CVD背离量化交易策略

Author: ChaoZhang, Date: 2024-03-15 16:47:47Tags:

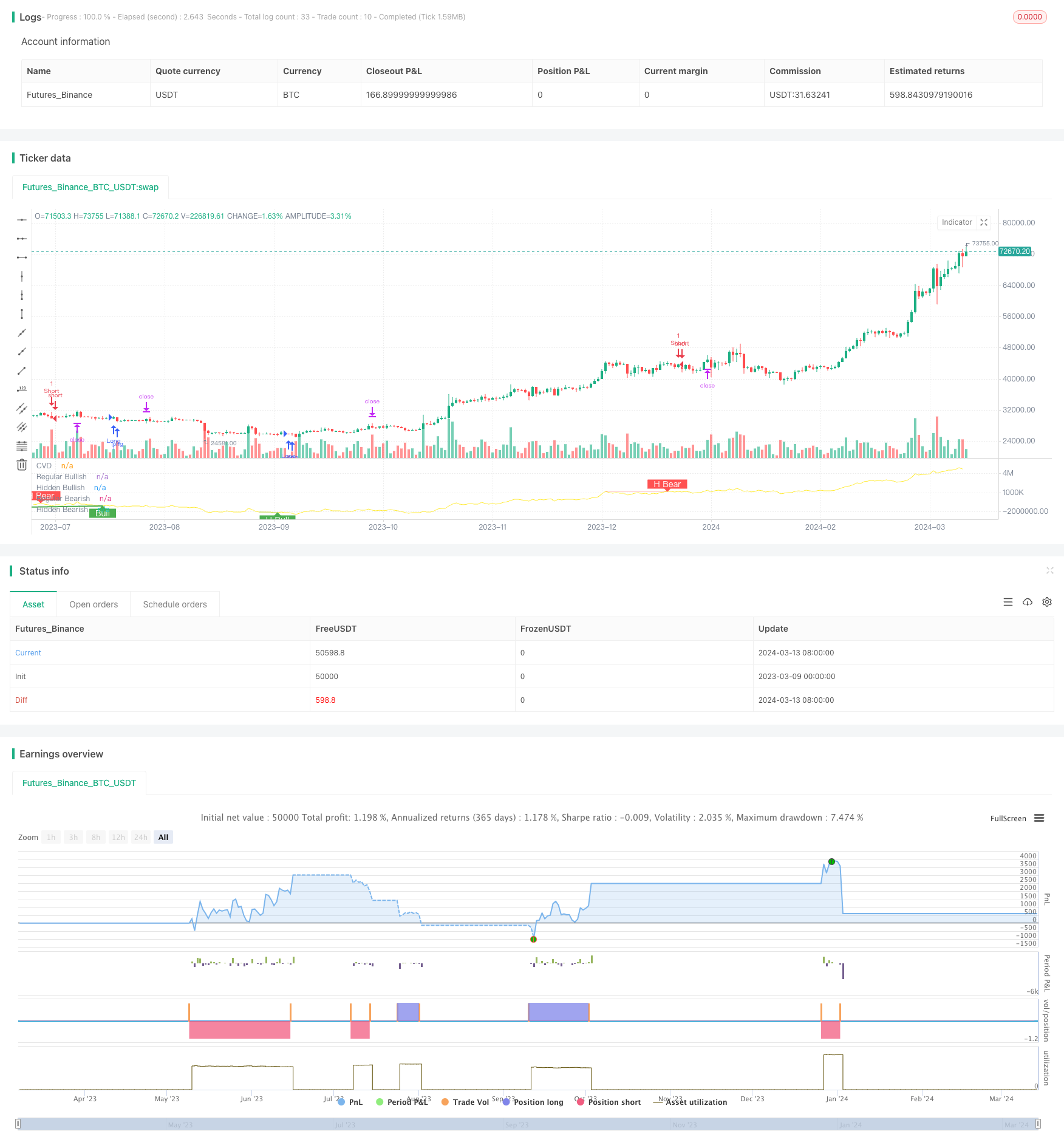

策略概述: 该CVD背离量化交易策略利用CVD指标与价格形成背离来捕捉潜在的趋势反转信号。策略会计算CVD指标,并通过与价格进行比较,判断是否形成看涨或看跌背离。当出现背离信号时,策略会开仓做多或做空。同时使用移动止损和固定百分比止盈来控制风险和锁定利润。该策略同时支持多个仓位的金字塔加仓。

