Dual Stochastics and Volume Weighted Moving Average Combination Indicator Strategy

Author: ChaoZhang, Date: 2023-10-26 17:18:53Tags:

Overview

This is a strategy that utilizes a combination of dual Stochastics indicators and Volume Weighted Moving Average to identify trends. It uses two Stochastics indicators with different periods, one short-term and one long-term, combined with VWMA to determine the current trend direction.

Strategy Logic

The strategy mainly implements trend identification through the following parts:

-

Calculate a short-period Stochastics indicator with period length input(30) and smooth parameter 2

-

Calculate a long-period Stochastics indicator with period length input(90) and smooth parameter 2

-

Add the short-period and long-period Stochastics together to get a combined Stochastics curve ts

-

Calculate a Volume Weighted Moving Average of ts curve with period length input(30)

-

Compare current tsl value with its value 1 period ago, when tsl rises, it indicates an uptrend, when tsl falls, it indicates a downtrend

-

Combine with Stochastics curve position to identify bullish or bearish signals

- When tsl rises and ts is in middle zone, it is a bullish signal

- When tsl falls and ts is in middle zone, it is a bearish signal

Advantage Analysis

The strategy combines trend identification and overbought-oversold analysis, which can identify trend direction quite reliably. The advantages are:

-

The dual Stochastics can reflect both short-term and long-term overbought/oversold situations, avoiding missing some signals

-

Volume weighted moving average can filter out some false breakout signals

-

Stochastics curve position re-confirms the reliability of trend signals

-

Adjustable parameters suit different markets

-

Clear and simple logic, easy to understand and modify

Risks and Improvements

There are also some risks to note for this strategy:

-

Stochastics may give false signals, needs filtering with longer-period indicators

-

Fixed periods may not suit all markets, dynamic optimization could help

-

Purely technical indicator based, fundamentals may improve accuracy

-

Inaccurate volume data affects results, need to verify data quality

-

Insufficient backtesting history, more data needed for validation

-

Entry points can be improved, rather than direct long on crosses under lowest

Conclusion

In summary, this strategy identifies trends using dual Stochastics and VWMA, which can reliably identify trend reversals in theory. But parameter tuning is needed for specific markets, and false signals risk exists. Recommend combining other factors like fundamentals, long-term trends etc for judgment, to improve strategy Profit Factor. The logic is simple and clear, providing a template for quant trading, which can be modified as needed. It has great application value.

