Многопоказательная адаптивная стратегия торговли на основе RSI, MACD и объема

Автор:Чао Чжан, Дата: 2024-12-13 10:19:34Тэги:РСИMACDVOLББЕМАSMAVWMAWMAСММА

Обзор

Эта стратегия представляет собой комплексную торговую систему, которая сочетает в себе индекс относительной силы (RSI), дивергенцию конвергенции скользящей средней (MACD), полосы Боллинджера (BB) и анализ объема.

Принцип стратегии

Основная логика стратегии основана на следующих аспектах: 1. Использует РСИ ((14) для оценки условий перекупленности/перепроданности на рынке, причем РСИ ниже 30 считается перепроданным 2. Использует MACD ((12,26,9) для определения направления тренда, с MACD золотой крест как длинный сигнал 3. подтверждает достоверность ценового тренда путем расчета разницы между увеличением и уменьшением объема (Delta Volume) 4. Включает полосы Боллинджера для оценки волатильности цен для оптимизации времени входа 5. Система генерирует лучшие сигналы покупки, когда RSI перепродан, MACD показывает золотой крест, и Delta Volume положительный Автоматически закрывает позиции, когда MACD показывает кросс смерти или RSI превышает 60 для контроля риска

Преимущества стратегии

- Многоиндикаторная перекрестная проверка повышает надежность торговых сигналов

- Анализ объема подтверждает достоверность ценовой тенденции

- Включает адаптивный выбор типа скользящей средней, повышающий гибкость стратегии

- Содержит всеобъемлющие механизмы управления рисками, включая установку стоп-лосса и выигрыша.

- Параметры стратегии могут быть оптимизированы для различных рыночных условий

Стратегические риски

- Сочетание нескольких показателей может привести к задержке сигнала

- На различных рынках могут возникать ложные сигналы

- Оптимизация параметров может привести к перенастройке

- Высокочастотная торговля может повлечь за собой значительные затраты на транзакции

- Волатильность рынка может привести к значительным снижениям

Направления оптимизации стратегии

- Внедрение адаптивных параметровых механизмов для динамической корректировки параметров показателей на основе рыночных условий

- Добавление фильтров силы тренда для уменьшения ложных сигналов на рыночных диапазонах

- Оптимизация механизмов стоп-лосса и получения прибыли для повышения эффективности капитала

- Включить фильтры волатильности для корректировки позиций в условиях высокой волатильности

- Разработка интеллектуальных систем управления фондами для динамического контроля позиций

Резюме

Это композитная торговая стратегия, интегрирующая несколько технических индикаторов, захватывающая рыночные возможности посредством многомерного анализа, включая RSI, MACD и объем. Стратегия демонстрирует сильную адаптивность и масштабируемость, а также комплексные механизмы контроля рисков. Благодаря постоянной оптимизации и улучшению эта стратегия имеет потенциал для поддержания стабильной производительности в различных рыночных условиях.

