Quantitatives Handelssignal-Tracking und diversifiziertes System zur Optimierung der Exit-Strategie

Überblick

Die Strategie ist ein auf LuxAlgo® Signalen und überlagerten Indikatoren basierendes quantitatives Handelssystem. Es eröffnet mehrere Positionen, indem es benutzerdefinierte Warnbedingungen erfasst, und verwaltet die Positionen in Kombination mit mehreren Ausstiegssignalen. Das System ist modular aufgebaut und unterstützt die Kombination mehrerer Ausstiegsbedingungen, einschließlich intelligenter Stop-Loss-Verfolgung, Trendwende-Bestätigung und traditioneller Prozentsatz-Stopps.

Strategieprinzip

Die Kernlogik der Strategie umfasst die folgenden Schlüsselelemente:

- Eintrittssignalsystem: Multi-Head-Eintrittssignal wird durch eine benutzerdefinierte LuxAlgo®-Alarm-Bedingung ausgelöst.

- Aktienmanagement: Aktienmanagement kann optional aktiviert werden, um eine Position auf der Basis einer bestehenden Position zu erhöhen.

- Mehrstufige Ausstiegsmechanismen:

- Smart Tracking Stop Loss: Die Beziehung zwischen Monitoringpreisen und Smart Tracking Lines

- Trend Bestätigung Ausstieg: Blank Bestätigungssignale für Basis- und Verstärkungsversionen

- Eingebettetes Ausstiegssignal: Mehrfache Ausstiegsbedingungen, die von der Anzeige selbst erzeugt werden

- Traditionelle Stop-Loss: Unterstützung von prozentualen, festen Stop-Loss-Einstellungen

- Zeitfensterverwaltung: Flexible Einstellungen für den Datumsbereich der Rückmessung.

Strategische Vorteile

- Systematisches Risikomanagement: Die Abwärtsrisiken werden durch mehrstufige Ausstiegsmechanismen wirksam kontrolliert.

- Flexible Positionsverwaltung: Unterstützt verschiedene Strategien zum Auf- und Abnehmen von Positionen, die sich dynamisch an die Marktbedingungen anpassen können.

- Hohe Anpassbarkeit: Benutzer können verschiedene Ausstiegsbedingungen kombinieren, um ein personalisiertes Handelssystem zu erstellen.

- Modulares Design: Die einzelnen Funktionsmodule sind relativ unabhängig, was die Wartung und Optimierung erleichtert.

- Vollständige Retrospektive-Unterstützung: bietet detaillierte Retrospektive-Parameter-Einstellungen und unterstützt historische Datenüberprüfung.

Strategisches Risiko

- Signalabhängigkeitsrisiken: Die Strategie ist stark von der Signalqualität der LuxAlgo®-Indikatoren abhängig.

- Marktanpassungsrisiken: Die Strategie kann in unterschiedlichen Marktumgebungen unterschiedlich gut funktionieren.

- Parameter-Sensitivitätsrisiken: Eine Kombination von mehreren Ausstiegsbedingungen kann zu einem vorzeitigen Ausstieg oder einer verpassten Chance führen.

- Liquiditätsrisiko: Die Effektivität von Ein- und Ausstiegsgeschäften kann beeinträchtigt werden, wenn die Marktliquidität gering ist.

- Technische Realisierungsrisiken: Die Notwendigkeit, den stabilen Betrieb von Indikatoren und Strategien zu gewährleisten, um technische Störungen zu vermeiden.

Richtung der Strategieoptimierung

- Optimierung des Signalsystems:

- Einführung von mehr technischen Kennzahlen für die Signalerkennung

- Entwicklung von adaptiven Signal-Throughput-Mechanismen

- Erhöhung der Risikokontrollen:

- Verlustmechanismen, die sich an die Volatilität anpassen

- Entwicklung eines dynamischen Positionsmanagementsystems

- Leistungsoptimierung:

- Optimierung der Rechenleistung und Verringerung des Ressourcenverbrauchs

- Verbesserte Signalverarbeitungslogik, um die Verzögerung zu reduzieren

- Funktionserweiterung:

- Weitere Analyse-Tools für die Marktumgebung

- Entwicklung eines flexibleren Rahmenwerks für die Optimierung von Parametern

Zusammenfassen

Durch die Kombination von LuxAlgo® hochwertigen Signalen und einem mehrschichtigen Risikomanagementsystem bietet die Strategie eine Komplettlösung für quantitative Transaktionen. Ihr modulares Design und ihre flexiblen Konfigurationsoptionen machen sie sehr anpassungsfähig und skalierbar. Obwohl einige inhärente Risiken vorhanden sind, besteht durch kontinuierliche Optimierung und Verbesserung noch viel Raum für eine Verbesserung der Gesamtperformance der Strategie.

