Overview

The Grid Dollar-Cost Averaging Strategy (GridDCA) is an automated trading strategy that utilizes dollar-cost averaging (DCA) to invest a fixed amount at multiple price grids, reducing investment risk and increasing the stability of asset accumulation. The strategy is developed using Pine Script on the TradingView platform and allows flexible settings for the number of grids, grid distance, stop-loss percentage, and profit target. It supports both market orders and limit orders.

Strategy Principle

DCA is a long-term investment strategy that involves investing a fixed amount at regular time intervals, regardless of the current asset price, to mitigate the impact of market volatility on investments. The GridDCA strategy introduces the concept of price grids based on this foundation. According to the user-defined number of grids and grid distance, it generates multiple grids at different price levels. Each grid has a corresponding buy quantity and price. When the price reaches a certain grid, the strategy executes a buy order using either a market order or a limit order, depending on the settings. Additionally, the strategy sets stop-loss and take-profit levels for each grid purchase based on the specified stop-loss percentage and profit target. By investing at different price levels, the GridDCA strategy effectively smooths out the cost of buying and reduces investment risk.

Advantages Analysis

- Automated trading: The GridDCA strategy can automatically execute trades, saving time and effort while reducing the interference of human emotions.

- Risk reduction: By investing at different price levels, the DCA strategy mitigates the impact of market volatility on investments and increases the stability of asset accumulation.

- High flexibility: The GridDCA strategy supports customizable parameters such as the number of grids, grid distance, stop-loss percentage, and profit target, allowing users to adjust according to their needs.

- Diversified order types: The strategy supports both market orders and limit orders, catering to different user preferences.

Risk Analysis

- Market trend risk: If the market is in a prolonged downtrend, the buying cost of the GridDCA strategy may be higher than the market average. The solution is to set reasonable grid distances and stop-loss percentages to avoid excessive exposure to downside risk.

- Parameter setting risk: Inappropriate parameter settings may lead to suboptimal strategy performance. The solution is to optimize parameters through backtesting and adjust them according to market conditions.

- Liquidity risk: In cases of insufficient market liquidity, limit orders may fail to execute. The solution is to use market orders or adjust the limit order price.

Optimization Direction

- Dynamic parameter adjustment: Based on market conditions and asset performance, dynamically adjust parameters such as grid distance, stop-loss percentage, and profit target to adapt to market changes and improve strategy performance.

- Trend judgment integration: In addition to DCA, incorporate trend indicators such as moving averages to increase the buy quantity in uptrends and decrease the buy quantity in downtrends, further reducing risk and enhancing returns.

- Multi-currency, multi-timeframe: Apply the GridDCA strategy to multiple currencies and timeframes to diversify investments, reduce single market risk, and capture opportunities in different markets and timeframes.

Conclusion

The Grid Dollar-Cost Averaging Strategy (GridDCA) is an automated trading strategy based on dollar-cost averaging that effectively reduces the impact of market volatility on investments and increases the stability of asset accumulation by investing a fixed amount at multiple price grids. The strategy offers advantages such as automated trading, risk reduction, high flexibility, and diversified order types. However, it also faces challenges such as market trend risk, parameter setting risk, and liquidity risk. Through optimization directions like dynamic parameter adjustment, trend judgment integration, and multi-currency, multi-timeframe application, the performance of the GridDCA strategy can be further enhanced, making it a strategy worth in-depth research and application in the field of quantitative trading.

