Donchian Channel Breakout Strategy with ATRSL Trailing Stop

Author: ChaoZhang, Date: 2024-03-22 16:13:58Tags:

Strategy Overview

The Donchian Channel Breakout Strategy is a trend-following quantitative trading strategy. It utilizes Donchian Channels to capture market trends while using an ATRSL trailing stop to manage risk. When the price breaks above the upper band of the Donchian Channel, the strategy enters a long position; when the price falls below the ATRSL trailing stop line, the strategy closes the position.

Strategy Principle

- Calculate Donchian Channel: Based on the user-defined

donLengthparameter, calculate the highest high and lowest low of the pastdonLengthperiods as the upper banddonUpperand lower banddonLowerof the Donchian Channel, respectively. The midlinedonBasisis the average of the upper and lower bands. - Calculate ATRSL Trailing Stop: Based on the user-defined

AP2andAF2parameters, calculate the ATR valueSL2. Then, dynamically adjust the trailing stop priceTrail2according to the relationship between the current close priceSCand the previous trailing stop priceTrail2[1]. - Entry Condition: When the current close price crosses above the upper band of the Donchian Channel, enter a long position.

- Exit Condition: When the current close price crosses below the ATRSL trailing stop line, close the position.

Strategy Advantages

- Trend Following: By using Donchian Channels to determine trend direction, the strategy can effectively capture market trends.

- Dynamic Stop Loss: The ATRSL trailing stop allows for dynamic adjustment of the stop loss level based on market volatility, helping to manage risk.

- Parameter Flexibility: Users can adjust parameters such as

donLength,AP2, andAF2according to their needs to optimize strategy performance.

Strategy Risks

- Parameter Risk: Different parameter settings can lead to significant differences in strategy performance, requiring thorough backtesting and parameter optimization.

- Market Risk: During choppy markets or trend reversals, the strategy may experience significant drawdowns.

- Slippage and Trading Costs: Frequent trading may result in high slippage and trading costs, impacting strategy profitability.

Optimization Directions

- Add Trend Filters: In the entry condition, indicators such as ADX can be added to assess trend strength and only enter positions when the trend is strong, improving entry quality.

- Optimize Stop Loss: Experiment with other stop loss methods, such as percentage-based stop loss or ATR stop loss, or combine multiple stop loss approaches to increase stop loss flexibility.

- Incorporate Position Sizing: Dynamically adjust position size based on market volatility and account risk to manage risk exposure.

Summary

The Donchian Channel Breakout Strategy is a classic trend-following strategy that captures trends using Donchian Channels and manages risk with an ATRSL trailing stop. The strategy’s advantages include its simple and clear logic, ease of implementation, and potential for optimization. However, its drawbacks include poor performance during choppy markets and trend reversals, and significant impact of parameter settings on strategy performance. In practical application, the strategy can be enhanced by adding trend filters, optimizing stop loss, and incorporating position sizing modules to improve stability and profitability. At the same time, it is important to control trading frequency and costs, and flexibly adjust strategy parameters based on market characteristics and personal risk preferences.

