Strategy Name

Dual Moving Average Crossover Quantitative Trading Strategy

Strategy Overview

This strategy makes trading decisions based on the crossover signals of two moving averages (MA) with different periods. When the short-term MA crosses above the long-term MA, it generates a buy signal; when the short-term MA crosses below the long-term MA, it generates a sell signal. The strategy attempts to capture the medium to long-term trends of prices and profit from trend following.

Strategy Principle

The strategy uses two moving averages with different periods as the main technical indicators. One is the short-term moving average, which reflects the short-term trend of prices; the other is the long-term moving average, which reflects the medium to long-term trend of prices. When the short-term MA crosses the long-term MA, it often implies a change in trend.

Specifically, when the short-term MA crosses above the long-term MA, it indicates that the price may enter an upward trend, and the strategy will generate a buy signal. Conversely, when the short-term MA crosses below the long-term MA, it indicates that the price may enter a downward trend, and the strategy will generate a sell signal. This trend-following approach can help investors align with market trends and profit from price increases or decreases.

In the code implementation of the strategy, the following main steps are used:

1. Use the input function to set the period parameters of the short-term MA and long-term MA, allowing users to customize.

2. Use the ta.sma function to calculate the short-term MA.

3. Determine whether the price is above or below the short-term MA by comparing the closing price with the short-term MA.

4. Determine whether to generate buy or sell signals by judging whether the relationship between the closing price and the short-term MA changes between two consecutive bars.

5. Use the strategy.entry function to make trades based on buy and sell signals.

6. Use the plotshape function to mark buy and sell signals on the chart.

7. Use the plot function to draw the short-term MA curve on the chart.

Through the organic combination of these steps, the strategy can dynamically adjust positions based on the changes in moving average crossovers, attempting to continuously profit from market trends.

Strategy Advantages

- Simple and easy to understand: The strategy only uses moving averages as a technical indicator, with a simple and clear principle that is easy to understand and implement.

- High adaptability: By flexibly setting the period parameters of the two moving averages, it can adapt to different market characteristics and investment needs.

- Trend following: The strategy judges trends based on moving average crossovers, which can effectively capture the medium to long-term trends of prices and follow market trends for trading.

- Easy to optimize: The performance of the strategy can be improved by optimizing the period parameters of the moving averages.

- Wide applicability: The strategy can be applied to various financial markets and trading instruments, such as stocks, futures, forex, etc.

Strategy Risks

- Parameter sensitivity: The performance of the strategy is relatively sensitive to the period parameters of the moving averages, and improper parameter settings may lead to performance degradation.

- Amplitude sensitivity: When the price fluctuates with a large amplitude, frequent crossover signals may lead to excessive trades and increase costs.

- Oscillating market: In an oscillating market, prices frequently fluctuate above and below the moving averages, which may generate more false positive signals.

- Lag: Moving averages are lagging indicators, and when crossover signals are generated, prices may have already run for some time, with a slight lag.

- Single indicator: The strategy only relies on moving averages as a single indicator, which may lack a comprehensive consideration of the market and face certain limitations and risks.

To address these risks, the following measures can be taken to improve the strategy: 1. Seek the optimal combination of moving average periods through parameter optimization to improve robustness. 2. Introduce other technical indicators or market signals, such as volume, momentum, etc., to enrich the consideration dimensions of the strategy. 3. Set reasonable take-profit and stop-loss rules to control the risk of a single trade. 4. Filter trading signals, such as requiring multiple consecutive candles to confirm trend changes, to reduce false positives. 5. Regularly review and adjust the strategy to adapt to dynamic changes in the market.

Strategy Optimization

- Parameter optimization: Methods such as walk-forward analysis and grid search can be used to optimize the period parameters of the moving averages, seeking the best parameter combination to improve the robustness and profitability of the strategy. The optimized period parameters can be adjusted according to different market characteristics and investment styles.

- Signal filtering: After generating trading signals, some filtering rules can be used to improve the quality of signals, such as requiring a certain distance between the short-term MA and long-term MA, requiring a certain follow-through after the price crosses the MA, requiring synchronous confirmation of signals from multiple time frames, etc., to reduce false positive signals.

- Take-profit and stop-loss: Reasonable take-profit and stop-loss rules can be set for each trade to prevent downside risk of a single trade on the one hand and timely lock in profits on the other. The position of take-profit and stop-loss can be dynamically adjusted according to factors such as price volatility, support, and resistance.

- Position management: The size of the position for each trade can be dynamically adjusted according to factors such as the strength of the market trend and the risk tolerance of the account, increasing the position when the trend is strong and reducing the position when the trend weakens, to better adapt to the market.

- Multi-indicator combination: Other technical indicators or market signals can be combined with moving averages, such as MACD, RSI, ATR, etc., to judge and confirm trends from multiple dimensions and improve the reliability of the strategy. The weights between different indicators can be allocated according to their stability in different market states.

The purpose of these optimization directions is to improve the adaptability, robustness, and profitability of the strategy, and better cope with changes and challenges in the market. Through continuous optimization and improvement, the strategy can achieve better results in practical applications.

Summary

The dual moving average crossover quantitative trading strategy is a simple, easy-to-understand, and highly adaptable trend-following strategy. It judges price trends through the crossover changes of two moving averages with different periods, attempting to capture medium to long-term opportunities in the market. The advantages of the strategy lie in its simple and clear principle, easy implementation and optimization, and applicability to various financial markets. However, it also faces risks such as parameter sensitivity, poor performance in oscillating markets, and signal lag.

