Flawless Victory Quantitative Trading Strategy Based on Double BB Indicators and RSI

Author: ChaoZhang, Date: 2024-01-29 10:33:43Tags:

Overview

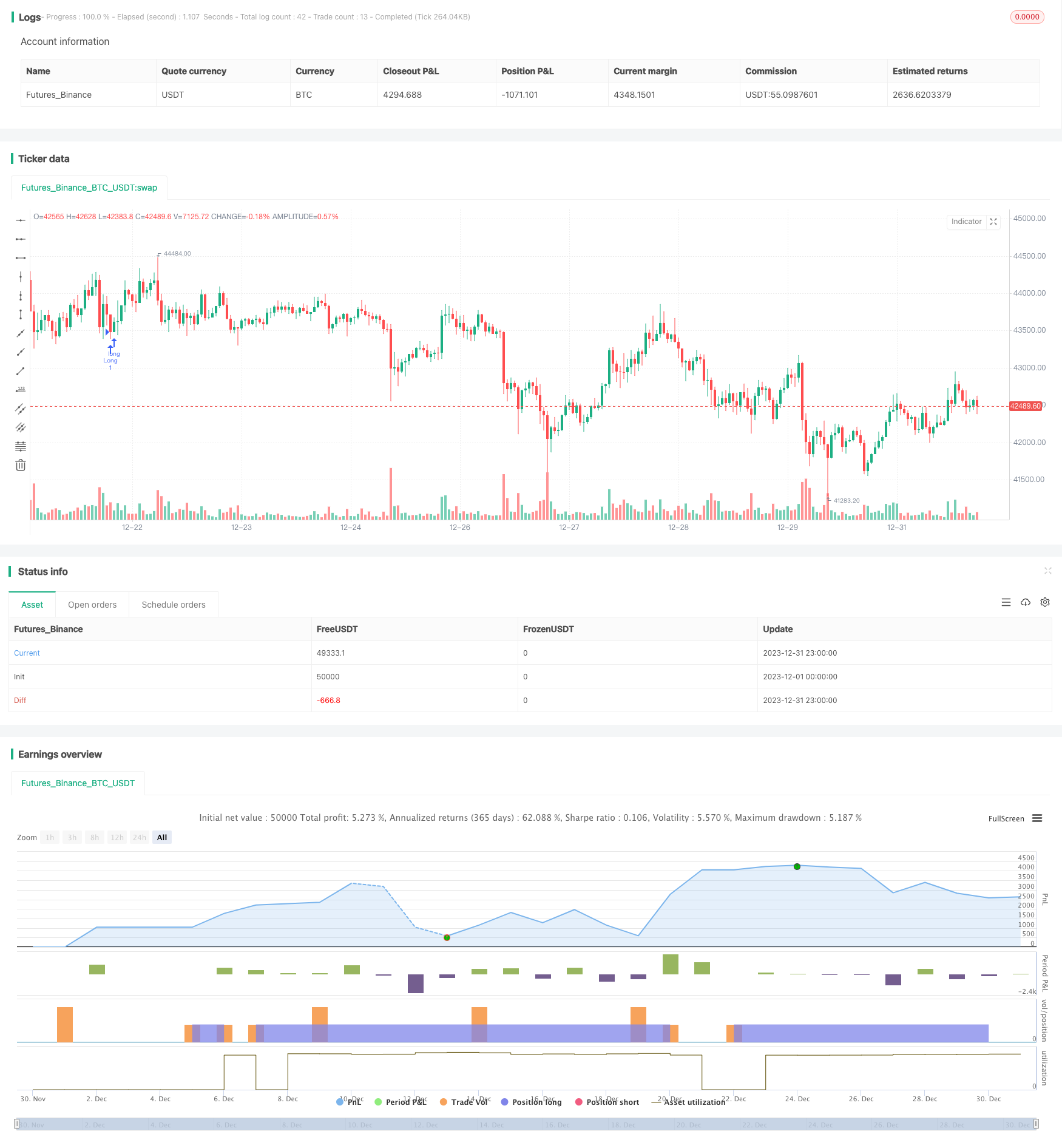

This strategy is a quantitative trading strategy based on the Bollinger Bands indicator and the Relative Strength Index (RSI) indicator. This strategy uses machine learning methods to backtest and optimize parameters over nearly 1 year of historical data using Python language, finding the optimal parameter combination.

Strategy Principles

The trading signals of this strategy come from the combined judgement of double Bollinger Bands and RSI indicators. Among them, the Bollinger Bands indicator is the volatility channel calculated based on the price standard deviation. It generates trading signals when the price approaches or touches the channel. The RSI indicator judges the overbought and oversold situation of the price.

Specifically, a buy signal is generated when the closing price is below the lower rail of 1.0 standard deviations and RSI is greater than 42 at the same time. A sell signal is generated when the closing price is above the upper rail of 1.0 standard deviations and RSI is greater than 70 at the same time. In addition, this strategy also sets two sets of BB and RSI parameters, which are used for entry and stop loss closing positions respectively. These parameters are optimal values obtained through extensive backtesting and machine learning.

