概述

该策略是一个基于动量和趋势跟踪的多层次交易系统。它通过结合威廉姆斯鳄鱼指标、威廉姆斯分形、神奇震荡指标(AO)和指数移动平均线(EMA)来识别高概率的做多机会。策略采用资金分层投入机制,在趋势增强时逐步加仓,最多可同时持有5个头寸,每个头寸使用10%的资金。

策略原理

策略使用多重过滤机制来确保交易方向的准确性。首先通过EMA进行长期趋势判断,只在价格位于EMA之上时寻找做多机会。其次,通过威廉姆斯鳄鱼指标和分形的组合判断短期趋势,当上分形突破发生在鳄鱼牙齿线之上时,确认上升趋势成立。最后,在确认趋势后,策略寻找AO指标的”碗状”做多信号作为具体入场时机。系统在每次开仓时仅使用10%的资金,并在趋势持续走强时最多可以开启5个做多仓位。当分形和鳄鱼指标组合显示趋势反转时,系统会平掉所有仓位。

策略优势

- 多层过滤机制有效降低假信号干扰

- 资金管理科学,采用渐进式加仓方式

- trend-following特性使其能够捕捉大趋势

- 无固定止损位,而是通过技术指标动态判断趋势结束

- 系统具有良好的可配置性,便于根据不同市场条件调整参数

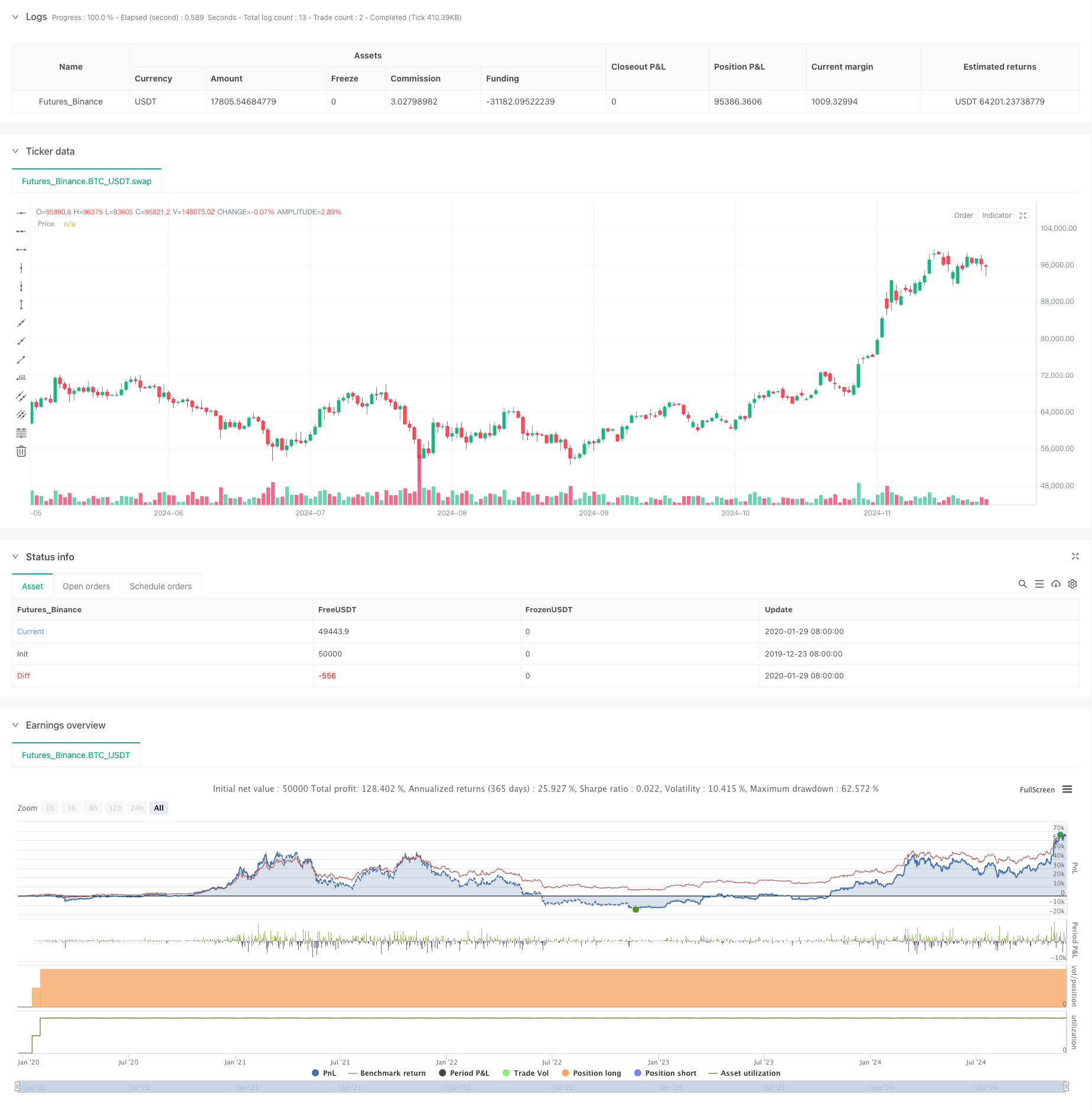

- 回测结果显示有不错的盈利因子和平均收益

策略风险

- 在震荡市场中可能产生连续假信号

- 趋势反转时可能出现较大回撤

- 多重过滤条件可能导致错过一些交易机会

- 资金管理方面,连续加仓可能在剧烈波动时带来风险

- EMA参数的选择对策略表现影响较大

为降低这些风险,建议: - 在不同市场环境下对参数进行优化 - 考虑增加波动率过滤器 - 建立更严格的加仓条件 - 设置最大回撤限制

策略优化方向

- 引入ATR指标进行波动率过滤

- 增加交易量分析,提高信号可靠性

- 开发动态参数自适应机制

- 完善止盈机制,在趋势减弱时及时获利了结

- 增加市场状态识别模块,在不同市场环境下使用不同参数

总结

这是一个设计合理的趋势跟踪策略,通过多重技术指标的配合使用,在保证安全性的同时,实现了不错的收益表现。策略的创新点在于多层次的趋势确认机制和渐进式的资金管理方法。虽然存在一些需要优化的地方,但总体而言是一个值得尝试的交易系统。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Skyrexio

//@version=6

//_______ <licence>

strategy(title = "MultiLayer Awesome Oscillator Saucer Strategy [Skyrexio]",

shorttitle = "AO Saucer",

overlay = true,

format = format.inherit,

pyramiding = 5,

calc_on_order_fills = false,

calc_on_every_tick = false,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5,

use_bar_magnifier = true)

//_______ <constant_declarations>

var const color skyrexGreen = color.new(#2ECD99, 0)

