概述

这个策略结合了布林带(Bollinger Bands)和5日指数移动平均线(5-day EMA)来生成交易信号。当价格超出布林带上轨且收盘价低于5日EMA时,开空头仓位;当价格跌破布林带下轨且收盘价高于5日EMA时,开多头仓位。同时,当出现反向信号时,策略会平掉现有仓位并开立新的反向仓位。这个策略旨在捕捉市场的波动性和趋势变化,通过布林带来判断价格的相对高低,并利用EMA作为趋势的滤网,以此来产生交易信号。

策略原理

- 计算布林带的上轨、中轨和下轨。上轨为中轨加上两倍标准差,下轨为中轨减去两倍标准差,中轨为收盘价的简单移动平均线。

- 计算5日EMA作为趋势的参考。

- 当开盘价大于布林带上轨且收盘价小于5日EMA时,开空头仓位。

- 当开盘价小于布林带下轨且收盘价大于5日EMA时,开多头仓位。

- 如果已有空头仓位,当触发多头信号时,平掉空头并开多头仓位。

- 如果已有多头仓位,当触发空头信号时,平掉多头并开空头仓位。

- 如果持有多头仓位,当触发空头平仓信号时,平掉多头仓位。

- 如果持有空头仓位,当触发多头平仓信号时,平掉空头仓位。

策略优势

- 同时利用价格的波动性和趋势特征来产生信号,可以在趋势和震荡行情中把握机会。

- 布林带能够灵活调整参数,适应不同的市场状况和品种特征。

- 5日EMA作为趋势过滤,可以有效降低噪音和频繁交易。

- 及时止损和反向开仓的机制,可以更好地控制风险,并积极把握新的趋势机会。

- 逻辑清晰,容易理解和实现,便于进一步优化。

策略风险

- 参数选择不当可能导致信号失真或者过度交易。需要根据品种和周期进行优化测试。

- 在震荡市可能出现频繁的交易信号,导致过度交易和成本增加。

- 趋势转折点的把握存在滞后,可能错过最佳入场时机。

- 单一技术指标组合可能面临失效的风险,需要与其他信号进行验证。

- 极端行情下可能面临失控的风险,需要严格的风控措施。

策略优化方向

- 对布林带的参数如长度、倍数等进行优化,找到最佳的参数组合。

- 对EMA的周期进行优化测试,选择最佳的趋势周期。

- 加入其他趋势类指标如MACD等作为辅助判断,提高趋势把握的准确性。

- 引入波动率指标如ATR等作为止损和仓位管理的依据,控制单笔风险。

- 对交易的时间段进行限制,避开特定时间的非有效波动。

- 根据行情特征,设置适当的止盈止损策略。

总结

该策略通过布林带和EMA的结合,可以比较有效地捕捉趋势性机会和波动性机会,适用于中长周期的交易策略。但是需要注意参数的优化,仓位的控制以及风险的管理,并且要与其他技术指标和基本面分析相结合,才能更好地发挥策略的效力。策略的表现可能会受到市场状态的影响,需要根据实际情况进行调整和优化。

