Стратегия оптимизации фильтрации двойных тенденций

Автор:Чао Чжан, Дата: 2024-02-27 14:46:32Тэги:

Обзор

Эта стратегия использует средний двойной фильтр и многоуровневые механизмы подтверждения направления тренда для разработки относительно стабильной системы отслеживания.

-

Оптимизированная система отслеживания тренда, основанная на улучшенных двойных пиковых осцилляторах для определения основного направления тренда.

-

Система фильтрации суб-тенденции, основанная на комбинации скользящих средних нескольких циклов для дальнейшей фильтрации некоторого шума.

-

Индекс Alpha обеспечивает окончательное подтверждение для обеспечения надежности торговых сигналов.

С помощью описанной выше тройной защиты стратегия может более точно оценивать основные тенденции и очень эффективно фильтровать краткосрочный рыночный шум.

Принцип

Отслеживание основных тенденций

Он использует усовершенствованный двойной пиковый осциллятор TOTT и двойной трендовый фильтр Close Series для расчета основного направления тренда.

Фильтрация субтенденции

В дополнение к системе основной оценки тренда, стратегия также устанавливает систему фильтрации субтенденций, основанную на комбинациях EMA нескольких циклов.

Альфа подтверждение

При входе и выходе из позиций стратегия также проверяет значение индекса Альфа для обеспечения надежности окончательных торговых сигналов.

Преимущества

- Дизайн защиты на нескольких уровнях для более точного определения основных тенденций

- Мощная способность фильтрации шума

- Стабильные и надежные торговые сигналы

- Большое пространство оптимизации параметров

Риски

- Сигнальная частота может быть низкой

- Система отслеживания использует скользящие средние, которые могут быть разбиты в резких изменениях рынка

Для смягчения рисков параметры могут быть скорректированы с целью оптимизации чувствительности трекера, или дополнительные индикаторы обратного действия могут быть добавлены в качестве финальных фильтров.

Руководство по оптимизации

- Настройка параметров двойного пикового осциллятора для поиска лучших комбинаций параметров

- Попробуйте оптимизацию параметров различных типов скользящих средних

- Оптимизировать циклы скользящих средних в комбинации EMA

- Улучшить механизм фильтрации Альфа

- Добавить механизм остановки потери

Заключение

Общая конструкция этой стратегии надежна, с надлежащими мерами и множеством защитных средств. Мощная фильтрация шума дает ей стабильную производительность. Есть возможность дальнейшего улучшения посредством непрерывной оптимизации параметров и улучшения механизма.

