Vix Fix Linear Regression Bottom Fishing Strategy

Author: ChaoZhang, Date: 2024-01-30 16:56:39Tags:

Overview

The core idea of this strategy is to combine Vix Fix indicator and its linear regression to accurately capture market bottoms. The strategy is named “Fix Regression Bottom Fishing Strategy”.

Strategy Logic

- Calculate the Vix Fix indicator, which is good at judging market bottoms

- Apply linear regression on Vix Fix. When the linear regression histogram color turns green, it means the Vix Fix linear regression starts to rise, a buy signal can be triggered

- Combine with the green columns of the Vix Fix indicator to further confirm the timing of entries

- When the linear regression histogram color turns red, it means the Vix Fix linear regression starts to decline, a sell signal is triggered

The above process utilizes linear regression to improve the accuracy and timeliness of Vix Fix signals, filtering out some false signals, and thus accurately capturing bottoms.

Advantage Analysis

- The strategy uses linear regression to filter out some false signals of the Vix Fix indicator, making buy/sell signals more accurate and reliable

- Linear regression improves the sensitivity and timeliness of signals, and can quickly capture market turning points

- The strategy logic is simple and clear, easy to understand and implement, suitable for quantitative trading

- There are many configurable parameters that can be flexibly adjusted to adapt to market changes

Risks and Solutions

- This strategy is mainly used to determine the overall market bottom, not suitable for individual stocks

- Linear regression cannot completely filter out false signals. Combining with the Vix Fix indicator can reduce risks

- Need to properly adjust parameters to adapt to market changes and avoid failure

- It is recommended to combine with other indicators to further confirm signals

Optimization Directions

- Consider combining with volatility indicators or on-balance volume indicators to further filter out signals

- Study parameter adaptive optimization methods to make the strategy more intelligent

- Explore machine learning methods to predict Vix Fix trends with more complex models

- Try to apply similar methods to individual stocks to study how to filter false signals

Conclusion

This strategy utilizes the Vix Fix indicator to judge bottoms while introducing linear regression to improve signal quality, thereby effectively capturing market bottoms. The strategy is simple, practical and yields decent results. The main risk lies in the false signals that fail to be completely filtered out. We still need to optimize parameter settings and consider introducing other means to further confirm signals to make the strategy more robust. Overall, this strategy provides a new effective way to determine market bottoms, and is worth further research.

