概述

本策略是一个基于斐波那契回撤和延展水平,结合EMA均线趋势判断的复合型量化交易系统。策略通过识别市场的重要支撑阻力位,结合趋势信号进行交易。系统使用20周期和50周期EMA均线判断市场趋势,并在此基础上利用斐波那契回撤水平寻找最佳交易机会。

策略原理

策略的核心逻辑包含三个主要部分:首先计算近10个周期的最高价和最低价,用于确定价格波动区间;其次基于该区间计算五个关键的斐波那契回撤水平(0.236、0.382、0.5、0.618、0.786);最后通过20和50周期EMA的交叉确定趋势方向。在上升趋势中,当价格突破回撤水平时发出做多信号;在下降趋势中,当价格跌破回撤水平时发出做空信号。

策略优势

- 结合了趋势跟踪和价格回撤两种交易理念,提高了交易的准确性

- 使用斐波那契数列作为关键价格水平,这些水平在市场中具有较强的心理意义

- 通过EMA均线判断趋势,避免了在横盘市场中频繁交易

- 系统设计简洁,易于理解和维护

- 可以适用于不同的时间周期,具有较强的适应性

策略风险

- 在剧烈波动的市场中可能产生虚假信号

- 依赖于趋势的持续性,在震荡市场中表现可能不佳

- 回撤水平的计算基于历史高低点,可能滞后于市场

- 入场点的选择可能不够精确,导致止损位置较远

- 系统缺乏动态的仓位管理机制

策略优化方向

- 引入成交量指标,提高趋势判断的准确性

- 增加动态止损机制,更好地控制风险

- 优化回撤水平的计算周期,使其更符合市场节奏

- 加入波动率过滤器,避免在高波动期间交易

- 设计更灵活的仓位管理系统,根据市场条件调整持仓量

总结

该策略通过结合经典的技术分析工具,构建了一个相对完整的交易系统。虽然存在一些需要优化的地方,但整体框架具有良好的市场适应性。通过持续优化和改进,该策略有望在实际交易中取得更好的表现。建议在实盘交易前,进行充分的历史数据回测和参数优化。

