Trend Following Strategy with Stop Loss and Take Profit

Author: ChaoZhang, Date: 2024-02-21 14:55:41Tags:

Overview

The main idea of this strategy is to determine the direction of long and short based on the weekly price trend. In an uptrend, it goes long when there is a bullish candlestick pattern. It takes profit when the price rises to the preset take profit level and stops loss when it falls to the preset stop loss level.

Strategy Logic

The strategy first defines the conditions for judging the weekly trend:

isUptrend = close > close[1]

isDowntrend = close < close[1]

If the current close is higher than the previous close, it is judged as an uptrend. Otherwise, it is a downtrend.

Then the intraday trading signal is defined:

buyCondition = getPrevDayClose() > getPrevDayOpen() and getPrevDayOpen() > getPrevDayClose()[1] and isUptrend

That is, the previous close is higher than the previous open (bullish candle), and the previous open is higher than the close before previous day (gap up), and it is in an uptrend. These criteria meet the long entry condition.

After entering the position, the stop loss is set to the previous close minus 1.382 times the previous day’s real body:

stopLoss = getPrevDayClose() - 1.382 * (getPrevDayClose() - getPrevDayOpen())

The take profit is set to the previous close plus 2 times the difference between the previous close and stop loss:

takeProfit = getPrevDayClose() + 2 * (getPrevDayClose() - stopLoss)

This realizes the stop loss and profit taking strategy.

Advantage Analysis

The advantages of this strategy include:

- Trading along trends avoids risks of counter-trend shorting

- Entry signal combines bullish candle and gap up to avoid premature long entry

- Stop loss positioning is reasonable to control single loss

- Take profit range is large with high profit potential

Risk Analysis

There are also some risks:

- Unable to determine trend reversal points, may miss turning opportunities

- Stop loss is too close with higher probability of being trapped

- No consideration of cost control, profit may decrease at high trading frequency

To control these risks, some optimizations can be considered:

- Set trailers near stop loss to trail the stop loss

- Add cost control module to limit order frequency

- Add judgment of SUPPORT/RESISTANCE

Optimization Directions

The strategy can also be optimized in the following ways:

- Determine trend based on more factors like MA direction, volume change etc.

- Optimize entry signals with more candlestick patterns

- Dynamically trail stop loss and take profit according to price fluctuation

- Add quantitative module to control position sizing

- Combinations of multiple timeframes to filter based on higher level trends

Summary

Overall this is quite a practical strategy, highlighting trading along trends while controlling risks. It can serve as a basic intraday trading strategy and can be modularly optimized for different markets and products to create diversified trading portfolios. In actual usage, controlling costs and avoiding traps remain critical, so maintaining proper mentality is key.