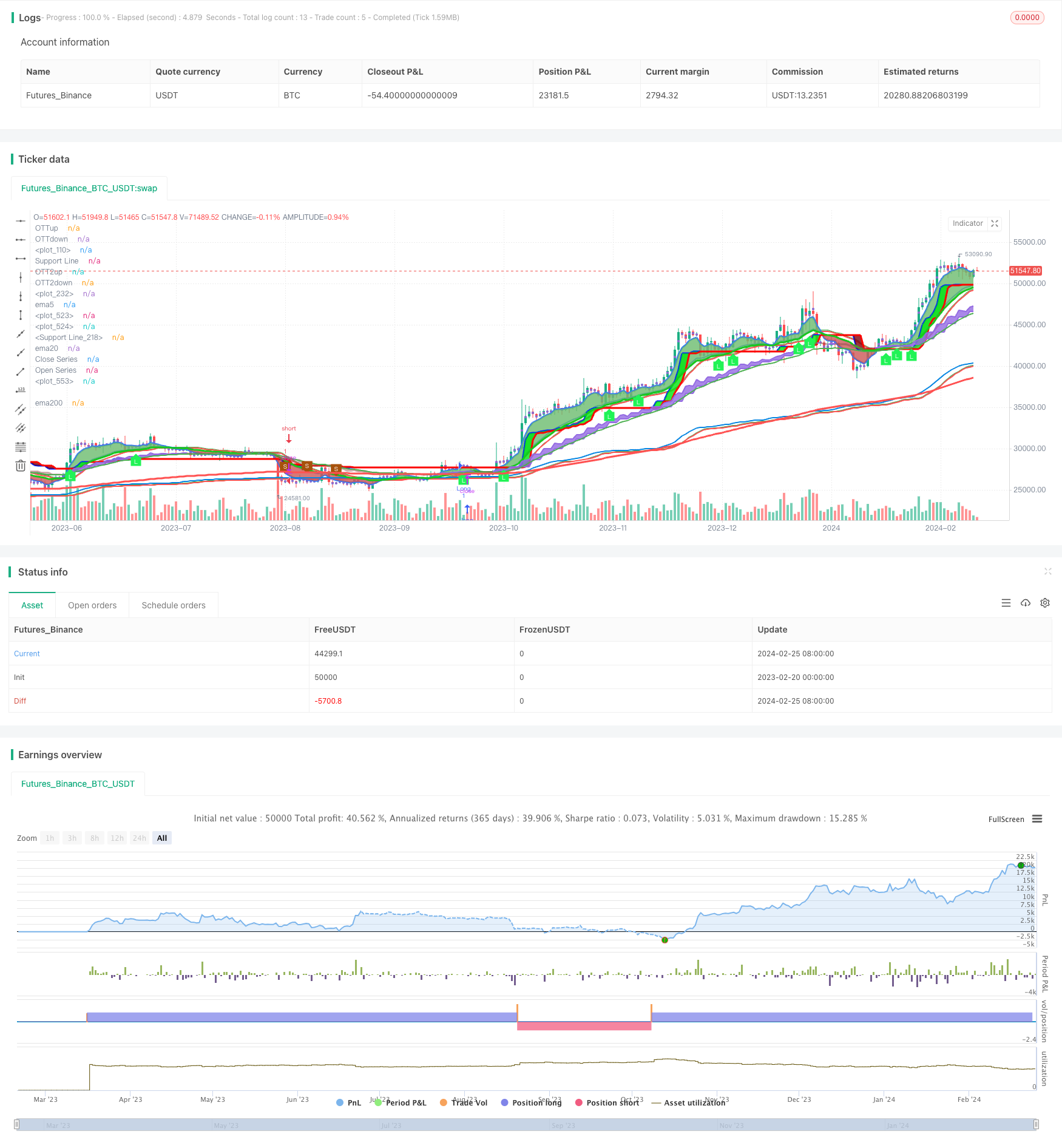

/*backtest

start: 2023-02-20 00:00:00

end: 2024-02-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

strategy('TOTT-OCC R5.1 wixca-buy-sell', 'TOTT', overlay=true)

src = input(close, title='Source')

length = input.int(18, 'OTT Period', minval=1)

percent = input.float(1, 'Optimization Constant', step=0.1, minval=0)

coeff1 = input.float(0.001, 'Twin OTT Coefficient', step=0.001, minval=0)

showsupport = input(title='Show Support Line?', defval=true)

showsignalsk1 = input(title='Show Signals?', defval=true)

mav = input.string(title='Moving Average Type', defval='EMA', options=['SMA', 'EMA', 'WMA', 'TMA', 'VAR', 'WWMA', 'ZLEMA', 'TSF'])

highlighting = input(title='Highlighter On/Off ?', defval=true)

Var_Func(src, length) =>

valpha = 2 / (length + 1)

vud1 = src > src[1] ? src - src[1] : 0

vdd1 = src < src[1] ? src[1] - src : 0

vUD = math.sum(vud1, 9)

vDD = math.sum(vdd1, 9)

vCMO = nz((vUD - vDD) / (vUD + vDD))

VAR = 0.0

VAR := nz(valpha * math.abs(vCMO) * src) + (1 - valpha * math.abs(vCMO)) * nz(VAR[1])

VAR

VAR = Var_Func(src, length)

Wwma_Func(src, length) =>

wwalpha = 1 / length

WWMA = 0.0

WWMA := wwalpha * src + (1 - wwalpha) * nz(WWMA[1])

WWMA

WWMA = Wwma_Func(src, length)

Zlema_Func(src, length) =>

zxLag = length / 2 == math.round(length / 2) ? length / 2 : (length - 1) / 2

zxEMAData = src + src - src[zxLag]

ZLEMA = ta.ema(zxEMAData, length)

ZLEMA

ZLEMA = Zlema_Func(src, length)

Tsf_Func(src, length) =>

lrc = ta.linreg(src, length, 0)

lrc1 = ta.linreg(src, length, 1)

lrs = lrc - lrc1

TSF = ta.linreg(src, length, 0) + lrs

TSF

TSF = Tsf_Func(src, length)

getMA(src, length) =>

ma = 0.0

if mav == 'SMA'

ma := ta.sma(src, length)

ma

if mav == 'EMA'

ma := ta.ema(src, length)

ma

if mav == 'WMA'

ma := ta.wma(src, length)

ma

if mav == 'TMA'

ma := ta.sma(ta.sma(src, math.ceil(length / 2)), math.floor(length / 2) + 1)

ma

if mav == 'VAR'

ma := VAR

ma

if mav == 'WWMA'

ma := WWMA

ma

if mav == 'ZLEMA'

ma := ZLEMA

ma

if mav == 'TSF'

ma := TSF

ma

ma

MAvg = getMA(src, length)

fark = MAvg * percent * 0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir == 1 ? longStop : shortStop

OTT = MAvg > MT ? MT * (200 + percent) / 200 : MT * (200 - percent) / 200

OTTup = OTT * (1 + coeff1)

OTTdn = OTT * (1 - coeff1)

