Overview

The Multi-Timeframe RSI Trading Strategy is a comprehensive trading tool that utilizes the Relative Strength Index (RSI) across three different timeframes: 15-minute (M15), 1-hour (H1), and 4-hour (H4). This strategy helps traders identify momentum and trend shifts by comparing RSI values across these timeframes.

Strategy Logic

The core logic of this strategy is to calculate RSI on 15-minute (M15), 1-hour (H1) and 4-hour (H4) timeframes and compare the RSI readings across these three timeframes. Specifically, it follows these principles:

A buy signal is generated when the RSI on M15 is greater than H1, and H1 is greater than H4, with the condition that H4 RSI is above 30 to avoid oversold conditions.

A sell signal occurs when the RSI on H1 is less than H4, and M15 RSI is less than H1, with the condition that H4 RSI is below 70 to avoid overbought conditions.

It suggests closing buy positions when the RSI on M15 crosses below the RSI on H1.

It recommends closing sell positions when the RSI on M15 crosses above the RSI on H1.

Advantages

Compared to single timeframe RSI, this strategy has the following advantages:

Multi-timeframe analysis provides more reliable trading signals. Comparing RSI across different periods filters out some noisy signals.

Intuitive visualizations. The strategy plots each timeframe’s RSI in distinct colors for clearer decision making.

Dynamic entry/exit mechanism. The strategy automatically generates buy and sell signals based on RSI configuration changes.

Customizable overbought/oversold levels. Traders can adjust RSI periods and threshold levels based on their trading style and risk tolerance.

Risk Analysis

The strategy also carries some risks, mainly:

RSI can generate false signals. It may produce frequent crossovers in ranging markets.

Noise from shorter timeframes may be amplified in multi-timeframe judgments.

Economic news and major events increase market volatility, affecting indicator reliability.

To mitigate risks, thorough backtesting, parameter optimization, and additional signal filtering tools are recommended. Traders should also be mindful of high-impact economic event calendars to avoid openings during such times.

Enhancement Opportunities

There is room for further enhancing this strategy:

Incorporate more timeframes to construct a multi-layer RSI trading system, e.g. adding daily or weekly RSI analysis.

Test different RSI parameter settings to find optimal configurations.

Combine with other indicators for signal verification, e.g. Volume, MACD etc.

Add stop loss strategies to effectively control single trade loss amount.

Conclusion

The Multi-Timeframe RSI Strategy generates more stable and efficient trading signals by comparing cross-period RSI configurations. Compared to single timeframe RSI, it has advantages like noise filtering and intuitive visualizations. As a technical indicator based strategy, it still carries some inherent risks and would need proper optimization and tuning to minimize those risks. Overall, it provides new ideas for RSI application and is worth further research and usage by quantitative traders.