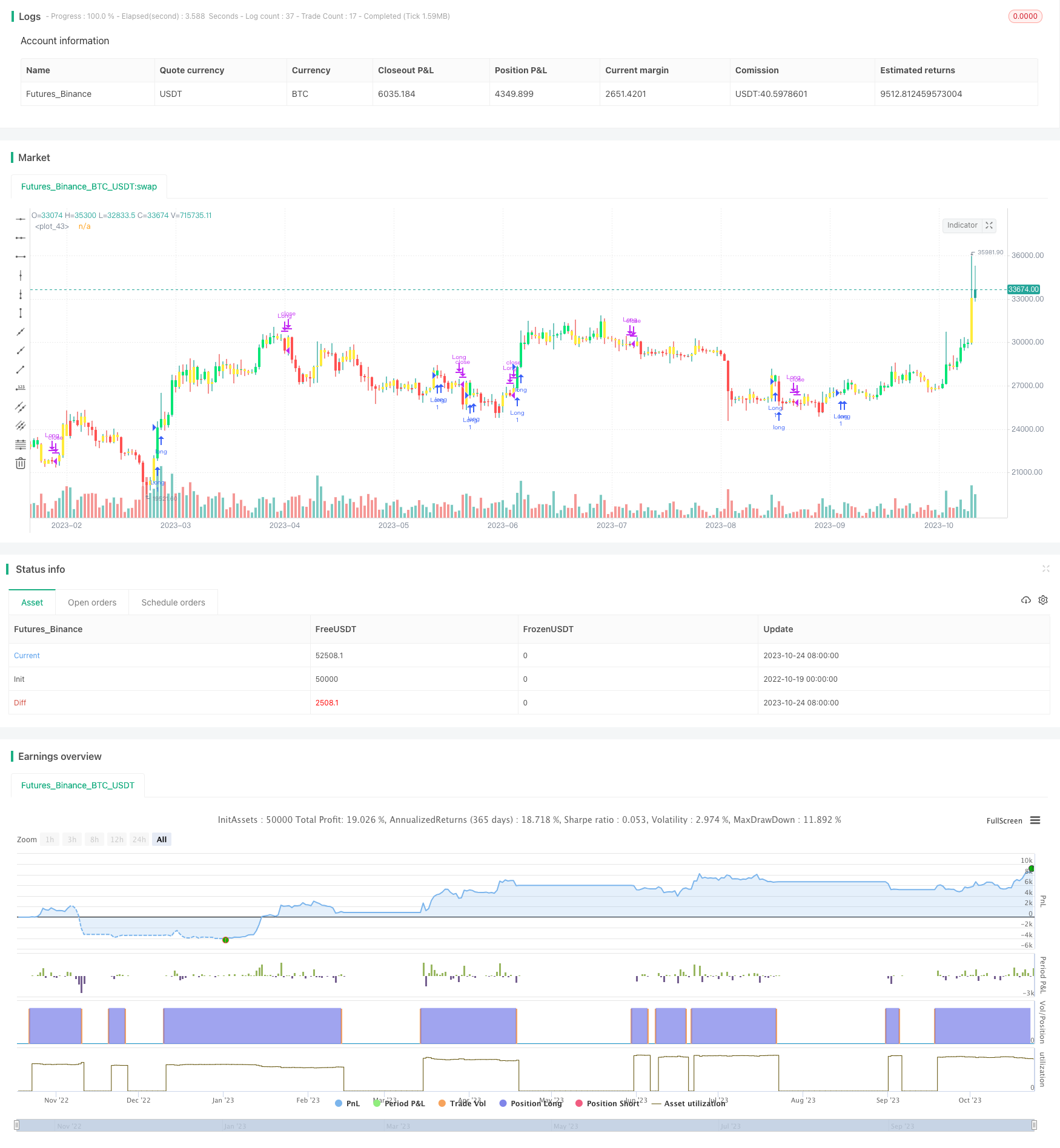

/*backtest

start: 2022-10-19 00:00:00

end: 2023-10-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Trend Finder V2", shorttitle="TFV2", format=format.price, precision=2, overlay = true)

//----------Indicator------------//

periodK = input(30)

periodD = 3

smoothK = 2

periodK_two = input(90)

periodD_two = 3

smoothK_two = 2

k = sma(stoch(close, high, low, periodK), smoothK)

d = sma(k, periodD)

k_two = sma(stoch(close, high, low, periodK_two), smoothK_two)

d_two = sma(k, periodD_two)

ts = k + k_two

tsl = vwma(ts, input(30, title = "VWMA Length"))

//--------Label parameter--------//

up_label = tsl[1] < 100 and tsl > 100 ? 1 : 0

down_label = tsl[1] > 100 and tsl < 100 ? 1 : 0

//----------Color Code-----------//

//tsl_col = tsl > 100 and tsl > tsl[1] ? color.aqua : tsl > 100 and tsl < tsl[1] ? color.green : tsl < 100 and tsl > tsl[1] ? color.maroon : tsl < 100 and tsl < tsl[1] ? color.red : color.silver

//tsl_col = tsl > 100 and ts < 100 and ts > ts[1] ? color.aqua : tsl > 100 and ts > 100 and (ts > ts[1] or ts < ts[1]) ? color.green : tsl < 100 and ts > 100 and ts < ts[1] ? color.red : tsl < 100 and ts < 100 and (ts < ts[1] or ts > ts[1]) ? color.maroon : color.purple

tsl_col = ts > ts[1] and tsl > tsl[1] ? color.lime : ts < ts[1] and tsl < tsl[1] ? color.red : color.yellow

ts_col = (tsl_col == color.lime or tsl_col == color.maroon) and (k>k[1] and k < 30) ? color.lime : (tsl_col == color.green or tsl_col == color.red) and (k < k[1] and k > 70) ? color.red : color.silver

//-------------Plots-------------//

buy = tsl_col[1] == color.yellow and tsl_col == color.lime ? 1 : 0

sell = tsl_col[1] == color.yellow and tsl_col == color.red ? -1 : 0

plotcandle(open,high,low,close, color=tsl_col)

strategy.entry("Long", strategy.long,when=buy==1)

strategy.close("Long", when=sell==-1)

- Moving Average Crossover Strategy

- Reversal Breakout Strategy

- Multi-Period Dynamic Moving Average Strategy

- Seasonal Range Moving Average RSI Strategy

- 1-3-1 Red Green Candlestick Reversal Strategy

- Momentum Tracking Stop Loss Strategy

- Cumulative RSI Breakout Strategy

- High Frequency Hedging Strategy Based on MACD Bar Color and Linear Regression

- Momentum Stacking Strategy of Different Timeframes

- Cryptocurrency Momentum Breakout Strategy

- Trend Trading with Double EMA Crossover System

- Gradual Moving Average Trend Following Strategy

- RSI Momentum Long Short Strategy

- Combined Stochastic Oscillator and 123 Reversal Strategy

- Dual Reversal Overlap Selective Strategy

- Dual Moving Average Reversal and Triple Bottom Flash Combo Trading Strategy

- Average Stochastic Trading Strategy

- Volatility Force Breakthrough Trading Strategy

- Triple Indicator Momentum Reversal Strategy

- Gap Trading Moving Average Strategy