggests that buyers will soon have control of the market."

bulleng_ = "The bullish engulfing pattern is formed of two candlesticks. The first candle is a short red body that is completely engulfed by a larger green candle"

+ "\n" + "\n Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers"

hanging_ = "The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend."

+ "\n" + "It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. The large sell-off is often seen as an indication that the bulls are losing control of the market."

shotting_ = "The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick."

+ "\n" + "Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground."

beareng_ = "A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle."

+ "\n" + "It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The lower the second candle goes, the more significant the trend is likely to be."

//------------------------------------------------------------------------------

n = bar_index

label lbl = na

H = valH > valpH ? "HH" : valH < valpH ? "LH" : na

L = valL < valpL ? "LL" : valL > valpL ? "HL" : na

txt = hammer ? "Hammer" : ihammer ? "Inverse Hammer" :

bulleng ? "Bullish Engulfing" : hanging ? "Hanging Man" :

shooting ? "Shooting Star" : beareng ? "Bearish Engulfing" : "None"

des = hammer ? hammer_ : ihammer ? ihammer_ :

bulleng ? bulleng_ : hanging ? hanging_ :

shooting ? shotting_ : beareng ? beareng_ : ""

//------------------------------------------------------------------------------

if ph

strategy.entry("Enter Long", strategy.long)

else if pl

strategy.entry("Enter Short", strategy.short)

- ZigZag PA Стратегия V4.1

- Индикатор настройки демарка

- Кто-то сломал мечту - это ваша прибыль!

- Поглощающие свечи

- Марковская цепочка вероятность преобразования состояния количественная стратегия торговли

- Прорыв поддержки-сопротивления

- Двойная временная рамка тенденции реверсии K-линии формы количественной стратегии торговли

- Стратегия EMA по перекрестному и краткосрочному сигналу

- RSI динамический диапазон и модели оптимизации волатильности

- Динамическая стратегия определения состояния рынка на основе линейного regression slope

- MAGIC MACD

- Показатель Z с помощью сигналов

- Путешествие в Пиньи

- 3EMA + Боуллингер + PIVOT

- Багеты многозерновые

- Милемашина

- Индикатор обратного движения K I

- Поглощающие свечи

- М.А. Император инсиликонот

- Точки переворота Демарка

- Наложение TMA

- Стратегия MACD + SMA 200

- Система CM Sling Shot

- Болинджер + RSI, двойная стратегия v1.1

- Стратегия полос Боллинджера

- Оптимизированный трейлер трендов

- Ежемесячные доходы в стратегиях PineScript

- ADX и DI для v4

- MacD пользовательский индикатор-многократные временные рамки + все доступные варианты!

- Индикатор: Осиллятор WaveTrend