Trading strategies based on box theory that support commodity futures and digital currencies

Author: , Created: 2019-07-20 16:23:14, Updated: 2023-10-23 17:32:55[TOC]

Origin of the box theory

The first contact with box theory was in the book How I Made 2 Million Pounds from the Stock Market by author Nicholas Davas, who invested the money he earned in stocks after each world tour and made $2 million in just a few short years using his method of box theory.

This was so incredible at the time that he was even covered by the periodical The Times. He later wrote several books on his trading history and methods.

What is box theory?

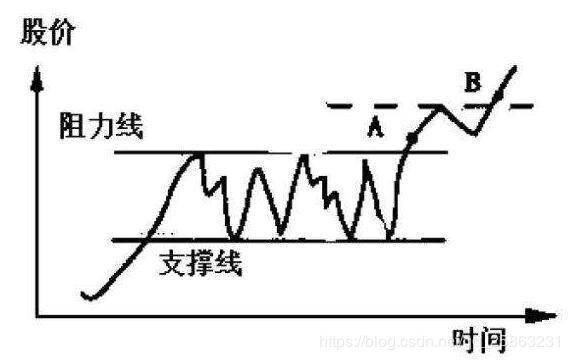

The so-called box body, also known as a form, is based on the support and resistance lines. Usually, when the price rises to a previous high, there is a sell-pressure price rebound, and when the price falls to a previous low, there is a buy-pressure that raises the price. If the price moves up and down in this way several times, a box body can be formed based on the historical highs and lows of the price over a period of time. The concept of a box is a subjective definition of an artificial, theoretical box that acts as an up-and-down resistance and support, and the price will always move up and down inside the box. Once the price breaks the box, it means that it is a multihead force that is stronger than the resistance line, and the future price may form a multihead trend and rise to another box that is expected. Conversely, once the price breaks down, it means that it is a vacuum force that is stronger than the stock's support line, and the future price may form a multihead trend and fall to another box that is expected.

The concept of a box is a subjective definition of an artificial, theoretical box that acts as an up-and-down resistance and support, and the price will always move up and down inside the box. Once the price breaks the box, it means that it is a multihead force that is stronger than the resistance line, and the future price may form a multihead trend and rise to another box that is expected. Conversely, once the price breaks down, it means that it is a vacuum force that is stronger than the stock's support line, and the future price may form a multihead trend and fall to another box that is expected.

The essence of box theory

The idea of the box theory is to measure possible future prices through price boxes, which predict that prices will reach higher boxes when they break above the top of the box. Conversely, prices will reach lower boxes when they break below the bottom. Thus, when the price is effectively up at the top of the breakout, the previous resistance line becomes a support line, and the price enters an upward cycle or a higher box at some future time. Similarly, when the price is effectively down at the bottom of the breakout, the previous support line becomes a resistance line, and the price enters a downward cycle or a lower box at some future time.

Thus, when the price is effectively up at the top of the breakout, the previous resistance line becomes a support line, and the price enters an upward cycle or a higher box at some future time. Similarly, when the price is effectively down at the bottom of the breakout, the previous support line becomes a resistance line, and the price enters a downward cycle or a lower box at some future time.

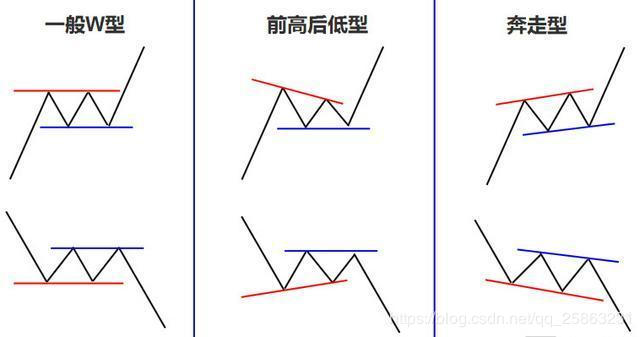

Of course, the actual box shape is not the same as a box in the market, and we know that the price movement is not always a regular pattern, as shown above, sometimes the box will present a standard W-type or M-type, but sometimes it will also appear in a front-high-low or front-low-high shape, or even a flag-like shape.

Formulas and strategic logic of body theory

- Support price = closing price lowest of cycle N

- Resistance price = closing price at the highest of N cycles

- Box height = resistor - support price

The box theory My language

N=50;

PRICE:=(OPEN+HIGH+LOW+CLOSE*2)/5;

UPPERBAND:REF(HHV(PRICE,N),1);

LOWERBAND:REF(LLV(PRICE,N),1);

C>=UPPERBAND,BPK;

C<=LOWERBAND,SPK;

WWW.FMZ.COM:C,NODRAW;

MID=(UPPERBAND+LOWERBAND)/2;

C<MID||C<LLV(PRICE,N/2),SP;

C>MID||C>HHV(PRICE,N/2),BP;

AUTOFILTER;

The above is a trading strategy based on box theory that supports commodity futures and digital currencies. At the top and bottom of the box, there are no highs and lows, but an average of the opening price + the highest price + the lowest price + 2 times the closing price.

