基于连续K线动态网格自适应均线动态止损策略

Author: ChaoZhang, Date: 2024-06-03 16:16:15Tags: MASL

概述

该策略基于连续K线的走势,通过比较当前收盘价与前三根K线的收盘价来判断是否进行开仓。当连续三根K线走高时进行多头开仓,反之则平仓。同时,该策略采用了动态止损的方法,止损位根据开仓价和设定的止损百分比来确定。这种方法能够动态调整止损位,更好地控制风险。

策略原理

- 通过比较当前收盘价与前三根K线的收盘价,判断是否满足连续三根K线走高或走低的条件。

- 如果满足连续三根K线走高的条件,则在第四根K线开盘时进行多头开仓。

- 开仓后,根据开仓价和设定的止损百分比计算止损位。

- 如果满足连续三根K线走低的条件或者价格触及止损位,则平仓。

策略优势

- 该策略基于连续K线的走势进行判断,能够捕捉到市场的趋势性机会。

- 采用动态止损的方法,根据开仓价和止损百分比实时调整止损位,可以更好地控制风险。

- 策略逻辑清晰,易于理解和实现。

- 适用于多种市场和品种,具有一定的普适性。

策略风险

- 该策略依赖于连续K线的走势判断,如果市场出现震荡或非趋势性行情,可能会出现频繁开平仓的情况,导致交易成本增加。

- 止损位的设置依赖于止损百分比的选择,如果选择不当,可能会导致止损过早或过晚,影响策略表现。

- 该策略未考虑交易品种的特性,如波动率、流动性等,在实际应用中需要根据具体情况进行调整。

策略优化方向

- 引入更多的技术指标,如移动平均线、MACD等,作为辅助判断条件,提高开平仓的准确性。

- 对止损百分比进行参数优化,找到最佳的止损设置,提高策略的风险控制能力。

- 考虑加入仓位管理的逻辑,根据市场波动率、账户资金等因素动态调整仓位,提高资金使用效率。

- 针对不同的交易品种和市场特性,对策略参数进行分别优化,提高策略的适应性。

总结

该策略通过连续K线的走势判断来进行开平仓决策,同时采用动态止损的方法控制风险。策略逻辑清晰,易于理解和实现,适用于多种市场和品种。但在实际应用中,需要注意市场的非趋势性风险,并对止损百分比等参数进行优化。此外,引入更多技术指标、仓位管理等方法,可以进一步提升策略表现。

