概述

本策略是一个基于交易量异常和RSI指标的交易系统。策略通过监控成交量突破和RSI超买超卖水平来识别潜在的交易机会,并结合价格行为确认信号。该策略采用动态的止损和获利目标设置,以实现风险收益的最优配置。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 成交量验证:使用20周期简单移动平均线计算平均成交量,当实时成交量超过平均值的1.5倍时触发成交量异常信号 2. RSI指标:采用14周期RSI进行超买超卖判断,RSI<30视为超卖,RSI>70视为超买 3. 入场条件: - 多头:出现成交量异常 + RSI超卖 + 收盘价高于开盘价 - 空头:出现成交量异常 + RSI超买 + 收盘价低于开盘价 4. 风险管理:使用ATR动态计算止损位置,并基于设定的风险收益比(1:2)自动确定获利目标

策略优势

- 多重确认机制:结合成交量、RSI和价格行为等多个维度进行交易确认,提高信号可靠性

- 动态风险管理:通过ATR动态调整止损位置,更好地适应市场波动性变化

- 全时段适用:不受时间限制,可以捕捉全天候交易机会

- 可定制性强:关键参数如RSI阈值、成交量倍数、风险收益比等均可根据具体需求调整

- 清晰的可视化:通过背景颜色标注交易信号,便于策略监控和回测分析

策略风险

- 假突破风险:成交量异常可能来自市场噪音,需要通过调整成交量倍数参数来优化

- 非活跃时段风险:在市场流动性较低的时段,可能出现滑点或成交困难

- 市场环境依赖:策略在趋势市场表现可能优于区间震荡市场

- 参数敏感性:多个关键参数的设置会显著影响策略表现,需要充分测试

策略优化方向

- 市场状态识别:增加市场状态判断机制,在不同市场条件下使用不同的参数设置

- 信号过滤:增加趋势过滤器,如移动平均线系统,提高交易方向的准确性

- 仓位管理:引入动态仓位管理机制,根据市场波动性调整开仓规模

- 成交量分析深化:结合成交量形态分析,如成交量涨跌比等指标,提高成交量异常判断的准确性

- 流动性评估:增加流动性评估指标,在流动性不足时调整或暂停交易

总结

该策略通过整合多个经典技术指标,构建了一个逻辑严密的交易系统。策略的优势在于多重确认机制和完善的风险管理体系,但同时也需要注意假突破和非活跃时段风险等问题。通过持续优化和完善,策略有望在实际交易中取得稳定表现。

