True Relative Movement Moving Average Strategy

Author: ChaoZhang, Date: 2024-01-30 16:04:19Tags:

Overview

The True Relative Movement Moving Average (TRMMA) strategy is a trend-following strategy that combines the Relative Strength Index (RSI) and True Strength Index (TSI). It uses the indicators of RSI and TSI to generate buy and sell signals, with moving averages for strategy optimization.

Principles

The strategy consists of the following main parts:

TSI Calculation Calculate the exponential smoothed value of the rate of price changes through double exponential smoothing, then divide it by the exponential smoothed value of the absolute rate of price changes to obtain the TSI indicator. The long term is 25 days, the short term is 5 days, and the signal line is 14 days.

RSI Calculation RSI indicator with close price as input and length of 5 days.

Signal Judgment A buy signal is generated when TSI crosses above its signal line and RSI crosses above 50. A sell signal is generated when TSI crosses below its signal line and RSI crosses below 50.

Candlestick Coloring Color the candlesticks based on signals to assist judgment.

Strategy Parameters Set parameters like position ratio and capital.

Advantage Analysis

The strategy combines the TSI and RSI indicators to effectively judge market trends and overbought/oversold situations, thus generating trading signals. Compared with using TSI or RSI alone, it can filter out more false signals. In addition, compared with the default parameters, this strategy adopts a more aggressive setting of TSI and RSI parameters to obtain earlier and higher quality trading signals.

Risk Analysis

The main risks of this strategy include:

Parameter optimization risk. The optimal parameters of TSI and RSI may differ across markets, products, and timeframes. Parameters need to be optimized for specific situations.

Trend reversal risk. The strategy itself focuses on trends. Sudden events that cause short-term adjustments or medium-to-long term trend reversals will result in greater losses for the strategy.

Frequent signal risk. Compared with default parameters, this strategy uses a more aggressive parameter setting, which may generate more frequent trading signals, bringing higher trading costs and implementation difficulties.

Optimization Directions

The strategy can be optimized in the following aspects:

Further filter signals by combining with moving averages and other indicators to reduce frequent trading.

Test the optimal combination of TSI and RSI parameters in different markets and products to find the best parameter settings.

Increase stop loss strategies to control the risk of single loss.

Optimize position management, increase positions when the trend is stronger, and reduce positions when the trend turns weak.

Conclusion

The TRMMA strategy combines the TSI and RSI indicators to determine entry and exit timing, with strong trend capturing capability. Compared with using TSI or RSI alone, it can effectively filter out false signals. The stability of the strategy can be further enhanced through parameter optimization, stop loss strategies, position management, etc. The strategy is suitable for investors with some quantitative basis who pursue high returns.

