Волновая тенденция и тенденция, основанная на VWMA в соответствии со стратегией Quant

Автор:Чао Чжан, Дата: 2024-01-26 17:35:29Тэги:

Обзор

Эта стратегия сочетает в себе осциллятор Wave Trend и индикатор VWMA для реализации тренда в соответствии с квантовой торговой стратегией. Она может идентифицировать рыночные тенденции и принимать решения о покупке или продаже на основе сигналов от осциллятора Wave Trend.

Логика стратегии

Стратегия основывается главным образом на следующих двух показателях:

-

Wave Trend Oscillator: это осциллятор, перенесенный на TradingView LazyBear, который идентифицирует

waves в колебаниях цен и генерирует сигналы покупки / продажи. Конкретный расчет состоит в следующем: сначала вычислить среднюю цену ap, затем вычислить EMA ap (называемый esa), затем вычислить EMA абсолютного значения разницы между ap и esa (называемый d), наконец, вычислить индекс последовательности ci=(ap-esa) /(0.015*d), EMA ci - это Wave Trend (wt1), а 4-периодная SMA wt1 - wt2. Когда wt1 пересекает выше wt2, это сигнал покупки, а когда wt1 пересекает ниже wt2, это сигнал продажи. -

Индикатор VWMA: это весовая скользящая средняя линия объема. В зависимости от того, находится ли цена внутри или вне полос VWMA (верхние и нижние полосы VWMA), он генерирует сигналы +1 (бычий), 0 (нейтральный) или -1 (медвежий).

Сигналы Wave Trend определяют, когда покупать и продавать, в то время как сигналы бычьего/медвежьего направления от индикатора VWMA определяют конкретный размер сделки для каждой сделки.

Преимущества

- Комбинирует сигналы от двух индикаторов для повышения точности принятия решений

- VWMA рассматривает объем потоков для оценки силы рынка

- Настраиваемые торговые сессии для предотвращения волатильности от новостей

- Размер сделки, скорректированный на основе сигналов VWMA для снижения рисков

Риски

- Потенциальные ложные сигналы от Wave Trend

- Неточные данные объема могут повлиять на VWMA

- Для расчета показателя требуется длинная история данных

- Нет остановки потери на месте

Оптимизация

- Испытать различные комбинации параметров, чтобы найти оптимальный

- Добавить стратегии стоп-лосса

- Подумайте о сочетании с другими индикаторами для фильтрации сигнала

- Проверить различные настройки для торговых сессий

- Динамическая корректировка расчета размера сделки

Заключение

Эта стратегия объединяет в себе суждение о тренде и возможности объема для продвинутого подхода к тренду.

