Buy Strategy Based on Close Price Breakthrough

Author: ChaoZhang, Date: 2024-02-21 14:48:59Tags:

Overview

The core idea of this strategy is to buy when the closing price of the stock is higher than the opening price of the day. When the buy condition is met, the strategy will go long at the close of that candlestick at the closing price. Stop loss price and take profit price will then be set. When the price reaches these two prices, the position will be closed.

Strategy Principle

If the closing price of the daily candlestick is higher than the opening price, it means that the stock price rose on that day. This is a buy signal. The breakthrough of the closing price from the opening price indicates that the buying power is quite strong and the stock price is likely to continue rising.

Therefore, the trading signal for this strategy is: Daily Candlestick Close Price > Daily Candlestick Open Price. When this condition is met, buy at the closing price at the close of that candlestick and hold daily.

This strategy uses two parameters:

Entry Price: The buying price, the default is 0, which means buying at the closing price

Take Profit Parameter: Take profit parameter, the take profit price formula is: Entry Price * (1 + Take Profit Parameter), the default value is 0.5%, equivalent to 0.5% of the entry price

The specific trading process is as follows:

- Wait for candlestick to close and check if close price > open price of the day

- When the condition is met, buy at the closing price

- After opening a position, set stop loss and take profit price

- When the price rises to take profit price, close position for profit

- When the price falls to the lowest point of the next candlestick, close position for stop loss

- Repeat steps 1-5 every day

Advantage Analysis

This strategy has the following advantages:

- The idea is simple and easy to understand and implement

- It only requires the open and close prices of candlestick for trade signal judgment, with small data requirements

- The risk of drawdown is small, using stop loss and take profit mechanism to control losses

Risk Analysis

There are also some risks with this strategy:

- There may be multiple buy opportunities during the day, but the strategy only buys once at close, possibly missing some opportunities

- Price may callback after close, increasing the probability of stop loss trigger

The risks can be reduced by:

- After buy signal triggered, track the highest price of the day and use AdjustAmount functions to dynamically adjust position

- Delay setting stop loss and take profit price for a period after close to avoid stop loss trigger immediately

Optimization Directions

This strategy can be optimized in the following aspects:

- Add volume confirmation, for example add volume or market heat indicators as confirmation for buy signal

- Use dynamic stop loss and take profit after buying, adjust stop loss and take profit price in real time

- Set parameters specifically for individual stocks, use machine learning methods to automatically optimize the parameters

- Add position management mechanism, adjust position size to avoid drawdown risk

Conclusion

This strategy generates buy signals based on close price breakthrough. The idea is simple with small drawdown risk. By adding confirmation indicators, dynamic stop loss/take profit, parameter optimization etc., the stability and profitability of the strategy can be further improved. Overall speaking, this strategy is suitable for investors who are interested in opening price breakthrough strategies to use and optimize, and has very good practicality.