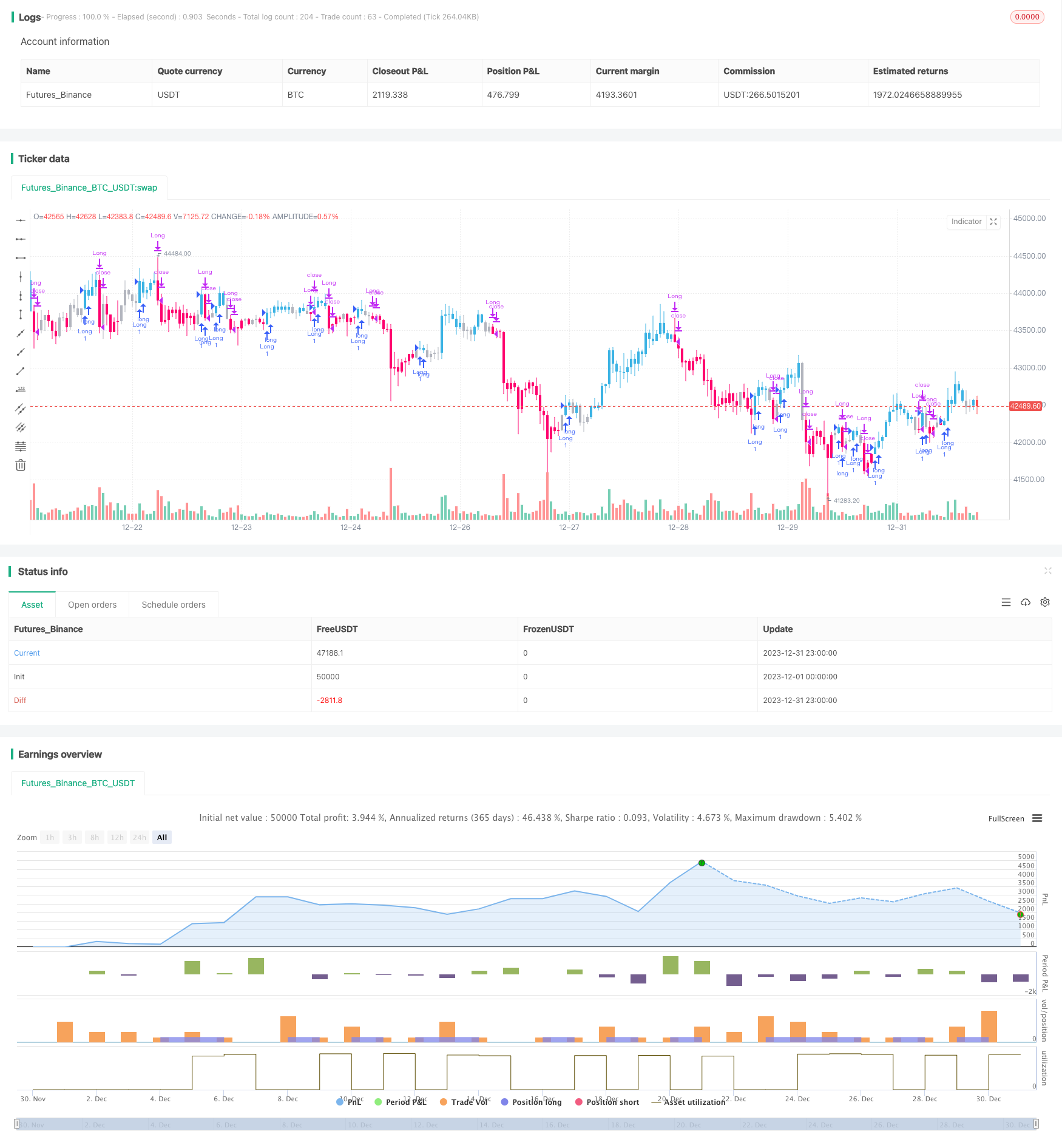

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// "True relative Movement" or "TRM" for short is a system that combines my two favorite indicators: RSI and TSI. I strived to put together an indicator that combined the best of both

// in order to help discretionary traders predict market direction, weakness and strength. As with most technical indicators there are "Buy and sell" signals. Similiar to Elder Impulse system,

///TRM paints bars 3 different colors to display 3 different conditions: Blue for "Buy", Pink for "Sell", and gray for "Take profit/Hold". When the bars turn blue, that means all conditions

/// have been met. When they turn pink, no conditions have been met. When they are gray, only one condition has been met. The system is simple, yet effective. A buy signal is prodcued when

/// TSI is above the signal line, and RSI is above 50, and vice versa for sell signals. I have modified the default parameters for TSI and RSI for more "aggressive" entries and exits. I may later on

/// name this condition "Fast-TRM" and "Slow-TRM" for when default settings for TSI and RSI are applies, as this is a very robust system as well.

///******ES 1HR, 15MIN/5MIN SYSTEM***** Go long, when all time frame on a buy signal and vice versa. Take profit when the 5 min chart flips to buy or sell depending on what side of the trade you are on. Close or flip

//// long/short when time all time frames flip to Buy/Hold if short and Sell/Hold if long. Use 20EMA for additional confirmation.

//@version=4

strategy("TKP-TRM Strategy", overlay=true)

Note = input( 0, title = "TSI standard values are 25, 13, 13, and RSI is 14. Can change the default values to these for 'Slow TRM'")

long = input(title="TSI-Long Length", type=input.integer, defval=25)

short = input(title="TSI-Short Length", type=input.integer, defval=5)

signal = input(title="TSI-Signal Length", type=input.integer, defval=14)

price = close

double_smooth(src, long, short) =>

fist_smooth = ema(src, long)

ema(fist_smooth, short)

pc = change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(abs(pc), long, short)

tsi_value = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

TSI_Signal_Line = (ema(tsi_value, signal))

/////////////////////////////RSI////////////////////////////////////////////////

src = close, len = input(5, minval=1, title="RSILength")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiBuyfilterlevel = input(50, minval = 1, title = "RSI cross above Buy Level")

rsiSellfilterlevel = input(50, minval = 1, title = "RSI cross below Sell Level")

////////////////////////////Bar Coloring//////////////////////////////////////////////////////////

TRM_Buy = ((tsi_value > TSI_Signal_Line) and (rsi > rsiBuyfilterlevel))

TRM_Sell = ( (tsi_value < TSI_Signal_Line) and (rsi <rsiSellfilterlevel))

TRM_Color = TRM_Buy? #3BB3E4 : TRM_Sell? #FF006E : #b2b5be

barcolor(TRM_Color)

///////////////////////////Strategy Paramters////////////////////////////////////////

if (TRM_Buy)

strategy.entry("Long", strategy.long, comment="Long")

if (TRM_Sell)

strategy.close("Long", comment="Sell")

- Dual Moving Average Confluence Strategy

- An RSI Reversal Trading Strategy

- Dual-directional ADX Trading Strategy

- Vix Fix Linear Regression Bottom Fishing Strategy

- Three Exponential Moving Averages and Stochastic Relative Strength Index Trading Strategy

- Double 7 Days Breakout Strategy

- Dual MACD Quantitative Trading Strategy

- Bollinger Band Moving Average Crossover Strategy

- Scalping Dips in Bull Market Strategy

- Trend Following Strategy Based on Adaptive Moving Average

- MACD and RSI Based 5-Minute Momentum Trading Strategy

- Double Fractal Breakout Strategy

- Noro Shifted Moving Average Stop Loss Strategy

- Double Exponential Moving Average RSI Trading Strategy

- Simple Moving Average Crossover Strategy

- Scalping Strategy Based on Market Liquidity and Trend

- Cross-Border Short-Term Breakthrough Reversal 5EMA Strategy

- RSI Indicator Based Stock Trading Pyramiding Strategy

- All about EMA Channel Trading Strategy

- Double Decker RSI Trading Strategy