策略源码

/*backtest

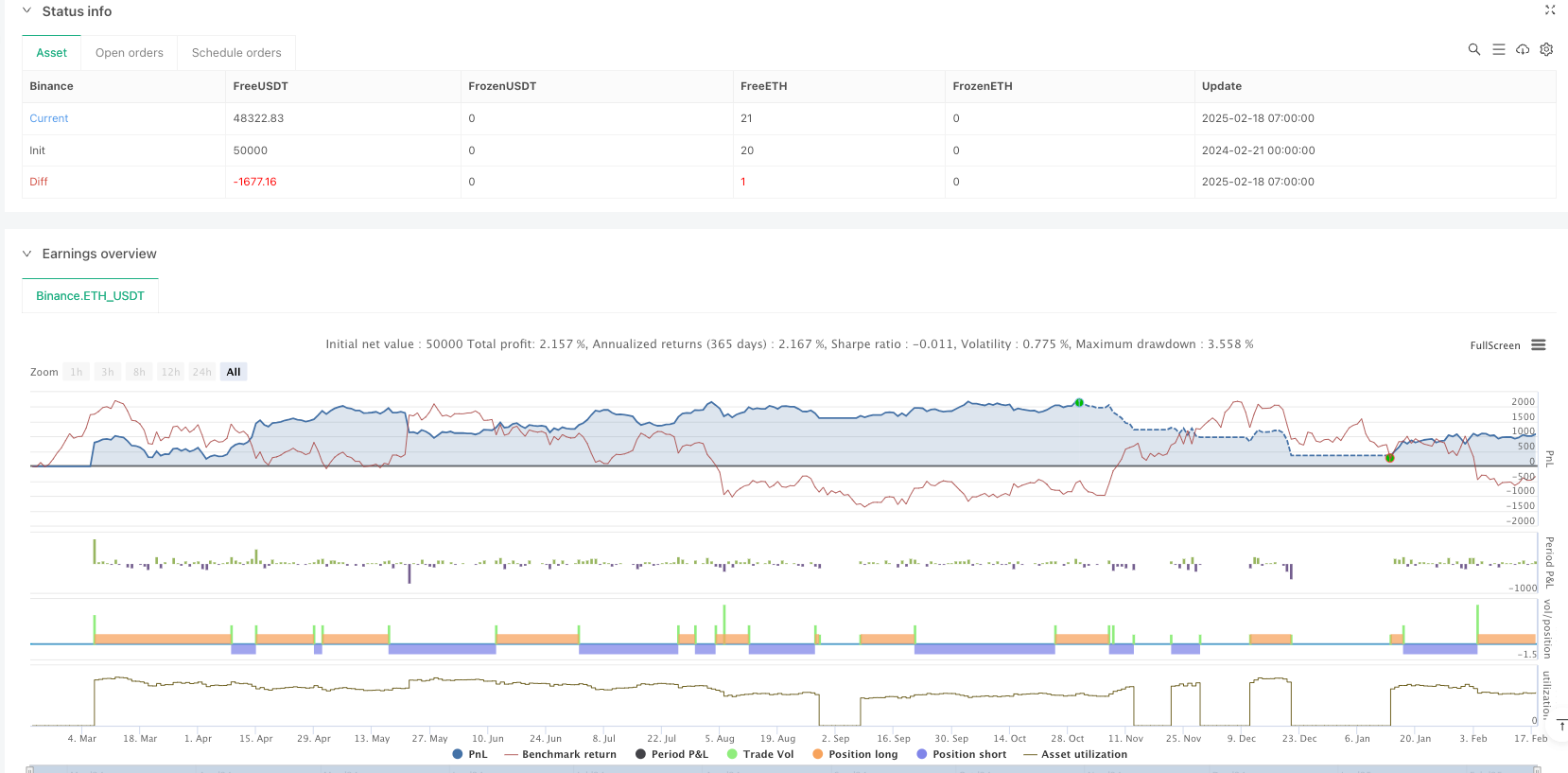

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Volume Spike & RSI Scalping (Session Restricted)", overlay=true)

// Inputs

rsi_length = input(14, title="RSI Length")

overSold = input(30, title="RSI Oversold Level")

overBought = input(70, title="RSI Overbought Level")

volume_threshold = input(1.5, title="Volume Spike Multiplier (e.g., 1.5x avg volume)")

risk_reward_ratio = input(2.0, title="Risk-Reward Ratio (1:X)")

atr_length = input(14, title="ATR Length")

// RSI Calculation

vrsi = ta.rsi(close, rsi_length)

// Volume Spike Detection

avg_volume = ta.sma(volume, 20)

volume_spike = volume > avg_volume * volume_threshold

// Entry Signals Based on RSI and Volume

long_condition = volume_spike and vrsi < overSold and close > open // Bullish price action

short_condition = volume_spike and vrsi > overBought and close < open // Bearish price action

// Execute Trades

if (long_condition)

stop_loss = low - ta.atr(atr_length)

take_profit = close + (close - stop_loss) * risk_reward_ratio

strategy.entry("Buy", strategy.long, comment="Buy Signal")

strategy.exit("Take Profit/Stop Loss", "Buy", stop=stop_loss, limit=take_profit)

if (short_condition)

stop_loss = high + ta.atr(atr_length)

take_profit = close - (stop_loss - close) * risk_reward_ratio

strategy.entry("Sell", strategy.short, comment="Sell Signal")

strategy.exit("Take Profit/Stop Loss", "Sell", stop=stop_loss, limit=take_profit)

// Background Highlighting for Signals

bgcolor(long_condition ? color.new(color.green, 85) : na, title="Long Signal Background")

bgcolor(short_condition ? color.new(color.red, 85) : na, title="Short Signal Background")

相关推荐