Momentum Capture Strategy Based on Moving Average

Author: ChaoZhang, Date: 2023-11-01 15:55:51Tags:

Overview

This strategy uses moving average as the main trading signal, combined with Heikin-Ashi to detect trend reversal, aiming to capture short-term price momentum. It is optimized from Gustavo Bramao’s Heikin Ashi MA strategy by removing the repainting function to generate non-lagging signals.

Strategy Logic

Calculate Heikin-Ashi close price nAMAn as the price baseline.

Calculate fast moving average fma and slow moving average sma based on nAMAn.

Generate buy signal when fma crosses over sma, and sell signal when fma crosses below sma.

The repainting is removed in this strategy to generate real-time trading signals and avoid backtesting bias.

Advantage Analysis

Heikin-Ashi helps determine trend reversal points more accurately.

The MA crossover filters out false signals effectively.

No lagging in signal generation ensures reliable live performance.

Flexible parameter tuning adaptable for different products.

Simple and clear logic, easy to understand and implement.

Can be automated completely to minimize manual trading risks.

Risk Analysis

Poor performance in range-bound market with price whipsaws.

Prone to generating false signals with dual MA crossover.

Inappropriate MA parameters may cause missing trends or increasing drawdown.

Trading cost impacts net profit in live trading.

Strict stop loss required to control single trade loss.

Mechanical trading strategies have inherent drawdown risks and require proper capital management.

Risk Management Solutions:

Add volatility filter to avoid range-bound market.

Add filters to ensure signal quality.

Optimize MA parameters through thorough testing.

Adjust trading frequency to reduce cost impact.

Set proper stop loss to control loss in single trades.

Optimize capital management to control position sizing.

Enhancement Directions

Optimize MA parameters to improve signal quality.

Add trend filter to avoid whipsaw market.

Incorporate volume indicators to confirm trend.

Implement dynamic stop loss and profit taking to optimize profit capturing.

Integrate capital management module to control position sizing.

Add algorithmic trading module for full automation.

Summary

This strategy integrates Heikin-Ashi and MA crossover techniques to create a simple and practical short-term trend following strategy. It generates reliable real-time trading signals and shows good performance in live trading. Further optimizations on parameters, risk management, and algorithmic trading modules can turn it into a fully automated strategy that is trustworthy.