PPLOT = plot(showsupport ? MAvg : na, color=color.new(#0585E1, 0), linewidth=2, title='Support Line')

pALLup = plot(nz(OTTup[2]), color=color.new(color.green, 0), linewidth=2, title='OTTup')

pALLdn = plot(nz(OTTdn[2]), color=color.new(color.red, 0), linewidth=2, title='OTTdown')

buySignalk1 = ta.crossover(MAvg, OTTup[2])

sellSignalk1 = ta.crossunder(MAvg, OTTdn[2])

K11 = ta.barssince(buySignalk1)

K22 = ta.barssince(sellSignalk1)

O11 = ta.barssince(buySignalk1[1])

O22 = ta.barssince(sellSignalk1[1])

//plotshape(buySignalk1 and showsignalsk1 and O11 > K22 ? math.min(low, OTTdn) : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

//plotshape(sellSignalk1 and showsignalsk1 and O22 > K11 ? math.max(high, OTTup) : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none)

//longFillColor = highlighting ? O22 > K11 ? color.green : na : na

//shortFillColor = highlighting ? O11 > K22 ? color.red : na : na

//fill(mPlot, PPLOT, title='UpTrend Highligter', color=longFillColor, transp=90)

//fill(mPlot, PPLOT, title='DownTrend Highligter', color=shortFillColor, transp=90)

fill(pALLup, pALLdn, title='Flat Zone Highligter', color=color.new(#e0e2e9, 12))

//plotshape(ta.crossover (AlphaTrend,OTTup), style=shape.labelup, location=location.belowbar, color=color.new(color.blue, 0), size=size.tiny, title='AT>OTT', text='AL1', textcolor=color.white)

//plotshape(ta.crossunder(AlphaTrend,OTTdn), style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, title='OTT<AT', text='SAT1', textcolor=color.white)

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//© vixca

//@version=5

//indicator('L&S', overlay=true) //pyramiding=1, initial_capital=1000,default_qty_type = strategy.cash, calc_on_order_fills=false,default_qty_value = 1000, commission_type=strategy.commission.percent, commission_value=0.2,calc_on_every_tick=true)

//strategy('Twin Optimized Trend Tracker', 'TOTT', overlay=true)

src2 = input(close, title='Source')

length2 = input.int(69, 'OTT Period', minval=1)

percent2 = input.float(1, 'Optimization Constant', step=0.1, minval=0)

coeff2 = input.float(0.001, 'Twin OTT Coefficient', step=0.001, minval=0)

showsupport2 = input(title='Show Support Line?', defval=true)

showsignalsk2 = input(title='Show Signals?', defval=true)

mav2 = input.string(title='Moving Average Type', defval='VAR2', options=['SMA', 'EMA', 'WMA', 'TMA', 'VAR2', 'WWMA', 'ZLEMA2', 'TSF2'])

highlighting2 = input(title='Highlighter On/Off ?', defval=true)

Var_Func2(src2, length2) =>

valpha = 2 / (length2 + 1)

vud1 = src2 > src2[1] ? src2 - src2[1] : 0

vdd1 = src2 < src2[1] ? src2[1] - src2 : 0

vUD = math.sum(vud1, 9)

vDD = math.sum(vdd1, 9)

vCMO = nz((vUD - vDD) / (vUD + vDD))

VAR2 = 0.0

VAR2 := nz(valpha * math.abs(vCMO) * src2) + (1 - valpha * math.abs(vCMO)) * nz(VAR2[1])

VAR2

VAR2 = Var_Func2(src2, length2)

Wwma_Func2(src2, length) =>

wwalpha = 1 / length2

WWMA2 = 0.0

WWMA2 := wwalpha * src2 + (1 - wwalpha) * nz(WWMA2[1])

WWMA2

WWMA2 = Wwma_Func2(src2, length2)

Zlema_Func2(src2, length) =>

zxLag = length2 / 2 == math.round(length2 / 2) ? length2 / 2 : (length2 - 1) / 2

zxEMAData = src2 + src2 - src2[zxLag]

ZLEMA2 = ta.ema(zxEMAData, length2)

ZLEMA2

ZLEMA2 = Zlema_Func2(src2, length2)

Tsf_Func2(src2, length2) =>

lrc = ta.linreg(src2, length2, 0)

lrc1 = ta.linreg(src2, length2, 1)

lrs = lrc - lrc1

TSF2 = ta.linreg(src2, length2, 0) + lrs

TSF2

TSF2 = Tsf_Func2(src2, length2)

getMA2(src2, length2) =>

ma = 0.0

if mav2 == 'SMA'

ma := ta.sma(src2, length2)

ma

if mav2 == 'EMA'

ma := ta.ema(src2, length2)

ma

if mav2 == 'WMA'

ma := ta.wma(src2, length2)

ma

if mav2 == 'TMA'

ma := ta.sma(ta.sma(src2, math.ceil(length2 / 2)), math.floor(length2 / 2) + 1)

ma

if mav2 == 'VAR2'

ma := VAR2

ma

if mav2 == 'WWMA2'

ma := WWMA2

ma

if mav2 == 'ZLEMA2'

ma := ZLEMA2

ma

if mav2 == 'TSF2'

