概述

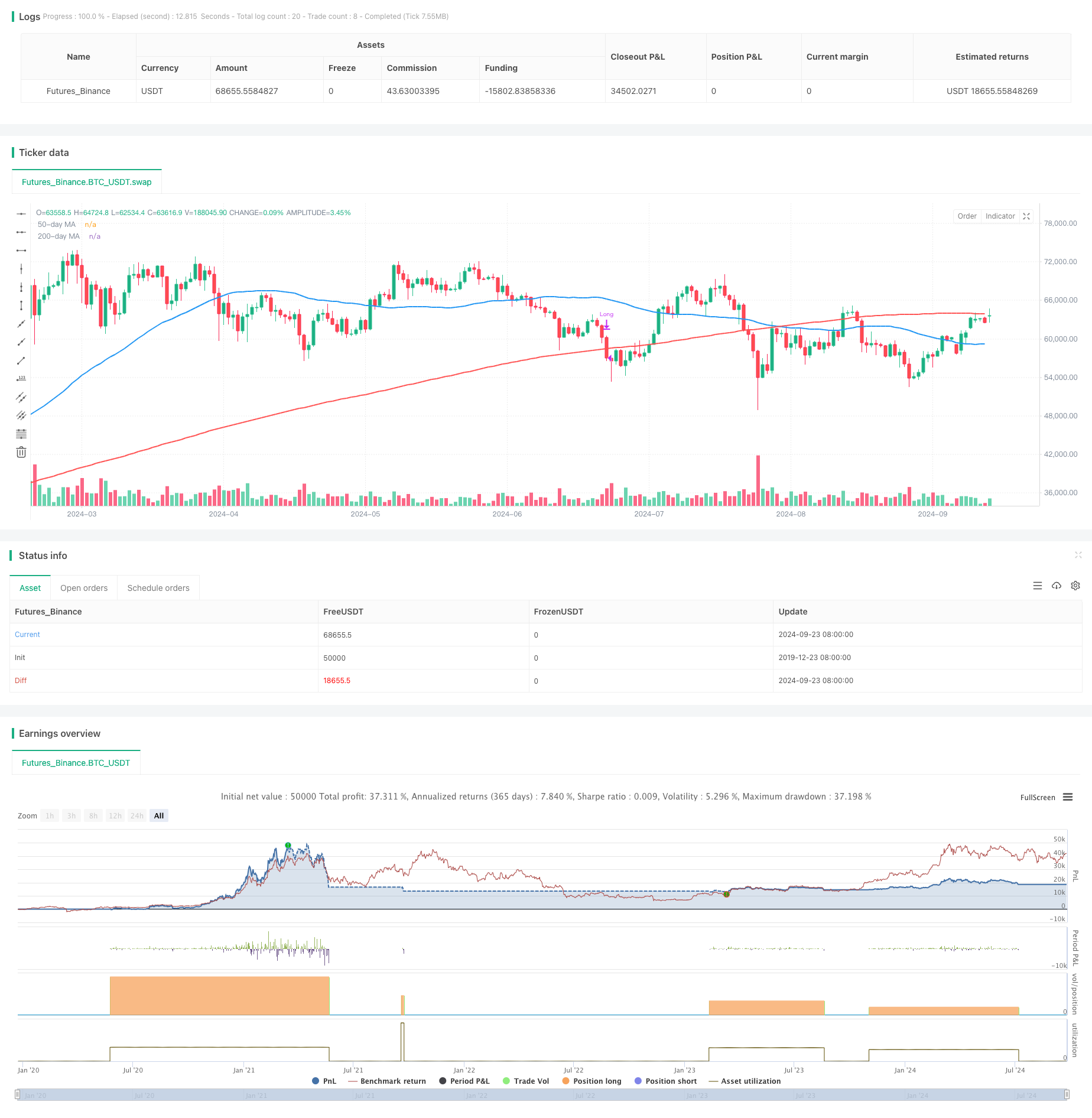

这是一个基于双均线黄金交叉的交易策略,结合了自适应风险管理和动态仓位调整。策略使用50日和200日简单移动平均线(SMA)来识别趋势,并在50日均线上穿200日均线时产生买入信号。同时,策略采用了基于账户总值2.5%的风险控制方法,动态计算每次交易的仓位大小,并使用相对于200日均线的百分比止损来保护盈利。

