概述

本策略通过结合不同时间框架下的量化指标,实现对比特币价格波段的识别,从而进行追踪交易。策略采用5分钟时间框架,长期持有波段获利。

策略原理

- 基于日线时间框架计算的RSI指标,采用成交量进行加权计算,过滤假突破。

- 对日线RSI指标进行EMA平滑处理,构建量化波段指标。

- 5分钟时间框架采用线性回归指标和HMA指标构建交易信号。

- 策略通过量化波段指标和交易信号的组合,实现不同时间框架之间的耦合,识别价格中长线波段。

优势分析

- 采用成交量加权的RSI指标,能有效识别真实波段,过滤假突破。

- HMA指标对价格变化更加敏感,能及时捕捉转折。

- 多时间框架结合,识别中长线波段更准确。

- 5分钟时间框架进行交易,更高操作频率。

- 波段追踪策略,无需精确选点,持有时间更长。

风险分析

- 量化指标可能发出错误信号,建议结合基本面分析。

- 波段可能中途反转,应设置止损退出机制。

- 交易信号延迟,可能错过最佳入场点位。

- 盈利波段需要较长持有期,需承担一定资金压力。

优化方向

- 测试不同参数的RSI指标效果。

- 尝试引入其他辅助波段指标。

- 优化HMA指标的长度参数。

- 添加止损和止盈策略。

- 调整波段交易的持有周期。

总结

本策略通过多时间框架耦合和波段追踪方式,实现了对比特币中长线趋势的有效捕捉。相较于短线交易,中长线波段交易回撤较小,获利空间更大。下一步,通过参数调整和风险管理策略的添加,可望进一步提高策略收益率和稳定性。