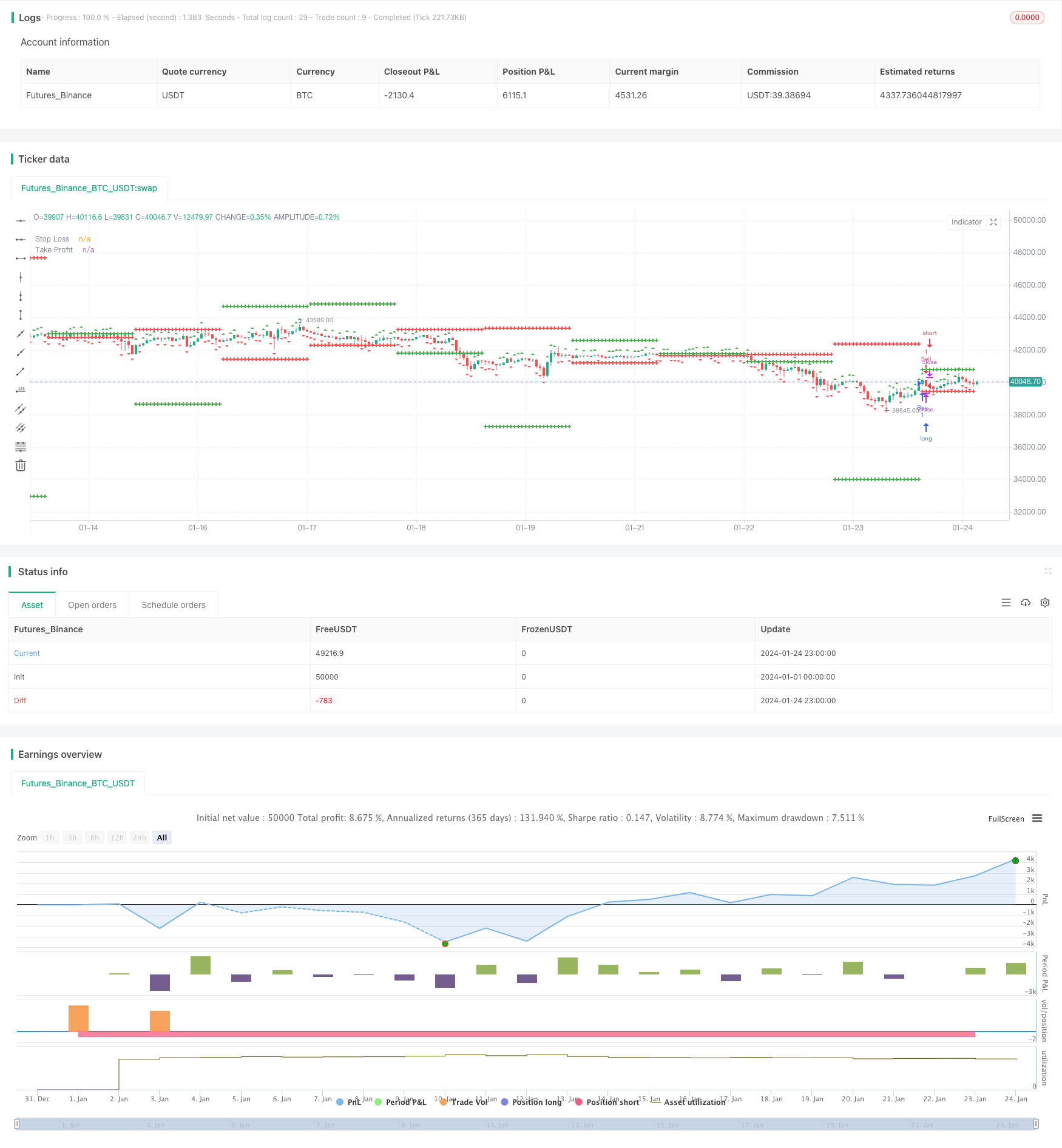

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Trend Following Strategy with Stop Loss and Take Profit", overlay=true)

// Function to get previous day's close and open

getPrevDayClose() =>

request.security(syminfo.tickerid, "D", close[1])

getPrevDayOpen() =>

request.security(syminfo.tickerid, "D", open[1])

// Determine weekly trend

isUptrend = close > close[1]

isDowntrend = close < close[1]

// Determine daily conditions for buy

buyCondition = getPrevDayClose() > getPrevDayOpen() and getPrevDayOpen() > getPrevDayClose()[1] and isUptrend

// Calculate stop loss and take profit

stopLoss = getPrevDayClose() - 1.382 * (getPrevDayClose() - getPrevDayOpen())

takeProfit = getPrevDayClose() + 2 * (getPrevDayClose() - stopLoss)

// Strategy logic

if (isUptrend)

strategy.entry("Buy", strategy.long, when = buyCondition)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", loss=stopLoss, profit=takeProfit)

if (isDowntrend)

strategy.entry("Sell", strategy.short)

// Plotting the trend on the chart

plotshape(series=isUptrend, title="Uptrend", color=color.green, style=shape.triangleup, location=location.abovebar)

plotshape(series=isDowntrend, title="Downtrend", color=color.red, style=shape.triangledown, location=location.belowbar)

// Plotting stop loss and take profit levels on the chart

plot(stopLoss, color=color.red, title="Stop Loss", linewidth=2, style=plot.style_cross)

plot(takeProfit, color=color.green, title="Take Profit", linewidth=2, style=plot.style_cross)

- Reversal Trading Strategy with EMA Crossover and Bollinger Bands

- Adaptive Moving Stop Line Trading Strategy

- Recursive Moving Trend Average Combined with 123 Reversal Pattern Strategy

- Multi Timeframe Moving Average and EMA Based Trend Strategy

- Multi Timeframe RSI and Stochastics Strategy

- Enhanced Moving Average Crossover Sakkoulas Trading Strategy

- Simple Moving Average Crossover Strategy

- Donchian Adaptive Moving Average Trading System

- Volume Weighted Trend Reversal Strategy

- Trading Strategy Based on Multiple Time Frame EMA Breakthrough and K-line Pattern Combination

- Dynamic Position Sizing Quant Strategy

- Buy Strategy Based on Close Price Breakthrough

- Dual Moving Average Strategy

- Breakout Bollinger Bands Oscillation Trading Strategy

- Trading Psychology Balancing Strategy

- Quantitative Trading Strategy Based on Double Moving Average Crossover

- Best ATR Stop Multiple Strategy

- Bollinger Crossing Death Golden Strategy

- Reversal Trading Strategy with Bollinger Bands, RSI, ADX and ATR

- DEMA Crossover Trend Following Strategy