ma := TSF2

ma

ma

mav2g = getMA2(src2, length2)

fark2 = mav2g * percent2 * 0.01

longStop2 = mav2g - fark2

longStop2Prev = nz(longStop2[1], longStop2)

longStop2 := mav2g > longStop2Prev ? math.max(longStop2, longStop2Prev) : longStop2

shortStop2 = mav2g + fark2

shortStop2Prev = nz(shortStop2[1], shortStop2)

shortStop2 := mav2g < shortStop2Prev ? math.min(shortStop2, shortStop2Prev) : shortStop2

dir2 = 1

dir2 := nz(dir2[1], dir2)

dir2 := dir2 == -1 and mav2g > shortStop2Prev ? 1 : dir2 == 1 and mav2g < longStop2Prev ? -1 : dir2

MT2 = dir2 == 1 ? longStop2 : shortStop2

OTT2 = mav2g > MT2 ? MT2 * (200 + percent2) / 200 : MT * (200 - percent) / 200

OTT2up = OTT2 * (1 + coeff2)

OTT2dn = OTT2 * (1 - coeff2)

PPLOT2 = plot(showsupport2 ? mav2g : na, color=color.new(#0585E1, 0), linewidth=2, title='Support Line')

pALLup2 = plot(nz(OTT2up[2]), color=color.new(color.green, 0), linewidth=2, title='OTT2up')

pALLdn2 = plot(nz(OTT2dn[2]), color=color.new(color.red, 0), linewidth=2, title='OTT2down')

buySignalk2 = ta.crossover(mav2g, OTT2up[2])

sellSignalk2 = ta.crossunder(mav2g, OTT2dn[2])

K111 = ta.barssince(buySignalk2)

K222 = ta.barssince(sellSignalk2)

O111 = ta.barssince(buySignalk2[1])

O222 = ta.barssince(sellSignalk2[1])

//plotshape(buySignalk2 and showsignalsk2 and O111 > K222 ? math.min(low, OTT2dn) : na, title='Buy2', text='Buy2', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

//plotshape(sellSignalk2 and showsignalsk2 and O222 > K111 ? math.max(high, OTT2up) : na, title='Sell2', text='Sell2', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot2 = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none)

longFillColor2 = highlighting2 ? O222 > K111 ? color.green : na : na

shortFillColor2 = highlighting2 ? O111 > K222 ? color.red : na : na

//fill(mPlot2, PPLOT2, title='UpTrend Highligter', color=longFillColor2, transp=90)

//fill(mPlot2, PPLOT2, title='DownTrend Highligter', color=shortFillColor2, transp=90)

fill(pALLup2, pALLdn2, title='Flat Zone Highligter', color=color.new(#9d7fce, 33))

//ema kesişimi yapmak için ekledim

//wma34 = ta.wma(close, 34)

//ema1 = ta.ema(close, 900)

src4 = input(title='Source', defval=close)

//length3 = input(34, 'wma')

//lenght4 = input(1000, "ema")

//plot(ta.wma(src4, length3), color=color.new(#dbbce0, 0), linewidth=3, title='wma34')

//plot(ta.ema(src4, lenght4), color=color.new(#080c05, 0), linewidth=3, title='ema1')

//plotshape(ta.crossover (close[3],ta.ema(close, 900))and (close > ta.ema(close,900)), style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Longtrend', text='LT', textcolor=color.white)

//plotshape(ta.crossunder (close[3],ta.ema(close, 900)) and (close < ta.ema(close,900)), style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Shorttrend', text='ST', textcolor=color.white)

//long_signal = ta.crossover (close,OTT2up) and (close [3] > OTT2up) // and ta.crossover (AlphaTrend,OTTup) //and ta.crossover(ta.ema(close, 5), ta.ema(close, 21))

//short_signal = ta.crossunder (close,OTTdn) and (close[3] < OTTdn) // and ta.crossunder (AlphaTrend,OTTdn) //and ta.crossunder(ta.ema(close,5), ta.ema(close, 21))

//long_signal1 = ta.crossover(mav2g,OTT2up[2])

//short_signal1 = ta.crossunder(mav2g, OTT2dn[2])

//plotshape(long_signal, style=shape.labelup, location=location.belowbar, color=color.new(color.blue, 0), size=size.tiny, title='wixcaAL', text='wixAL', textcolor=color.white)

//plotshape(short_signal, style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, title='wixcaSAT', text='wixSAT', textcolor=color.white)

//strategy.entry('Long', strategy.long, when=long_signal)

//strategy.entry('Short', strategy.short, when=short_signal)

//plotshape(buySignalk1 and showsignalsk1 and O11 > K22 ? math.min(low, OTTdn) : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

//@version=5

//indicator("EMA5 Strategy with Sequential Labels", overlay=true)

// EMA hesaplama

//emaLength = 21

//ema21 = ta.ema(close, emaLength)

