Dynamische Trendstrategie für die Verschwemmung

Schriftsteller:ChaoZhang, Datum: 2024-02-29 11:24:18Tags:

Übersicht

Die Dynamic Engulfing Trend Strategie ist eine Handelsstrategie, die lange oder kurze Positionen auf der Grundlage von Engulfing-Mustern in die Richtung des Trends nimmt. Diese Strategie verwendet den Average True Range (ATR) zur Messung der Marktvolatilität, den Supertrend-Indikator zur Bestimmung der Markttrendrichtung und tritt in Trades ein, wenn sich die Engulfing-Muster mit der Trendrichtung ausrichten.

Strategie Logik

- Berechnung des ATR zur Messung der Marktvolatilität.

- Berechnung des Supertrend-Indikators zur Ermittlung des Markttrends.

- Definition der Bedingungen für Aufwärtstrend und Abwärtstrend.

- Identifizieren Sie bullish engulfing (in Aufwärtstrend) und bearish engulfing (in Abwärtstrend).

- Berechnen Sie die Stop Loss- (SL) und Take Profit- (TP) -Levels anhand der Absorptionsmuster.

- Trades eingehen, wenn sich die Abnahme-Muster mit der Trendrichtung decken.

- Exit-Trades, wenn der Preis die SL- oder TP-Level erreicht.

- Zeichnen Sie die Verschwemmungsmuster auf der Karte.

Analyse der Vorteile

Zu den Vorteilen dieser Strategie gehören:

- Verbesserte Signalqualität durch Kombination von Verschwemmungsmustern mit Trend.

- Fähigkeit, Trendumkehrungen bei präzisen Einträgen zu erkennen.

- Lange/kurze Signale für ein besseres Timing.

- Die Strategie "Stopp" folgt dem Trend bei gleichzeitiger Risikomanagement.

- Modularer Code-Rahmen für einfache Optimierungen.

Risikoanalyse

Es gibt auch einige Risiken, die zu berücksichtigen sind:

- Verzehrmuster können sich als falsche Ausbrüche erweisen.

- Schwierig, optimale Parameter wie Mustergröße, Dauer usw. zu bestimmen.

- Eine unvollkommene Trendbestimmung kann zu falschen Signalen führen.

- Die Stop-Loss- und Take-Profit-Level beruhen auf Diskretion und können subjektiv sein.

- Die Leistung hängt von der Einstellung der Parameter ab, basierend auf historischen Daten.

Die Risiken können gemildert werden, indem

- Ich füge Filter hinzu, um falsche Ausbruchssignale zu entfernen.

- Anpassungsfähige ATR für robuste Parameterberechnungen.

- Verbesserung der Trendbestimmung durch maschinelles Lernen.

- Optimale Parameter durch genetische Algorithmen finden.

- Zur Gewährleistung der Robustheit wird über längere Zeitspannen geprüft.

Optimierungsrichtlinien

Es gibt Raum für weitere Optimierungen:

- Maschinelles Lernen kann die Trendbestimmung verbessern.

- Neue Mustererkennungsmethoden ermöglichen eine bessere Identifizierung von Schluckmustern.

- Die neuesten Stop-Loss-/Take-Profit-Strategien können die Level dynamisch optimieren.

- Hochfrequenzdaten können kurzfristige Systeme entwickeln.

- Parameter Abstimmung für verschiedene Instrumente.

Schlussfolgerung

Zusammenfassend lässt sich sagen, dass die Dynamic Engulfing Trend-Strategie die hochwertigen Engulfing-Mustersignale mit einer genauen Trendbestimmung kombiniert, um ein Handelssystem mit präzisen Einträgen und angemessenen Stop-Losses und Gewinnentnahme zu generieren. Weitere Verbesserungen bei Parametern, Risikomanagement und Technologieintegration können seine Stabilität und Rentabilität verbessern.

