Dual Reversal Oscillating Band Trend Following Strategy

Author: ChaoZhang, Date: 2024-01-25 16:01:04Tags:

Overview

The Dual Reversal Oscillating Band Trend Following strategy combines dual reversal signals and oscillating band indicators to implement trend following trading. It first uses the 123 reversal system to generate reversal signals, and then combines the Fractal Chaos Bands indicator to filter signals and follow trends. This strategy can identify both reversal opportunities and follow trends, making it a very comprehensive trading strategy.

Strategy Principle

123 Reversal System

The 123 reversal system is from page 183 of the book “How I Tripled My Money in The Futures Market” by Ulf Jensen. Its trading signals are:

Buy when the closing price is higher than the previous day’s close for 2 consecutive days, and 9-day Slow K-line is below 50; Sell when the closing price is lower than the previous day’s close for 2 consecutive days, and 9-day Fast K-line is above 50.

This section mainly uses the Stochastic oscillator indicator to generate signals in the overbought and oversold regions. When the stocks rise continuously but the Stochastic oscillator indicator shows there is still room to rise, take a bullish view; when the stocks fall continuously but the Stochastic oscillator indicator shows there is still room to fall, take a bearish view.

Fractal Chaos Bands Indicator

The Fractal Chaos Bands indicator determines market trends by plotting price highs and lows to form upper and lower rails. The specific rules are:

Buy when price breaks through the upper rail upwards; Sell when price breaks through the lower rail downwards.

This section mainly serves as a trend filter, combined with the 123 reversal signal. Only when both signals are consistent will a position be opened.

Advantages of the Strategy

- Combining reversal and trend to capture opportunities comprehensively

The Dual Reversal Oscillating Band Trend Following Strategy can capture both reversal opportunities and follow trends, making it very comprehensive. It can obtain trading signals regardless of whether the market is oscillating or trending.

- Reducing false signals and improving win rate

Compared with a single indicator, this strategy can greatly reduce false signals and improve actual trading win rate and profit rate through the filtering of dual indicator combinations.

- Flexible parameter adjustment and strong adaptability

The parameters of the Dual Reversal Oscillating Band Trend Following Strategy are easy to understand. Users can adjust them according to their own needs and market conditions, making it very flexible. It can adapt to both oscillating and trending markets through parameter tuning.

Risks and Optimization

- Unable to adapt under major trends

The strategy itself relies more on medium-term trading opportunities. Under major market trends, the strategy may generate too many reverse signals and stop out with losses. This can be optimized through parameter adjustment.

- Requires margin capital support

The Dual Reversal Oscillating Band Trend Following Strategy belongs to frequent trading types, requiring sufficient margin capital to support the margin requirements for opening positions. For users with insufficient capital, it may be necessary to appropriately reduce the position size.

- Can combine more indicators for filtering

The strategy can introduce more different types of indicators on the existing basis to enrich signal sources and improve the robustness of the strategy. For example, adding indicators like volume, volatility index, etc. to verify reversal and trend signals.

Conclusion

The Dual Reversal Oscillating Band Trend Following Strategy successfully combines the advantages of reversal trading and trend following. It can capture both reversals and follow trends, making it very comprehensive and efficient. Compared with a single indicator, it can greatly reduce false signals and improve the actual trading win rate and profit level. In addition, this strategy has flexible parameter adjustment for users to optimize according to their own style and market environment. In general, this is an excellent quantitative strategy that is worth live trading verification.