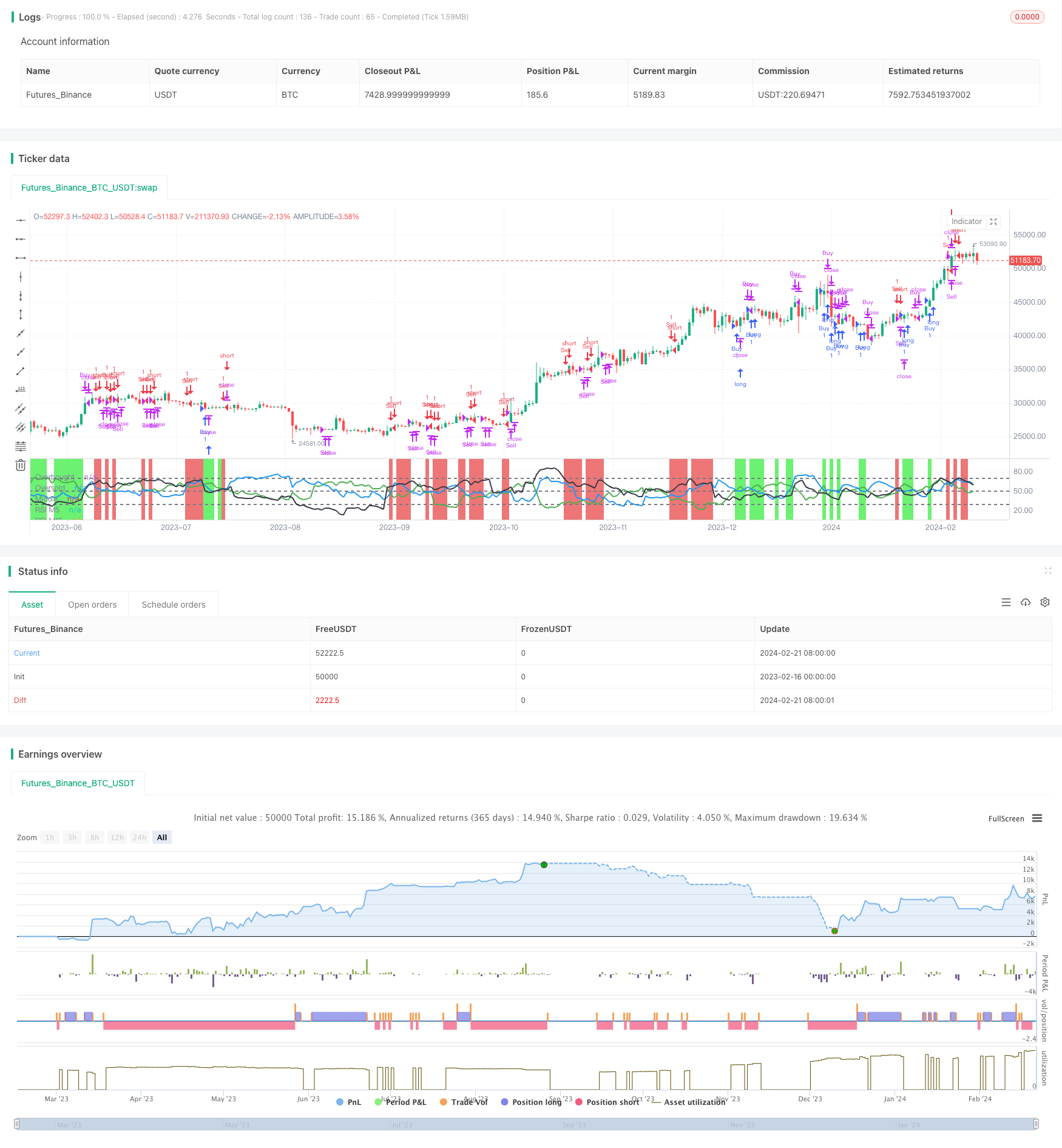

/*backtest

start: 2023-02-16 00:00:00

end: 2024-02-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Timeframe RSI Strategy", overlay=false)

// Lấy dữ liệu RSI từ các biểu đồ khác nhau

rsiM15 = request.security(syminfo.tickerid, "15", ta.rsi(close, 14))

rsiH1 = request.security(syminfo.tickerid, "60", ta.rsi(close, 14))

rsiH4 = request.security(syminfo.tickerid, "240", ta.rsi(close, 14))

// Vẽ đường RSI

plot(rsiM15, title="RSI M5", color=color.green, linewidth=2)

plot(rsiH1, title="RSI M15", color=color.blue, linewidth=2)

plot(rsiH4, title="RSI H1", color=color.black, linewidth=2)

// Điều kiện mua và bán

buyCondition = rsiM15 > rsiH1 and rsiH1 > rsiH4 and rsiH4 > 30

sellCondition = rsiH1 < rsiH4 and rsiM15 < rsiH1 and rsiH4 <70

// Điều kiện đóng lệnh

closeBuyCondition = rsiM15 < rsiH1

closeSellCondition = rsiM15 > rsiH1

// Vẽ đường Overbought và Oversold

hline(70, "Overbought", color=color.gray, linewidth=2)

hline(30, "Oversold", color=color.gray, linewidth=2)

hline(50, "Middle", color=color.gray, linewidth=2)

// Màu nền cho điều kiện mua và bán

bgcolor(buyCondition ? color.new(#0ce714, 40) : sellCondition ? color.new(#e21b1b, 40) : na)

// Đưa ra các quyết định mua hoặc bán

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Điều kiện đóng lệnh

if (closeBuyCondition)

strategy.close("Buy")

if (closeSellCondition)

strategy.close("Sell")

//@version=5

// Tạo các cảnh báo

alertcondition(buyCondition, title="Mua Signal", message="Mua Signal")

alertcondition(sellCondition, title="Bán Signal", message="Bán Signal")