Double Moving Average and MACD Combination Trading Strategy

Author: ChaoZhang, Date: 2024-02-29 11:31:48Tags:

Overview

The double moving average and MACD combination trading strategy is a quantitative trading strategy that utilizes both moving averages and momentum indicators for trade signal generation and validation. By combining the trend-following capability of moving averages and the momentum characteristic of MACD, this strategy can effectively catch the contour of market trends through strict entry and exit criteria setting, while avoiding the risk of narrowed profit range or market fluctuation that may lead to reduced profit or even loss.

Strategy Logic

This strategy employs a combination of the 20-period simple moving average (SMA) and 5-period exponential moving average (EMA). The 20-period SMA can smooth market fluctuations effectively and determine mid- to long-term price trends, while the 5-period EMA assigns higher weights to recent prices and reacts sensitively to short-term price changes. Buy signals are generated when price crosses above the 5-period line while above the 20-period line, and sell signals are generated when price crosses below the 5-period line while below the 20-period line. Such double moving average combination ensures trade signals follow major trends while improving sensitivity and timeliness of signals through the introduction of short-term moving averages.

After trade signals are generated, the MACD indicator is introduced to validate the trend. Specifically, when buy signals are triggered, the MACD DIFF line needs to see a “golden cross” with the DEA line which is maintained for several periods to confirm an upward trend; conversely, when sell signals are triggered, a “dead cross” followed by a downward trend for several periods needs to be observed. This filters noise trades and avoids opening positions frequently during market consolidations.

Lastly, reasonable stop-loss levels are set for both long and short positions. The long stop-loss line is set below the lowest point since entry, while the short stop-loss line is set above the highest point since entry. The stop loss levels update dynamically with price fluctuations. Such stop loss method locks in profits to the largest extent and prevents unacceptable losses in case of serious market reversals.

Advantage Analysis

- Double moving averages effectively identify trading direction and avoid market noise interference

- MACD validation ensures established trend and prevents opening positions frequently during consolidations

- Strict stop loss strategy locks in profits to maximum extent and controls market risk

- Adjustable parameters allowing optimization based on market and product characterists

Risk Analysis

- Improper MACD parameter selection may miss shorter trends or intervene too frequently

- Moving average parameters need testing for optimum per product

- Stop loss may be penetrated in strong trending markets causing certain losses

MACD parameters can be adjusted for better cooperation. Also, moving average period parameters need optimization per product characterists. Finally, stop loss range can be loosened reasonably to allow full profit release for major directional moves.

Optimization Directions

Further optimizations can be pursued in the following directions for this strategy:

-

Introduce adaptive moving average algorithms. Dynamic period moving average combinations automatically adapt to markets without manual parameter tuning needs.

-

Incorporate machine learning models. Algorithms like deep learning can automatically identify market characterists of different products and output optimal parameter settings in real time.

-

Add supplementary filters. Other technical indicators can be introduced on top of current signals as auxiliary judgement standards, such as integrating volume factors.

-

Optimize stop loss strategies. More intelligent stop loss techniques like breakout stop loss and tracking stop loss should be researched, in order to obtain greater reward while controlling risk.

Summary

The double moving average and MACD combination strategy comprehensively considers aspects like trend, momentum, risk control beyond limitations of single technical indicators, and can effectively improve the stability of quantitative trading. This strategy adapts well to different market environments through parameter tuning and is well worth live application and continued optimization. Meanwhile, substantial room remains in incorporating more intelligent techniques for automated optimization and maximized strategy efficacy.

