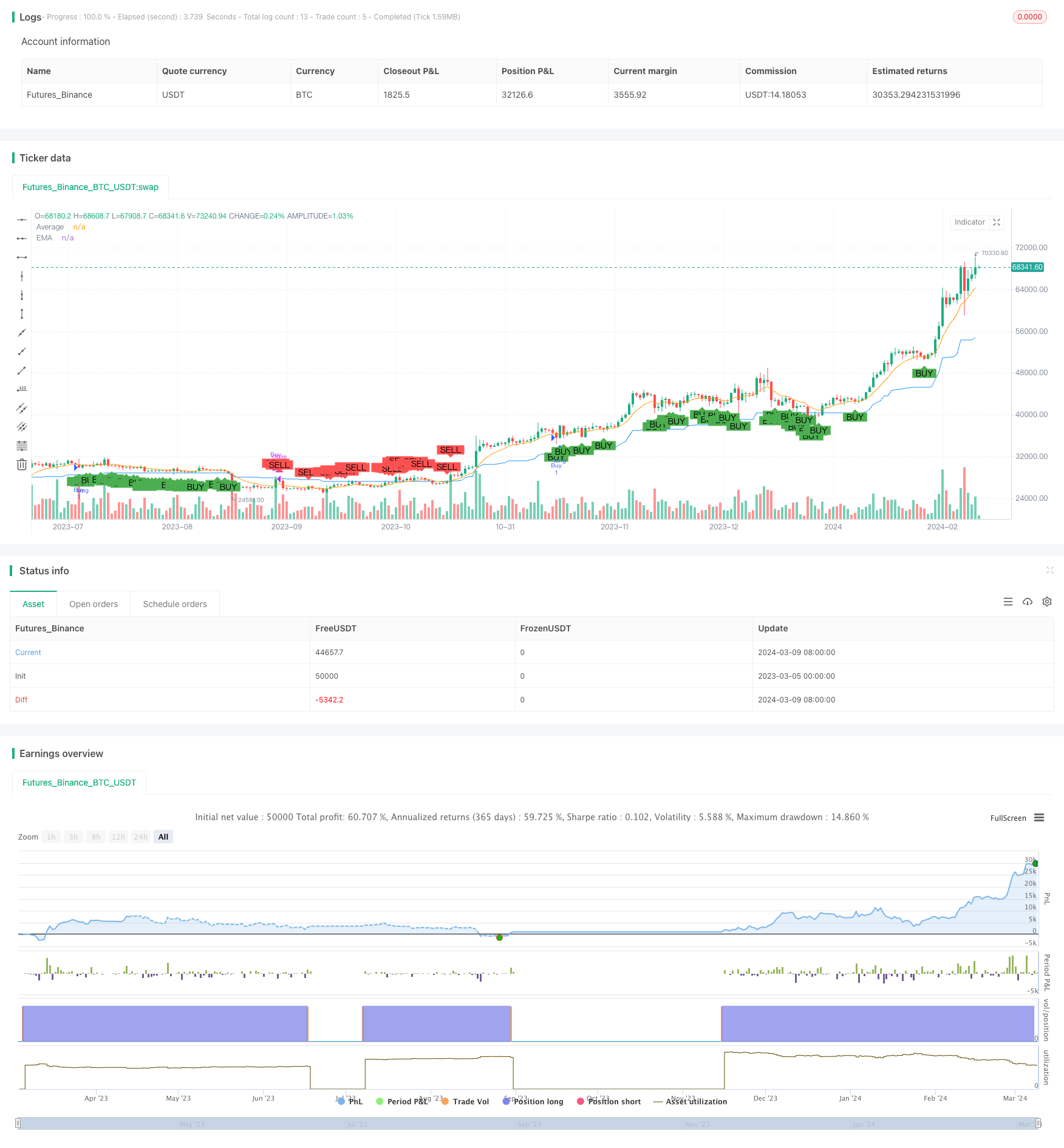

G-Channel与EMA结合的趋势跟踪策略

Author: ChaoZhang, Date: 2024-03-11 11:08:06Tags:

概述

本文介绍了一个基于G-Channel指标和指数移动平均线(EMA)的趋势跟踪交易策略。该策略利用G-Channel指标判断当前市场趋势方向,并结合EMA指标的穿越来产生买卖信号。这个策略的主要思想是在上涨趋势中价格回调到EMA附近时买入,在下跌趋势中价格反弹到EMA附近时卖出,从而捕捉主要的价格趋势。

策略原理

该策略的核心是G-Channel指标,该指标由Andrew Guppy首次提出,旨在判断当前价格走势的趋势方向。G-Channel指标由一条上轨、一条下轨和一条平均线组成。其中上轨连接近期价格的最高点,下轨连接近期价格的最低点,平均线是上下轨的算术平均。

当收盘价向上突破上轨时,意味着开始形成上升趋势;当收盘价向下突破下轨时,意味着开始形成下降趋势。该策略使用 barssince()函数来计算最近一次向上突破和向下突破分别发生在多少根K线之前,两者中发生在最近的那个方向就是当前的趋势方向。