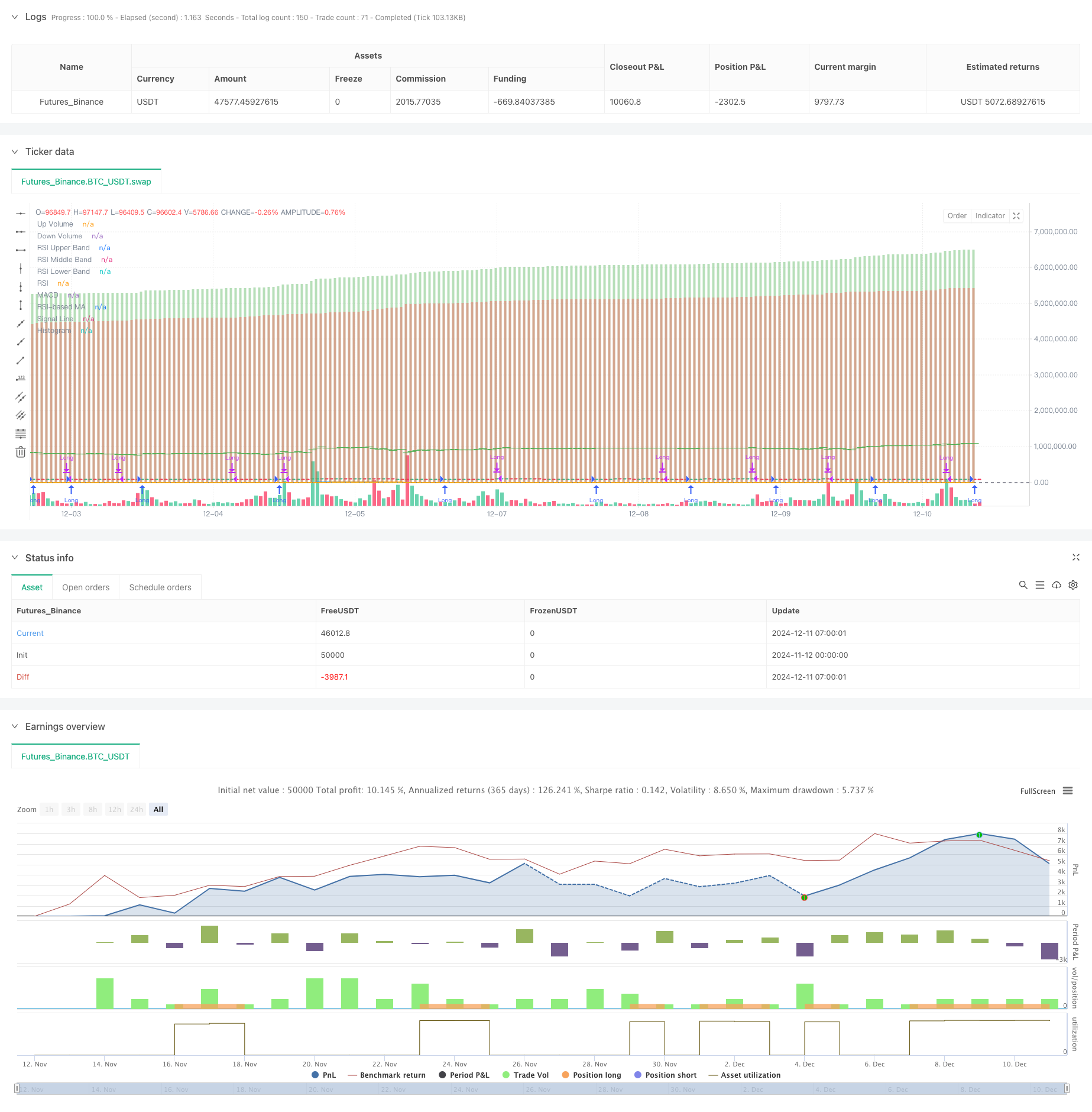

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Liraz sh Strategy - RSI MACD Strategy with Bullish Engulfing and Net Volume", overlay=true, currency=currency.NONE, initial_capital=100000, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Input parameters

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "RSI Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

fastLength = input.int(12, minval=1, title="MACD Fast Length")

slowLength = input.int(26, minval=1, title="MACD Slow Length")

signalLength = input.int(9, minval=1, title="MACD Signal Length")

startDate = input(timestamp("2018-01-01"), title="Start Date")

endDate = input(timestamp("2069-12-31"), title="End Date")

// Custom Up and Down Volume Calculation

var float upVolume = 0.0

var float downVolume = 0.0

if close > open

upVolume += volume

else if close < open

downVolume += volume

delta = upVolume - downVolume

plot(upVolume, "Up Volume", style=plot.style_columns, color=color.new(color.green, 60))

plot(downVolume, "Down Volume", style=plot.style_columns, color=color.new(color.red, 60))

plotchar(delta, "Delta", "—", location.absolute, color=delta > 0 ? color.green : color.red)

// MA function

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// RSI calculation

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

// MACD calculation

fastMA = ta.ema(close, fastLength)

slowMA = ta.ema(close, slowLength)

macd = fastMA - slowMA

signalLine = ta.sma(macd, signalLength)

hist = macd - signalLine

// Bullish Engulfing Pattern Detection

bullishEngulfingSignal = open[1] > close[1] and close > open and close >= open[1] and close[1] >= open and (close - open) > (open[1] - close[1])

barcolor(bullishEngulfingSignal ? color.yellow : na)

