Trend der doppelten Umkehrung des Schwingungsbandes nach Strategie

Schriftsteller:ChaoZhang, Datum: 2024-01-25 16:01:04Tags:

Übersicht

Die Dual Reversal Oscillating Band Trend Following Strategie kombiniert zwei Umkehrsignale und Oszillating Band Indikatoren, um den Trend nach dem Handel umzusetzen.

Strategieprinzip

123 Umkehrsystem

Kaufen, wenn der Schlusskurs 2 aufeinanderfolgende Tage höher ist als der Schlusskurs des vorherigen Tages und die 9-tägige langsame K-Linie unter 50 liegt; verkaufen, wenn der Schlusskurs 2 aufeinanderfolgende Tage niedriger ist als der vorherige Tag und die 9-tägige schnelle K-Linie über 50 liegt.

Fractal Chaos Bands Indikator

Vorteile der Strategie

Die Dual Reversal Oscillating Band Trend Following Strategie kann sowohl Umkehrchancen als auch Trends verfolgen, was sie sehr umfassend macht.

- Reduzierung falscher Signale und Verbesserung der Gewinnrate

Im Vergleich zu einem einzelnen Indikator kann diese Strategie falsche Signale erheblich reduzieren und die tatsächliche Handelsgewinnrate und -gewinnrate durch das Filtern von Kombinationen von zwei Indikatoren verbessern.