var const color skyrexGray = color.new(#F2F2F2, 0)

var const color skyrexWhite = color.new(#FFFFFF, 0)

//________<variables declarations>

var int trend = 0

var float upFractalLevel = na

var float upFractalActivationLevel = na

var float downFractalLevel = na

var float downFractalActivationLevel = na

var float saucerActivationLevel = na

bool highCrossesUpfractalLevel = ta.crossover(high, upFractalActivationLevel)

bool lowCrossesDownFractalLevel = ta.crossunder(low, downFractalActivationLevel)

var int signalsQtyInRow = 0

//_______ <inputs>

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "🤖Trading Bot Settings🤖")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "🤖Trading Bot Settings🤖")

// Trading period settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

// Strategy settings

EMaLength = input.int(100, minval = 10, step = 10, title = "EMA Length", group = "📈Strategy settings📈")

//_______ <function_declarations>

//@function Used to calculate Simple moving average for Alligator

//@param src Sourse for smma Calculations

//@param length Number of bars to calculate smma

//@returns The calculated smma value

smma(src, length) =>

var float smma = na

sma_value = ta.sma(src, length)

smma := na(smma) ? sma_value : (smma * (length - 1) + src) / length

smma

//_______ <calculations>

//Upfractal calculation

upFractalPrice = ta.pivothigh(2, 2)

upFractal = not na(upFractalPrice)