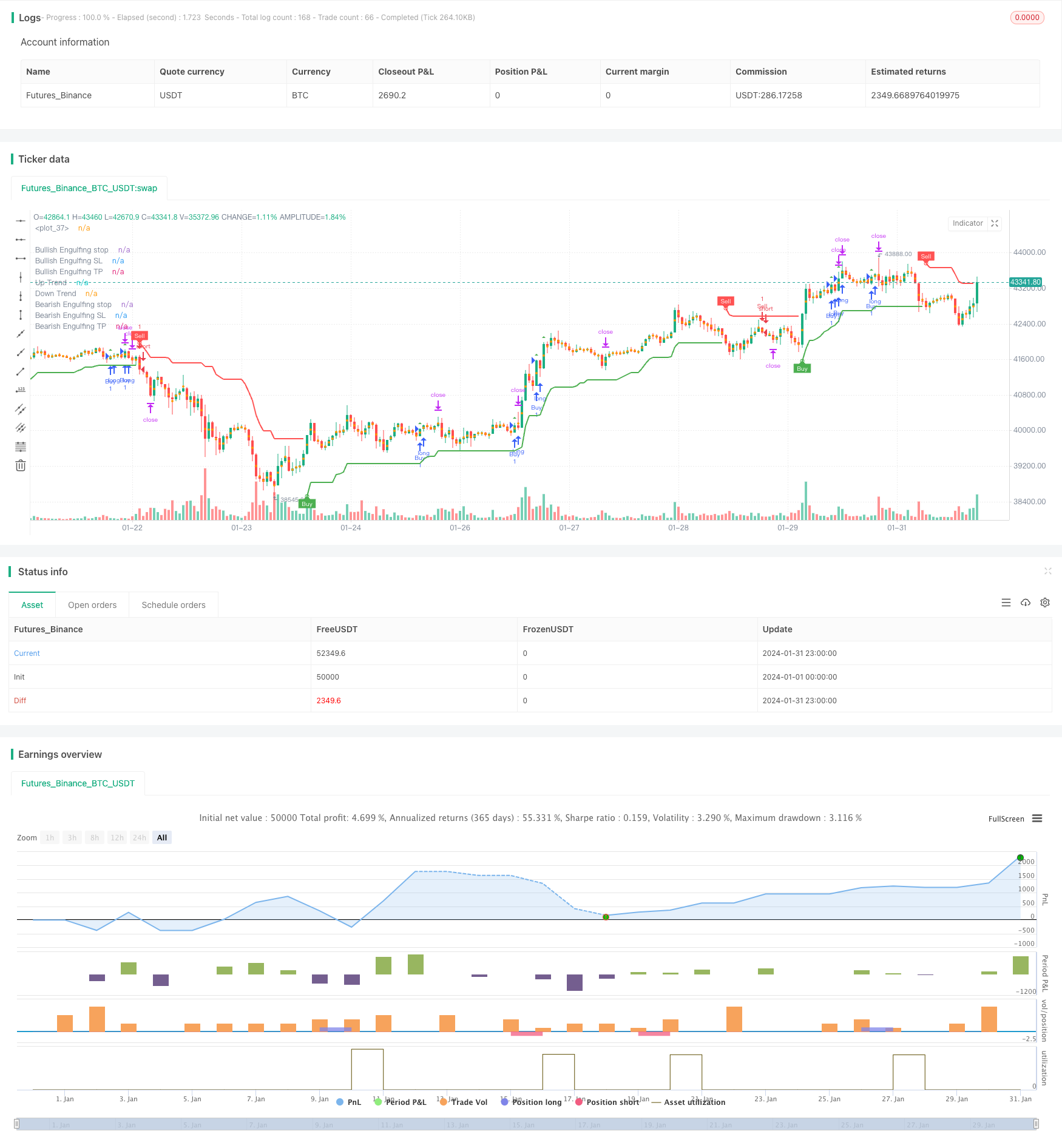

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Malikdrajat

//@version=4

strategy("Engulfing with Trend", overlay=true)

Periods = input(title="ATR Period", type=input.integer, defval=10)

src = input(hl2, title="Source")

Multiplier = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3.0)

changeATR= input(title="Change ATR Calculation Method ?", type=input.bool, defval=true)

showsignals = input(title="Show Buy/Sell Signals ?", type=input.bool, defval=true)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

atr2 = sma(tr, Periods)

atr= changeATR ? atr(Periods) : atr2

up=src-(Multiplier*atr)

up1 = nz(up[1],up)

up := close[1] > up1 ? max(up,up1) : up

dn=src+(Multiplier*atr)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title="Up Trend", style=plot.style_linebr, linewidth=2, color=color.green)

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title="UpTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(buySignal and showsignals ? up : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

dnPlot = plot(trend == 1 ? na : dn, title="Down Trend", style=plot.style_linebr, linewidth=2, color=color.red)

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title="DownTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

plotshape(sellSignal and showsignals ? dn : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? (trend == 1 ? color.green : color.white) : color.white

shortFillColor = highlighting ? (trend == -1 ? color.red : color.white) : color.white

fill(mPlot, upPlot, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, dnPlot, title="DownTrend Highligter", color=shortFillColor)

alertcondition(buySignal, title="SuperTrend Buy", message="SuperTrend Buy!")

alertcondition(sellSignal, title="SuperTrend Sell", message="SuperTrend Sell!")

changeCond = trend != trend[1]

alertcondition(changeCond, title="SuperTrend Direction Change", message="SuperTrend has changed direction!")