// Mum kapanışı EMA5'in altında ise short aç

//shortCondition = close < ema21

// Mum kapanışı EMA5'in üstündeyse long aç

//longCondition = close > ema21

// Sinyal sayacı

//var int signalCount = 0

// Ticaret sinyallerini plot et ve ardışık numaralandırma

//plotshape(series=shortCondition, title="Short Signal", color=color.red, style=shape.triangledown, location=location.abovebar) //text = string(signalCount + 1))

//plotshape(series=longCondition, title="Long Signal", color=color.green, style=shape.triangleup, location=location.belowbar)//, text = str.tostring(signalCount + 2))

// Sinyal sayacını güncelle

//if (shortCondition or longCondition)

// signalCount := signalCount + 2

//

//@version=5

//

//strategy(title='Open Close Cross Strategy R5.1 revised by JustUncleL', shorttitle='OCC Strategy R5.1', overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=10, calc_on_every_tick=false)

//

// Revision: 5

// Original Author: @JayRogers

// Revision Author: JustUncleL revisions 3, 4, 5

//

// *** USE AT YOUR OWN RISK ***

// - There are drawing/painting issues in pinescript when working across resolutions/timeframes that I simply

// cannot fix here.. I will not be putting any further effort into developing this until such a time when

// workarounds become available.

// NOTE: Re-painting has been observed infrequently with default settings and seems OK up to Alternate

// multiplier of 5.

// Non-repainting mode is available by setting "Delay Open/Close MA" to 1 or more, but the reported

// performance will drop dramatically.

//

// R5.1 Changes by JustUncleL

// - Upgraded to Version 3 Pinescript.

// - Added option to select Trade type (Long, Short, Both or None)

// - Added bar colouring work around patch.

// - Small code changes to improve efficiency.

// - NOTE: To enable non-Repainting mode set "Delay Open/Close MA" to 1 or more.

// 9-Aug-2017

// - Correction on SuperSmooth MA calculation.

//

// R5 Changes by JustUncleL

// - Corrected cross over calculations, sometimes gave false signals.

// - Corrected Alternate Time calculation to allow for Daily,Weekly and Monthly charts.

// - Open Public release.

// R4 Changes By JustUncleL

// - Change the way the Alternate resolution in selected, use a Multiplier of the base Time Frame instead,

// this makes it easy to switch between base time frames.

// - Added TMA and SSMA moving average options. But DEMA is still giving the best results.

// - Using "calc_on_every_tick=false" ensures results between backtesting and real time are similar.

// - Added Option to Disable the coloring of the bars.

// - Updated default settings.

//

// R3 Changes by JustUncleL:

// - Returned a simplified version of the open/close channel, it shows strength of current trend.

// - Added Target Profit Option.

// - Added option to reduce the number of historical bars, overcomes the too many trades limit error.

// - Simplified the strategy code.

// - Removed Trailing Stop option, not required and in my opion does not work well in Trading View,

// it also gives false and unrealistic performance results in backtesting.

//

// R2 Changes:

// - Simplified and cleaned up plotting, now just shows a Moving Average derived from the average of open/close.

// - Tried very hard to alleviate painting issues caused by referencing alternate resolution..

//

// Description:

// - Strategy based around Open-Close Crossovers.

// Setup:

// - I have generally found that setting the strategy resolution to 3-4x that of the chart you are viewing

// tends to yield the best results, regardless of which MA option you may choose (if any) BUT can cause

// a lot of false positives - be aware of this

// - Don't aim for perfection. Just aim to get a reasonably snug fit with the O-C band, with good runs of

// green and red.

// - Option to either use basic open and close series data, or pick your poison with a wide array of MA types.

// - Optional trailing stop for damage mitigation if desired (can be toggled on/off)

// - Positions get taken automagically following a crossover - which is why it's better to set the resolution

// of the script greater than that of your chart, so that the trades get taken sooner rather than later.

// - If you make use of the stops, be sure to take your time tweaking the values. Cutting it too fine

// will cost you profits but keep you safer, while letting them loose could lead to more drawdown than you

// can handle.

// - To enable non-Repainting mode set "Delay Open/Close MA" to 1 or more.

//

// === INPUTS ===

useRes = input(defval=true, title='Use Alternate Resolution?')

intRes = input(defval=3, title='Multiplier for Alernate Resolution')

stratRes = timeframe.ismonthly ? str.tostring(timeframe.multiplier * intRes, '###M') : timeframe.isweekly ? str.tostring(timeframe.multiplier * intRes, '###W') : timeframe.isdaily ? str.tostring(timeframe.multiplier * intRes, '###D') : timeframe.isintraday ? str.tostring(timeframe.multiplier * intRes, '####') : '60'

basisType = input.string(defval='SMMA', title='MA Type: ', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'VWMA', 'SMMA', 'HullMA', 'LSMA', 'ALMA', 'SSMA', 'TMA'])

basisLen = input.int(defval=8, title='MA Period', minval=1)

offsetSigma = input.int(defval=6, title='Offset for LSMA / Sigma for ALMA', minval=0)

offsetALMA = input.float(defval=0.85, title='Offset for ALMA', minval=0, step=0.01)

scolor = input(false, title='Show coloured Bars to indicate Trend?')

