Strategie zur Verfolgung von Ausbrüchen

Schriftsteller:ChaoZhang, Datum: 2023-10-17 16:36:49Tags:

Übersicht

Diese Strategie verwendet hauptsächlich den

Strategie Logik

-

Einstellparameter für den Indikator

Donchian Channel , Standardabstand ist 20; -

Einrichtung des gleitenden EMA, Ausfallzeitraum 200;

-

Gefahr/Rendite-Verhältnis festgelegt, Ausfall beträgt 1,5;

-

Einstellung der Rückzugparameter nach dem Ausbruch für lang und kurz;

-

Aufzeichnen, ob der vorherige Ausbruch ein Höchst- oder Tiefpunkt war;

-

Langsignal: Wenn der vorherige Ausbruch niedrig war, brechen die Preise über den Donchian-Oberband und die EMA-Linie;

-

Kurzsignal: Wenn der vorherige Ausbruch ein Hoch war, fällt der Kurs unter den unteren Donchian-Band und die EMA-Linie;

-

Nach dem Long-Entry, setzen Sie den Stop-Loss auf Donchian-Unterband minus 5 Punkte, nehmen Sie Gewinn bei Risiko/Rendite-Verhältnis mal Stop-Loss-Distanz;

-

Nach einem kurzen Einstieg, setzen Sie den Stop-Loss auf Donchian-Oberband plus 5 Punkte, nehmen Sie Gewinn bei Risiko/Rendite-Verhältnis mal Stop-Loss-Distanz.

Die Strategie kombiniert Trendfollowing und Breakout-Trading, um zusammen mit dem Haupttrend zu handeln.

Analyse der Vorteile

-

Folgen Sie dem großen Trend, vermeiden Sie gegen den Trend zu handeln.

-

Der Donchian Channel als langfristiger Indikator kann in Kombination mit dem EMA-Filter den Trend effektiv erkennen.

-

Stop Loss und Take Profit kontrollieren das Risiko pro Handel, begrenzen potenzielle Verluste.

-

Die Optimierung des Risiko-Rendite-Verhältnisses kann den Gewinnfaktor erhöhen und überschüssige Renditen erzielen.

-

Flexible Backtest-Parameter können die Parameter für verschiedene Märkte optimieren.

Risikoanalyse

-

Donchian Channel und EMA können manchmal falsche Signale geben.

-

Breakout-Handel kann leicht gefangen werden, müssen Trend Hintergrund klar zu identifizieren.

-

Festgesetzte Stop-Loss- und Take-Profit-Verfahren können nicht anhand der Marktvolatilität angepasst werden.

-

Begrenzter Optimierungsraum für Parameter, Live-Leistung nicht garantiert.

-

Handelssysteme, die anfällig für schwarze Schwanen sind, können zu schweren Verlusten führen.

Optimierungsrichtlinien

-

Erwägen Sie, mehr Filter wie Oszillatoren hinzuzufügen, um die Signalqualität zu verbessern.

-

Anpassungsfähige Stop-Loss- und Take-Profit-Einstellungen basierend auf Marktvolatilität und ATR.

-

Verwenden Sie maschinelles Lernen, um Parameter zu testen und zu optimieren, um sie auf den realen Märkten anzupassen.

-

Optimieren Sie die Einstiegslogik mit Volumen oder Volatilität als Bedingung, um Fallen zu vermeiden.

-

Kombinieren Sie mit Trendfolgensystemen oder maschinellem Lernen, um hybride Modelle für Robustheit zu erstellen.

Schlussfolgerung

Diese Strategie ist eine Breakout-Tracking-Strategie, bei der die Logik des Handels entlang des identifizierten Haupttrends besteht und der Breakout als Einstiegssignal verwendet wird, während Stop-Loss und Take-Profit festgelegt werden, um das Risiko pro Handel zu kontrollieren. Die Strategie hat einige Vorteile, aber auch Verbesserungsmöglichkeiten. Insgesamt kann sie mit einer richtigen Parameter-Ausrichtung, Eintrittszeitplanung und Verbesserungen mit anderen Techniken zu einer praktischen Trend-Nachstrategie werden.