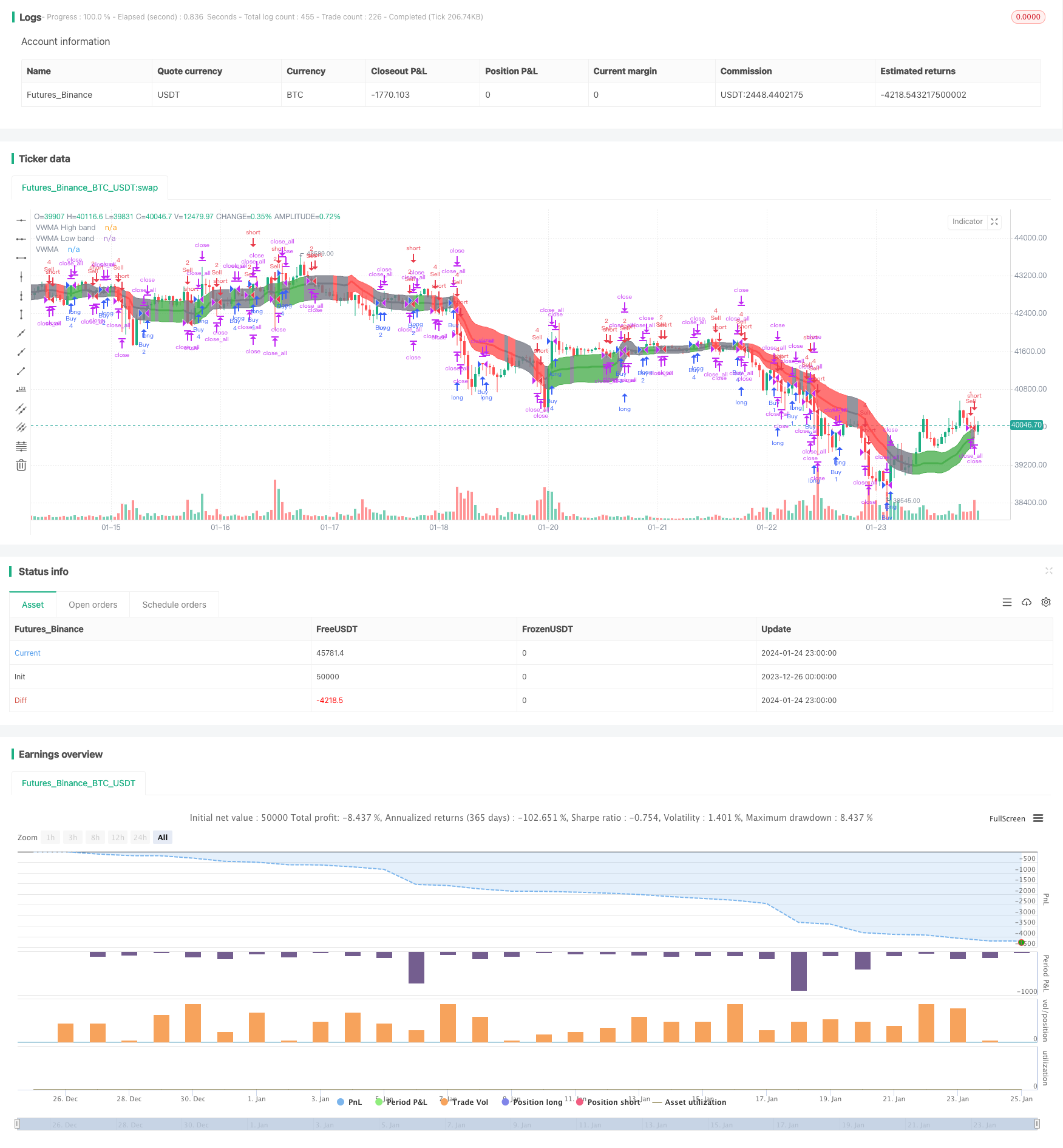

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at

// https://mozilla.org/MPL/2.0/

//

// Created by jadamcraig

//

// This strategy benefits from extracts taken from the following

// studies/authors. Thank you for developing and sharing your ideas in an open

// way!

// * Wave Trend Strategy by thomas.gigure

// * cRSI + Waves Strategy with VWMA overlay by Dr_Roboto

//

//@version=4

//==============================================================================

//==============================================================================

overlay = true // plots VWMA (need to close and re-add)

//overlay = false // plots Wave Trend (need to close and re-add)

strategy("Wave Trend w/ VWMA overlay", overlay=overlay)

baseQty = input(defval=1, title="Base Quantity", type=input.float, minval=1)

useSessions = input(defval=true, title="Limit Signals to Trading Sessions?")

sess1_startHour = input(defval=8, title="Session 1: Start Hour",

type=input.integer, minval=0, maxval=23)

sess1_startMinute = input(defval=25, title="Session 1: Start Minute",

type=input.integer, minval=0, maxval=59)

sess1_stopHour = input(defval=10, title="Session 1: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess1_stopMinute = input(defval=25, title="Session 1: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess2_startHour = input(defval=12, title="Session 2: Start Hour",

type=input.integer, minval=0, maxval=23)

sess2_startMinute = input(defval=55, title="Session 2: Start Minute",

type=input.integer, minval=0, maxval=59)

sess2_stopHour = input(defval=14, title="Session 2: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess2_stopMinute = input(defval=55, title="Session 2: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess1_closeAll = input(defval=false, title="Close All at End of Session 1")

sess2_closeAll = input(defval=true, title="Close All at End of Session 2")

//==============================================================================

//==============================================================================

// Volume Weighted Moving Average (VWMA)

//==============================================================================

//==============================================================================

plotVWMA = overlay

// check if volume is available for this equity

useVolume = input(

title="VWMA: Use Volume (uncheck if equity does not have volume)",

defval=true)

vwmaLen = input(defval=21, title="VWMA: Length", type=input.integer, minval=1,

maxval=200)

vwma = vwma(close, vwmaLen)

vwma_high = vwma(high, vwmaLen)

vwma_low = vwma(low, vwmaLen)

if not(useVolume)

vwma := wma(close, vwmaLen)

vwma_high := wma(high, vwmaLen)

vwma_low := wma(low, vwmaLen)

// +1 when above, -1 when below, 0 when inside

vwmaSignal(priceOpen, priceClose, vwmaHigh, vwmaLow) =>

sig = 0

color = color.gray

if priceClose > vwmaHigh

sig := 1

color := color.green

else if priceClose < vwmaLow

sig := -1

color := color.red

else

sig := 0

color := color.gray

[sig,color]

[vwma_sig, vwma_color] = vwmaSignal(open, close, vwma_high, vwma_low)

priceAboveVWMA = vwma_sig == 1 ? true : false

priceBelowVWMA = vwma_sig == -1 ? true : false

// plot(priceAboveVWMA?2.0:0,color=color.blue)

// plot(priceBelowVWMA?2.0:0,color=color.maroon)

//bandTrans = input(defval=70, title="VWMA Band Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