To improve the strategy, we can start from aspects such as parameter optimization, signal filtering, position management, and multi-indicator combination to improve the adaptability and robustness of the strategy. It is also necessary to regularly review and adjust the strategy to adapt to dynamic changes in the market.

Overall, the dual moving average crossover strategy provides a basic framework for quantitative trading, but in practical applications, it still needs to be optimized and improved according to specific market characteristics and investment needs to achieve better results. For quantitative traders, studying and optimizing this strategy can help understand market patterns and accumulate valuable practical experience.

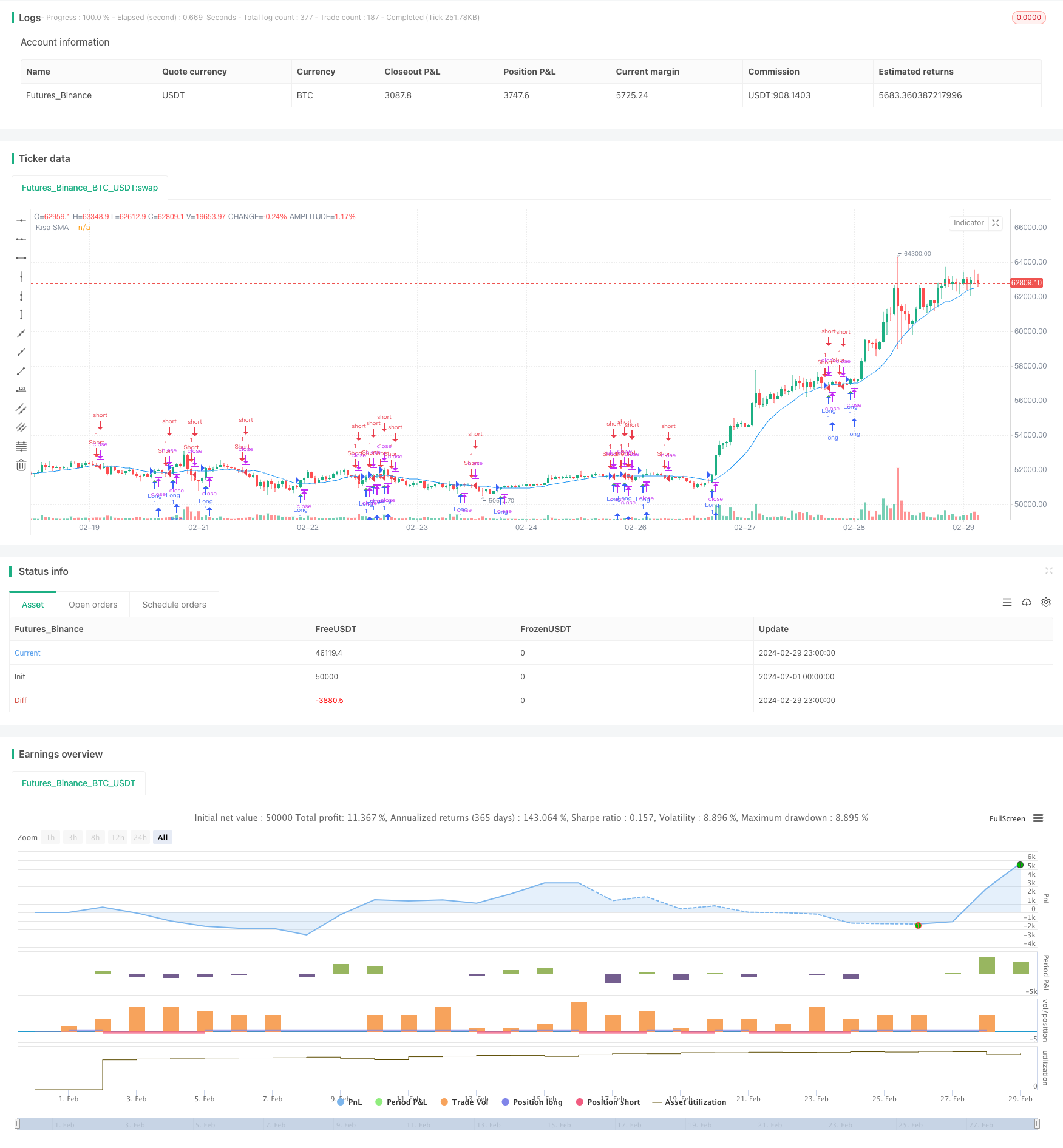

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SMA Crossover Strategy", overlay=true)

// SMA parametrelerini ayarla

sma_short_length = input.int(15, "Kısa SMA Uzunluğu")

sma_long_length = input.int(200, "Uzun SMA Uzunluğu")

// Hareketli ortalama hesaplamalarını yap

sma_short = ta.sma(close, sma_short_length)

// Fiyatın SMA'yı yukarı veya aşağı kestiğini kontrol et

price_above_sma = close > sma_short

price_below_sma = close < sma_short

// Alım-Satım noktalarını belirle

longCondition = (close[1] < sma_short[1] and close > sma_short) and price_above_sma

shortCondition = (close[1] > sma_short[1] and close < sma_short) and price_below_sma

// Al-Sat stratejisi

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Fiyatın kısa SMA'yı yukarı kesme noktalarını göster

plotshape(series=longCondition, title="Long", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

// Fiyatın kısa SMA'yı aşağı kesme noktalarını göster

plotshape(series=shortCondition, title="Short", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Hareketli ortalamaları grafiğe çiz

plot(sma_short, color=color.blue, title="Kısa SMA")