// Define Downtrend and Uptrend conditions

downtrend = trend == -1

uptrend = trend == 1

// Engulfing

boringThreshold = input(25, title="Boring Candle Threshold (%)", minval=1, maxval=100, step=1)

engulfingThreshold = input(50, title="Engulfing Candle Threshold (%)", minval=1, maxval=100, step=1)

stopLevel = input(200, title="Stop Level (Pips)", minval=1)

// Boring Candle (Inside Bar) and Engulfing Candlestick Conditions

isBoringCandle = abs(open[1] - close[1]) * 100 / abs(high[1] - low[1]) <= boringThreshold

isEngulfingCandle = abs(open - close) * 100 / abs(high - low) <= engulfingThreshold

// Bullish and Bearish Engulfing Conditions

bullEngulfing = uptrend and close[1] < open[1] and close > open[1] and not isBoringCandle and not isEngulfingCandle

bearEngulfing = downtrend and close[1] > open[1] and close < open[1] and not isBoringCandle and not isEngulfingCandle

// Stop Loss, Take Profit, and Entry Price Calculation

bullStop = close + (stopLevel * syminfo.mintick)

bearStop = close - (stopLevel * syminfo.mintick)

bullSL = low

bearSL = high

bullTP = bullStop + (bullStop - low)

bearTP = bearStop - (high - bearStop)

// Entry Conditions

enterLong = bullEngulfing and uptrend

enterShort = bearEngulfing and downtrend

// Exit Conditions

exitLong = crossover(close, bullTP) or crossover(close, bullSL)

exitShort = crossover(close, bearTP) or crossover(close, bearSL)

// Check if exit conditions are met by the next candle

exitLongNextCandle = exitLong and (crossover(close[1], bullTP[1]) or crossover(close[1], bullSL[1]))

exitShortNextCandle = exitShort and (crossover(close[1], bearTP[1]) or crossover(close[1], bearSL[1]))

// Strategy Execution

strategy.entry("Buy", strategy.long, when=enterLong )

strategy.entry("Sell", strategy.short, when=enterShort )

// Exit Conditions for Long (Buy) Positions

if (bullEngulfing and not na(bullTP) and not na(bullSL))

strategy.exit("Exit Long", from_entry="Buy", stop=bullSL, limit=bullTP)

// Exit Conditions for Short (Sell) Positions

if (bearEngulfing and not na(bearTP) and not na(bearSL))

strategy.exit("Exit Short", from_entry="Sell", stop=bearSL, limit=bearTP)

// Plot Shapes and Labels

plotshape(bullEngulfing, style=shape.triangleup, location=location.abovebar, color=color.green)

plotshape(bearEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red)

// Determine OP, SL, and TP

plot(bullEngulfing ? bullStop : na, title="Bullish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearStop : na, title="Bearish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bullEngulfing ? bullSL : na, title="Bullish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearSL : na, title="Bearish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bullEngulfing ? bullTP : na, title="Bullish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearTP : na, title="Bearish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

- Momentum-Crossover-Strategie mit dynamischem Trailing-Stop Loss

- Quantitative Handelsstrategie der EMA und des RSI

- Momentum-Trend-Strategie auf Basis von MACD und Bollinger-Bändern

- Mehrzeitrahmen-Stochastikstrategie

- Bewegliche durchschnittliche Crossover-Strategie mit Intraday-Candlestick-Mustern

- Bitcoin-Scalping-Strategie basierend auf gleitenden Durchschnitts-Crossover- und Candlestick-Mustern

- Kombination von Momentum und gleitendem Durchschnitt Langstrategie

- Momentum Durchschnittlicher Richtungsbewegungsindex Bewegtem Durchschnitt Kreuzungstrategie

- Strategie zur Beobachtung der Trendentwicklung durch doppelte EMA-Kreuzungen

- Handelsstrategie für die Kombination von doppelten gleitenden Durchschnitten und MACD

- Handelsstrategie für einen Rückschlag auf den gleitenden Durchschnitt in mehreren Zeitrahmen

- Strategie zur Beobachtung der Volatilität doppelter gleitender Durchschnitte

- Kurzfristige Handelsstrategie auf Basis von Bollinger-Bändern

- Trend-Riding-Strategie auf Basis von MOST und KAMA

- Doppelzeitrahmen-Trend nach Strategie

- Bitlinc MARSI Handelsstrategie

- Die Bollinger-Band-Verfolgungsstrategie

- SuperTrend-Ausbruchstrategie

- Die Analyse der Doppel-EMA-Strategie

- Die Durchbruchs-Rückruf-Handelstrategie