//Downfractal calculation

downFractalPrice = ta.pivotlow(2, 2)

downFractal = not na(downFractalPrice)

//Calculating Alligator's teeth

teeth = smma(hl2, 8)[5]

//Calculating upfractal and downfractal levels

if upFractal

upFractalLevel := upFractalPrice

else

upFractalLevel := upFractalLevel[1]

if downFractal

downFractalLevel := downFractalPrice

else

downFractalLevel := downFractalLevel[1]

//Calculating upfractal activation level, downfractal activation level to approximate the trend and this current trend

if upFractalLevel > teeth

upFractalActivationLevel := upFractalLevel

if highCrossesUpfractalLevel

trend := 1

upFractalActivationLevel := na

downFractalActivationLevel := downFractalLevel

if downFractalLevel < teeth

downFractalActivationLevel := downFractalLevel

if lowCrossesDownFractalLevel

trend := -1

downFractalActivationLevel := na

upFractalActivationLevel := upFractalLevel

if trend == 1

upFractalActivationLevel := na

if trend == -1

downFractalActivationLevel := na

//Calculating filter EMA

filterEMA = ta.ema(close, EMaLength)

//Сalculating AO saucer signal

ao = ta.sma(hl2,5) - ta.sma(hl2,34)

diff = ao - ao[1]

saucerSignal = ao > ao[1] and ao[1] < ao[2] and ao > 0 and ao[1] > 0 and ao[2] > 0 and trend == 1 and close > filterEMA

//Calculating sauser activation level

if saucerSignal

saucerActivationLevel := high

else

saucerActivationLevel := saucerActivationLevel[1]

if not na(saucerActivationLevel[1]) and high < saucerActivationLevel[1] and diff > 0

saucerActivationLevel := high

saucerSignal := true

if (high > saucerActivationLevel[1] and not na(saucerActivationLevel)) or diff < 0

saucerActivationLevel := na

//Calculating number of valid saucer signal in current trading cycle

if saucerSignal and not saucerSignal[1]

signalsQtyInRow := signalsQtyInRow + 1

if not na(saucerActivationLevel[1]) and diff < 0 and na(saucerActivationLevel) and not (strategy.opentrades[1] <= strategy.opentrades - 1)

signalsQtyInRow := signalsQtyInRow - 1

if trend == -1 and trend[1] == 1

signalsQtyInRow := 0

//_______ <strategy_calls>

//Defining trade close condition

closeCondition = trend[1] == 1 and trend == -1

//Cancel stop buy order if current Awesome oscillator column lower, than prevoius

if diff < 0

strategy.cancel_all()

//Strategy entry

if (signalsQtyInRow == 1 and not na(saucerActivationLevel))

strategy.entry(id = "entry1", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 2 and not na(saucerActivationLevel))

strategy.entry(id = "entry2", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry2",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 3 and not na(saucerActivationLevel))

strategy.entry(id = "entry3", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry3",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 4 and not na(saucerActivationLevel))

strategy.entry(id = "entry4", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry4",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 5 and not na(saucerActivationLevel))

strategy.entry(id = "entry5", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry5",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//Strategy exit

if (closeCondition)

strategy.close_all(alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//_______ <visuals>

//Plotting shapes for adding to current long trades

gradPercent = if strategy.opentrades == 2

90

else if strategy.opentrades == 3

80

else if strategy.opentrades == 4

70

else if strategy.opentrades == 5

60

pricePlot = plot(close, title="Price", color=color.new(color.blue, 100))

teethPlot = plot(strategy.opentrades > 1 ? teeth : na, title="Teeth", color= skyrexGreen, style=plot.style_linebr, linewidth = 2)

fill(pricePlot, teethPlot, color = color.new(skyrexGreen, gradPercent))

if strategy.opentrades != 1 and strategy.opentrades[1] == strategy.opentrades - 1

label.new(bar_index, teeth, style = label.style_label_up, color = color.lime, size = size.tiny, text="Buy More", textcolor = color.black, text_formatting = text.format_bold)

//_______ <alerts>

相关推荐