Bitcoin Trading Strategy Based on Ichimoku Cloud

Author: ChaoZhang, Date: 2024-01-31 11:06:02Tags:

Overview

This strategy is a bitcoin trading strategy designed based on the Ichimoku cloud indicator. It generates trading signals when the short-term line crosses over the long-term line by calculating the equilibrium prices over different periods.

Strategy Logic

The strategy uses the Ichimoku cloud indicator. The specific formulas are:

Lmax = highest price over period_max

Smax = lowest price over period_max

Lmed = highest price over period_med

Smed = lowest price over period_med

Lmin = highest price over period_min

Smin = lowest price over period_min

HL1 = (Lmax + Smax + Lmed + Smed)/4

HL2 = (Lmed + Smed + Lmin + Smin)/4

It calculates the equilibrium prices for the long-term line HL1 and short-term line HL2. A long signal is generated when HL2 crosses over HL1. A close signal is generated when HL2 crosses below HL1.

Advantage Analysis

The advantages of this strategy include:

- Using Ichimoku cloud filters market noise and identifies trends effectively.

- Crossover of different period lines generates trading signals and reduces false signals.

- The logic is simple and easy to understand and implement.

- Customizable period parameters adapt to different market environments.

Risk Analysis

There are also some risks:

- Ichimoku cloud has lagging and may miss short-term signals.

- Crossover of long and short term lines can be vulnerable to arbitrage.

- Signals may become unreliable during high volatility.

These risks can be reduced by optimizing parameters or incorporating other indicators.

Optimization Directions

The strategy can be optimized in the following aspects:

- Optimize long and short term periods to adapt to market changes.

- Add stop loss to control losses.

- Incorporate other indicators like MACD to improve accuracy.

- Suspend trading at high volatility periods to avoid huge losses.

Conclusion

This strategy generates signals when short-term equilibrium line crosses over long-term line based on Ichimoku cloud. Compared to single indicators, it effectively filters out false signals. Further improvements on parameters and risk control can enhance its stability and profitability.

