概述

该策略是一个结合了双移动平均线和MACD指标的趋势跟踪系统。它利用50期和200期移动平均线来确定趋势方向,同时使用MACD指标捕捉具体的入场时机。策略采用了动态的止盈止损机制,并通过多重过滤条件来提高交易质量。这是一个在15分钟时间框架上运行的完整交易系统,具有精确的入场和出场规则。

策略原理

策略的核心逻辑建立在以下几个关键要素上: 1. 趋势判断:使用50均线和200均线的位置关系判断整体趋势,当快速均线在慢速均线之上时判断为上升趋势,反之为下降趋势。 2. 入场信号:在确认趋势方向后,使用MACD指标的交叉来触发具体的入场信号。在上升趋势中,MACD线上穿信号线时入场做多;在下降趋势中,MACD线下穿信号线时入场做空。 3. 交易过滤:引入了最小交易间隔、趋势强度和MACD阈值等多重过滤机制,以避免在波动剧烈的市场环境中过度交易。 4. 风险控制:采用固定点数的止损和可调节的止盈机制,同时结合移动均线和MACD的反向信号作为动态退场条件。

策略优势

- 趋势跟踪与动量结合:通过结合移动均线和MACD指标,既能把握大趋势,又能准确定位入场时机。

- 完善的风险管理:设置了多重止损机制,包括固定止损和技术指标触发的动态止损。

- 灵活的参数设置:关键参数如止损止盈点数、均线周期等都可以根据市场情况灵活调整。

- 智能过滤机制:通过多重过滤条件减少假信号,提高交易质量。

- 完整的性能统计:内置了详细的交易统计功能,包括胜率、平均盈亏等关键指标的实时计算。

策略风险

- 震荡市场风险:在横盘震荡市场中可能产生频繁的假信号,建议增加趋势确认指标。

- 滑点风险:小周期交易容易受到滑点影响,建议适当放宽止损设置。

- 参数敏感性:策略表现对参数设置较为敏感,需要经过充分的参数优化。

- 市场环境依赖:策略在强趋势市场表现较好,但在其他市场环境中效果可能不稳定。

策略优化方向

- 动态止损优化:可以根据ATR指标动态调整止损幅度,使其更适应市场波动。

- 入场时机优化:可以添加RSI等辅助指标来确认入场时机,提高交易准确率。

- 仓位管理优化:引入基于波动率的动态仓位管理系统,更好地控制风险。

- 市场环境识别:增加市场环境识别模块,在不同市场条件下使用不同的参数组合。

总结

这是一个设计合理、逻辑完整的趋势跟踪交易系统。通过结合经典的技术指标和现代的风险管理方法,该策略在把握趋势的同时也注重对风险的控制。尽管存在一些需要优化的地方,但整体而言是一个具有实用价值的交易策略。建议交易者在实盘使用前进行充分的回测,并根据具体的交易品种和市场环境对参数进行适当调整。