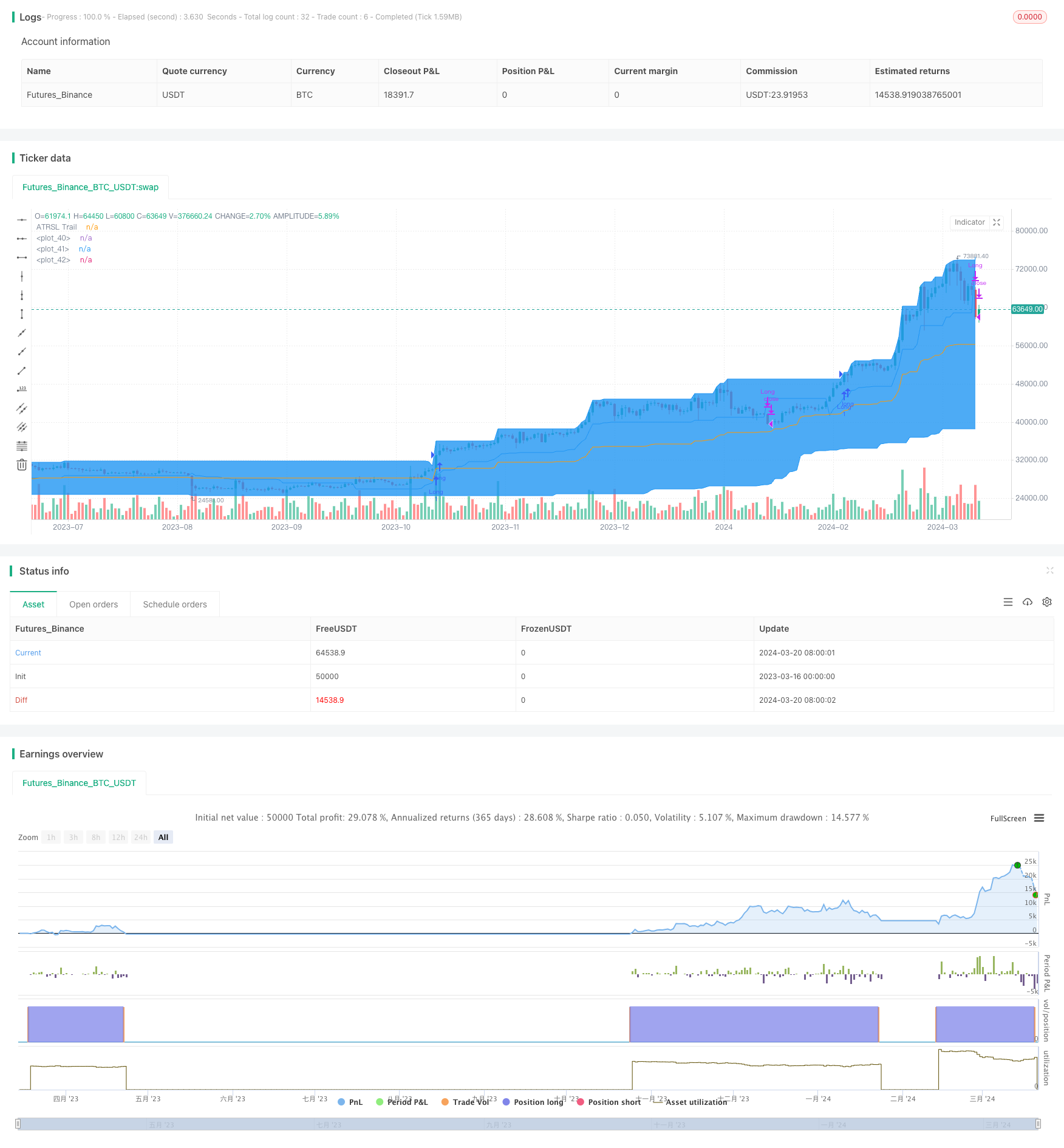

/*backtest

start: 2023-03-16 00:00:00

end: 2024-03-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Stock Trend USE THIS", overlay = true)

donLength = input(100, minval=1)

//Donchian Long

donLower = lowest(donLength)

donUpper = highest(donLength)

donBasis = avg(donUpper,donLower)

// ATRSL

SC = close

// Slow Trail //

AP2 = input(10, title="Slow ATR period") // ATR Period

AF2 = input(3, title="Slow ATR multiplier") // ATR Factor

SL2 = AF2 * atr(AP2) // Stop Loss

Trail2 = 0.0

iff_3 = SC > nz(Trail2[1], 0) ? SC - SL2 : SC + SL2

iff_4 = SC < nz(Trail2[1], 0) and SC[1] < nz(Trail2[1], 0) ? min(nz(Trail2[1], 0), SC + SL2) : iff_3

Trail2 := SC > nz(Trail2[1], 0) and SC[1] > nz(Trail2[1], 0) ? max(nz(Trail2[1], 0), SC - SL2) : iff_4

// Long and Short Conditions

longCondition = (crossover(close,donUpper[1]))

// Close Conditions

closeLongCondition = crossunder(close,Trail2)

// Strategy logic

if (longCondition)

strategy.entry("Long", strategy.long)

alert("Open Long position")

if (closeLongCondition)

strategy.close("Long")

alert("Close Long position")

// Plot Donchian

l = plot(donLower, color=color.blue)

u = plot(donUpper, color=color.blue)

plot(donBasis, color=color.orange)

fill(u, l, color=color.blue)

plot(Trail2, color=color.blue, title="ATRSL Trail")

- Bollinger Bands Long Only Strategy

- AlphaTrend and Bollinger Bands Combined Mean Reversion + Trend Following Strategy

- Grid Dollar-Cost Averaging Strategy

- Quantitative Trading Strategy Based on Three Consecutive Bullish/Bearish Candles and Dual Moving Averages

- Multi-EMA, RSI and Standard Deviation-Based Exit Candlestick Height Breakout Trading Strategy

- Binance accounts can be redirected

- Grid Trading Risk Hedging Strategy

- EMA-Parabolic Trend Following Strategy

- Long-Short Linear Regression Crossover Strategy

- Trend Momentum-Based Multi-Indicator Moving Average Crossover Strategy

- Dynamic Grid Trend-Following Quantitative Trading Strategy

- Bollinger Band Dynamic Take Profit and Dynamic Position Adding Strategy

- High-Frequency Cryptocurrency Trading Strategy Combining TrippleMACD Crossover and Relative Strength Index

- RSI and EMA Dual Filter Strategy

- Grid-based Long Martingale Dynamic Position Grid Trading Strategy

- Dual Exponential Moving Average Cloud Crossover Automated Trading Strategy

- Dual-Timeframe EMA Crossover Long-Short Strategy

- Hull Moving Average Crossover Strategy

- Dual Moving Average Crossover with Optimized Stop Loss Strategy

- ATR Trend Breakout Strategy