策略原理: 1. 计算CVD指标:根据多头成交量和空头成交量计算CVD指标及其移动平均线。 2. 识别背离:通过比较CVD指标的高低点和价格的高低点,判断是否形成背离。 - 常规看涨背离:价格创新低,但CVD指标形成更高低点 - 隐藏看涨背离:价格创新高,但CVD指标形成更低低点 - 常规看跌背离:价格创新高,但CVD指标形成更低高点 - 隐藏看跌背离:价格创新低,但CVD指标形成更高高点 3. 开仓:当识别到背离信号时,根据背离类型开仓做多或做空。 4. 止损止盈:使用移动止损和固定百分比止盈。止损价格根据开仓价乘以止损百分比计算,止盈价格根据开仓价乘以止盈百分比计算。 5. 金字塔加仓:策略最多允许3个仓位的金字塔加仓。

策略优势: 1. 趋势反转信号:CVD背离是一个有效的趋势反转信号,可以帮助捕捉趋势反转机会。 2. 趋势延续信号:隐藏背离可以作为趋势延续信号,帮助策略在趋势中保持正确方向。 3. 风险控制:使用移动止损和固定百分比止盈,对风险进行了有效控制。 4. 金字塔加仓:允许多个仓位加仓,可以更好地利用趋势行情。

策略风险: 1. 讯号有效性:背离信号并非完全可靠,有时会出现假信号。 2. 参数配置:策略结果对参数设置较为敏感,不同参数可能带来不同结果。 3. 止损滑点:在剧烈行情中,止损订单可能无法按预设价格成交,带来额外风险。 4. 交易费用:频繁开平仓可能带来较高的交易费用,影响策略收益。

优化方向: 1. 动态参数优化:对不同市场状况采用自适应参数,提高讯号有效性。 2. 结合其他指标:与其他技术指标如RSI、MACD等结合,提高讯号可靠度。 3. 改进止损止盈:采用更高级的止损止盈策略,如追踪止损、波动率止损等。 4. 头寸规模管理:根据市场波动率、账户资金等动态调整头寸规模。

总结: CVD背离量化交易策略通过捕捉CVD指标与价格的背离,识别潜在的趋势反转机会。同时采用移动止损和固定百分比止盈控制风险。策略的主要优势在于能有效捕捉趋势反转和延续讯号,并通过金字塔加仓更好把握趋势行情。但该策略也存在讯号有效性、参数配置、止损滑点和交易费用等风险。未来可通过动态参数优化、结合其他指标、改进止损止盈和头寸规模管理等方式进一步强化策略表现。总的来说,CVD背离量化交易策略是一个有效且可优化的趋势交易策略,适合在把控风险的同时捕捉趋势机会的量化交易者。

/*backtest

start: 2023-03-09 00:00:00

end: 2024-03-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@ mmattman

//Thank you to @ contrerae and Tradingview each for parts of the code to make

//this indicator and matching strategy and also theCrypster for the clean concise TP/SL code.

// indicator(title="CVD Divergence Indicator 1", shorttitle='CVD Div1', format=format.price, timeframe="", timeframe_gaps=true)

strategy("CVD Divergence Strategy.1.mm", shorttitle = 'CVD Div Str 1', overlay=false)

//..................................................................................................................

// Inputs

periodMa = input.int(title='MA Length', minval=1, defval=20)

plotMa = input(title='Plot MA?', defval=false)

// Calculations (Bull & Bear Balance Indicator by Vadim Gimelfarb)

iff_1 = close[1] < open ? math.max(high - close[1], close - low) : math.max(high - open, close - low)

iff_2 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_3 = close[1] < open ? math.max(high - close[1], close - low) : high - open

iff_4 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_5 = close[1] < open ? math.max(open - close[1], high - low) : high - low

iff_6 = close[1] > open ? math.max(high - open, close - low) : iff_5

iff_7 = high - close < close - low ? iff_4 : iff_6

iff_8 = high - close > close - low ? iff_3 : iff_7

iff_9 = close > open ? iff_2 : iff_8

bullPower = close < open ? iff_1 : iff_9

iff_10 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_11 = close[1] > open ? math.max(close[1] - low, high - close) : math.max(open - low, high - close)

iff_12 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_13 = close[1] > open ? math.max(close[1] - low, high - close) : open - low

iff_14 = close[1] < open ? math.max(open - low, high - close) : high - low

iff_15 = close[1] > open ? math.max(close[1] - open, high - low) : iff_14

iff_16 = high - close < close - low ? iff_13 : iff_15

iff_17 = high - close > close - low ? iff_12 : iff_16

iff_18 = close > open ? iff_11 : iff_17

bearPower = close < open ? iff_10 : iff_18

// Calculations (Bull & Bear Pressure Volume)

bullVolume = bullPower / (bullPower + bearPower) * volume

bearVolume = bearPower / (bullPower + bearPower) * volume

// Calculations Delta

delta = bullVolume - bearVolume

cvd = ta.cum(delta)

cvdMa = ta.sma(cvd, periodMa)