策略源码

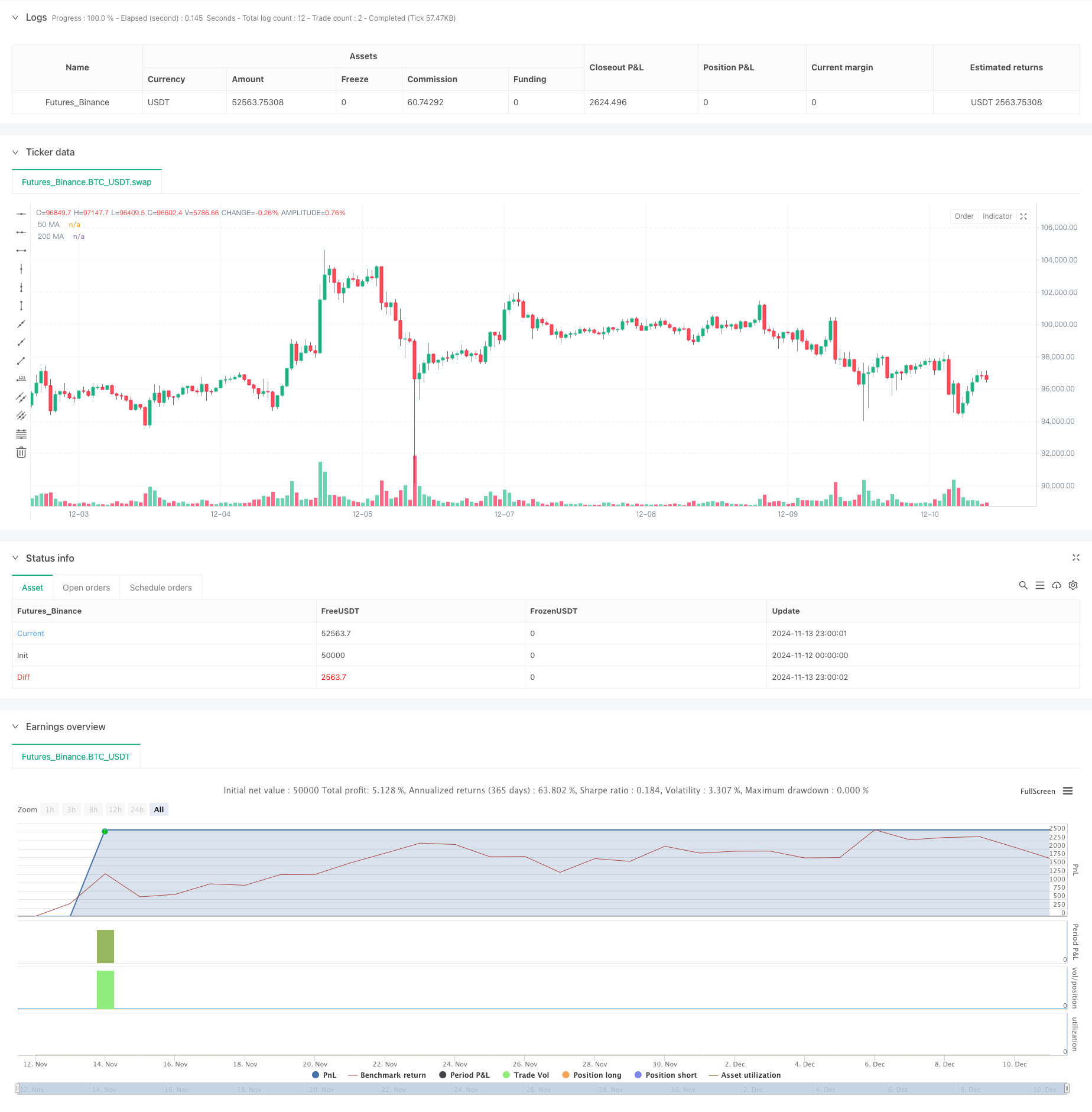

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © WolfofAlgo

//@version=5

strategy("Trend Following Scalping Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Input Parameters

stopLossPips = input.float(5.0, "Stop Loss in Pips", minval=1.0)

takeProfitPips = input.float(10.0, "Take Profit in Pips", minval=1.0)

useFixedTakeProfit = input.bool(true, "Use Fixed Take Profit")

// Moving Average Parameters

fastMA = input.int(50, "Fast MA Period")

slowMA = input.int(200, "Slow MA Period")

// MACD Parameters

macdFastLength = input.int(12, "MACD Fast Length")

macdSlowLength = input.int(26, "MACD Slow Length")

macdSignalLength = input.int(9, "MACD Signal Length")

// Trade Filter Parameters (Adjusted to be less strict)

minBarsBetweenTrades = input.int(5, "Minimum Bars Between Trades", minval=1)

trendStrengthPeriod = input.int(10, "Trend Strength Period")

minTrendStrength = input.float(0.4, "Minimum Trend Strength", minval=0.1, maxval=1.0)

macdThreshold = input.float(0.00005, "MACD Threshold", minval=0.0)

// Variables for trade management

var int barsLastTrade = 0

barsLastTrade := nz(barsLastTrade[1]) + 1

// Calculate Moving Averages

ma50 = ta.sma(close, fastMA)

ma200 = ta.sma(close, slowMA)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

// Calculate trend strength (simplified)

trendDirection = ta.ema(close, trendStrengthPeriod) > ta.ema(close, trendStrengthPeriod * 2)

isUptrend = close > ma50 and ma50 > ma200

isDowntrend = close < ma50 and ma50 < ma200

// Calculate pip value

pointsPerPip = syminfo.mintick * 10

// Entry Conditions with Less Strict Filters

macdCrossUp = ta.crossover(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

macdCrossDown = ta.crossunder(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

// Long and Short Conditions

longCondition = close > ma50 and macdCrossUp and barsLastTrade >= minBarsBetweenTrades and isUptrend

shortCondition = close < ma50 and macdCrossDown and barsLastTrade >= minBarsBetweenTrades and isDowntrend