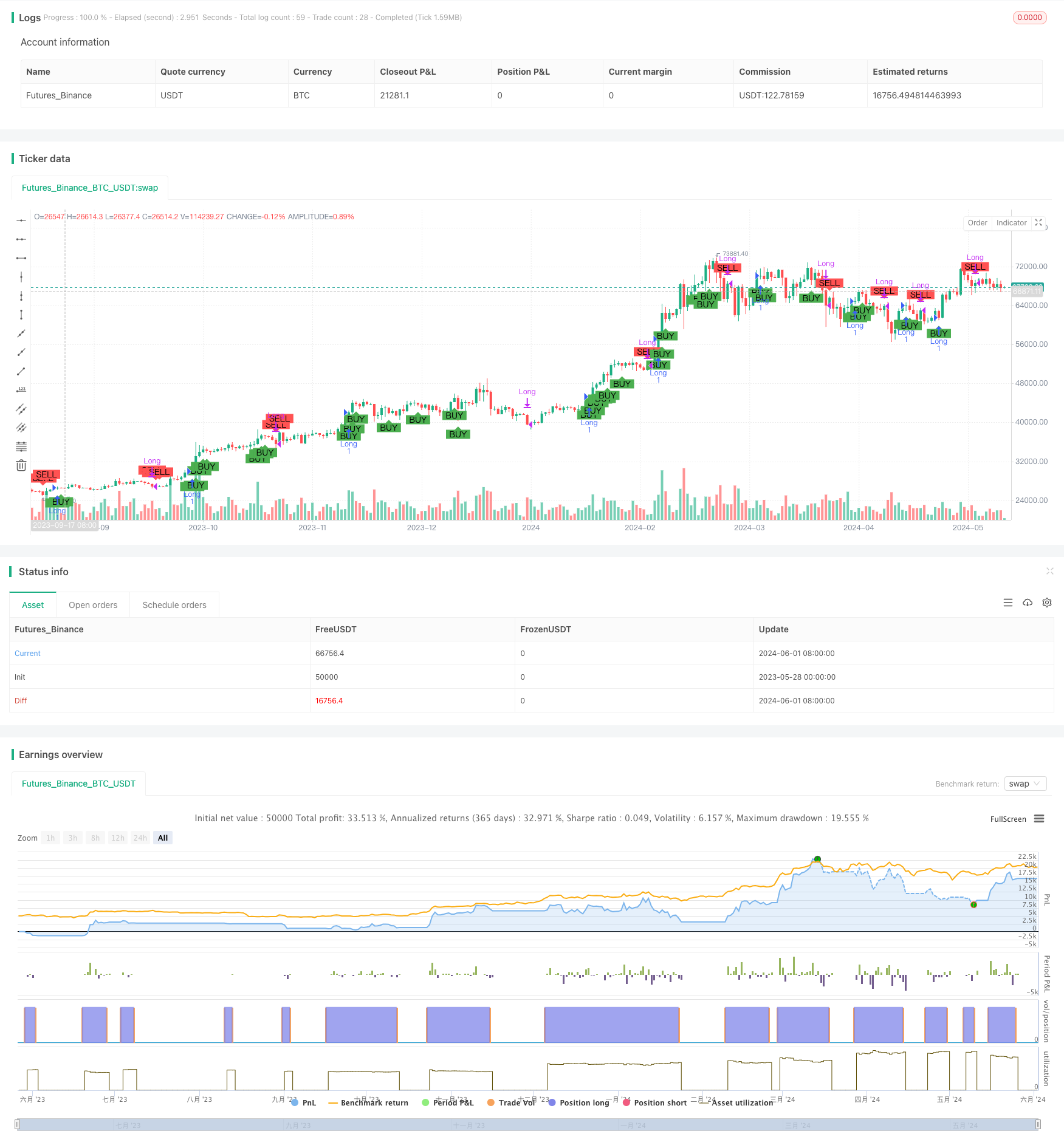

/*backtest

start: 2023-05-28 00:00:00

end: 2024-06-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("4 Candle Entry and Exit Strategy", overlay=true)

// Define the stop loss percentage

stopLossPercent = input.float(11, title="Stop Loss Percentage", minval=0.1) / 100

// Identify if the previous 3 candles are consecutively higher

longCondition = close[3] > close[4] and close[2] > close[3] and close[1] > close[2]

// Identify if the previous 3 candles are consecutively lower

exitCondition = close[3] < close[4] and close[2] < close[3] and close[1] < close[2]

// Initialize the entry price and stop loss variables

var float entryPrice = na

var float stopLoss = na

// Update the entry price and stop loss if the long condition is met

if (longCondition)

entryPrice := close[1]

stopLoss := entryPrice * (1 - stopLossPercent)

// Enter the long position at the open of the 4th candle

if (longCondition)

strategy.entry("Long", strategy.long, qty=1)

// Exit the position if exit condition is met or stop loss is hit

if (exitCondition or (strategy.position_size > 0 and low <= stopLoss))

strategy.close("Long")

// Optional: Plot the entry and exit signals on the chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=exitCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

相关内容

- G-Channel趋势检测策略

- 动态RSI超卖反弹交易策略结合止损优化模型

- 均线,简单移动平均线,均线斜率,追踪止损,重新进场

- 多时间框架比特币、币安币和以太坊交易回撤策略

- 随机震荡指标与移动平均线策略

- 趋势突破交易系统(移动平均线突破策略)

- 动态移动止损双目标价均线交叉策略

- 动态移动均线交叉趋势跟踪策略

- 智能均线交叉策略与动态止盈止损系统

- 双均线交叉带止盈止损的自适应量化交易策略

更多内容

- 趋势过滤与异常退出的平滑移动平均止损止盈策略

- MACD与R:R比率日内限制收敛策略

- 星光移动平均交叉策略

- 百分比阈值量化交易策略

- 基于双均线交叉的移动平均线策略

- MACD与Supertrend组合策略

- 基于量价信号和烛台模式的买卖策略

- SMA趋势跟踪策略

- EMA与布林带突破策略

- 基于CDC行动区的ATR止盈止损交易机器人策略

- 移动平均线交叉策略

- 趋势跟随与动量过滤相结合的交易策略

- RSI与线性回归通道交易策略

- 双重Vegas通道波动性调整SuperTrend量化交易策略

- EMA与RSI交叉策略

- 移动平均聚合动量云策略

- 双均线交叉止盈止损策略

- TEMA双均线交叉策略

- 多时间尺度SMA趋势跟踪与动态止损策略

- Bollinger Bands准确入场和风险控制策略