delayOffset = input.int(defval=0, title='Delay Open/Close MA (Forces Non-Repainting)', minval=0, step=1)

tradeType = input.string('BOTH', title='What trades should be taken : ', options=['LONG', 'SHORT', 'BOTH', 'NONE'])

// === /INPUTS ===

// Constants colours that include fully non-transparent option.

green100 = #008000FF

lime100 = #00FF00FF

red100 = #FF0000FF

blue100 = #0000FFFF

aqua100 = #00FFFFFF

darkred100 = #8B0000FF

gray100 = #808080FF

// === BASE FUNCTIONS ===

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len, offSig, offALMA) =>

v1 = ta.sma(src, len) // Simple

v2 = ta.ema(src, len) // Exponential

v3 = 2 * v2 - ta.ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ta.ema(v2, len)) + ta.ema(ta.ema(v2, len), len) // Triple Exponential

v5 = ta.wma(src, len) // Weighted

v6 = ta.vwma(src, len) // Volume Weighted

v7 = 0.0

sma_1 = ta.sma(src, len) // Smoothed

v7 := na(v7[1]) ? sma_1 : (v7[1] * (len - 1) + src) / len

v8 = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len))) // Hull

v9 = ta.linreg(src, len, offSig) // Least Squares

v10 = ta.alma(src, len, offALMA, offSig) // Arnaud Legoux

v11 = ta.sma(v1, len) // Triangular (extreme smooth)

// SuperSmoother filter

// © 2013 John F. Ehlers

a1 = math.exp(-1.414 * 3.14159 / len)

b1 = 2 * a1 * math.cos(1.414 * 3.14159 / len)

c2 = b1

c3 = -a1 * a1

c1 = 1 - c2 - c3

v12 = 0.0

v12 := c1 * (src + nz(src[1])) / 2 + c2 * nz(v12[1]) + c3 * nz(v12[2])

type == 'EMA' ? v2 : type == 'DEMA' ? v3 : type == 'TEMA' ? v4 : type == 'WMA' ? v5 : type == 'VWMA' ? v6 : type == 'SMMA' ? v7 : type == 'HullMA' ? v8 : type == 'LSMA' ? v9 : type == 'ALMA' ? v10 : type == 'TMA' ? v11 : type == 'SSMA' ? v12 : v1

// security wrapper for repeat calls

reso(exp, use, res) =>

security_1 = request.security(syminfo.tickerid, res, exp, gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on)

use ? security_1 : exp

// === /BASE FUNCTIONS ===

// === SERIES SETUP ===

closeSeries = variant(basisType, close[delayOffset], basisLen, offsetSigma, offsetALMA)

openSeries = variant(basisType, open[delayOffset], basisLen, offsetSigma, offsetALMA)

// === /SERIES ===

// === PLOTTING ===

// Get Alternate resolution Series if selected.

closeSeriesAlt = reso(closeSeries, useRes, stratRes)

openSeriesAlt = reso(openSeries, useRes, stratRes)

//

trendColour = closeSeriesAlt > openSeriesAlt ? color.rgb(148, 106, 226) : color.rgb(146, 80, 80, 62)

bcolour = closeSeries > openSeriesAlt ? lime100 : red100

barcolor(scolor ? bcolour : na, title='Bar Colours')

closeP = plot(closeSeriesAlt, title='Close Series', color=trendColour, linewidth=2, style=plot.style_line, transp=20)

openP = plot(openSeriesAlt, title='Open Series', color=trendColour, linewidth=2, style=plot.style_line, transp=20)

fill(closeP, openP, color=trendColour, transp=80)

// === /PLOTTING ===

// === ALERT conditions

xlong = ta.crossover(closeSeriesAlt, openSeriesAlt)

xshort = ta.crossunder(closeSeriesAlt, openSeriesAlt)

longCond = xlong // alternative: longCond[1]? false : (xlong or xlong[1]) and close>closeSeriesAlt and close>=open

shortCond = xshort // alternative: shortCond[1]? false : (xshort or xshort[1]) and close<closeSeriesAlt and close<=open

// === /ALERT conditions.