策略源码

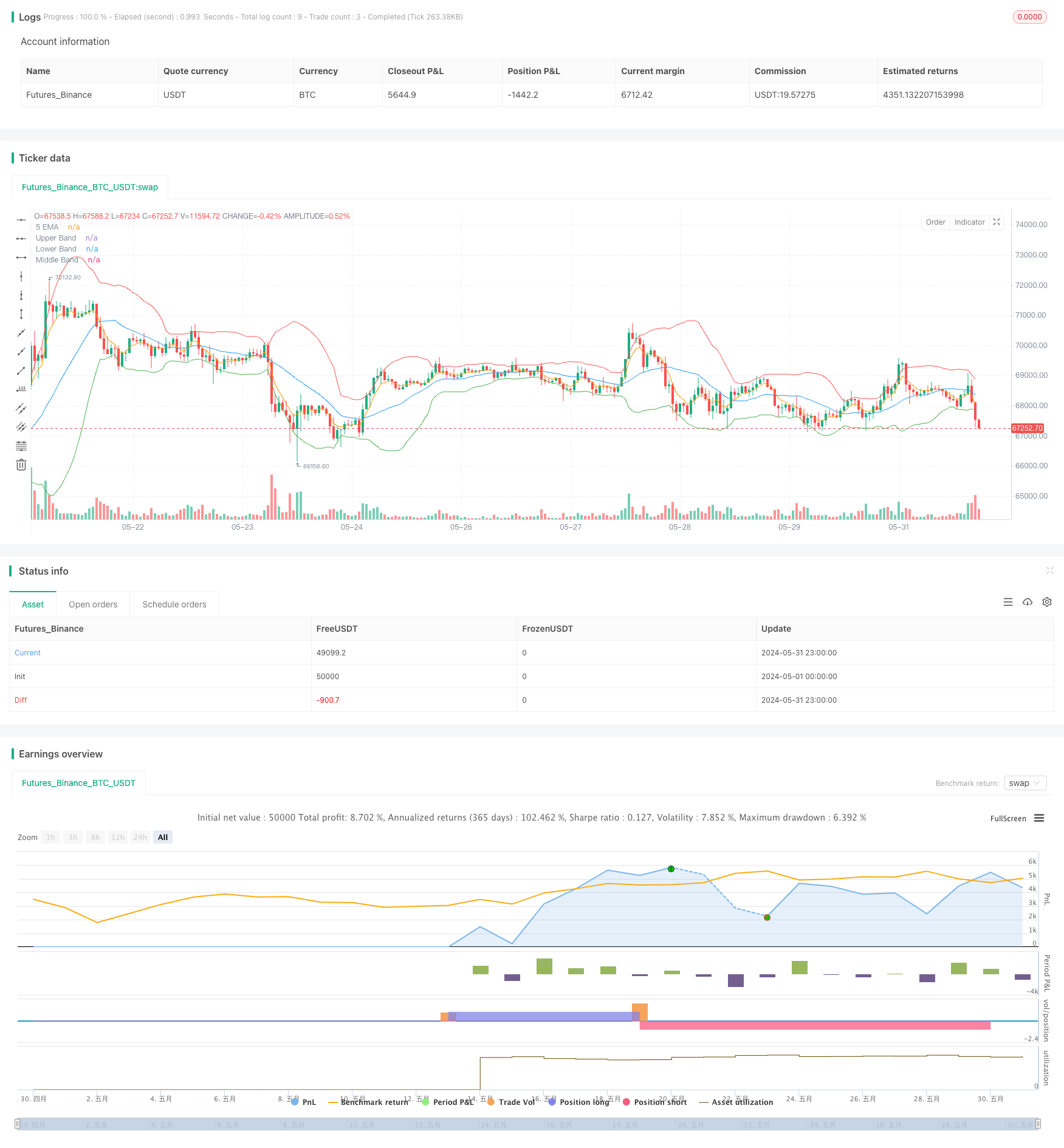

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands and EMA Strategy", overlay=true)

// Define the Bollinger Bands

length = input.int(20, title="BB Length")

src = input(close, title="BB Source")

mult = input.float(2.0, title="BB Multiplier")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot Bollinger Bands

plot(upper, "Upper Band", color=color.red)

plot(lower, "Lower Band", color=color.green)

plot(basis, "Middle Band", color=color.blue) // Use plot instead of hline for basis

// Define the 5-period EMA

ema5 = ta.ema(close, 5)

// Plot the 5 EMA

plot(ema5, "5 EMA", color=color.orange)

// Generate signals

var float entry_price = na

var string trade_direction = "none"

if (na(close[1]))

trade_direction := "none"

// Condition for entering a short trade

if (open > upper and close < ema5)

if (trade_direction != "short")

strategy.entry("Short", strategy.short)

entry_price := close

trade_direction := "short"

// Condition for entering a long trade

if (open < lower and close > ema5)

if (trade_direction != "long")

strategy.entry("Long", strategy.long)

entry_price := close

trade_direction := "long"

// Close short trade on a long signal

if (trade_direction == "short" and open < lower and close > ema5)

strategy.close("Short")

strategy.entry("Long", strategy.long)

entry_price := close

trade_direction := "long"

// Close long trade on a short signal

if (trade_direction == "long" and open > upper and close < ema5)

strategy.close("Long")

strategy.entry("Short", strategy.short)

entry_price := close

trade_direction := "short"

// Close trades when opposite signal is generated

if (trade_direction == "long" and open > upper and close < ema5)

strategy.close("Long")

trade_direction := "none"

if (trade_direction == "short" and open < lower and close > ema5)

strategy.close("Short")

trade_direction := "none"

相关推荐