策略源码

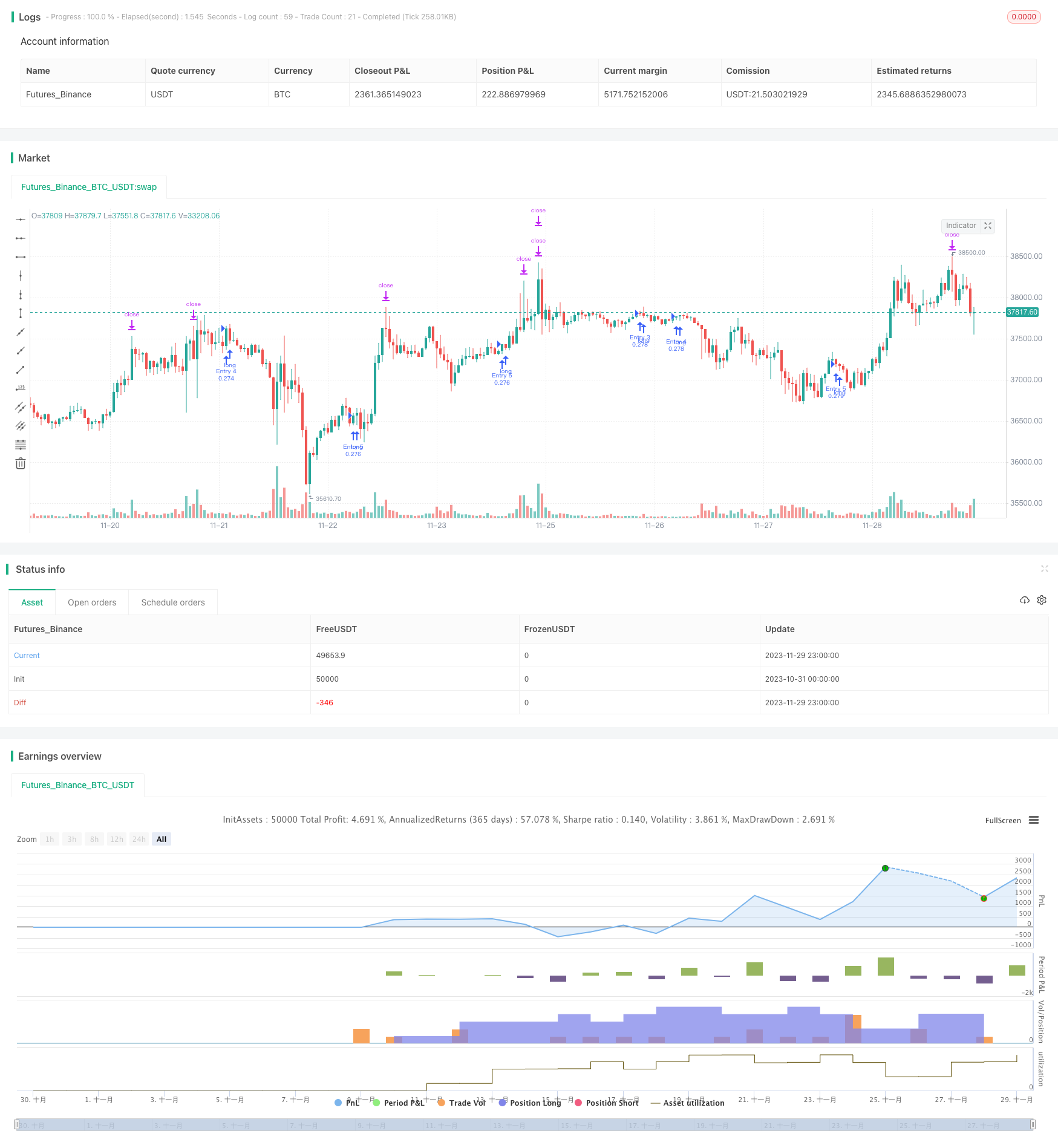

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title='Pyramiding BTC 5 min', overlay=true, pyramiding=5, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=20, commission_type=strategy.commission.percent, commission_value=0.075)

//the pyramide based on this script https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

//

fastLength = input(250, title="Fast filter length ", minval=1)

slowLength = input(500,title="Slow filter length", minval=1)

source=close

v1=ema(source,fastLength)

v2=ema(source,slowLength)

//

//Backtest dates

fromMonth = input(defval=1, title="From Month")

fromDay = input(defval=10, title="From Day")

fromYear = input(defval=2020, title="From Year")

thruMonth = input(defval=1, title="Thru Month")

thruDay = input(defval=1, title="Thru Day")

thruYear = input(defval=2112, title="Thru Year")

showDate = input(defval=true, title="Show Date Range")

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

leng=1

p1=close[1]

len55 = 10

//taken from https://www.tradingview.com/script/Ql1FjjfX-security-free-MTF-example-JD/

HTF = input("1D", type=input.resolution)

ti = change( time(HTF) ) != 0

T_c = fixnan( ti ? close : na )

vrsi = rsi(cum(change(T_c) * volume), leng)

pp=wma(vrsi,len55)

d=(vrsi[1]-pp[1])

len100 = 10

x=ema(d,len100)

//

zx=x/-1

col=zx > 0? color.lime : color.orange

//

tf10 = input("1", title = "Timeframe", type = input.resolution, options = ["1", "5", "15", "30", "60","120", "240","360","720", "D", "W"])

length = input(50, title = "Period", type = input.integer)

shift = input(1, title = "Shift", type = input.integer)

hma(_src, _length)=>

wma((2 * wma(_src, _length / 2)) - wma(_src, _length), round(sqrt(_length)))

hma3(_src, _length)=>

p = length/2

wma(wma(close,p/3)*3 - wma(close,p/2) - wma(close,p),p)

b =security(syminfo.tickerid, tf10, hma3(close[1], length)[shift])

//plot(a,color=color.gray)

//plot(b,color=color.yellow)

close_price = close[0]

len = input(25)

linear_reg = linreg(close_price, len, 0)

filter=input(true)

buy=crossover(linear_reg, b)

longsignal = (v1 > v2 or filter == false ) and buy and window()

//set take profit

ProfitTarget_Percent = input(3)

Profit_Ticks = close * (ProfitTarget_Percent / 100) / syminfo.mintick

//set take profit

LossTarget_Percent = input(10)

Loss_Ticks = close * (LossTarget_Percent / 100) / syminfo.mintick

//Order Placing

strategy.entry("Entry 1", strategy.long, when=strategy.opentrades == 0 and longsignal)

strategy.entry("Entry 2", strategy.long, when=strategy.opentrades == 1 and longsignal)

strategy.entry("Entry 3", strategy.long, when=strategy.opentrades == 2 and longsignal)

strategy.entry("Entry 4", strategy.long, when=strategy.opentrades == 3 and longsignal)

strategy.entry("Entry 5", strategy.long, when=strategy.opentrades == 4 and longsignal)

if strategy.position_size > 0

strategy.exit(id="Exit 1", from_entry="Entry 1", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 2", from_entry="Entry 2", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 3", from_entry="Entry 3", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 4", from_entry="Entry 4", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 5", from_entry="Entry 5", profit=Profit_Ticks, loss=Loss_Ticks)