策略源码

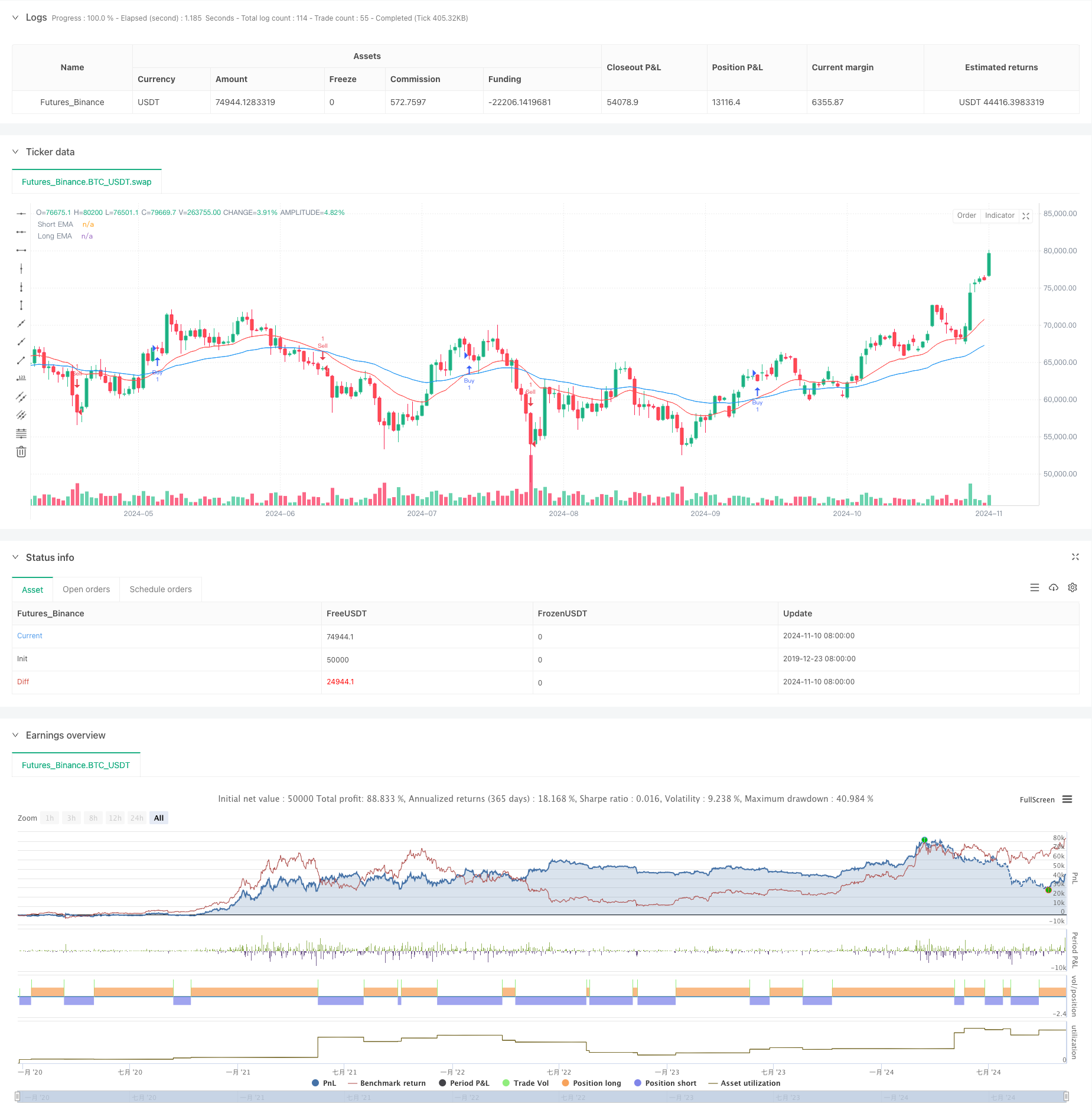

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fibonacci Retracement and Extension Strategy", overlay=true)

// Define the Fibonacci levels for retracement and extension

fibRetracementLevels = array.new_float(5)

array.set(fibRetracementLevels, 0, 0.236)

array.set(fibRetracementLevels, 1, 0.382)

array.set(fibRetracementLevels, 2, 0.5)

array.set(fibRetracementLevels, 3, 0.618)

array.set(fibRetracementLevels, 4, 0.786)

fibExtensionLevels = array.new_float(5)

array.set(fibExtensionLevels, 0, 1.618)

array.set(fibExtensionLevels, 1, 2.618)

array.set(fibExtensionLevels, 2, 3.618)

array.set(fibExtensionLevels, 3, 4.236)

array.set(fibExtensionLevels, 4, 5.618)

// Calculate the high and low prices for the last 10 bars

highPrice = ta.highest(high, 10)

lowPrice = ta.lowest(low, 10)

// Calculate the Fibonacci retracement levels

fibRetracement = array.new_float(5)

for i = 0 to 4

array.set(fibRetracement, i, highPrice - (highPrice - lowPrice) * array.get(fibRetracementLevels, i))

// Calculate the trend using the Exponential Moving Average (EMA)

shortEMA = ta.ema(close, 20)

longEMA = ta.ema(close, 50)

// Define the trend conditions

isUptrend = shortEMA > longEMA

isDowntrend = shortEMA < longEMA

// Generate buy and sell signals

var float lastFibRetracementLevel = na

var float lastFibExtensionLevel = na

// Buy condition: price crosses above the highest retracement level

if (isUptrend)

for i = 0 to 4

if (close > array.get(fibRetracement, i))

lastFibRetracementLevel := array.get(fibRetracement, i)

strategy.entry("Buy", strategy.long)

// Sell condition: price crosses below the lowest retracement level

if (isDowntrend)

for i = 0 to 4

if (close < array.get(fibRetracement, i))

lastFibRetracementLevel := array.get(fibRetracement, i)

strategy.entry("Sell", strategy.short)

// Plotting the Fibonacci levels on the chart

// for i = 0 to 4

// line.new(bar_index[10], array.get(fibRetracement, i), bar_index, array.get(fibRetracement, i), color=color.new(color.blue, 70), width=1)

// Plot the EMAs

plot(shortEMA, color=color.red, title="Short EMA")

plot(longEMA, color=color.blue, title="Long EMA")

相关推荐

- 高效趋势捕捉型指数移动平均线交叉与动态追踪止损策略

- 多重均线过滤趋势交叉量化交易策略

- 多指数移动平均与方向性趋势过滤交易系统

- 三重指数移动平均与三重相对移动平均自适应通道交叉策略

- 双指数均线交叉与尾随止损结合的量化交易策略

- 动态趋势过滤ATM期权卖出策略结合EMA交叉与RSI动量确认

- 动态波动率自适应EMAxRSI交叉策略

- 双指数移动平均交叉转向退出策略

- 50周期指数移动平均线交叉结合月度定投的双重优化趋势跟踪策略

- 多重均线与成交量加权趋势交叉分析系统

- EMA 34 动态止损交叉策略:趋势跟踪与风险管理的智能结合

更多内容

- 双均线RSI趋势动量策略

- 多指标融合均值回归趋势跟踪策略

- 基于ATR动态管理的开市突破交易策略

- 基于多指标集成和智能风控的量化交易系统

- 多重指标动态自适应调仓ATR波动率策略

- RSI动态止损智能交易策略

- 均线修正型RSI三重验证机会策略

- 结合布林带与RSI的自适应震荡趋势交易策略

- ADX (Average Directional Index) 和交易量趋势动态跟踪策略

- 多重成交量动量组合交易策略

- 基于EMA指标的跨市场多空趋势隔夜持仓策略

- 基于多重技术指标的均值回归趋势跟踪策略

- WebSocket 加速驱动

- 多平台期货资金费率获取与监控策略

- EMA/MACD/RSI 交叉策略

- 多指标交叉动量交易策略结合止盈止损优化系统

- 波动率停止云策略与均线交叉系统

- 布林带精确交叉突破量化策略

- 动态风险管理的均线交叉与布林带策略

- 多级平衡量化交易策略