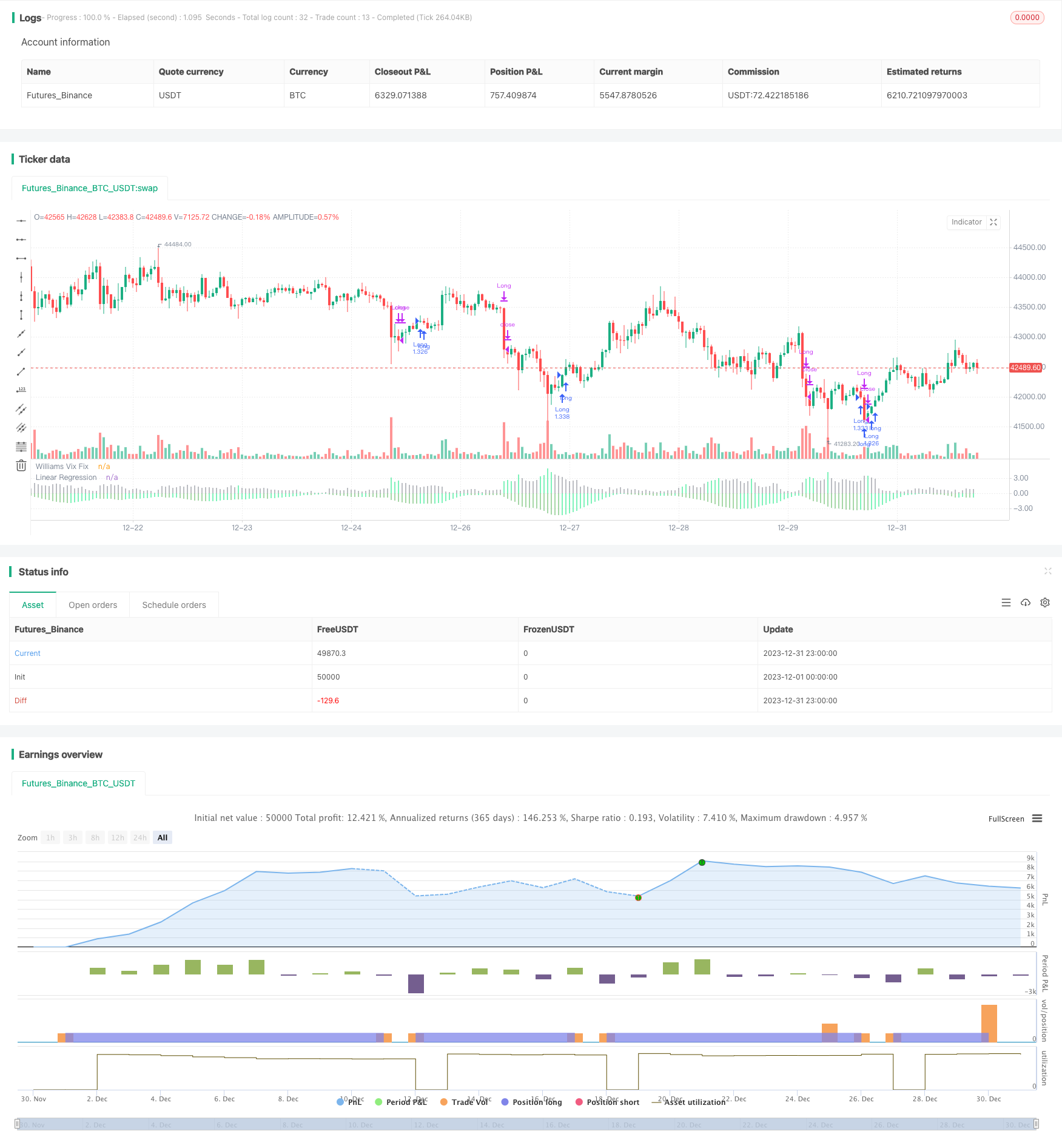

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HeWhoMustNotBeNamed

//@version=4

strategy("VixFixLinReg-Strategy", shorttitle="VixFixLinReg - Strategy",

overlay=false, initial_capital = 100000,

default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type = strategy.commission.percent, pyramiding = 1,

commission_value = 0.01)

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

pl = input(1.01, title="Lowest Percentile - 1.10=90%, 1.05=95%, 1.01=99%")

hp = input(false, title="Show High Range - Based on Percentile and LookBack Period?")

sd = input(false, title="Show Standard Deviation Line?")

i_startTime = input(defval = timestamp("01 Jan 2010 00:00 +0000"), title = "Start Time", type = input.time)

i_endTime = input(defval = timestamp("01 Jan 2099 00:00 +0000"), title = "End Time", type = input.time)

inDateRange = true

considerVIXFixClose = input(false)

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

atrLen = input(22)

atrMult = input(5)

initialStopBar = input(5)

waitForCloseBeforeStop = input(true)

f_getStop(atrLen, atrMult)=>

stop = strategy.position_size > 0 ? close - (atrMult * atr(atrLen)) : lowest(initialStopBar)

stop := strategy.position_size > 0 ? max(stop,nz(stop[1], stop)) : lowest(initialStopBar)

stop

wvf = ((highest(close, pd)-low)/(highest(close, pd)))*100

sDev = mult * stdev(wvf, bbl)

midLine = sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (highest(wvf, lb)) * ph

rangeLow = (lowest(wvf, lb)) * pl

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

val = linreg(wvf, pd, 0)

absVal = abs(val)

linRegColor = val>val[1]? (val > 0 ? color.green : color.orange): (val > 0 ? color.lime : color.red)

plot(hp and rangeHigh ? rangeHigh : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(hp and rangeLow ? rangeLow : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(wvf, title="Williams Vix Fix", style=plot.style_histogram, linewidth = 4, color=col)

plot(sd and upperBand ? upperBand : na, title="Upper Band", style=plot.style_line, linewidth = 3, color=color.aqua)

plot(-absVal, title="Linear Regression", style=plot.style_histogram, linewidth=4, color=linRegColor)

vixFixState = (col == color.lime) ? 1: 0

vixFixState := strategy.position_size == 0? max(vixFixState, nz(vixFixState[1],0)) : vixFixState

longCondition = (vixFixState == 1 and linRegColor == color.lime) and inDateRange

exitLongCondition = (linRegColor == color.orange or linRegColor == color.red) and considerVIXFixClose

stop = f_getStop(atrLen, atrMult)

label_x = time+(60*60*24*1000*20)

myLabel = label.new(x=label_x, y=0, text="Stop : "+tostring(stop), xloc=xloc.bar_time, style=label.style_none, textcolor=color.black, size=size.normal)

label.delete(myLabel[1])

strategy.entry("Long", strategy.long, when=longCondition, oca_name="oca_buy")

strategy.close("Long", when=exitLongCondition or (close < stop and waitForCloseBeforeStop and linRegColor == color.green))

strategy.exit("ExitLong", "Long", stop = stop, when=not waitForCloseBeforeStop and linRegColor == color.green)

- Dual Breakout Volatility Channel Strategy

- Trend Following Strategy Based on Multiple Indicators

- Multi Timeframe MACD Trading Strategy

- Monthly Returns Strategy with Benchmark

- Squeeze Momentum Breakout Strategy

- Dual Breakthrough Strategy

- Momentum Breakout and Engulfing Pattern Algorithmic Trading Strategy

- Dual Moving Average Confluence Strategy

- An RSI Reversal Trading Strategy

- Dual-directional ADX Trading Strategy

- Three Exponential Moving Averages and Stochastic Relative Strength Index Trading Strategy

- Double 7 Days Breakout Strategy

- Dual MACD Quantitative Trading Strategy

- Bollinger Band Moving Average Crossover Strategy

- Scalping Dips in Bull Market Strategy

- Trend Following Strategy Based on Adaptive Moving Average

- True Relative Movement Moving Average Strategy

- MACD and RSI Based 5-Minute Momentum Trading Strategy

- Double Fractal Breakout Strategy

- Noro Shifted Moving Average Stop Loss Strategy