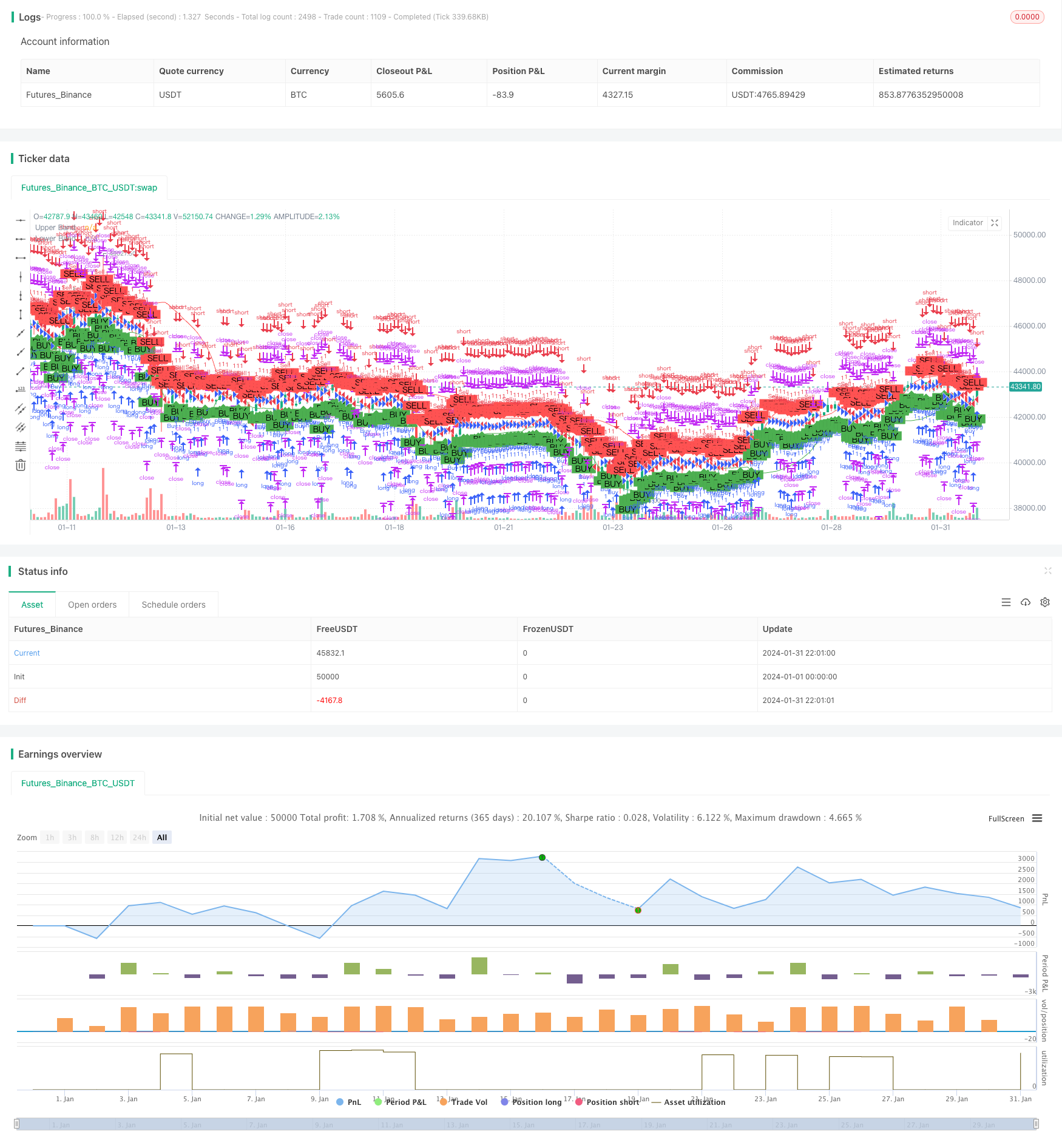

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Band Strategy with Early Signal (v5)", overlay=true)

// Inputs

length = 20

mult = 1.5

src = close

riskRewardRatio = input(3.0, title="Risk-Reward Ratio")

// Calculating Bollinger Bands

basis = ta.ema(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plotting Bollinger Bands

plot(upper, "Upper Band", color=color.red)

plot(lower, "Lower Band", color=color.green)

// Tracking Two Candles Ago Crossing Bollinger Bands

var float twoCandlesAgoUpperCrossLow = na

var float twoCandlesAgoLowerCrossHigh = na

if (close[2] > upper[2])

twoCandlesAgoUpperCrossLow := low[2]

if (close[2] < lower[2])

twoCandlesAgoLowerCrossHigh := high[2]

// Entry Conditions

longCondition = (not na(twoCandlesAgoLowerCrossHigh)) and (high > twoCandlesAgoLowerCrossHigh)

shortCondition = (not na(twoCandlesAgoUpperCrossLow)) and (low < twoCandlesAgoUpperCrossLow)

// Plotting Entry Points

plotshape(longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy Execution

if (longCondition)

stopLoss = low - (high - low) * 0.05

takeProfit = close + (close - stopLoss) * riskRewardRatio

strategy.entry("Buy", strategy.long)

strategy.exit("Exit Buy", "Buy", stop=stopLoss, limit=takeProfit)

if (shortCondition)

stopLoss = high + (high - low) * 0.05

takeProfit = close - (stopLoss - close) * riskRewardRatio

strategy.entry("Sell", strategy.short)

strategy.exit("Exit Sell", "Sell", stop=stopLoss, limit=takeProfit)

- Trend Following Moving Average Strategy

- Momentum Crossover Strategy with Dynamic Trailing Stop Loss

- EMA and RSI Quantitative Trading Strategy

- Momentum Trend Strategy Based on MACD and Bollinger Bands

- Multi-Timeframe Stochastic Strategy

- Moving Average Crossover Strategy with Intraday Candlestick Patterns

- Bitcoin Scalping Strategy Based on Moving Average Crossover and Candlestick Patterns

- Momentum and Moving Average Combination Long Strategy

- Momentum Average Directional Movement Index Moving Average Crossover Strategy

- Dual EMA Crossover Trend Tracking Strategy

- Dynamic Engulfing Trend Strategy

- Multi Timeframe Moving Average Pullback Trading Strategy

- Dual Moving Average Volatility Tracking Strategy

- Short-term Trading Strategy Based on Bollinger Bands

- Trend Riding Strategy Based on MOST and KAMA

- Dual Timeframe Trend Following Strategy

- Bitlinc MARSI Trading Strategy

- The Bollinger Bands Tracking Strategy

- SuperTrend Breakout Strategy

- The Double EMA Strategy Analysis