唐奇安通道突破策略

Author: ChaoZhang, Date: 2024-03-22 16:13:58Tags:

策略概述

唐奇安通道突破策略是一种趋势跟踪型量化交易策略。该策略利用唐奇安通道来捕捉市场趋势,同时使用 ATRSL 移动止损来控制风险。当价格突破唐奇安通道上轨时,策略开仓做多;当价格跌破 ATRSL 移动止损线时,策略平仓。

策略原理

- 计算唐奇安通道:根据用户输入的

donLength参数计算过去donLength个周期的最高价和最低价,分别作为唐奇安通道的上轨donUpper和下轨donLower,通道中线donBasis为上下轨的平均值。 - 计算 ATRSL 移动止损:根据用户输入的

AP2和AF2参数计算 ATR 值SL2,然后根据当前收盘价SC和前一个移动止损价Trail2[1]的关系,动态调整移动止损价Trail2。 - 开仓条件:当前收盘价上穿唐奇安通道上轨时,开仓做多。

- 平仓条件:当前收盘价下穿 ATRSL 移动止损线时,平仓。

策略优势

- 趋势跟踪:通过唐奇安通道来判断趋势方向,能够有效捕捉市场趋势。

- 动态止损:使用 ATRSL 移动止损,可以根据市场波动情况动态调整止损位置,控制风险。

- 参数灵活:用户可以根据自己的需求,调整

donLength、AP2和AF2等参数,优化策略表现。

策略风险

- 参数风险:不同的参数设置会导致策略表现差异较大,需要进行充分的回测和参数优化。

- 市场风险:在震荡市或趋势反转时,该策略可能会出现较大回撤。

- 滑点和交易成本:频繁交易可能会导致较高的滑点和交易成本,影响策略收益。

优化方向

- 加入趋势过滤:在开仓条件中,可以加入 ADX 等指标来判断趋势强度,只在趋势明显时开仓,提高开仓质量。

- 优化止损:可以尝试使用其他止损方法,如百分比止损、ATR 止损等,或者结合多种止损方式,提高止损灵活性。

- 加入仓位管理:根据市场波动情况和账户风险,动态调整仓位大小,控制风险暴露。

总结

唐奇安通道突破策略是一种经典的趋势跟踪策略,通过唐奇安通道捕捉趋势,并使用 ATRSL 移动止损控制风险。该策略优点是逻辑简单清晰,容易实现和优化;缺点是在震荡市和趋势反转时表现较差,并且参数设置对策略表现影响较大。在实际应用中,可以在原有策略基础上加入趋势过滤、优化止损和仓位管理等模块,提高策略稳定性和收益性。同时,需要注意控制交易频率和成本,并根据市场特点和自身风险偏好,灵活调整策略参数。