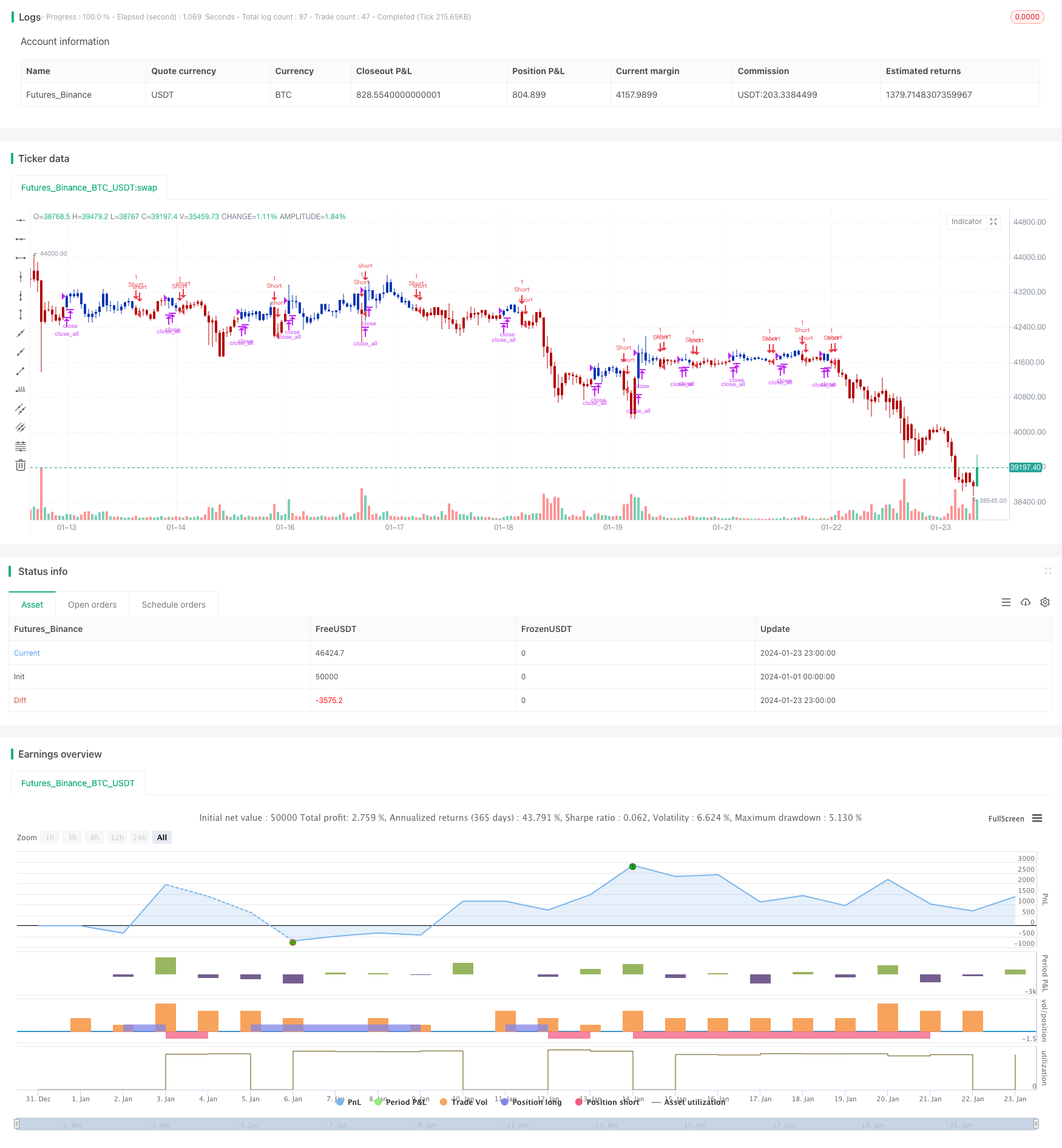

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/09/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Stock market moves in a highly chaotic way, but at a larger scale, the movements

// follow a certain pattern that can be applied to shorter or longer periods of time

// and we can use Fractal Chaos Bands Indicator to identify those patterns. Basically,

// the Fractal Chaos Bands Indicator helps us to identify whether the stock market is

// trending or not. When a market is trending, the bands will have a slope and if market

// is not trending the bands will flatten out. As the slope of the bands decreases, it

// signifies that the market is choppy, insecure and variable. As the graph becomes more

// and more abrupt, be it going up or down, the significance is that the market becomes

// trendy, or stable. Fractal Chaos Bands Indicator is used similarly to other bands-indicator

// (Bollinger bands for instance), offering trading opportunities when price moves above or

// under the fractal lines.

//

// The FCB indicator looks back in time depending on the number of time periods trader selected

// to plot the indicator. The upper fractal line is made by plotting stock price highs and the

// lower fractal line is made by plotting stock price lows. Essentially, the Fractal Chaos Bands

// show an overall panorama of the price movement, as they filter out the insignificant fluctuations

// of the stock price.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res =0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCB(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

pos := iff(close > xUpper, 1,

iff(close < xLower, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Bands", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCB = FCB(Pattern)

pos = iff(posReversal123 == 1 and posFCB == 1 , 1,

iff(posReversal123 == -1 and posFCB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Linear Regression and Dual Moving Average Short-Term Strategy

- Triple Overlapping Stochastic Momentum Strategy

- Momentum Trend Strategy

- Momentum Moving Average Crossover Quant Strategy

- Combination Strategy of Dual Moving Average Reversal and ATR Trailing Stop

- Leveraged Martingale Futures Trading Strategy

- Momentum Pullback Strategy

- Dual Candlestick Prediction Close Strategy

- CMO and WMA Based Dual Moving Average Trading Strategy

- Stochastic Supertrend Tracking Stop Loss Trading Strategy

- Trend Following Strategy Based on DMI and RSI

- Quantitative Support and Resistance Oscillation Strategy

- Trend-Following Strategy with 3 EMAs, DMI and MACD

- Dual Indicators Breakthrough Strategy

- Pete Wave Trading System Strategy

- Quantitative Strategy Based on Exponential Moving Average and Volume Weighting

- Origix Ashi Strategy Based on Smoothed Moving Average

- BlackBit Trader XO Macro Trend Scanner Strategy

- Crude Oil ADX Trend Following Strategy

- MT-Coordination Trading Strategy