- Flexible Anpassung der Parameter und starke Anpassungsfähigkeit

Risiken und Optimierung

- Unfähigkeit, sich an wichtige Trends anzupassen

- Kann mehrere Indikatoren zur Filterung kombinieren

Schlussfolgerung

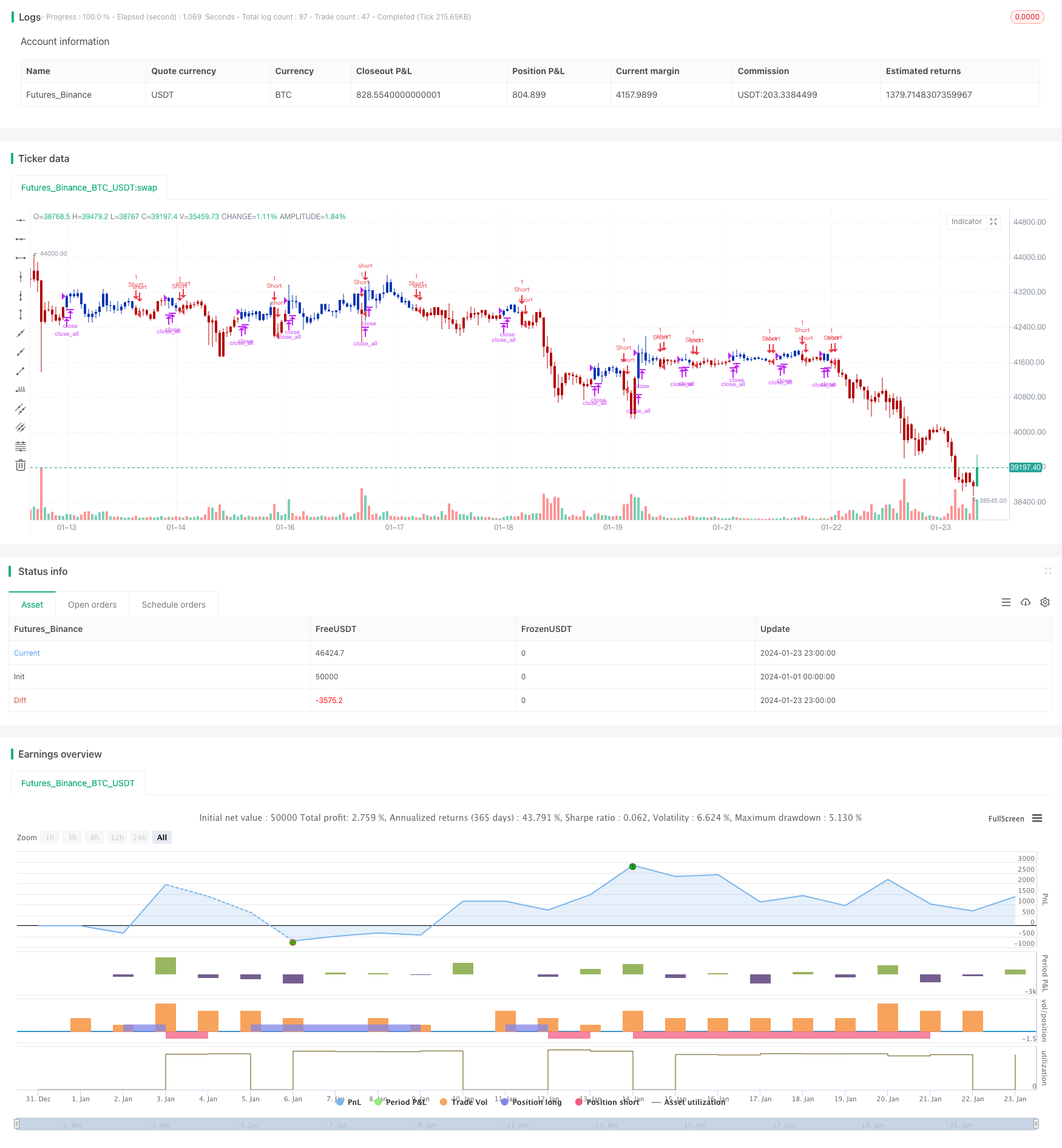

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/09/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Stock market moves in a highly chaotic way, but at a larger scale, the movements

// follow a certain pattern that can be applied to shorter or longer periods of time

// and we can use Fractal Chaos Bands Indicator to identify those patterns. Basically,

// the Fractal Chaos Bands Indicator helps us to identify whether the stock market is

// trending or not. When a market is trending, the bands will have a slope and if market

// is not trending the bands will flatten out. As the slope of the bands decreases, it

// signifies that the market is choppy, insecure and variable. As the graph becomes more

// and more abrupt, be it going up or down, the significance is that the market becomes

// trendy, or stable. Fractal Chaos Bands Indicator is used similarly to other bands-indicator

// (Bollinger bands for instance), offering trading opportunities when price moves above or

// under the fractal lines.

//

// The FCB indicator looks back in time depending on the number of time periods trader selected

// to plot the indicator. The upper fractal line is made by plotting stock price highs and the

// lower fractal line is made by plotting stock price lows. Essentially, the Fractal Chaos Bands

// show an overall panorama of the price movement, as they filter out the insignificant fluctuations

// of the stock price.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res =0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCB(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

pos := iff(close > xUpper, 1,

iff(close < xLower, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Bands", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCB = FCB(Pattern)

pos = iff(posReversal123 == 1 and posFCB == 1 , 1,

iff(posReversal123 == -1 and posFCB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Kurzfristige Strategie der linearen Regression und des doppelten gleitenden Durchschnitts

- Dreifach überlappende Stochastik-Momentumsstrategie

- Strategie für die Dynamikentwicklung

- Momentum Moving Average Crossover Quant Strategie

- Kombinationsstrategie der doppelten Umkehrung des gleitenden Durchschnitts und des ATR Trailing Stop

- Handelsstrategie mit Leveraged Martingale-Futures

- Momentum Pullback-Strategie

- Zweikandelsvorhersage Schließstrategie

- Stochastic Supertrend Tracking Stop Loss Handelsstrategie

- Trend-Nachfolge-Strategie auf Basis von DMI und RSI

- Trendfolgende Strategie mit 3 EMA, DMI und MACD

- Durchbruchsstrategie für Doppelindikatoren

- Pete Wave Handelssystem Strategie

- Quantitative Strategie auf der Grundlage eines exponentiellen gleitenden Durchschnitts und einer Volumengewichtung

- Origix Ashi-Strategie auf Basis eines glätteten gleitenden Durchschnitts

- BlackBit Trader XO Makrotrendenscanner-Strategie

- ADX-Trend für Rohöl nach Strategie

- MT-Koordinierungshandelsstrategie