// === STRATEGY ===

// stop loss

slPoints = input.int(defval=0, title='Initial Stop Loss Points (zero to disable)', minval=0)

tpPoints = input.int(defval=0, title='Initial Target Profit Points (zero for disable)', minval=0)

// Include bar limiting algorithm

ebar = input.int(defval=10000, title='Number of Bars for Back Testing', minval=0)

dummy = input(false, title='- SET to ZERO for Daily or Longer Timeframes')

//

// Calculate how many mars since last bar

tdays = (timenow - time) / 60000.0 // number of minutes since last bar

tdays := timeframe.ismonthly ? tdays / 1440.0 / 5.0 / 4.3 / timeframe.multiplier : timeframe.isweekly ? tdays / 1440.0 / 5.0 / timeframe.multiplier : timeframe.isdaily ? tdays / 1440.0 / timeframe.multiplier : tdays / timeframe.multiplier // number of bars since last bar

//

//set up exit parameters

TP = tpPoints > 0 ? tpPoints : na

SL = slPoints > 0 ? slPoints : na

// Make sure we are within the bar range, Set up entries and exit conditions

//if (ebar == 0 or tdays <= ebar) and tradeType != 'NONE'

// strategy.entry('long', strategy.long, when=longCond == true and tradeType != 'SHORT')

// strategy.entry('short', strategy.short, when=shortCond == true and tradeType != 'LONG')

// strategy.close('long', when=shortCond == true and tradeType == 'LONG')

// strategy.close('short', when=longCond == true and tradeType == 'SHORT')

// strategy.exit('XL', from_entry='long', profit=TP, loss=SL)

// strategy.exit('XS', from_entry='short', profit=TP, loss=SL)

// === /STRATEGY ===

// eof

line1=ta.ema (close, 5)

line2=ta.ema(close, 20)

line3=ta.ema(close, 13)

trendColour1= line1 >= line2 ? color.rgb(108, 187, 110) : color.rgb(204, 87, 87)

p1 = plot(line1, title="ema5", color=#3179f5, linewidth=3)

p2 = plot(line2, title="ema20", color=#18c71d, linewidth=3)

fill(p1, p2, title = "5-20 Background", color = trendColour1, transp=80)

//length6 = input(50, 'sma1')

//plot(ta.sma(src4, length6), color=color.new(color.lime, 0), linewidth=3, title='sma50')

//length7 = input(200, 'sma2')

//plot(ta.sma(src4, length7), color=color.new(color.olive, 0), linewidth=3, title='sma200')

//length8 = input(900, 'ema3')

//plot(ta.ema(src4, length8), color=color.new(color.teal, 0), linewidth=3, title='ema900')

//longCondition =long

//if longCondition

// strategy.entry("Long", strategy.long)

//shortCondition = short

//if shortCondition

// strategy.entry("Short", strategy.short)

//if (ebar == 0 or tdays <= ebar) and tradeType != 'NONE'

// strategy.entry('long', strategy.long, when=longCond == true and tradeType != 'SHORT')

// strategy.entry('short', strategy.short, when=shortCond == true and tradeType != 'LONG')

//strategy.close('long', when=shortCond == true and tradeType == 'LONG')

//strategy.close('short', when=longCond == true and tradeType == 'SHORT')

//strategy.exit('XL', from_entry='long', profit=TP, loss=SL)

//strategy.exit('XS', from_entry='short', profit=TP, loss=SL)

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// author © KivancOzbilgic

// developer © KivancOzbilgic

//@version=5

//indicator('AlphaTrend', shorttitle='AT', overlay=true, format=format.price, precision=2, timeframe='')

coeff = input.float(1, 'Multiplier', step=0.1)

AP = input(14, 'Common Period')

ATR = ta.sma(ta.tr, AP)

src5 = input(close)

showsignalsk = input(title='Show Signals?', defval=true)

novolumedata = input(title='Change calculation (no volume data)?', defval=false)

upT = low - ATR * coeff

downT = high + ATR * coeff

AlphaTrend = 0.0

AlphaTrend := (novolumedata ? ta.rsi(src5, AP) >= 50 : ta.mfi(hlc3, AP) >= 50) ? upT < nz(AlphaTrend[1]) ? nz(AlphaTrend[1]) : upT : downT > nz(AlphaTrend[1]) ? nz(AlphaTrend[1]) : downT

color1 = AlphaTrend > AlphaTrend[2] ? #00E60F : AlphaTrend < AlphaTrend[2] ? #80000B : AlphaTrend[1] > AlphaTrend[3] ? #00E60F : #80000B

k1 = plot(AlphaTrend, color=color.new(#0022FC, 0), linewidth=3)

k2 = plot(AlphaTrend[2], color=color.new(#FC0400, 0), linewidth=3)

fill(k1, k2, color=color1)

buySignalk = ta.crossover(AlphaTrend, AlphaTrend[2])

sellSignalk = ta.crossunder(AlphaTrend, AlphaTrend[2])

K1 = ta.barssince(buySignalk)

K2 = ta.barssince(sellSignalk)

O1 = ta.barssince(buySignalk[1])

O2 = ta.barssince(sellSignalk[1])

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vixca

//@version=5

//indicator('EMA Strategy', overlay=true)

// EMA values

ema5 = ta.ema(close, 5)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema200 = ta.ema(close, 200)

ema900 = ta.ema(close, 900)

// Plot EMA lines

//plot(ema5, color=color.new(color.blue, 0), linewidth=2)