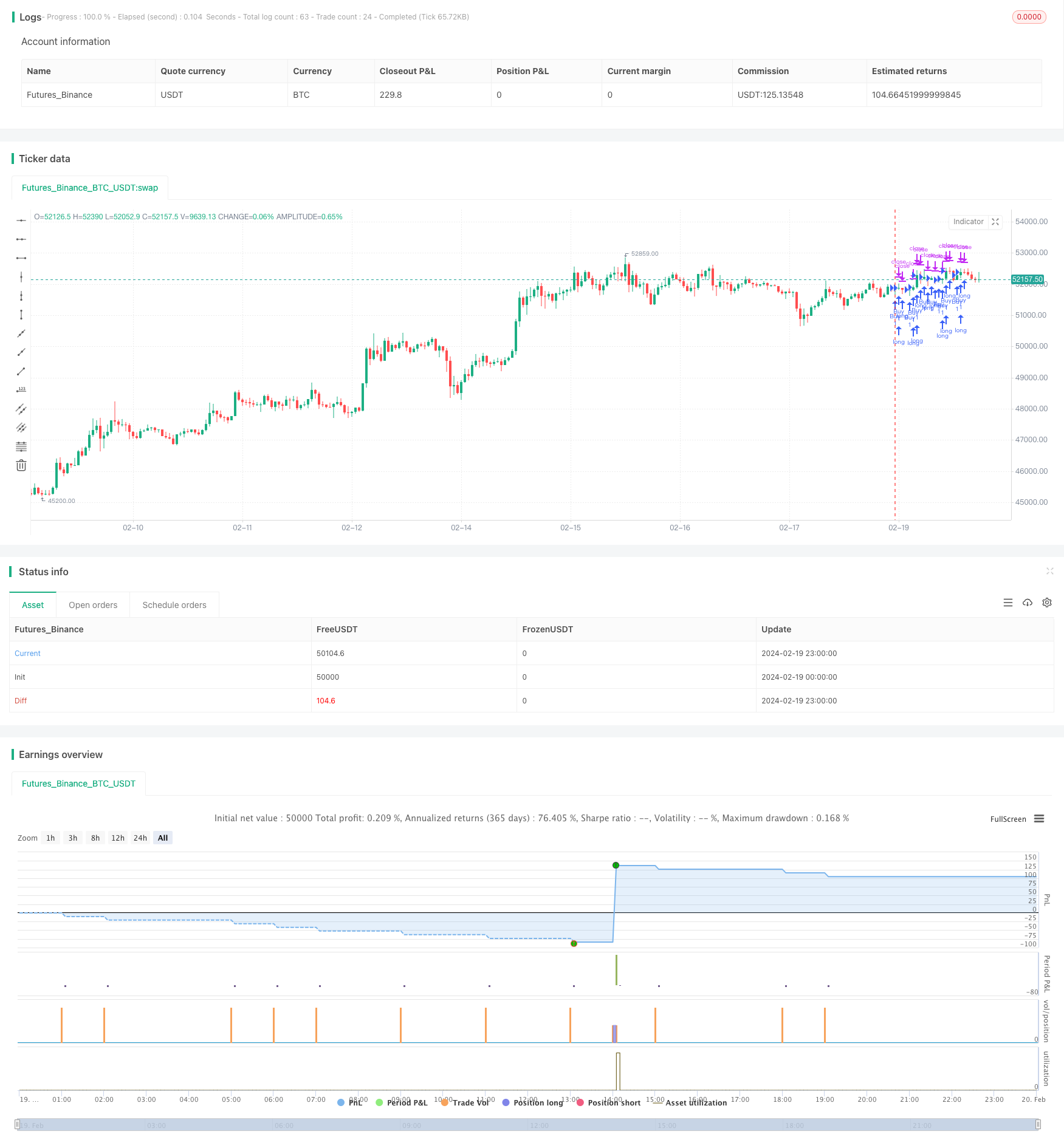

/*backtest

start: 2024-02-19 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy on Close Strategy", overlay=true)

// Входные параметры

var float entry_price = na

if (na(entry_price))

entry_price := input.float(title="Entry Price", defval=0)

// Функция для расчета Take Profit

calc_take_profit(price) =>

price * 1.005 // 0.5% от суммы сделки

// Проверяем условие для открытия позиции на покупку

buy_condition = close > open

// Переменная для отслеживания открытой позиции

var bool open_position = na

// Реализация стратегии

if (buy_condition)

// Открываем сделку на покупку

strategy.entry("Buy", strategy.long)

open_position := true

// Закрываем позицию по Take Profit или при закрытии свечи

if (open_position)

// Рассчитываем уровень Take Profit

take_profit_level = calc_take_profit(entry_price)

// Закрываем сделку по Take Profit

strategy.exit("Take Profit", "Buy", limit=take_profit_level)

// Закрываем сделку при закрытии свечи

if (close < open)

strategy.close("Close Candle", "Buy")

- Recursive Moving Trend Average Combined with 123 Reversal Pattern Strategy

- Multi Timeframe Moving Average and EMA Based Trend Strategy

- Multi Timeframe RSI and Stochastics Strategy

- Enhanced Moving Average Crossover Sakkoulas Trading Strategy

- Simple Moving Average Crossover Strategy

- Donchian Adaptive Moving Average Trading System

- Volume Weighted Trend Reversal Strategy

- Trading Strategy Based on Multiple Time Frame EMA Breakthrough and K-line Pattern Combination

- Trend Following Strategy with Stop Loss and Take Profit

- Dynamic Position Sizing Quant Strategy

- Dual Moving Average Strategy

- Breakout Bollinger Bands Oscillation Trading Strategy

- Trading Psychology Balancing Strategy

- Quantitative Trading Strategy Based on Double Moving Average Crossover

- Best ATR Stop Multiple Strategy

- Bollinger Crossing Death Golden Strategy

- Reversal Trading Strategy with Bollinger Bands, RSI, ADX and ATR

- DEMA Crossover Trend Following Strategy

- Extreme Reversal Setup Strategy

- OBV and CCI Indicators Based Trend Following Strategy