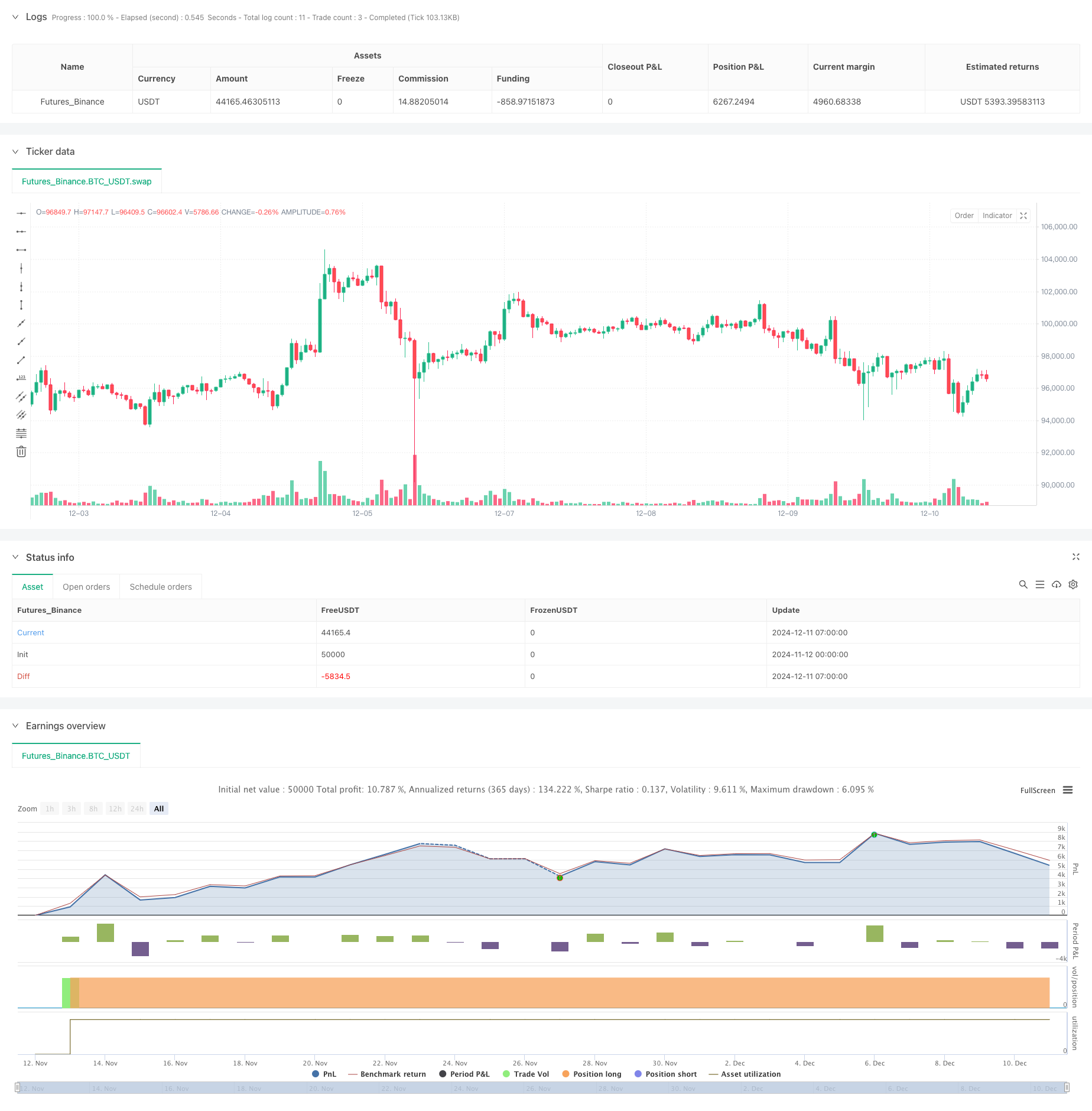

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Chart0bserver

// This strategy is NOT from the LuxAlgo® developers. We created this to compliment their hard work. No association with LuxAlgo® is intended nor implied.

// Please visit https://chart.observer to test your Tradingview Strategies in our paper-trading sandbox environment. Webhook your alerts to our API.

// Past performance does not ensure future results. This strategy provided with absolutely no warranty and is for educational purposes only

// The goal of this strategy is to enter a long position using the Custom Alert condition feature of LuxAlgo® Signals & Overlays™ indicator

// To trigger an exit from the long position, use one or more of the common exit signals which the Signals & Overlays™ indicator provides.

// You will need to connect those signals to this strategy in the dialog box.

// We're calling this a "piggyback" strategy because the LuxAlgo® Signals & Overlays indicator must be present, and remain on the chart.