//plot(ema20, color=color.new(color.orange, 0), linewidth=2)

plot(ema50, color=color.new(color.green, 0), linewidth=2)

plot(ema200, title="ema200", color=color.new(color.red, 0), linewidth=3)

plot(ema900, title="ema900", color=color.new(color.purple, 0), linewidth=4)

// Long condition

//longCondition = ema5 > ema20 and ema50 > ema200 and close > ema900

// Short condition

//shortCondition = ema5 < ema20 and ema50 < ema200 and close < ema900

// Plot signals

//plotshape(longCondition, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.large)

//plotshape(shortCondition, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.large)

//plotshape(long, style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Longtrend', text='Lt', textcolor=color.white)

//plotshape(short, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Shorttrend', text='St', textcolor=color.white)

// Güçlü al ve güçlü sat koşulları

//strongBuy = longCondition and long

//strongSell = shortCondition and short

// Güçlü al ve güçlü sat sinyalleri 3 mum sonrada doğru mu?

//strongBuy = longCondition and long and close[3] > close[0]

//strongSell = shortCondition and short and close[3] < close[0]

// Güçlü al ve güçlü sat sinyallerini çiz

//plotshape(strongBuy, style=shape.circle, location=location.belowbar, color=color.new(color.blue, 0), size=size.large, title='Strong Buy', text='B', textcolor=color.white)

//plotshape(strongSell, style=shape.xcross, location=location.abovebar, color=color.new(color.black, 0), size=size.large, title='Strong Sell', text='S', textcolor=color.white)

//plotshape(strongBuy, style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Strong Buy', text='B', textcolor=color.white)

//plotshape(strongSell, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Strong Sell', text='S', textcolor=color.white)

long = ema5 > ema20 and close > OTT2up and close[1] > OTT2up[1] and close > OTTup and close[1] > OTTup[1] and close > AlphaTrend and close[1] > AlphaTrend[1] and low > OTTup and low[1] > OTTup[1] and close > openSeriesAlt and close[1] > openSeriesAlt[1]// and and low[1] > OTT2up and low[2] > ema50[2] and low[2] > OTT2up//and AlphaTrend > OTT2up and close > ema50

short = ema5 < ema20 and close < OTT2dn and close[1] < OTT2dn[1] and close < OTTdn and close[1] < OTTdn[1] and close < AlphaTrend and close[1] < AlphaTrend[1] and high < OTTdn and high[1] < OTTdn[1] and close < closeSeriesAlt and close[1] < closeSeriesAlt[1]//] and high [1] < OTT2dn and high [2] < ema50[2] and high [2] < OTT2dn//and AlphaTrend < OTTdn and close < ema50

//close > ema50 and close[1] > ema50[1] and close[2] > ema50[2]

// longShortCond şartını çiz

//plotshape(long, style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Long Condition', text='L', textcolor=color.white)

//plotshape(short, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Short Condition', text='S', textcolor=color.white)

// Pozisyon açma ve kapatma sinyallerini belirleyin

buy = long and not long[1]

sell = short and not short[1]

close_long = short and not short[1]

close_short = long and not long[1]

// Sinyalleri grafiğe işaretleyin

plotshape(buy,style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Long Condition', text='L', textcolor=color.white)

plotshape(sell, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Short Condition', text='S', textcolor=color.white)

//plotshape(close_long, style=shape.xcross, location=location.abovebar, color=color.green, text="Close Long")

//plotshape(close_short, style=shape.xcross, location=location.belowbar, color=color.red, text="Close Short")

// Sinyalleri stratejiye uygulayın

strategy.entry("Long", strategy.long, when=buy)

strategy.entry("Short", strategy.short, when=sell)

strategy.close("Long", when=close_long)

strategy.close("Short", when=close_short)

- Стратегия комбинированного количественного отслеживания тенденций

- Удивительный Осиллятор Двойной Стохастический Фильтрованная Дивергенция Торговая Стратегия

- Количественная стратегия, основанная на каналах Келтнера и индикаторе CCI

- Динамическая стратегия прорыва канала

- Стратегия отслеживания трендов поддержки и сопротивления

- Стратегия перекрестка MACD с подтверждением RSI

- Динамическая стратегия остановки

- Торговая стратегия на базе каналов Donchain

- Импульс прямоугольный канал двойной движущейся средней торговой стратегии

- Двойная скользящая средняя после стратегии

- Динамическая стратегия торговли прибылью

- Стратегия обратной торговли на основе динамической скользящей средней

- Стратегия серфера на основе индекса импульса стохастики

- Стратегия смены импульса на основе нескольких временных рамок

- Продай стратегию митингов

- Криптовалютная стратегия Bollinger Bands с несколькими временными рамками

- Краткосрочная стратегия торговли на основе индикатора импульса

- Динамическая остановка длинного следования только тренду после стратегии с фильтром сезонности

- Стратегия перекрестного использования двойной скользящей средней

- Стратегия движения по Дончианскому каналу