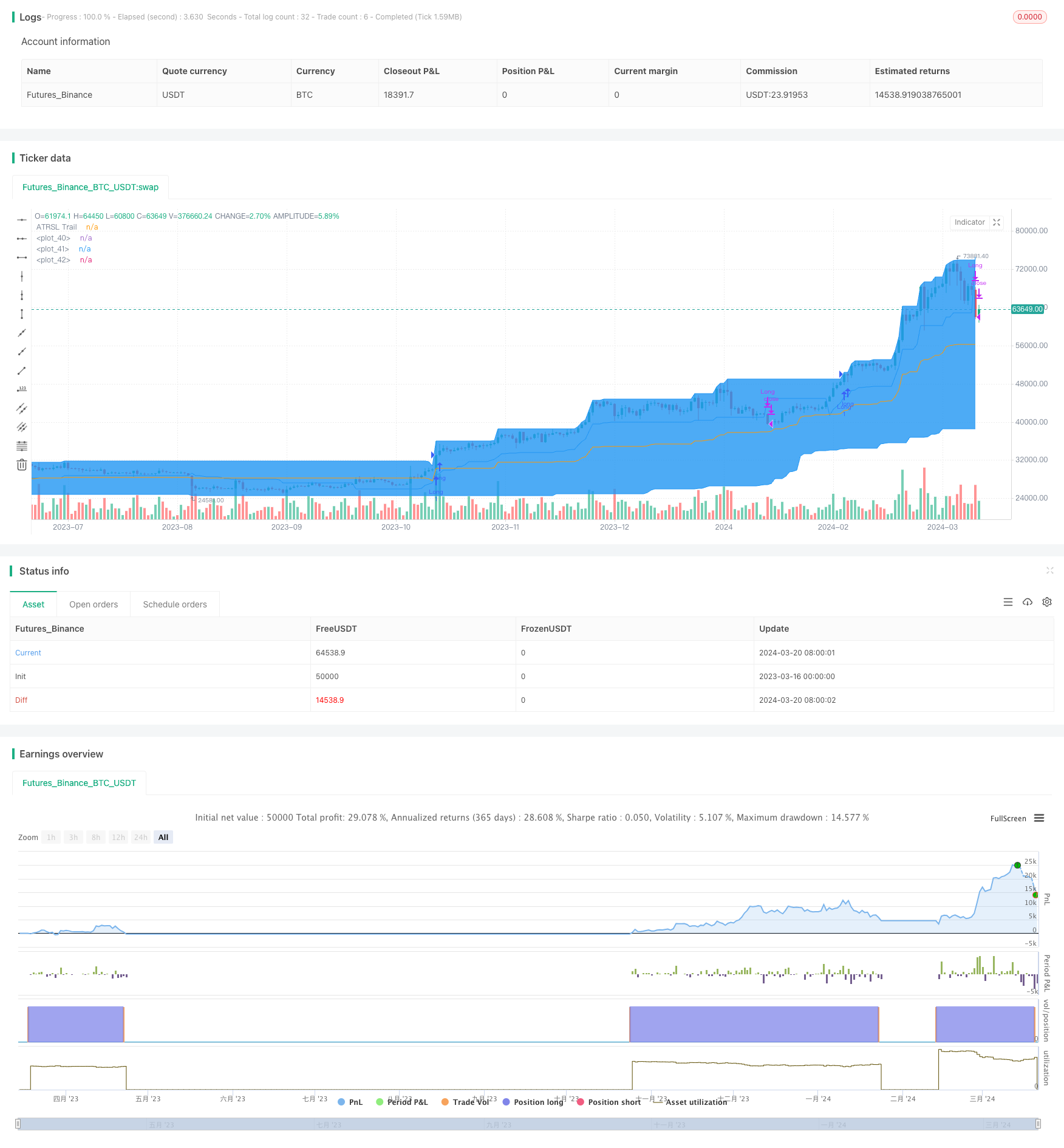

/*backtest

start: 2023-03-16 00:00:00

end: 2024-03-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Stock Trend USE THIS", overlay = true)

donLength = input(100, minval=1)

//Donchian Long

donLower = lowest(donLength)

donUpper = highest(donLength)

donBasis = avg(donUpper,donLower)

// ATRSL

SC = close

// Slow Trail //

AP2 = input(10, title="Slow ATR period") // ATR Period

AF2 = input(3, title="Slow ATR multiplier") // ATR Factor

SL2 = AF2 * atr(AP2) // Stop Loss

Trail2 = 0.0

iff_3 = SC > nz(Trail2[1], 0) ? SC - SL2 : SC + SL2

iff_4 = SC < nz(Trail2[1], 0) and SC[1] < nz(Trail2[1], 0) ? min(nz(Trail2[1], 0), SC + SL2) : iff_3

Trail2 := SC > nz(Trail2[1], 0) and SC[1] > nz(Trail2[1], 0) ? max(nz(Trail2[1], 0), SC - SL2) : iff_4

// Long and Short Conditions

longCondition = (crossover(close,donUpper[1]))

// Close Conditions

closeLongCondition = crossunder(close,Trail2)

// Strategy logic

if (longCondition)

strategy.entry("Long", strategy.long)

alert("Open Long position")

if (closeLongCondition)

strategy.close("Long")

alert("Close Long position")

// Plot Donchian

l = plot(donLower, color=color.blue)

u = plot(donUpper, color=color.blue)

plot(donBasis, color=color.orange)

fill(u, l, color=color.blue)

plot(Trail2, color=color.blue, title="ATRSL Trail")

更多内容

- 基于布林带的多头策略

- AlphaTrend和布林带相结合的均值回归+趋势跟踪策略

- 网格美元成本平均策略

- 基于三连阳/阴和双均线的量化交易策略

- 基于多重移动平均线、RSI 和标准差出场的蜡烛线高度突破交易策略

- 币安账户万向划转小工具

- 网格交易风险对冲策略

- 基于抛物线指标和移动平均线的多空趋势判断策略

- 多空线性交叉策略

- 基于趋势动量的多指标均线交叉策略

- 动态网格趋势追踪量化交易策略

- 布林带动态止盈与动态加仓策略

- TrippleMACD均线交叉与相对强弱指标结合的高频加密货币交易策略

- RSI与EMA双重过滤策略

- 基于网格的多头 Martingale 动态加仓网格交易策略

- 双重指数移动平均云交叉自动交易策略

- 基于双时间框架EMA交叉信号的多空策略

- 赫尔移动平均交叉策略

- 双均线交叉优化止损策略

- 趋势突破策略