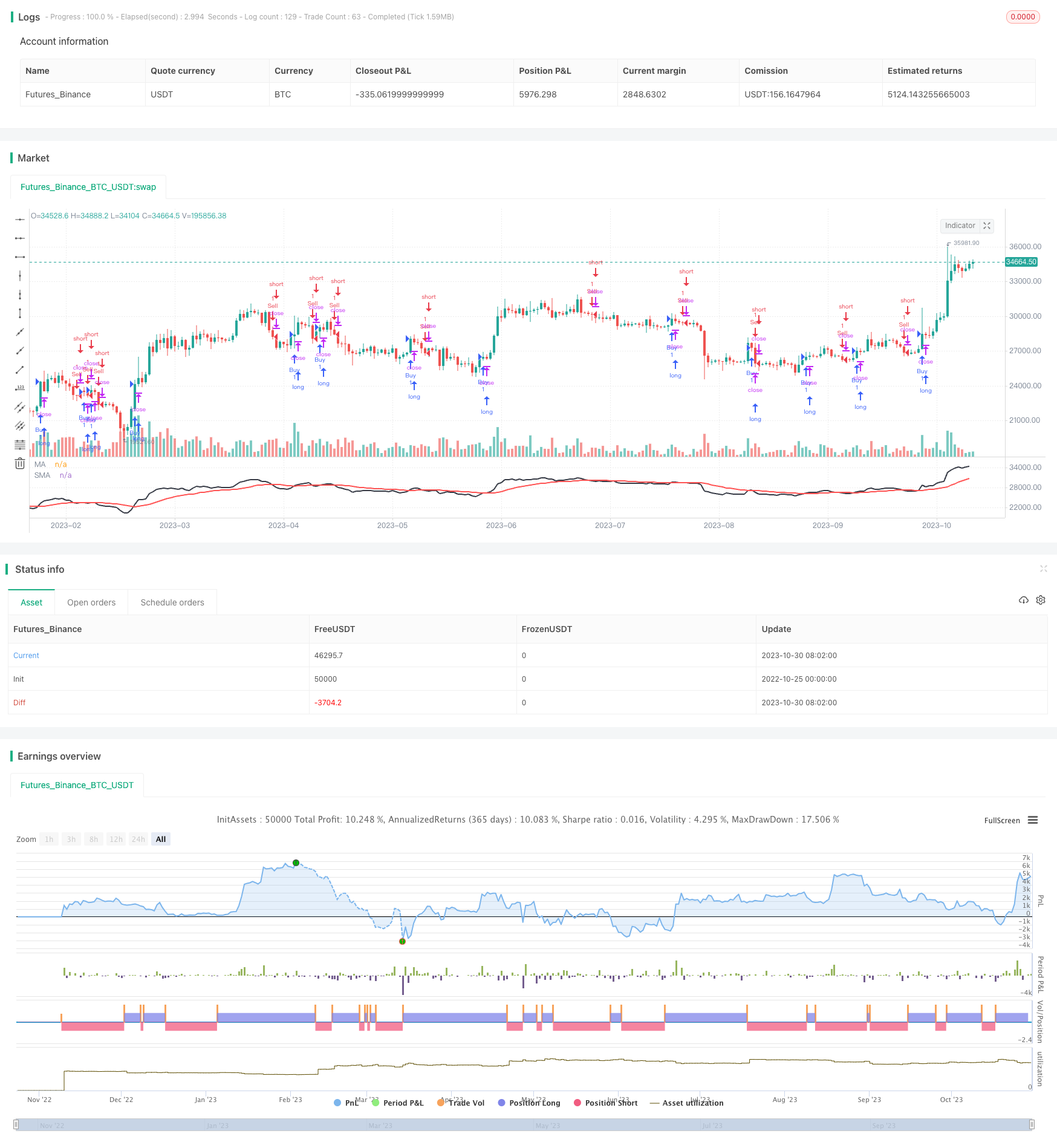

/*backtest

start: 2022-10-25 00:00:00

end: 2023-10-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Heikin/Kaufman by Gustavo v5

// strategy('Heikin Ashi EMA v5 no repaint ', shorttitle='Heikin Ashi EMA v5 no repaint', overlay=true, max_bars_back=500, default_qty_value=1000, initial_capital=100000, currency=currency.EUR)

// Settings - H/K

res1 = input.timeframe(title='Heikin Ashi EMA Time Frame', defval='D')

test = input(0, 'Heikin Ashi EMA Shift')

sloma = input(20, 'Slow EMA Period')

nAMA = hlc3

//Kaufman MA

Length = input.int(5, minval=1)

xPrice = input(hlc3)

xvnoise = math.abs(xPrice - xPrice[1])

Fastend = input.float(2.5, step=.5)

Slowend = input(20)

nfastend = 2 / (Fastend + 1)

nslowend = 2 / (Slowend + 1)

nsignal = math.abs(xPrice - xPrice[Length])

nnoise = math.sum(xvnoise, Length)

nefratio = nnoise != 0 ? nsignal / nnoise : 0

nsmooth = math.pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMAn = nz(nAMA[1]) + nsmooth * (xPrice - nz(nAMA[1]))

//Heikin Ashi Open/Close Price

ha_t = ticker.heikinashi(syminfo.tickerid)

ha_close = request.security(ha_t, timeframe.period, nAMAn)

mha_close = request.security(ha_t, res1, hlc3)

//Moving Average

fma = ta.ema(mha_close[test], 1)

sma = ta.ema(ha_close, sloma)

plot(fma, title='MA', color=color.new(color.black, 0), linewidth=2, style=plot.style_line)

plot(sma, title='SMA', color=color.new(color.red, 0), linewidth=2, style=plot.style_line)

//Strategy

golong = ta.crossover(fma, sma)

goshort = ta.crossunder(fma, sma)

strategy.entry('Buy', strategy.long, when=golong)

strategy.entry('Sell', strategy.short,when=goshort)

- Dual Reversal Trading Strategy

- Bollinger Bands Oscillation Breakthrough Strategy

- Fibonacci Moving Averages Input Strategy

- MACD Dissipation and Multi Time Frame Moving Average Strategy

- Wealth Creation Composite Strategy

- Dollar Cost Averaging Investment Strategy

- CCI Mean Reversion Channel Strategy

- RSI Mean Reversion Trading Strategy

- Low Scanner Smart Tracking Method

- Schaff Trend Cycle Momentum Following Strategy

- Dual Moving Average Bollinger Bands Trend Following Strategy

- Trend Following Strategy with Dynamic Stops

- Dual ATR Channel Trend Following Strategy

- Bollinger Bands Trend Reversal Strategy

- Correlation-based Bullish/Bearish Crypto Trading Strategy Based on Wall Street CCI Index

- SMI Ergodic Oscillator Momentum Trading Strategy

- trend following strategy based on Donchian Channels

- Rose Cross Star Dual Indicator Volatility Strategy

- Adaptive ATR Trend Breakout Strategy

- Bollinger Band Momentum Burst Strategy