// Plotting

customColor = cvd > cvdMa ? color.new(color.teal, 50) : color.new(color.red, 50)

plotRef1 = plot(cvd, style=plot.style_line, linewidth=1, color=color.new(color.yellow, 0), title='CVD')

plotRef2 = plot(plotMa ? cvdMa : na, style=plot.style_line, linewidth=1, color=color.new(color.white, 0), title='CVD MA')

fill(plotRef1, plotRef2, color=customColor)

//..................................................................................................................

// len = input.int(title="RSI Period", minval=1, defval=14)

// src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=3)

lbL = input(title="Pivot Lookback Left", defval=7)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=true)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = cvd

// plot(osc, title="CVD", linewidth=2, color=#2962FF)

// hline(50, title="Middle Line", color=#787B86, linestyle=hline.style_dotted)

// obLevel = hline(70, title="Overbought", color=#787B86, linestyle=hline.style_dotted)

// osLevel = hline(30, title="Oversold", color=#787B86, linestyle=hline.style_dotted)

// fill(obLevel, osLevel, title="Background", color=color.rgb(33, 150, 243, 90))

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCondAlert = priceLL and oscHL and plFound

bullCond = plotBull and bullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor)

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCondAlert = priceHL and oscLL and plFound

hiddenBullCond = plotHiddenBull and hiddenBullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCondAlert = priceHH and oscLH and phFound

bearCond = plotBear and bearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor)

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCondAlert = priceLH and oscHH and phFound

hiddenBearCond = plotHiddenBear and hiddenBearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

// alertcondition(bullCondAlert, title='Regular Bullish CVD Divergence', message="Found a new Regular Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar")

// alertcondition(hiddenBullCondAlert, title='Hidden Bullish CVD Divergence', message='Found a new Hidden Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(bearCondAlert, title='Regular Bearish CVD Divergence', message='Found a new Regular Bearish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(hiddenBearCondAlert, title='Hidden Bearisn CVD Divergence', message='Found a new Hidden Bearisn Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

le = bullCondAlert or hiddenBullCondAlert

se = bearCondAlert or hiddenBearCondAlert

ltp = se

stp = le

// Check if the entry conditions for a long position are met

if (le) //and (close > ema200)

strategy.entry("Long", strategy.long, comment="EL")

// Check if the entry conditions for a short position are met

if (se) //and (close < ema200)

strategy.entry("Short", strategy.short, comment="ES")

// Close long position if exit condition is met

if (ltp) // or (close < ema200)

strategy.close("Long", comment="XL")

// Close short position if exit condition is met

if (stp) //or (close > ema200)

strategy.close("Short", comment="XS")

// The Fixed Percent Stop Loss Code

// User Options to Change Inputs (%)

stopPer = input.float(5.0, title='Stop Loss %') / 100

takePer = input.float(10.0, title='Take Profit %') / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

if strategy.position_size > 0

strategy.exit("Close Long", "Long", stop=longStop, limit=longTake)

if strategy.position_size < 0

strategy.exit("Close Short", "Short", stop=shortStop, limit=shortTake)

- 基于动态多均线与MACD指标的XAUUSD交易策略

- 基于双移动平均线交叉的量化交易策略

- EMA 200 交叉量价趋势策略

- RSI动态止损止盈策略

- 一文中局部震荡趋势识别策略

- 基于9EMA动态仓位的5分钟双收盘价强势突破策略

- 基于多空自适应动态网格策略

- 基于平均真实波幅和相对强弱指数的钱德勒出场策略

- 高低点自动预测与交易策略

- 日内锤子反转形态多头策略

- 布林带与相对强弱指数结合策略

- 一目均衡动力指数策略

- AI趋势预测交易策略

- TrendHunter w/MF 多时间框架趋势策略

- 布林带与斐波那契回调策略

- 基于RSI和MACD交叉策略

- 基于双均线交叉的交易策略

- 动态RSI双均线买卖策略

- 多重指数移动平均线交易策略

- 基于RSI 穿越交易策略