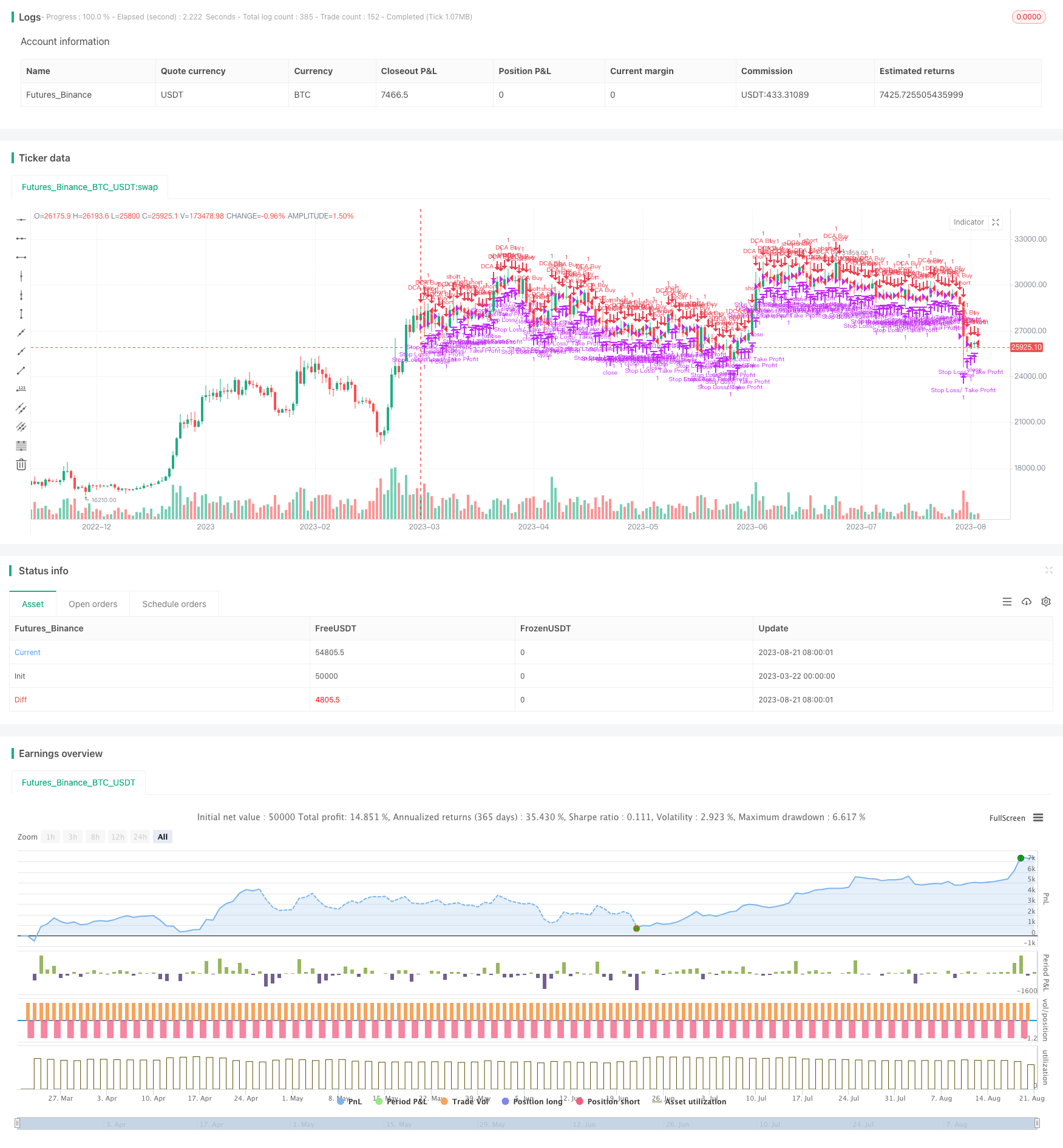

/*backtest

start: 2023-03-22 00:00:00

end: 2023-08-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("DCA Trading Strategy", overlay=true)

// Define input options

numGrids = input.int(5, title="Number of Grids")

gridDistance = input.float(0.5, title="Grid Distance")

stopLossPct = input.float(1, title="Stop Loss Percentage")

takeProfitPct = input.float(1, title="Take Profit Percentage")

useMarketOrder = input.bool(false, title="Use Market Order")

// Define DCA function

dca(quantity, price, stopLoss, takeProfit) =>

if useMarketOrder

strategy.entry("DCA Buy", strategy.short, qty=quantity)

else

strategy.entry("DCA Buy", strategy.short, qty=quantity, limit=price)

strategy.exit("Stop Loss/ Take Profit", "DCA Buy", stop=stopLoss, limit=takeProfit)

// Calculate grid levels

gridLevels = math.floor(strategy.position_size / (numGrids + 1) + 0.5)

// Calculate buy quantity

buyQuantity = strategy.position_size / numGrids

// Loop through each grid level

for i = 1 to numGrids

priceLevel = strategy.position_avg_price * (1 - gridDistance * i)

stopLossPrice = priceLevel * (1 - stopLossPct / 100)

takeProfitPrice = priceLevel * (1 + takeProfitPct / 100)

dca(buyQuantity, priceLevel, stopLossPrice, takeProfitPrice)

// Plot grid levels

plotshape(series=gridLevels, title="Grid Levels", location=location.abovebar, color=color.blue, style=shape.triangleup, size=size.small)