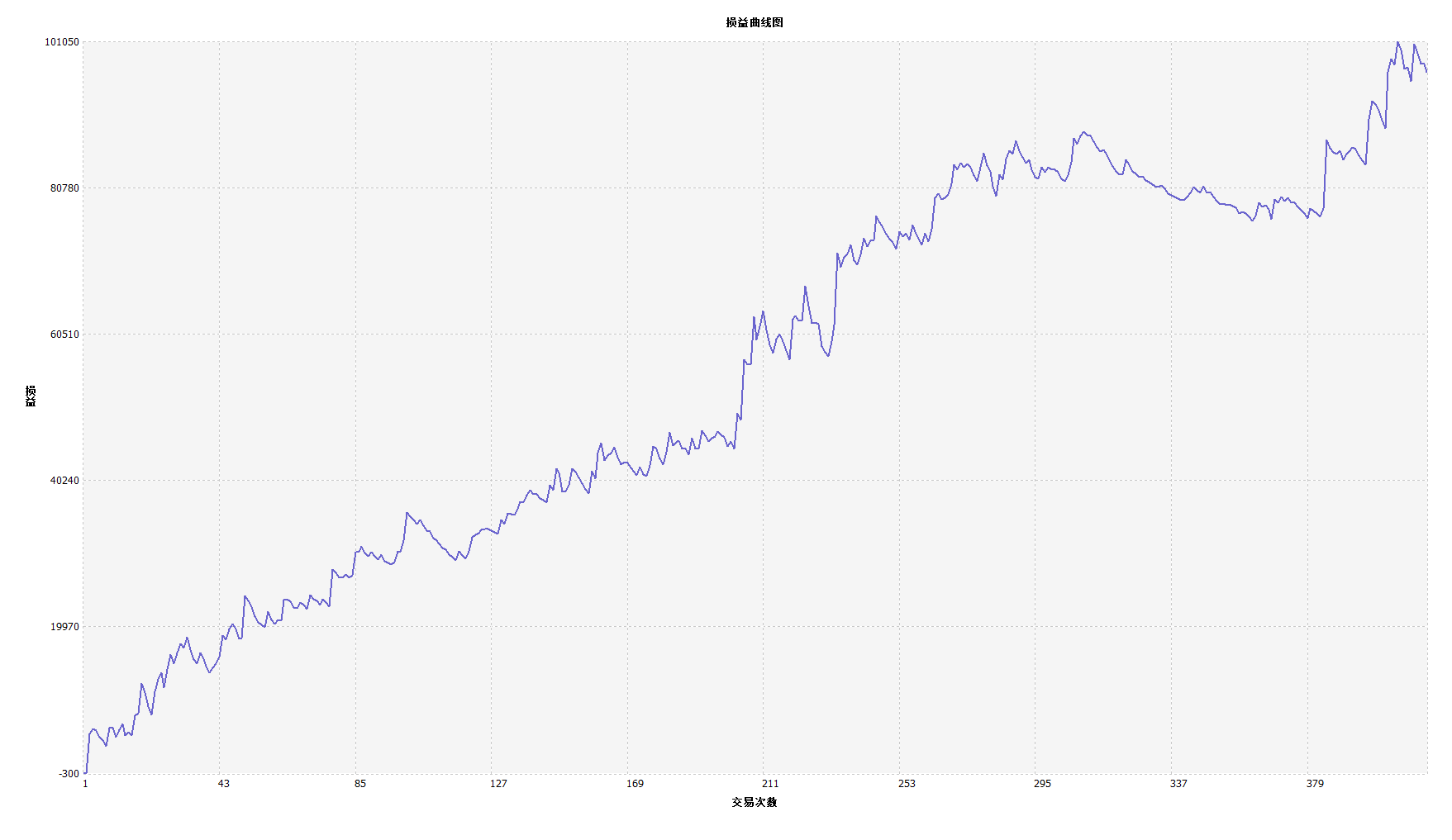

Strategic retesting

In order to get closer to the real trading environment, we used a stress test with 2 jumps in the open position and 2 times the transaction fees in the retest, testing the environment as follows:

- Industry: Iron ore index

- Trade varieties: mainly iron ore

- Time: from 23 October 2013 to 18 July 2019

- Cycle: hour line

- Slide point: 2 jumps to the open position

- Fee: Exchange doubled

The funding curve

Overall, the reassessed capital curve is steadily upward, and the strategy performs well when market trends are fluid, whether in a bullish or bearish market. Basically, every larger trend market can profit.

Overall, the reassessed capital curve is steadily upward, and the strategy performs well when market trends are fluid, whether in a bullish or bearish market. Basically, every larger trend market can profit.

Copying policy source code

The source code of the strategy has been released to:https://www.fmz.com/strategy/158088In addition to the above, you will also be able to download and download the online version of the game.

Summary

As an ancient method of trading, the box theory is still alive in today's domestic commodity futures and digital currencies. Although this strategy is relatively simple, the shortcut is equally applicable in the field of traders. A correct strategic framework is not concerned with the ups and downs of each trade, but rather from a global perspective, as long as the strategy is in line with the win-lose ratio, it can be maintained for a stable profit in the long term.

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Implementation and application of the inventor quantified platform in the fall line trading strategy

- Visualizing modules to build trading strategies - out

- KENTNA channel upgraded version of the KENTNA kingkeltner strategy

- Quantitative trading strategies with a trade index weighting

- Introducing the Aroon indicator

- The relative strengths and weaknesses of price-based quantitative trading strategies

- Introducing the adaptive moving average KAMA

- Implementation of Dual Thrust trading algorithms using My language on the inventor's quantification platform

- Introduction to RangeBreak Strategy

- Trading strategy based on box theory

- Thermometer strategies in the practice and application of inventor quantization platforms

- The strategic framework for the indicators

- 6 simple strategies and practices for beginners in quantitative digital currency trading

- Visualizing modules to build trading strategies - progress

- Pivot Point day trading system

- Three potential models in quantitative trading

- RangeBreak strategy combined with real-world use of volatility

- Neural network and digital currency quantitative trading series ((1)

LSTM predicts Bitcoin price - Principles and writing of stop-loss models

- Visualizing modules to build trading strategies - a basic understanding

wxmsummerIt's essentially a strategy to break the channel.