Advantage Analysis

The biggest advantage of this strategy is the accuracy of parameters. Through machine learning methods, each parameter is obtained through comprehensive backtesting to achieve the best Sharpe ratio. This ensures both the return rate of the strategy and controls risks. In addition, the combination of double indicators also improves the accuracy and win rate of signals.

Risk Analysis

The main risk of this strategy comes from the setting of stop loss points. If the stop loss point is set too large, it will not effectively control losses. In addition, if the stop loss point does not properly calculate other trading costs such as commissions and slippage, it will also increase risks. To reduce risks, it is recommended to adjust the stop loss magnitude parameter to reduce trading frequency, while calculating a reasonable stop loss position.

Optimization Directions

There is still room for further optimization of this strategy. For example, you can try to change the length parameters of Bollinger Bands, or adjust the overbought and oversold thresholds of RSI. You can also try to introduce other indicators to build a multi-indicator combination. This may increase the profit space and stability of the strategy.

Summary

This strategy combines double BB indicators and RSI indicators, and obtains optimal parameters through machine learning methods to achieve high returns and controllable risk levels. It has the advantages of combined indicator judgement and parameter optimization. With continuous improvement, this strategy has the potential to become an excellent quantitative trading strategy.

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Bunghole 2020

strategy(overlay=true, shorttitle="Flawless Victory Strategy" )

// Stoploss and Profits Inputs

v1 = input(true, title="Version 1 - Doesn't Use SL/TP")

v2 = input(false, title="Version 2 - Uses SL/TP")

stoploss_input = input(6.604, title='Stop Loss %', type=input.float, minval=0.01)/100

takeprofit_input = input(2.328, title='Take Profit %', type=input.float, minval=0.01)/100

stoploss_level = strategy.position_avg_price * (1 - stoploss_input)

takeprofit_level = strategy.position_avg_price * (1 + takeprofit_input)

//SL & TP Chart Plots

plot(v2 and stoploss_input and stoploss_level ? stoploss_level: na, color=color.red, style=plot.style_linebr, linewidth=2, title="Stoploss")

plot(v2 and takeprofit_input ? takeprofit_level: na, color=color.green, style=plot.style_linebr, linewidth=2, title="Profit")

// Bollinger Bands 1

length = 20

src1 = close

mult = 1.0

basis = sma(src1, length)

dev = mult * stdev(src1, length)

upper = basis + dev

lower = basis - dev

// Bollinger Bands 2

length2 = 17

src2 = close

mult2 = 1.0

basis2 = sma(src1, length2)

dev2 = mult2 * stdev(src2, length2)

upper2 = basis2 + dev2

lower2 = basis2 - dev2

// RSI

len = 14

src = close

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

// Strategy Parameters

RSILL= 42

RSIUL= 70

RSILL2= 42

RSIUL2= 76

rsiBuySignal = rsi > RSILL

rsiSellSignal = rsi > RSIUL

rsiBuySignal2 = rsi > RSILL2

rsiSellSignal2 = rsi > RSIUL2

BBBuySignal = src < lower

BBSellSignal = src > upper

BBBuySignal2 = src2 < lower2

BBSellSignal2 = src2 > upper2

// Strategy Long Signals

Buy = rsiBuySignal and BBBuySignal

Sell = rsiSellSignal and BBSellSignal

Buy2 = rsiBuySignal2 and BBBuySignal2

Sell2 = rsiSellSignal2 and BBSellSignal2

if v1 == true

strategy.entry("Long", strategy.long, when = Buy, alert_message = "v1 - Buy Signal!")

strategy.close("Long", when = Sell, alert_message = "v1 - Sell Signal!")

if v2 == true

strategy.entry("Long", strategy.long, when = Buy2, alert_message = "v2 - Buy Signal!")

strategy.close("Long", when = Sell2, alert_message = "v2 - Sell Signal!")

strategy.exit("Stoploss/TP", "Long", stop = stoploss_level, limit = takeprofit_level)

- RSI Indicator Grid Trading Strategy

- PPO Price Sensitivity Momentum Double Bottom Directional Trading Strategy

- Scalping Strategy with Volume and VWAP Confirmation

- ADX, MA and EMA Long Only Trend Tracking Strategy

- Momentum Breakthrough Golden Cross Strategy

- Triple Indicator Collision Strategy

- Out-of-the-box Machine Learning Trading Strategy

- Moving Average Turning Point Crossover Trading Strategy

- Cross-Cycle Arbitrage Strategy Based on Multiple Indicators

- The Bollinger Band breakout strategy is a long-only momentum chasing strategy

- RSI-based Stop Loss and Take Profit Strategy

- Moving Average Channel Breakout Strategy

- Fixed Time Breakback Testing Strategy

- Time and Space Optimized Multi Timeframe MACD Strategy

- Quantitative Trading Strategy Based on Stoch RSI and MFI

- Multi-indicator Composite Trading Strategy

- Crossover EMA Short-term Trading Strategy

- Trend Following Strategy Based on Dynamic Stop Loss of Dual EMA Crossover

- Bull Market Breakout Darvas Box Buy Strategy

- The relative momentum strategy