// The Signals and Overlays™ indicator is invite-only, and requires a paid subscription from LuxAlgo® - https://luxalgo.com/?rfsn=8404759.b37a73

//@version=6

strategy("Simple Backtester for LuxAlgo® Signals & Overlays™", "Simple Backtester for LuxAlgo® S&O ", true, pyramiding=3, default_qty_type = 'percent_of_equity', calc_on_every_tick = true, process_orders_on_close=false, calc_on_order_fills=true, default_qty_value = 33, initial_capital = 10000, currency = currency.USD, commission_type = format.percent, commission_value = 0.10 )

// Initialize a flag to track order placement

var bool order_placed = false

// Reset the flag at the start of each new bar

if (not na(bar_index) and bar_index != bar_index[1])

order_placed := false

// === Inputs which the user needs to change in the configuration dialog to point to the corresponding LuxAlgo alerts === //

// === The Signals & Overlays indicator must be present on the chart in order for this to work === //

la_EntryAlert = input.source(close, "LuxAlgo® Custom Alert signal", "Replace 'close' with your LuxAlgo® entry signal. For example, try using their Custom Alert.", display=display.none, group="Enter Long Position")

useAddOnTrades = input.bool(false, "Add to your long position on LuxAlgo® signals", display=display.none, group="Add-On Trade Signal for Longs")

la_AddOnAlert = input.source(close, "Add to open longs with this signal", "Replace 'close' with your desired Add-On Trade Signal", display=display.none, group="Add-On Trade Signal for Longs")

la_SmartTrail = input.source(close, "LuxAlgo® Smart Trail", "Replace close with LuxAlgo® Smart Trail", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_BearishConfirm = input.source(close, "LuxAlgo® Any Bearish Confirmation", "Replace close with LuxAlgo® Any Bearish Confirmation", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_BearishConfirmPlus = input.source(close, "LuxAlgo® Bearish Confirmation+", "Replace close with LuxAlgo® Bearish Confirmation+", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_BuiltInExits = input.source(close, "LuxAlgo® Bullish Exit", "Replace close with LuxAlgo® Bullish Exit", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

la_TrendCatcherDn = input.source(close, "LuxAlgo® Trend Catcher Down", "Replace close with LuxAlgo® Trend Catcher Down", display=display.none, group="LuxAlgo® Signals & Overlays™ Alerts")

// === Check boxes alowing the user to select exit criteria from th long position === //

exitOnSmartTrail = input.bool(true, "Exit long trade on Smart Trail Switch Bearish", group="Exit Long Conditions")

exitOnBearishConf = input.bool(false, "Exit on Any Bearish Confirmation", group="Exit Long Conditions")

exitOnBearishConfPlus = input.bool(true, "Exit on Bearish Confirmation+", group="Exit Long Conditions")

exitOnBuiltInExits = input.bool(false, "Exit on Bullish Exits", group="Exit Long Conditions")

exitOnTrendCatcher = input.bool(false, "Exit on Trend Catcher Down", group="Exit Long Conditions")

// === Optional Stop Loss ===//

useStopLoss = input.bool(false, "Use a Stop Loss", group="Optional Stop Loss")

stopLossPercent = input.float(0.25, "Stop Loss %", minval=0.25, step=0.25, group="Optional Stop Loss")

// Use Lux Algo's signals as part of your strategy logic

buyCondition = la_EntryAlert > 0

if useAddOnTrades and la_AddOnAlert > 0 and strategy.opentrades > 0 and not buyCondition

buyCondition := true

sellCondition = false

sellComment = ""

if exitOnSmartTrail and ta.crossunder(close, la_SmartTrail)

sellCondition := true

sellComment := "Smart Trail"

if exitOnBearishConf and la_BearishConfirm == 1

sellCondition := true

sellComment := "Bearish"

if exitOnBearishConfPlus and la_BearishConfirmPlus == 1

sellCondition := true

sellComment := "Bearish+"

if exitOnBuiltInExits and la_BuiltInExits == 1

sellCondition := true

sellComment := "Bullish Exit"

if exitOnTrendCatcher and la_TrendCatcherDn == 1

sellCondition := true

sellComment := "Trnd Over"

// Stop Loss Calculation

stopLossMultiplyer = 1 - (stopLossPercent / 100)

float stopLossPrice = na

if strategy.position_size > 0

stopLossPrice := strategy.position_avg_price * stopLossMultiplyer

// -----------------------------------------------------------------------------------------------------------//

// Back-testing Date Range code ----------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

fromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12, group='Back-Testing Date Range')

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31, group='Back-Testing Date Range')

fromYear = input.int(defval=2024, title='From Year', minval=1970, group='Back-Testing Date Range')

thruMonth = 1

thruDay = 1

thruYear = 2112

// === START/FINISH FUNCTION ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time

time >= start and time <= finish ? true : false

// End Date range code -----//

if buyCondition and window() and not order_placed

strategy.entry("Long", strategy.long)

order_placed := true

if sellCondition and window() and not order_placed

strategy.close("Long", comment=sellComment)

order_placed := true

if useStopLoss and window()

strategy.exit("Stop", "Long", stop=stopLossPrice)