//fillTrans = input(defval=70, title="VWMA Fill Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

bandTrans = 60

fillTrans = 60

// ***** Plot VWMA *****

highband = plot(plotVWMA?fixnan(vwma_high):na, title='VWMA High band',

color = vwma_color, linewidth=1, transp=bandTrans)

lowband = plot(plotVWMA?fixnan(vwma_low):na, title='VWMA Low band',

color = vwma_color, linewidth=1, transp=bandTrans)

fill(lowband, highband, title='VWMA Band fill', color=vwma_color,

transp=fillTrans)

plot(plotVWMA?vwma:na, title='VWMA', color = vwma_color, linewidth=3,

transp=bandTrans)

//==============================================================================

//==============================================================================

// Wave Trend

//==============================================================================

//==============================================================================

plotWaveTrend = not(overlay)

n1 = input(10, "Wave Trend: Channel Length")

n2 = input(21, "Wave Trend: Average Length")

obLevel1 = input(60, "Wave Trend: Over Bought Level 1")

obLevel2 = input(53, "Wave Trend: Over Bought Level 2")

osLevel1 = input(-60, "Wave Trend: Over Sold Level 1")

osLevel2 = input(-53, "Wave Trend: Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(plotWaveTrend?0:na, color=color.gray)

plot(plotWaveTrend?obLevel1:na, color=color.red)

plot(plotWaveTrend?osLevel1:na, color=color.green)

plot(plotWaveTrend?obLevel2:na, color=color.red, style=3)

plot(plotWaveTrend?osLevel2:na, color=color.green, style=3)

plot(plotWaveTrend?wt1:na, color=color.green)

plot(plotWaveTrend?wt2:na, color=color.red, style=3)

plot(plotWaveTrend?wt1-wt2:na, color=color.blue, transp=80)

//==============================================================================

//==============================================================================

// Order Management

//==============================================================================

//==============================================================================

// Define Long and Short Conditions

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

// Define Quantities

orderQty = baseQty * 2

if (longCondition)

if (vwma_sig == 1)

if ( strategy.position_size >= (baseQty * 4 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 4 + abs(strategy.position_size)

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size >= (baseQty * 2 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 2 + abs(strategy.position_size)

else

orderQty := baseQty * 2

else if (vwma_sig == -1)

if ( strategy.position_size >= (baseQty * 1 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 1 + abs(strategy.position_size)

else

orderQty := baseQty * 1

else if (shortCondition)

if (vwma_sig == -1)

if ( strategy.position_size <= (baseQty * 4) and

strategy.position_size > 0 )

orderQty := baseQty * 4 + strategy.position_size

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size <= (baseQty * 2) and

strategy.position_size > 2 )

orderQty := baseQty * 2 + strategy.position_size

else

orderQty := baseQty * 2

else if (vwma_sig == 1)

if ( strategy.position_size <= (baseQty * 1) and

strategy.position_size > 0 )

orderQty := baseQty * 1 + strategy.position_size

else

orderQty := baseQty * 1

// Determine if new trades are permitted

newTrades = false

if (useSessions)

if ( hour == sess1_startHour and minute >= sess1_startMinute )

newTrades := true

else if ( hour > sess1_startHour and hour < sess1_stopHour )

newTrades := true

else if ( hour == sess1_stopHour and minute < sess1_stopMinute )

newTrades := true

else if ( hour == sess2_startHour and minute >= sess2_startMinute )

newTrades := true

else if ( hour > sess2_startHour and hour < sess2_stopHour )

newTrades := true

else if ( hour == sess2_stopHour and minute < sess2_stopMinute )

newTrades := true

else

newTrades := false

else

newTrades := true

// Long Signals

if ( longCondition )

strategy.order("Buy", strategy.long, orderQty)

// Short Signals

if ( shortCondition )

strategy.order("Sell", strategy.short, orderQty)

// Close open position at end of Session 1, if enabled

if (sess1_closeAll )

strategy.close_all()

// Close open position at end of Session 2, if enabled

if (sess2_closeAll )

strategy.close_all()

- Стратегия стоп-лосса и прибыли, основанная на РСИ

- Стратегия прорыва перемещающегося среднего канала

- Стратегия тестирования с фиксированным временным отрывом

- Время и пространство Оптимизированная многовременная стратегия MACD

- Количественная стратегия торговли, основанная на РСИ акций и МФИ

- Многопоказательная комплексная стратегия торговли

- Краткосрочная стратегия торговли через ЕМА

- Тенденция после стратегии, основанной на динамическом стоп-лосе двойного кроссовера EMA

- Стратегия выхода на бычий рынок

- Стратегия относительной динамики

- Стратегия комбинации двойной скользящей средней и средней Уильямса

- Стратегия перекрестного использования скользящей средней

- Многопоказательная количественная стратегия торговли

- Ключевая стратегия обратного теста

- Три стратегии EMA по стохастическому RSI Crossover Golden Cross

- Стратегия обратного тестирования свечей

- Стратегия каналов высокой и низкой цены V.1