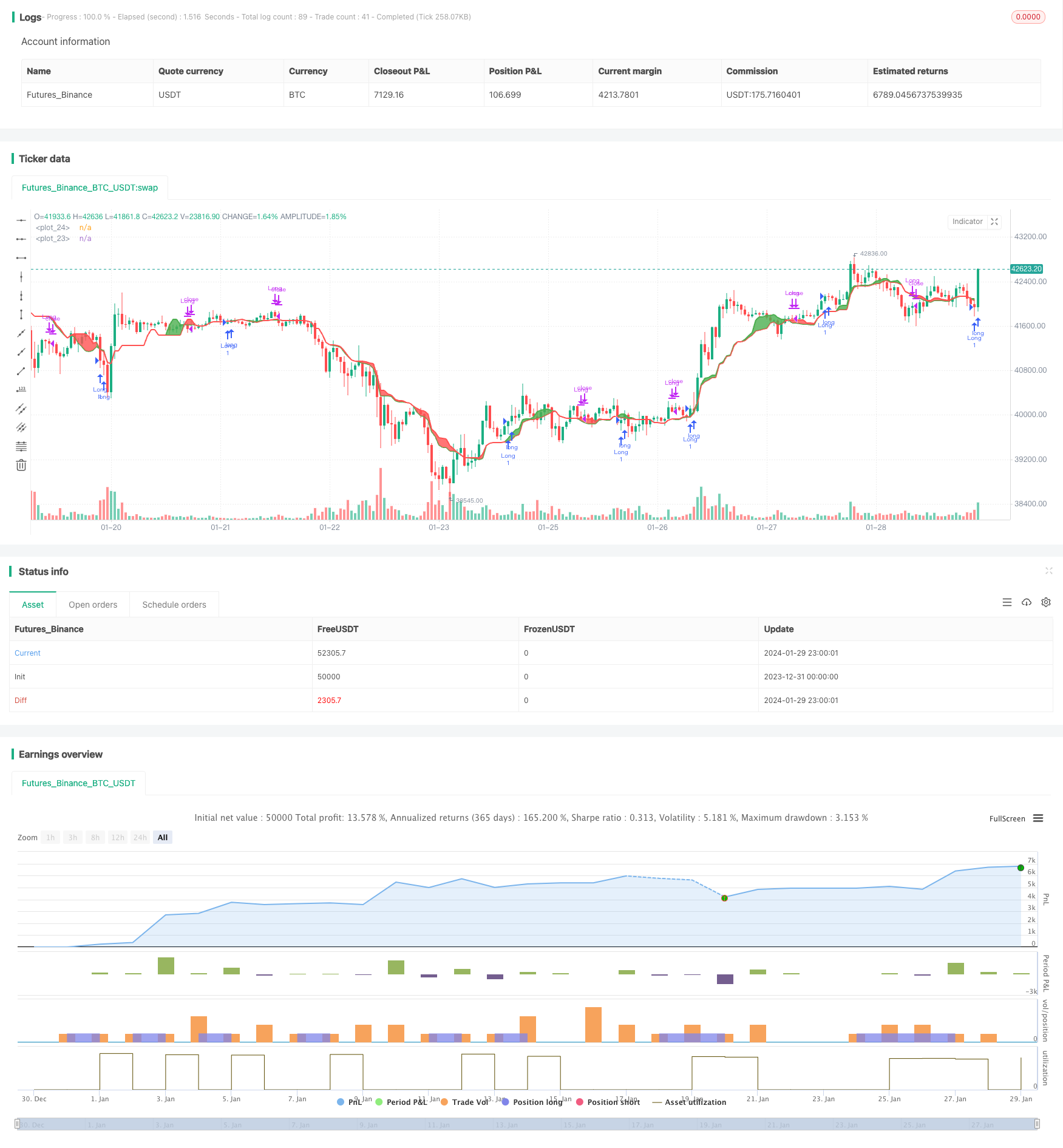

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Alferow

//@version=4

strategy("BTC_ISHIMOKU", overlay=true)

period_max = input(20, minval = 1)

period_med = input(10, minval = 1)

period_min = input(16, minval = 1)

Lmax = highest(high, period_max)

Smax = lowest(low, period_max)

Lmed = highest(high, period_med)

Smed = lowest(low, period_med)

Lmin = highest(high, period_min)

Smin = lowest(low, period_min)

HL1 = (Lmax + Smax + Lmed + Smed)/4

HL2 = (Lmed + Smed + Lmin + Smin)/4

p1 = plot(HL1, color = color.red, linewidth = 2)

p2 = plot(HL2, color = color.green, linewidth = 2)

fill(p1, p2, color = HL1 < HL2 ? color.green : color.red, transp = 90)

start = timestamp(input(2020, minval=1), 01, 01, 00, 00)

finish = timestamp(input(2025, minval=1),01, 01, 00, 00)

trig = time > start and time < finish ? true : false

strategy.entry("Long", true, when = crossover(HL2, HL1) and trig)

// strategy.entry("Short", false, when = crossunder(HL2, HL1) and trig)

strategy.close("Long", when = crossunder(HL2, HL1) and trig)

- Quant W Pattern Master Strategy

- Supertrend BarUpDn Fusion Strategy

- Previous Day's Close with ATR Trend Tracking Strategy

- Crossover Strategy of Moving Average Lines and Resistance Level Breakout

- Smooth Moving Average Stop Loss Strategy

- Momentum Bollinger Bands Dual Moving Average DCA Strategy

- Momentum Breakout Trading Strategy

- Multi-factor Quantitative Trading Strategy

- Double Moving Average Crossover Strategy

- Dual-Mechanism Dynamic Trend Tracking Strategy

- Bull Market Tracking System

- Intraday Trading Strategy for Stocks Based on Renko Low Point Retracement

- Trend Trading Strategy Based on Price Channel of Double Moving Averages

- Dual MA Momentum Breakout Strategy

- SMART Professional Quantitative Trading Strategy

- Dual Breakout Volatility Channel Strategy

- Trend Following Strategy Based on Multiple Indicators

- Multi Timeframe MACD Trading Strategy

- Monthly Returns Strategy with Benchmark

- Squeeze Momentum Breakout Strategy