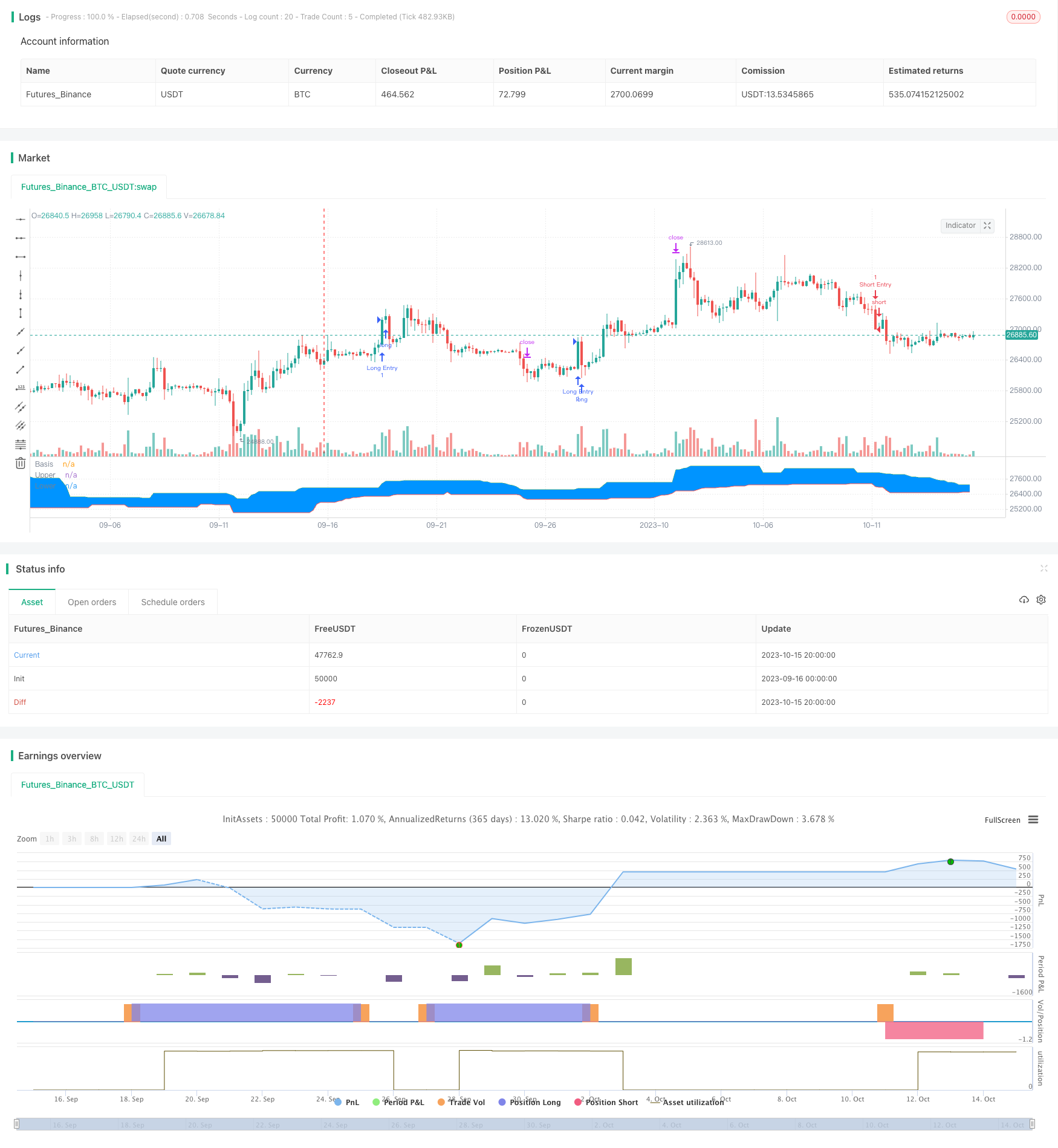

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Welcome to my second script on Tradingview with Pinescript

// First of, I'm sorry for the amount of comments on this script, this script was a challenge for me, fun one for sure, but I wanted to thoroughly go through every step before making the script public

// Glad I did so because I fixed some weird things and I ended up forgetting to add the EMA into the equation so our entry signals were a mess

// This one was a lot tougher to complete compared to my MACD crossover trend strategy but I learned a ton from it, which is always good and fun

// Also I'll explain the strategy and how I got there through some creative coding(I'm saying creative because I had to figure this stuff out by myself as I couldn't find any reference codes)

// First things first. This is a Donchian Channel Breakout strategy which follows the following rules

// If the price hits the upperband of the Donchian Channel + price is above EMA and the price previously hit the lowerband of the Donchian Channel it's a buy signal

// If the price hits the lowerband of the Donchian Channel + price is below EMA and the price prevbiously hit the upper band of the Donchian Channel it's a sell signal

// Stop losses are set at the lower or upper band with a 0.5% deviation because we are acting as if those two bands are the resistance in this case

// Last but not least(yes, this gave BY FAR the most trouble to code), the profit target is set with a 1.5 risk to reward ratio

// If you have any suggestions to make my code more efficient, I'll be happy to hear so from you

// So without further ado, let's walk through the code

// The first line is basically standard because it makes backtesting so much more easy, commission value is based on Binance futures fees when you're using BNB to pay those fees in the futures market

// strategy(title="Donchian Channels", shorttitle="DC", overlay=true, default_qty_type = strategy.cash, default_qty_value = 150, initial_capital = 1000, currency = currency.USD, commission_type = "percent", commission_value = 0.036)

// The built-in Donchian Channels + an added EMA input which I grouped with the historical bars from the Donchian Channels

length = input(20, minval=1, group = "Indicators")

lower = lowest(length)

upper = highest(length)

basis = avg(upper, lower)

emaInput = input(title = "EMA Input", type = input.integer, defval = 200, minval = 10, maxval = 400, step = 1, group = "Indicators")