// Exit Conditions (made more lenient)

exitLongCondition = macdCrossDown or close < ma50

exitShortCondition = macdCrossUp or close > ma50

// Reset bars counter on new trade

if (longCondition or shortCondition)

barsLastTrade := 0

// Calculate stop loss and take profit levels

longStopPrice = strategy.position_avg_price - (stopLossPips * pointsPerPip)

longTakeProfitPrice = strategy.position_avg_price + (takeProfitPips * pointsPerPip)

shortStopPrice = strategy.position_avg_price + (stopLossPips * pointsPerPip)

shortTakeProfitPrice = strategy.position_avg_price - (takeProfitPips * pointsPerPip)

// Plot Moving Averages

plot(ma50, "50 MA", color=color.blue)

plot(ma200, "200 MA", color=color.red)

// Plot Entry Signals

plotshape(longCondition, "Long Signal", shape.triangleup, location.belowbar, color.green, size=size.small)

plotshape(shortCondition, "Short Signal", shape.triangledown, location.abovebar, color.red, size=size.small)

// Strategy Entry Rules

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short", strategy.short)

// Strategy Exit Rules

if (strategy.position_size > 0 and exitLongCondition)

strategy.close("Long")

if (strategy.position_size < 0 and exitShortCondition)

strategy.close("Short")

// Stop Loss and Take Profit Management

if (strategy.position_size > 0)

strategy.exit("Long TP/SL", "Long", stop=longStopPrice, limit=useFixedTakeProfit ? longTakeProfitPrice : na)

if (strategy.position_size < 0)

strategy.exit("Short TP/SL", "Short", stop=shortStopPrice, limit=useFixedTakeProfit ? shortTakeProfitPrice : na)

// Performance Metrics

var float totalTrades = 0

var float winningTrades = 0

var float totalProfitPips = 0

var float totalLossPips = 0

if (strategy.closedtrades > 0)

totalTrades := strategy.closedtrades

winningTrades := strategy.wintrades

totalProfitPips := strategy.grossprofit / pointsPerPip

totalLossPips := math.abs(strategy.grossloss) / pointsPerPip

// Display Stats

var label statsLabel = na

label.delete(statsLabel[1])

// Create performance stats text

var string stats = ""

if (strategy.closedtrades > 0)

winRate = (winningTrades / math.max(totalTrades, 1)) * 100

avgWin = totalProfitPips / math.max(winningTrades, 1)

avgLoss = totalLossPips / math.max(totalTrades - winningTrades, 1)

plRatio = avgWin / math.max(avgLoss, 1)

stats := "Win Rate: " + str.tostring(winRate, "#.##") + "%\n" +

"Avg Win: " + str.tostring(avgWin, "#.##") + " pips\n" +

"Avg Loss: " + str.tostring(avgLoss, "#.##") + " pips\n" +

"P/L Ratio: " + str.tostring(plRatio, "#.##") + "\n" +

"Total Trades: " + str.tostring(totalTrades, "#")

statsLabel := label.new(x=bar_index, y=high, text=stats, style=label.style_label_down, color=color.new(color.blue, 80))

相关推荐

- 双均线交叉趋势追踪策略结合动态止盈止损系统

- 三重均线动量趋势交易策略

- 双均线交叉带定时交易窗口与止盈止损策略

- 多重EMA交叉趋势跟踪与动态止盈止损优化策略

- 双均线趋势捕捉策略结合动态止损和过滤器

- 高级量化交易多均线交叉体系配合成交量过滤策略

- 自适应移动平均交叉追踪止损策略

- 高级MACD均线交叉交易策略结合自适应风险管理

- 多重指标趋势交叉结合ATR动态波动策略

- 均值回归增强型MACD-ATR策略

更多内容

- TradingView信号执行策略(内建Http服务版本)

- 基于RSI和MACD的五日内交叉灵活入场策略优化版本研究

- 基于双RSI指标的自适应波段交易系统

- 动态双重超趋势量价策略

- 黑天鹅波动与均线交叉动量跟踪策略

- 布林带结合超级趋势的智能波动区间交易策略

- 多指标协同趋势跟踪策略与动态止损系统

- 基于波林格带动量突破的自适应趋势跟踪交易策略

- 均值回归增强型MACD-ATR策略

- 量化交易信号追踪与多样化退出策略优化系统

- 三倍标准差布林带突破量化交易策略结合百日均线优化

- EMA趋势交叉动态入场量化策略

- 多重波浪趋势交叉风险管理量化策略

- 双均线随机指标趋势跟踪交易策略

- 动态趋势跟踪多周期均线交叉策略

- 双重动量突破确认量化交易策略

- MACD-RSI趋势动量交叉策略结合风险管理模型

- 多周期均线穿越结合RSI动量与ATR波动率的趋势跟踪策略

- 双均线交叉风险收益智能调控策略

- 多均线组合趋势跟踪战略-基于EMA与SMA指标的长期投资信号系统