EMA是一种趋势跟踪指标,相比简单移动平均线,它的权重分布更倾向于近期价格,因此对价格变化的反应更加敏感。在上升趋势中,EMA往往位于价格下方,起到支撑作用;在下降趋势中,EMA往往位于价格上方,起到压力作用。

该策略的交易逻辑如下: - 当G-Channel指标显示当前处于上升趋势,且收盘价向下穿越EMA时产生买入信号,此时价格很可能经过回调后继续向上运行。 - 当G-Channel指标显示当前处于下降趋势,且收盘价向上穿越EMA时产生卖出信号,此时价格很可能经过反弹后继续向下运行。

优势分析

- 趋势跟踪能力强:G-Channel指标能够敏锐地捕捉到价格趋势的变化,避免在震荡市做出错误的判断。配合EMA这样的趋势型指标,可进一步提高趋势把握的准确性。

- 适应性强:该策略对于任何品种、任何周期都可以良好适应。不管是股票、期货、外汇,还是数字货币,都可以运用该策略进行交易。

- 参数优化空间大:包括G-Channel的观测周期、EMA的参数等,都可以根据不同市场特征和投资者偏好进行灵活调整,使策略更具针对性。

风险分析

- 趋势转折风险:该策略在趋势转折初期可能会出现较大的回撤。比如G-Channel指标已经显示趋势开始反转,但EMA信号可能有一定滞后,造成账户损失。

- 参数设置风险:不恰当的参数设置会导致趋势判断偏差,从而产生错误的交易信号。策略参数需要根据回测进行优化,并定期复核。

- 黑天鹅事件:极端行情下该策略可能失效。比如受到重大利空打击,价格快速下跌并长期偏离均线时,该策略可能错过最佳的出场时机。

优化方向

- 引入更多辅助指标:在EMA之外,可以结合布林带、MACD等其他趋势型指标,提高信号的可靠性。

- 优化仓位管理:根据趋势的强弱、价格距离均线位置的远近,动态调整仓位,在控制风险的同时提高盈利能力。

- 结合市场情绪指标:比如融入VIX恐慌指数、Put/Call Ratio等反映市场情绪的指标数据,在极端情况下及时止损或获利了结。

总结

本文介绍了一个基于G-Channel指标和EMA指标的趋势跟踪策略。该策略利用G-Channel准确判断当前市场趋势方向,并在趋势中利用价格对EMA的穿越来捕捉买卖机会。策略优势在于趋势跟踪能力强、适应性广,但同时也要警惕趋势转折、参数设置不当以及黑天鹅事件带来的风险。未来可以通过引入更多辅助指标、优化仓位管理、结合市场情绪指标等方式,进一步提升该策略的稳健性和盈利能力。总的来说,该策略思路清晰,原理简单易懂,适合进行二次开发和实盘应用,值得量化交易者参考和学习。

/*backtest

start: 2023-03-05 00:00:00

end: 2024-03-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © jonathan_422

//@version=4

strategy("G-Channel and EMA Strategy", shorttitle="G-EMA Strategy", overlay=true)

// G-Channel settings

length = input(100)

src = input(close)

// Calculating G-Channel

a = 0.0

b = 0.0

a := max(src, nz(a[1])) - nz(a[1] - b[1]) / length

b := min(src, nz(b[1])) + nz(a[1] - b[1]) / length

avg = avg(a, b)

// EMA settings

emaLength = input(9, title="EMA Length")

ema = ema(close, emaLength)

// G-Channel buy/sell signals

crossup = b[1] < close[1] and b > close

crossdn = a[1] < close[1] and a > close

bullish = barssince(crossdn) <= barssince(crossup)

// Strategy logic

buySignal = bullish and close < ema

sellSignal = not bullish and close > ema

// Plotting

plot(ema, "EMA", color=color.orange)

plot(avg, "Average", color=color.blue)

// Plot buy/sell signals

plotshape(buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy execution

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.close("Buy", when=sellSignal)

- 动态RSI双均线买卖策略

- 多重指数移动平均线交易策略

- 基于RSI 穿越交易策略

- 基于双均线交叉策略

- 基于ATR与SMA的动态止损追踪策略

- 基于布林带和RSI的多头摆动交易策略

- 基于平均价海金阿什烛台与相对强弱指数的动态调仓策略

- 均线与超级趋势结合的日内多空动态平衡策略

- 基于超级趋势和MACD的风险控制策略

- 基于UT Bot指标的ATR移动止损策略

- 布林带与移动平均线结合的相对强弱指标交易策略

- 基于动量顺势策略

- 基于随机力矩指标的量化交易策略

- 基于支撑阻力和动量指标的多时间框架趋势跟踪策略

- 基于VWAP和跨周期信号的多空动态止盈止损策略

- 基于EMA和随机RSI的多周期趋势跟踪交易策略

- 基于价格波动范围的买卖信号过滤策略

- 连续阴跌-阳涨反转策略

- 抛物线SAR趋势跟踪策略 6.0

- 布林带与随机指标KD交叉策略