// I've made three new inputs, for risk/reward ratio and for the standard pullback deviation. My advise is to not use the pullback inputs as I'm not 100% sure if they work as intended or not

riskreward = input(title = "Risk/Reward Ratio", type = input.float, defval = 1.50, minval = 0.01, maxval = 100, step = 0.01, group = "Risk/Reward")

pullbackLong = input(title = "Distance from Long pullback %", type = input.float, defval = 0.995, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

pullbackShort = input(title = "Distance from Short pullback %", type = input.float, defval = 1.005, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

// Input backtest range, you can adjust these in the input options, just standard stuff

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

// Date variable also standard stuff

inDataRange = (time >= timestamp(syminfo.timezone, fromYear, fromMonth, fromDay, 0, 0)) and (time < timestamp(syminfo.timezone, thruYear, thruMonth, thruDay, 0, 0))

// I had to makes these variables because the system has to remember whether the previous 'breakout' was a high or a low

// Also, because I based my stoploss on the upper/lower band of the indicator I had to find a way to change this value just once without losing the value, that was added, on the next bar

var previousishigh = false

var previousislow = false

var longprofit = 0.0

var shortprofit = 0.0

var stoplossLong = 0.0

var stoplossShort = 0.0

// These are used as our entry variables

emaCheck = ema(close, emaInput)

longcond = high >= upper and close > emaCheck

shortcond = low <= lower and close < emaCheck

// With these two if statements I'm changing the boolean variable above to true, we need this to decide out entry position

if high >= upper

previousishigh := true

if low <= lower

previousislow := true

// Made a last minute change on this part. To clean up our entry signals we don't want our breakouts, while IN a position, to change. This way we do not instantly open a new position, almost always in the opposite direction, upon exiting one

if strategy.position_size > 0 or strategy.position_size < 0

previousishigh := false

previousislow := false

// Strategy inputs

// Long - previous 'breakout' has to be a low, the current price has to be a new high and above the EMA, we're not allowed to be in a position and ofcourse it has to be within our given data for backtesting purposes

if previousislow == true and longcond and strategy.position_size == 0 and inDataRange

strategy.entry("Long Entry", strategy.long, comment = "Entry Long")

stoplossLong := lower * pullbackLong

longprofit := ((((1 - stoplossLong / close) * riskreward) + 1) * close)

strategy.exit("Long Exit", "Long Entry", limit = longprofit, stop = stoplossLong, comment = "Long Exit")

// Short - Previous 'breakout' has to be a high, current price has to be a new low and lowe than the 200EMA, we're not allowed to trade when we're in a position and it has to be within our given data for backtesting purposes

if previousishigh == true and shortcond and strategy.position_size == 0 and inDataRange

strategy.entry("Short Entry", strategy.short, comment = "Entry Short")

stoplossShort := upper * pullbackShort

shortprofit := (close - ((((1 - close / stoplossShort) * riskreward) * close)))

strategy.exit("Short Exit", "Short Entry", limit = shortprofit, stop = stoplossShort, comment = "Short Exit")

// This plots the Donchian Channels on the chart which is just using the built-in Donchian Channels

plot(basis, "Basis", color=color.blue)

u = plot(upper, "Upper", color=color.green)

l = plot(lower, "Lower", color=color.red)

fill(u, l, color=#0094FF, transp=95, title="Background")

// These plots are to show if the variables are working as intended, it's a mess I know but I didn't have any better ideas, they work well enough for me

// plot(previousislow ? close * 0.95 : na, color=color.red, linewidth=2, style=plot.style_linebr)

// plot(previousishigh ? close * 1.05 : na, color=color.green, style=plot.style_linebr)

// plot(longprofit, color=color.purple)

// plot(shortprofit, color=color.silver)

// plot(stoplossLong)

// plot(stoplossShort)

// plot(strategy.position_size)

- Strategie für das Bollinger-Band-System mit doppelten gleitenden Durchschnitten

- Architektur-Breakthrough-Backtesting-Strategie

- Breakout-Strategie auf der Grundlage von Schildkrötenhandel

- Der Trend der DEMA nach der Strategie

- Algorithmus RSI-Range-Breakout-Strategie

- RSI Steigende Krypto-Trend-Strategie

- EMA-Spannungskreuztrend nach Strategie

- TAM Intraday RSI Handelsstrategie

- Exponential Moving Average Crossover-Strategie

- Strategie für die Verlagerung des gleitenden Durchschnitts

- Modell zur Überwachung von Doppel gleitenden Durchschnitten

- Mittelumkehrstrategie auf der Grundlage von ATR

- Relative Volumenentwicklung nach Handelsstrategie

- MACD-Trend-Bilanzierungsstrategie

- EMA und Heikin Ashi Handelsstrategie

- Der Trend nach einer langen Strategie

- Strategie zur Kombination von mehrmodellenhaften Kerzenmustern

- Analyse der Handelsstrategie für die Umkehrung des Kanals

- Handelsstrategie mit doppelter Indikator-Leichte-Umkehr

- Die Strategie des Surf Riders