策略原理

- 入场信号:当50日均线上穿200日均线时(黄金交叉),触发买入信号。

- 风险管理:每次交易风险不超过账户总值的2.5%。

- 仓位计算:基于风险金额和止损距离动态计算每次交易的仓位大小。

- 止损设置:将止损价格设置在200日均线下方1.5%处。

- 出场条件:当价格跌破200日均线时,平仓结束交易。

策略优势

- 趋势跟踪:利用黄金交叉捕捉强劲上涨趋势,提高盈利机会。

- 风险控制:采用百分比风险管理,有效控制每次交易的风险敞口。

- 动态仓位:根据市场波动性自动调整仓位大小,在风险和收益之间取得平衡。

- 灵活止损:使用相对止损,随市场波动自动调整,既保护利润又给予价格足够的波动空间。

- 明确出场:设定清晰的出场条件,避免主观判断带来的犹豫不决。

策略风险

- 假突破:在震荡市中可能频繁触发假信号,导致连续小额亏损。

- 滞后性:移动平均线本质上是滞后指标,可能错过趋势初期的大幅上涨。

- 大幅跳空:若出现向下的大幅跳空,实际止损可能超过预设的2.5%风险限制。

- 过度交易:在横盘市场中,均线可能频繁交叉,增加不必要的交易成本。

- 单一技术指标:仅依赖移动平均线可能忽视其他重要的市场信息。

策略优化方向

- 引入筛选机制:可考虑加入成交量、波动率等指标,筛选更可靠的交易信号。

- 优化入场时机:结合其他技术指标(如RSI、MACD)确认趋势,减少假突破。

- 动态调整参数:根据不同市场周期自动调整均线周期,提高策略适应性。

- 增加止盈机制:设置动态止盈条件,在强势行情中锁定更多利润。

- 分散风险:考虑在多个不相关的市场同时应用该策略,降低系统性风险。

总结

这个基于双均线黄金交叉的自适应风险管理策略,通过结合经典的技术分析方法和现代的风险管理技术,为交易者提供了一个相对稳健的交易系统。它不仅能够捕捉中长期趋势,还能够有效控制风险,适合追求稳定收益的投资者。然而,交易者在使用此策略时,仍需密切关注市场变化,并根据实际交易表现不断优化参数,以达到最佳的风险收益比。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Golden Cross with 1.5% Stop-Loss & MA Exit", overlay=true)

// Define the 50-day and 200-day moving averages

ma50 = ta.sma(close, 50)

ma200 = ta.sma(close, 200)

// Entry condition: 50-day MA crosses above 200-day MA (Golden Cross)

goldenCross = ta.crossover(ma50, ma200)

// Exit condition: price drops below the 200-day MA

exitCondition = close < ma200

// Set the stop-loss to 1.5% below the 200-day moving average

stopLoss = ma200 * 0.985 // 1.5% below the 200-day MA

// Risk management (1.5% of total equity)

riskPercent = 0.025 // 1.5% risk

equity = strategy.equity

riskAmount = equity * riskPercent

// Calculate the distance between the entry price (close) and the stop-loss

stopDistance = close - stopLoss

// Calculate position size based on the risk amount and stop-loss distance

if (goldenCross and stopDistance > 0)

positionSize = riskAmount / stopDistance

strategy.entry("Long", strategy.long, qty=positionSize)

// Exit the trade when the price crosses below the 200-day moving average

if (exitCondition)

strategy.close("Long")

// Plot the moving averages on the chart for visualization

plot(ma50, color=color.blue, linewidth=2, title="50-day MA")

plot(ma200, color=color.red, linewidth=2, title="200-day MA")

相关推荐