// Plotting RSI and MACD

plot(rsi, "RSI", color=#7E57C2)

plot(rsiMA, "RSI-based MA", color=color.yellow)

hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

hline(30, "RSI Lower Band", color=#787B86)

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title="Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title="Lower Bollinger Band", color=color.green)

plot(macd, title="MACD", color=color.blue)

plot(signalLine, title="Signal Line", color=color.orange)

plot(hist, title="Histogram", style=plot.style_histogram, color=color.gray)

// Best time to buy condition

bestBuyCondition = rsi < 30 and ta.crossover(macd, signalLine) and delta > 0

// Plotting the best buy signal line

var line bestBuyLine = na

if (bestBuyCondition )

bestBuyLine := line.new(bar_index[1], close[1], bar_index[0], close[0], color=color.white)

// Strategy logic

longCondition = (ta.crossover(macd, signalLine) or bullishEngulfingSignal) and rsi < 70 and delta > 0

if (longCondition )

strategy.entry("Long", strategy.long)

// Reflexive exit condition: Exit if MACD crosses below its signal line or if RSI rises above 60

exitCondition = ta.crossunder(macd, signalLine) or (rsi > 60 and strategy.position_size > 0)

if (exitCondition )

strategy.close("Long")

- Многоиндикаторная синергетическая стратегия торговли с использованием полос Боллинджера, Фибоначчи, MACD и RSI

- Продвинутая количественная стратегия торговли, объединяющая дивергенцию и скользящие средние показатели

- Динамический RSI Смарт-тайминговый Swing Trading Strategy

- Боллингерские полосы и стратегия перекрестного использования скользящей средней

- Болинджерские полосы импульс прорыв адаптивная тенденция после стратегии

- Комбинированная естественная стратегия торговли MACD и RSI

- Многоуровневая интеллектуальная динамическая стратегия остановки отслеживания на основе полос Боллинджера и ATR

- Многопоказательная комплексная стратегия торговли: идеальное сочетание импульса, перекупленности/перепродажи и волатильности

- Супертенд Кродла

- SSS

- Двойная стохастическая тенденция EMA после стратегии торговли

- Динамическая тенденция после многопериодного скользящего среднего кроссовера

- Подтверждение двойного импульса прорыва Количественная стратегия торговли

- Крос-стратегия трендового импульса MACD-RSI с моделью управления рисками

- Многопериодический перекресток EMA с динамикой RSI и амортизацией ATR на основе волатильности

- Стратегия двойного перекрестного использования EMA с интеллектуальным контролем риска и вознаграждения

- Многоподвижная средняя тенденция в соответствии со стратегией - Долгосрочная инвестиционная сигнальная система на основе показателей EMA и SMA

- Исторический высокий прорыв с ежемесячным скользящим средним фильтром

- Стратегия торговли в условиях многоравновесного ценового тренда и перемены

- Индекс динамической волатильности (VIDYA) со стратегией обратного отклонения от тренда ATR

- Стратегия автоматизированной торговли на основе двойного дна и верхнего уровня

- Динамическая тенденция ATR после стратегии, основанной на выходе из поддержки

- Многочисленные скользящие средние и стохастические осцилляторы

- Стратегия адаптивного отслеживания тенденций и обнаружения обратного движения: количественная торговая система, основанная на индикаторах ZigZag и Aroon

- Многоиндикаторная синергетическая стратегия торговли с использованием полос Боллинджера, Фибоначчи, MACD и RSI

- Средняя реверсия Боллингер-Банда Средняя стоимость в долларах Инвестиционная стратегия

- Многомерная система анализа стратегии аномалии золотой пятницы

- Стратегия динамического отслеживания тенденций ATR на несколько временных рамок

- Пересечение скользящей средней с стратегией отслеживания тренда и импульса RSI

- Динамическая стратегия сдерживания торговли на основе ATR